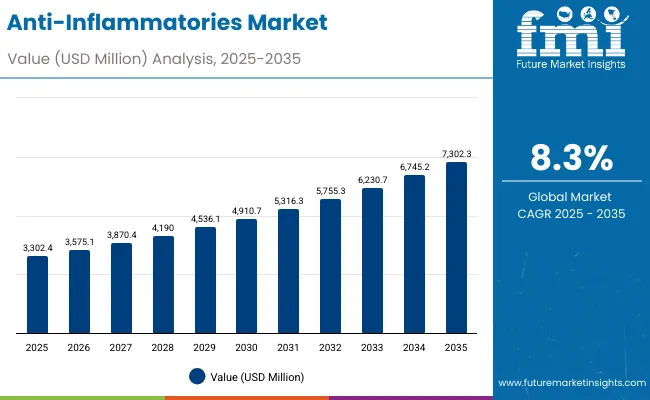

The Anti-Inflammatories Market is expected to record a valuation of USD 3,302.4 million in 2025 and USD 7,302.3 million in 2035, with an increase of USD 3,999.9 million, which equals a growth of 121% over the decade. The overall expansion represents a CAGR of 8.3% and more than a 2X increase in market size.

Anti-Inflammatories Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Inflammatories Market Estimated Value in (2025E) | USD 3,302.4 million |

| Anti-Inflammatories Market Forecast Value in (2035F) | USD 7,302.3 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

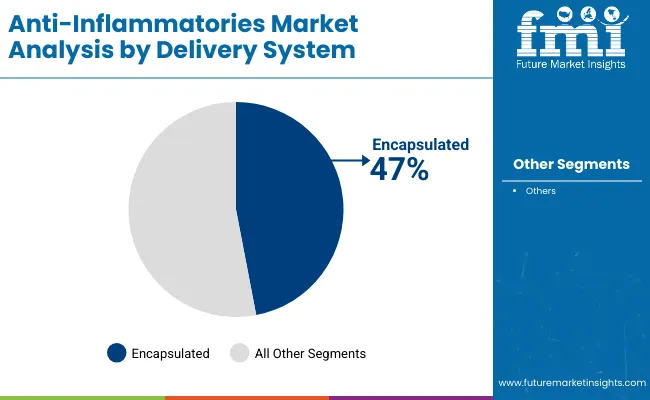

During the first five-year period from 2025 to 2030, the market increases from USD 3,302.4 million to USD 4,910.7 million, adding USD 1,608.3 million, which accounts for 40% of the total decade growth. This phase records steady adoption in skincare, dermocosmetic soothing formulations, and scalp care applications, driven by the rising use of cytokine-response modulators that directly address inflammatory pathways. Encapsulated delivery systems dominate this period, catering to over 47% of applications as they improve ingredient stability, controlled release, and bioavailability.

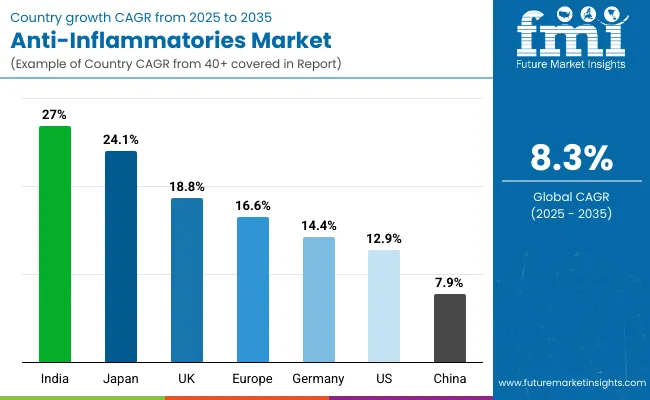

The second half from 2030 to 2035 contributes USD 2,391.6 million, equal to 60% of total growth, as the market jumps from USD 4,910.7 million to USD 7,302.3 million. This acceleration is powered by post-procedure adjuncts, biotech-derived actives, and premium formulations leveraging neurosensory comfort modulators. East Asia and South Asia & Pacific drive demand, with Japan (24.1% CAGR) and India (27% CAGR) emerging as global growth leaders. Marine-derived and polymer-complexed actives, though smaller in base share, are gaining attention in this period for their novel bioactivity and multifunctionality.

