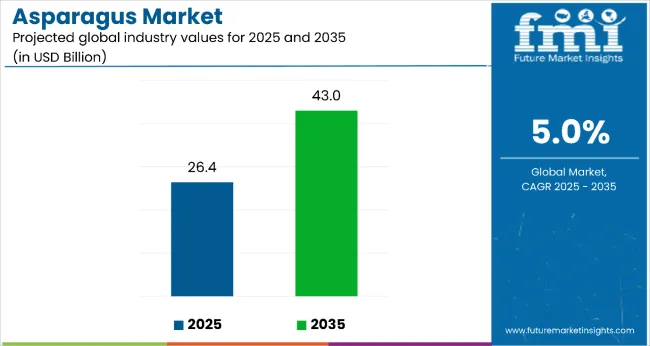

The Asparagus Market is estimated to be valued at USD 26.4 billion in 2025 and is projected to reach USD 43.0 billion by 2035, registering a CAGR of 5.0% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 16.6 billion over the forecast period. This reflects a 1.63 times growth at a compound annual growth rate of 5.0%. The market's evolution is expected to be shaped by rising demand for nutrient-rich vegetables, increasing consumer interest in premium fresh produce, and the growing influence of healthy eating trends across both developed and emerging economies.

By 2030, the market is likely to reach approximately USD 33.7 billion, accounting for USD 7.3 billion in incremental value over the first half of the decade and contributing to an overall absolute dollar opportunity of USD 16.6 billion. The remaining USD 9.3 billion is expected during the second half, suggesting a balanced but steady growth pattern. Product diversification across fresh, frozen, and canned formats is gaining traction due to evolving consumer lifestyles and expanding retail penetration.

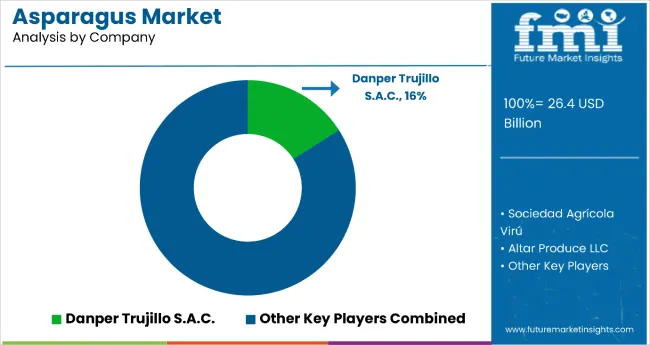

Companies such as Danper Trujillo S.A.C., Sociedad Agrícola Virú, and Altar Produce LLC are strengthening their competitive positions through advancements in environmentally responsible cultivation methods and product quality enhancement. Premium positioning strategies, organic certifications, and strong export networks are supporting expansion into health-conscious consumer segments and international markets. Market performance will remain anchored in efficient supply chains, seasonal availability management, and the ability to meet evolving consumer quality standards.

| Metric | Value |

|---|---|

| Asparagus Market Estimated Value in (2025E) | USD 26.4 billion |

| Asparagus Market Forecast Value in (2035F) | USD 43.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The market holds approximately 42% of the premium fresh vegetables segment, driven by its nutritional density, convenience, and versatility in culinary applications. It accounts for around 35% of the gourmet and specialty produce market, supported by growing awareness of asparagus as a nutrient-rich and low-calorie vegetable. The market contributes nearly 28% to the premium food ingredients category, particularly for incorporation into high-end restaurant dishes, frozen meal kits, and processed vegetable blends. It holds close to 22% of the organic vegetables market, where certified organic asparagus commands premium pricing among health-conscious consumers. The share in the functional foods and superfoods segment reaches about 31%, reflecting consumer preference for natural sources of fiber, vitamins, and antioxidants.

The market is undergoing structural change driven by rising health consciousness and expanding applications across the food service, retail, and processed food industries. Advanced processing methods including quick freezing, vacuum packaging, and value-added trimming have enhanced shelf life, maintained nutritional integrity, and improved consumer convenience. Manufacturers and growers are introducing value-added asparagus products such as pre-seasoned ready-to-cook packs, frozen asparagus spears, and blended vegetable assortments tailored for diverse dietary preferences.

The market is expanding steadily due to rising consumer awareness of its health benefits, including high antioxidant content, fiber, and essential vitamins that support heart health, digestion, and immunity. Its positioning as a premium, nutrient-rich vegetable is boosting demand in both fresh and processed forms.

Shifts toward healthier diets, plant-based nutrition, and functional foods are encouraging higher asparagus consumption worldwide. In addition, year-round availability supported by improved cold-chain logistics and advancements in preservation methods, such as freezing and canning, is increasing accessibility in both developed and emerging markets.

Growing demand from the foodservice sector, especially in gourmet cuisine, and the increasing popularity of convenience-oriented, ready-to-cook products are further fueling market growth. With consumers prioritizing nutritional value, freshness, and culinary versatility, asparagus is well-positioned for sustained expansion across global retail and foodservice channels.