From 2020 to 2024, the Anti-Inflammatories Market grew steadily from USD 2,500 million to USD 3,100 million, driven by skincare-focused adoption. During this period, the competitive landscape was dominated by global ingredient houses controlling nearly 70% of revenue, with leaders such as Givaudan, BASF, and Symrise focusing on botanical and synthetic anti-inflammatory actives. Competitive differentiation relied on purity of actives, clinical validation, and scalability, while advanced delivery systems like encapsulation were still limited to premium ranges. Service-driven platforms such as customized formulation partnerships contributed less than 12% of market value.

Demand for anti-inflammatories expands further to USD 3,302.4 million in 2025, and the revenue mix begins to shift as encapsulation and polymer-complexed systems grow to over 47% share in delivery methods. Traditional players face rising competition from biotech specialists and marine-derived ingredient innovators, offering unique actives targeting vascular soothing and neurosensory comfort pathways.

Major suppliers are pivoting toward integrated ecosystems, combining ingredient portfolios with formulation guidance, regulatory support, and dermocosmetic positioning to remain competitive. Emerging entrants specializing in microbiome-friendly actives, AI-based skin compatibility testing, and sustainable marine sourcing are gaining share. The competitive advantage is moving away from raw ingredient supply alone to solution-oriented partnerships and innovation ecosystems.

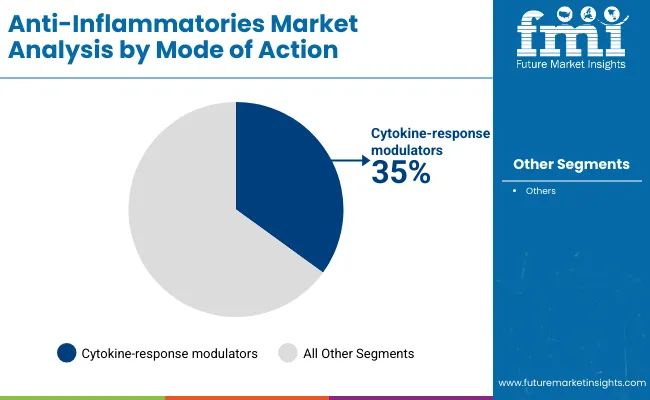

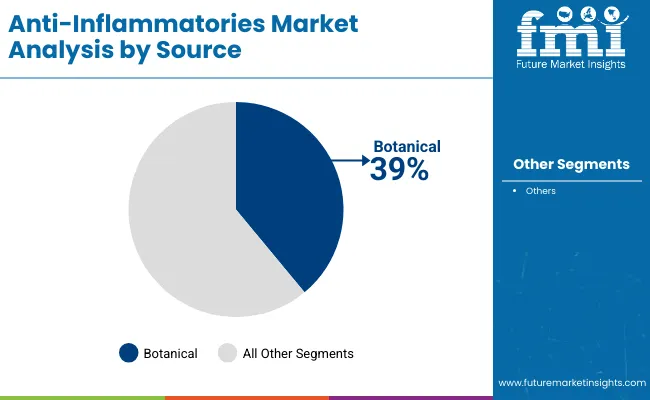

Advances in biotechnology and encapsulation systems have improved the efficacy, safety, and stability of anti-inflammatory actives, enabling broader use in both daily skincare and post-procedure applications. Cytokine-response modulators have gained popularity due to their direct action on inflammatory mediators, making them essential in dermocosmetic formulations. The rising preference for botanical sources (39% share in 2025) reflects consumer demand for natural, sustainable, and herbal-based soothing solutions. Additionally, the premiumization of scalp care and after-sun soothing categories has fueled adoption of advanced modulators that ensure rapid relief and skin barrier repair.

Expansion of dermocosmetics and multifunctional skincare is fueling market growth further. The shift toward encapsulated and polymer-complexed delivery systems has created new opportunities for formulators to enhance efficacy and reduce irritation, a major consumer concern. Regional growth is led by India (27% CAGR) and Japan (24.1% CAGR), where rising disposable incomes and premium skincare adoption intersect with traditional and biotech innovation. Segment growth is expected to be led by cytokine-response modulators, botanical sources, and encapsulated delivery systems, owing to their clinical validation, consumer trust, and adaptability across formats.

The Anti-Inflammatories Market is segmented by mode of action, source, delivery system, physical form, application, end use, and region. Mode of action includes COX/LOX modulators, cytokine-response modulators, vascular-soothing modulators, and neurosensory comfort modulators, reflecting diverse pathways for reducing inflammation. Source segmentation covers botanical, biotechnology-derived, synthetic, and marine-derived actives, underlining the balance between traditional herbal extracts and biotech innovation. Delivery systems include free form, encapsulated, and polymer-complexed formats, highlighting the role of technology in enhancing efficacy and safety.

Physical form categories include solutions/concentrates, powders, and dispersions, aligned with varied formulation needs. Applications span leave-on face & body care, after-sun soothing, scalp care, and post-procedure adjuncts. End use is defined as skincare, hair & scalp care, and dermocosmetic, covering both consumer and professional channels. Geographically, the market scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Mode of Action | Value Share% 2025 |

|---|---|

| Cytokine-response modulators | 35% |

| Others | 65.0% |

The cytokine-response modulators segment is projected to contribute 35% of the Anti-Inflammatories Market revenue in 2025, equivalent to USD 588.9 million, maintaining its lead as the dominant mode of action category. This is driven by their ability to regulate key inflammatory pathways and directly target immune-signaling mechanisms, making them essential in formulations for sensitive skincare and post-procedure recovery. Cytokine-response modulators are widely incorporated into dermocosmetic products due to their clinically validated soothing properties and compatibility with both skincare and scalp care formats.

The segment’s growth is also supported by innovation in encapsulation technologies, which enhance delivery efficiency, improve bioavailability, and extend the stability of active ingredients. As consumer demand for high-performance soothing solutions rises globally, cytokine-response modulators remain the backbone of advanced anti-inflammatory formulations, sustaining their leadership through 2035.

| Source | Value Share% 2025 |

|---|---|

| Botanical | 39% |

| Others | 61.0% |

The botanical source segment is forecasted to hold 39% of the market share in 2025, equivalent to USD 369 million, led by consumer preference for plant-derived and herbal actives that align with natural and sustainable beauty trends. Botanical anti-inflammatories are favored for their gentle soothing effects, multifunctionality, and strong alignment with consumer trust in natural remedies. They are especially popular in leave-on face & body care and after-sun soothing products, where natural positioning strengthens product claims and boosts adoption.

The segment’s growth is bolstered by the increasing clinical validation of plant extracts, such as polyphenols and flavonoids, known for their antioxidant and anti-inflammatory properties. Additionally, global demand for clean-label and eco-certified formulations has created strong momentum for botanical ingredients. With brands emphasizing sustainability and transparency, botanical actives are expected to remain at the forefront of innovation in the Anti-Inflammatories Market.

| Delivery System | Value Share% 2025 |

|---|---|

| Encapsulated | 47% |

| Others | 53.0% |

The encapsulated delivery system segment is projected to account for 47% of the Anti-Inflammatories Market revenue in 2025, representing USD 533.3 million, making it the leading delivery format. Encapsulation is preferred for its ability to enhance stability, control ingredient release, and improve skin penetration of sensitive actives. Its role is critical in reducing irritation while ensuring consistent efficacy, which makes it highly valuable in dermocosmetic and post-procedure adjunct formulations.

The growing demand for premium skincare and dermocosmetics has accelerated the use of encapsulated actives, as consumers increasingly expect products to deliver both immediate relief and long-term skin benefits. Advancements in nano-encapsulation and polymer-complexed systems have further improved ingredient performance, supporting widespread adoption across face, scalp, and body care. As the market continues to prioritize efficacy, safety, and consumer experience, encapsulated systems are expected to retain their dominant role throughout the forecast period.

Rising Post-Procedure Dermatology and Aesthetic Care Adoption

The surge in dermatology procedures, from chemical peels and laser resurfacing to injectables, is fueling demand for adjunctive anti-inflammatory formulations. Patients increasingly require products that reduce redness, soothe irritation, and accelerate recovery post-treatment. This trend is not only driving growth in post-procedure adjuncts but also elevating demand for encapsulated delivery systems that enhance tolerability while delivering high efficacy. Brands that co-market their anti-inflammatory actives with clinics and med-spa professionals are building trust and premium positioning, further expanding the category’s clinical alignment.