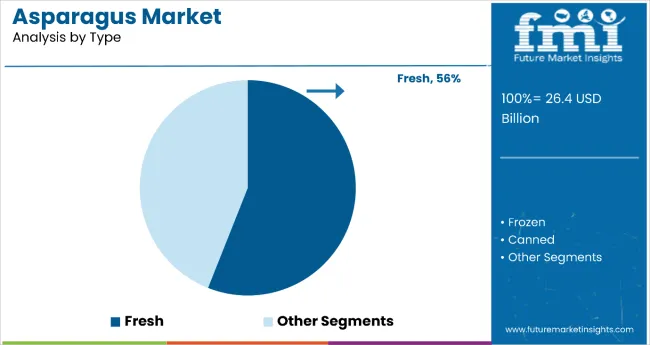

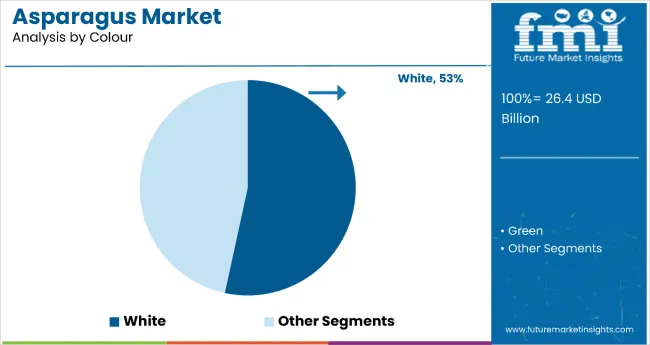

The market is segmented by type, color, and region. By type, the market is divided into fresh, canned, and frozen. Based oncolor, the market is bifurcated into white and green. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Fresh asparagus is the most lucrative segment, commanding 56% market share in 2025. This dominance is driven by premium pricing for fresh spears, strong retail and foodservice demand, and consumer preference for minimally processed, nutrient-dense vegetables. Fresh asparagus benefits from higher margins versus canned/frozen forms, shorter supply chains to premium retailers and restaurants, and growing year-round sourcing via offseason imports and controlled-environment production. Key value drivers include season-extension technologies (greenhouse/hydroponics), cold-chain logistics (to preserve texture and shelf life), and certification premiums (organic, GlobalG.A.P.).

Risks are perishability, weather-dependent yields, and price volatility during peak seasons; these make investment in post-harvest cooling, rapid distribution, and contract farming critical. Opportunities lie in branded fresh packs (pre-trimmed, ready-to-cook), export growth to high-demand markets (USA, China, Japan), and vertical integration with processors to capture value when surplus volumes arise. Strategic focus on supply resilience, quality consistency, and premium positioning will sustain and expand the fresh segment’s lead.

White asparagus is the most lucrative color segment, holding 53% market share in 2025. Its leadership stems from its premium positioning in gourmet cuisine, particularly in high-income markets such as Germany, France, Japan, and select parts of the USA White asparagus commands significantly higher prices than green varieties due to its labor-intensive cultivation method, where spears are grown underground or under soil mounds to prevent chlorophyll formation, resulting in a delicate flavor and tender texture.

Demand is reinforced by strong cultural and seasonal traditions such as the “Spargelzeit” in Europe where white asparagus is celebrated as a seasonal delicacy. Post-harvest handling, including rapid cooling and protective packaging, is crucial to maintaining quality, given its shorter shelf life compared to green asparagus.

From 2025 to 2035, growing public health awareness and nutrition science highlighting the benefits of asparagus consumption such as its high fiber content, antioxidant profile, and role in supporting heart and digestive health have significantly influenced purchasing decisions worldwide. Healthcare professionals increasingly recommend asparagus as part of balanced diets for weight management, cardiovascular health, and gut health.

Rising Health Consciousness and Lifestyle Shifts Fuel Asparagus Market Expansion

From 2025 to 2035, the asparagus market is primarily driven by rising consumer preference for nutrient-dense, low-calorie vegetables that support preventive healthcare and balanced diets. Growing awareness of asparagus’ health benefits, including its antioxidant properties, digestive health support, and potential in managing blood pressure, is influencing purchasing decisions across global markets. Expanding adoption of plant-based diets, particularly in urban populations, is boosting consumption, while premium positioning of fresh and organic asparagus caters to health-conscious and high-income demographics.

Production, Logistics, and Competitive Challenges Restrain Asparagus Market Growth

Despite its growth potential, the asparagus market faces restraints such as high production costs due to labor-intensive cultivation, seasonal availability, and limited mechanization in harvesting. Price volatility, driven by weather conditions and supply chain disruptions, can impact affordability and demand in price-sensitive markets. Perishability remains a major challenge, with fresh asparagus requiring rapid transportation and specialized storage facilities to maintain quality. Furthermore, competition from substitute vegetables with similar nutritional benefits, such as broccoli and green beans, may hinder market penetration in certain regions.