Expansion of Neurosensory Comfort Modulators in Sensitive Skin Care

With sensitive skin now recognized as one of the largest consumer concerns globally, neurosensory comfort modulators are emerging as high-value actives. These modulators work by reducing neurogenic inflammation and soothing hyper-reactive skin responses. Unlike general-purpose botanical soothers, neurosensory actives offer targeted relief and strong claims, especially in scalp care and leave-on products. Their adoption is accelerating in Europe and East Asia, where dermocosmetic awareness is high, and consumers actively seek products with neurosensory claims validated by clinical trials.

High Cost and Scalability Issues of Biotechnology- and Marine-Derived Actives

While biotechnology and marine-derived anti-inflammatories are positioned as premium solutions, their scalability remains a bottleneck. Fermentation-derived actives and marine bioactives often face supply chain volatility, limited raw material availability, and higher production costs compared to synthetic or botanical counterparts. This restricts mass-market adoption and keeps them concentrated in high-end product lines. For companies competing in price-sensitive regions such as South Asia & Pacific, cost efficiency limits the extent to which biotech-derived actives can penetrate mainstream formulations.

Regulatory Complexity for Novel Delivery Systems

Encapsulation and polymer-complexed systems, while highly effective, face regulatory scrutiny regarding safety, skin compatibility, and long-term effects. In markets like the USA and EU, authorities require extensive stability and safety testing, which delays time-to-market for newer formulations. For smaller companies, the investment required to validate encapsulated or nano-formulated anti-inflammatories creates an entry barrier, restraining innovation speed and market diversity.

Microbiome-Integrated Anti-Inflammatory Claims

A growing trend is the integration of anti-inflammatory actives with skin microbiome balance claims. Rather than only calming visible redness or irritation, brands are marketing formulations that "restore microbiome harmony" to prevent recurring flare-ups. This is especially evident in Europe and North America, where consumer awareness of microbiome health is rising. Anti-inflammatories like botanical flavonoids and biotech peptides are being paired with pre- and postbiotics to create holistic dermocosmetic solutions.

Premiumization of Scalp Care with Anti-Inflammatory Positioning

Scalp care is no longer just about dandruff or cleansing it is shifting toward premium soothing and barrier-repair segments. Anti-inflammatories, especially cytokine-response and neurosensory modulators, are increasingly formulated into leave-on scalp serums and tonics. East Asia, particularly Japan and South Korea, is leading this trend, where scalp health is positioned as an extension of skincare. This move toward premium scalp-focused dermocosmetics is expanding the end-use landscape beyond traditional skincare, unlocking new revenue streams for ingredient suppliers and brands.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

| USA | 12.9% |

| India | 27.0% |

| UK | 18.8% |

| Germany | 14.4% |

| Japan | 24.1% |

| Europe | 16.6% |

The Anti-Inflammatories Market shows significant divergence in country-level growth between 2025 and 2035, reflecting both maturity and innovation-driven adoption. India (27.0% CAGR) and Japan (24.1% CAGR) lead the trajectory, fueled by unique consumer and clinical dynamics. In India, the rising middle class and growing affordability of dermocosmetic products are creating strong demand for botanical and encapsulated anti-inflammatories, particularly in post-procedure adjuncts and scalp care.

Cultural reliance on herbal remedies is aligning with modern biotech formulations, making India a hotbed for hybrid innovations. Japan, meanwhile, is setting benchmarks in premium dermocosmetic care, where neurosensory comfort modulators and biotech-derived actives are driving product differentiation. High consumer willingness to invest in post-surgical soothing and sensitive skin solutions is amplifying adoption in East Asia.

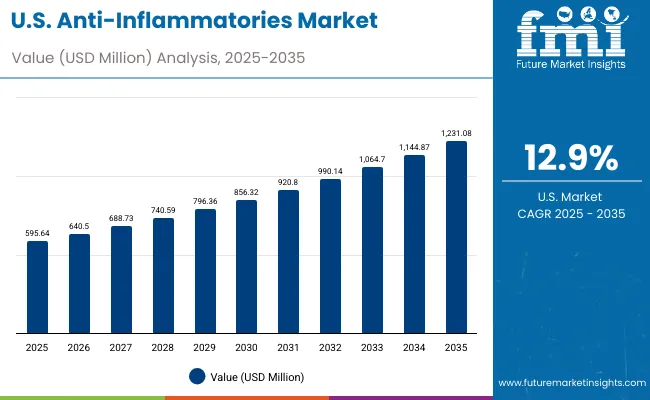

On the Western front, the USA (12.9% CAGR) and UK (18.8% CAGR) reflect a more mature yet innovation-driven market landscape. The USA growth is tied to expanding clinical dermatology applications and strong penetration of cytokine-response modulators in both mass and premium skincare categories. The UK is witnessing faster adoption due to heightened consumer awareness around scalp sensitivity and after-sun soothing formulations, supported by dermocosmetic positioning.

In Europe’s largest markets, Germany (14.4% CAGR) and the wider regional bloc (16.6% CAGR), regulation-driven product safety, coupled with consumer demand for clean-label botanical actives, supports stable growth. China (7.9% CAGR), though slower compared to India and Japan, remains crucial as a volume-driven market where botanical sources dominate due to their affordability, but premium categories are gradually emerging as urban consumers embrace biotechnology-derived solutions. Together, these growth profiles highlight how Asia-Pacific drives high-growth momentum, while Europe and North America consolidate innovation-led adoption.

| Year | USA Anti-Inflammatories Market (USD Million) |

|---|---|

| 2025 | 595.64 |

| 2026 | 640.50 |

| 2027 | 688.73 |

| 2028 | 740.59 |

| 2029 | 796.36 |

| 2030 | 856.32 |

| 2031 | 920.80 |

| 2032 | 990.14 |

| 2033 | 1,064.70 |

| 2034 | 1,144.87 |

| 2035 | 1,231.08 |

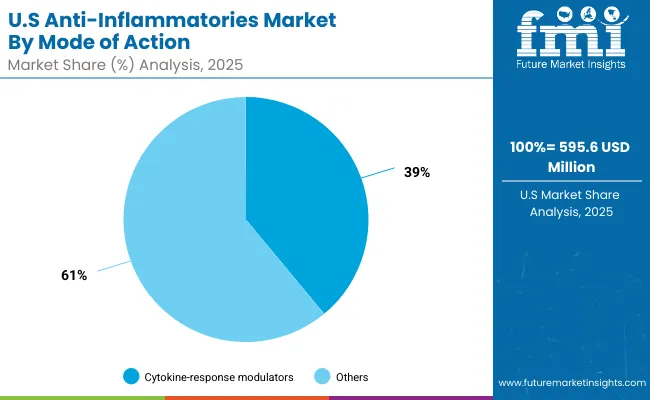

The Anti-Inflammatories Market in the United States is projected to grow at a CAGR of 12.9%, led by rising demand across dermatology clinics, premium skincare, and scalp care solutions. Post-procedure dermatology, especially laser treatments and aesthetic injectables, is driving adoption of cytokine-response modulators, which already account for 39% of the USA market in 2025. The scalp care segment is also gaining traction, with neurosensory modulators addressing irritation and sensitivity, while dermocosmetic positioning elevates after-sun and soothing categories. Innovations in encapsulated delivery formats are reshaping product efficacy, allowing brands to market clinically validated claims more aggressively.

The Anti-Inflammatories Market in the United Kingdom is expected to grow at a CAGR of 18.8%, supported by dermocosmetic positioning and premium scalp care adoption. Consumers in the UK are rapidly embracing formulations with botanical and biotech-derived actives, especially in after-sun soothing and leave-on skincare. Dermatologists and cosmetic practitioners are increasingly recommending post-procedure adjuncts, further enhancing product penetration. At the same time, sustainability is shaping demand for botanical actives with clean-label certifications. Partnerships between local brands and European ingredient houses are fueling innovation pipelines.

India is witnessing rapid growth in the Anti-Inflammatories Market, forecast to expand at a CAGR of 27.0% through 2035, the highest among major economies. Growth is driven by the affordability of botanical-based anti-inflammatories, which align with cultural preferences for herbal remedies, and by the surge in demand for affordable dermocosmetic solutions in tier-2 and tier-3 cities. Scalp care products addressing dandruff and irritation are penetrating retail channels, while post-procedure adjuncts are gaining traction as urban consumers increasingly undergo dermatology treatments. Educational initiatives in cosmetology schools are also encouraging adoption of biotech-derived actives.

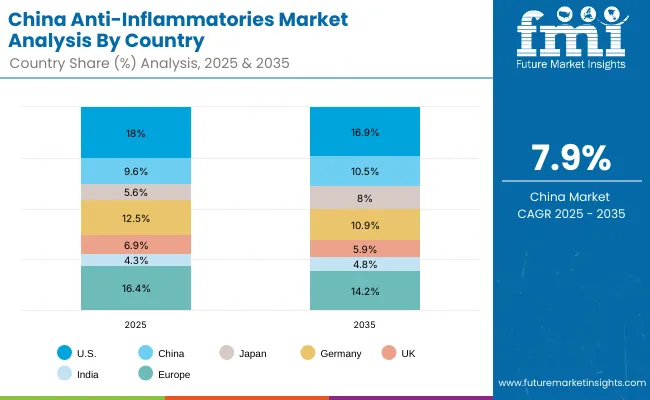

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.0% |

| China | 9.6% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.9% |

| India | 4.3% |

| Europe | 16.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 8.0% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

| Europe | 14.2% |

The Anti-Inflammatories Market in China is expected to grow at a CAGR of 7.9%, slower than other Asian peers but critical due to its large-scale consumer base. Growth is concentrated in botanical actives, which dominate due to their affordability and cultural acceptance. However, biotech-derived and marine-based ingredients are gaining momentum in urban centers, particularly within premium skincare. Municipal health campaigns promoting sensitive skin and sun protection awareness are also indirectly boosting demand for soothing formulations. Local players are introducing cost-effective encapsulated systems, supporting mass adoption in both skincare and scalp care.

| USA by Mode of Action | Value Share% 2025 |

|---|---|

| Cytokine-response modulators | 39% |

| Others | 61.0% |

The Anti-Inflammatories Market in the United States is valued at USD 595.6 million in 2025 and is projected to expand at a CAGR of 12.9% through 2035. Within the component breakdown, cytokine-response modulators dominate with a 39% share, reflecting their strong role in dermocosmetic and post-procedure care. The demand for these modulators stems from their ability to regulate inflammatory pathways at a molecular level, offering immediate soothing and long-term skin barrier benefits.

Post-procedure adjuncts are particularly critical in the USA, where dermatology clinics and medical spas are widely adopting anti-inflammatory actives to minimize redness, irritation, and recovery time following aesthetic treatments. Additionally, premium skincare lines are leveraging encapsulation systems to enhance efficacy, ensuring these actives penetrate deeper and perform more consistently. The USA market is also benefiting from heightened consumer awareness of scalp sensitivity, with scalp care and leave-on soothing formulations accelerating adoption.

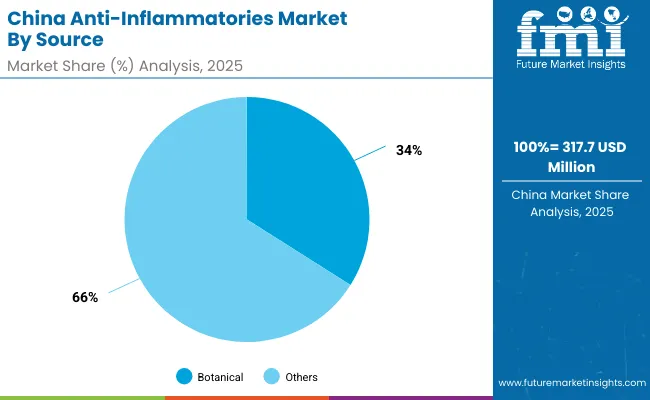

| China by source | Value Share% 2025 |

|---|---|

| Botanical | 34% |

| Others | 66.0% |

The Anti-Inflammatories Market in China is valued at approximately USD 317.7 million in 2025, with growth projected at a CAGR of 7.9%. The dominance of botanical actives (34% share, USD 108.0 million) is a direct outcome of strong cultural reliance on herbal formulations and the affordability of plant-based extracts compared to biotechnology or marine-derived ingredients. Botanical sources are widely integrated into after-sun soothing products and leave-on skincare, resonating with consumer trust in traditional remedies.

While the botanical segment leads, urban centers are seeing increasing adoption of biotechnology-derived and encapsulated actives, especially within premium skincare and dermocosmetic ranges. Local brands are beginning to invest in polymer-complexed delivery systems to differentiate offerings, though affordability still drives the mass-market segment. Government-led campaigns emphasizing sensitive skin and sun protection awareness further boost demand for soothing actives.

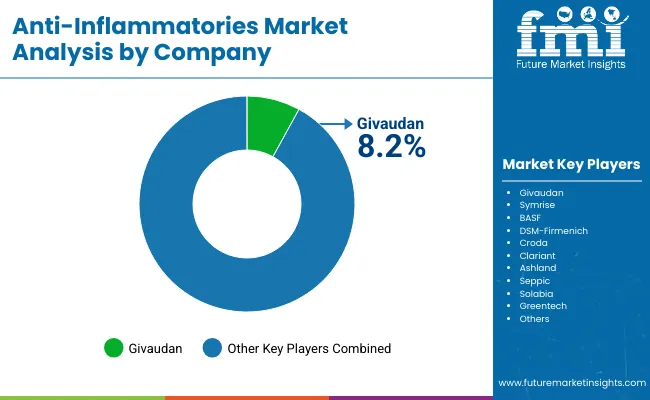

The Anti-Inflammatories Market is moderately fragmented, with global ingredient leaders, biotechnology innovators, and botanical specialists competing across multiple applications. Global leaders such as Givaudan, Symrise, BASF, DSM-Firmenich, and Croda hold significant influence due to their broad anti-inflammatory portfolios, combining botanical, biotech-derived, and encapsulated actives. Their strategies emphasize dermocosmetic positioning, AI-driven claim substantiation, and encapsulation platforms, helping them maintain a competitive edge in both mass and premium formulations.

Mid-sized innovators including Clariant, Ashland, Seppic, and Solabia are leveraging hybrid portfolios that blend synthetic stability with natural positioning, targeting scalp care, after-sun, and post-procedure categories. Their growing collaborations with dermatologists and formulators are accelerating their presence in clinical-grade dermocosmetics. Specialized firms such as Greentech focus on niche botanical extracts with sustainability certifications, appealing to clean-label beauty trends in Europe and Asia. Competitive differentiation is shifting away from single-ingredient supply toward integrated ecosystems of ingredients, clinical validation, and delivery systems. Subscription-style partnerships with brands, formulation guidance, and claim-backed marketing support are becoming as important as raw material quality in defining leadership.

Key Developments in Anti-Inflammatories Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Component | COX/LOX modulators, Cytokine-response modulators, Vascular-soothing modulators, Neurosensory comfort modulators |

| Source | Botanical, Biotechnology-derived, Synthetic, Marine-derived |

| Delivery System | Free form, Encapsulated, Polymer-complexed |

| Physical Form | Solution/concentrate, Powder, Dispersion |

| Application | Leave-on face & body care, After-sun & soothing, Scalp care, Post-procedure adjuncts |

| End-use Industry | Skincare, Hair & scalp care, Dermocosmetic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan, Symrise, BASF, DSM-Firmenich, Croda, Clariant, Ashland, Seppic, Solabia, Greentech |

| Additional Attributes | Dollar sales by mode of action, source, delivery system, and application; adoption trends in dermocosmetics, post-procedure care, and scalp care; rising demand for encapsulated and polymer-complexed systems; sector-specific growth in premium skincare and dermatology; revenue segmentation between botanical, synthetic, and biotech-derived actives; integration with microbiome claims and digital twin-enabled dermatology research; regional trends influenced by sensitive skin prevalence and urbanization; and innovations in neurosensory comfort modulators, vascular-soothing agents, and biotech peptides. |

The Anti-Inflammatories Market is estimated to be valued at USD 3,302.4 million in 2025.

The market size for the Anti-Inflammatories Market is projected to reach USD 7,302.3 million by 2035.

The Anti-Inflammatories Market is expected to grow at a CAGR of 8.3% between 2025 and 2035.

The key product types in the Anti-Inflammatories Market are cytokine-response modulators, COX/LOX modulators, vascular-soothing modulators, and neurosensory comfort modulators.

In terms of source, the botanical segment is projected to command 39% share in the Anti-Inflammatories Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA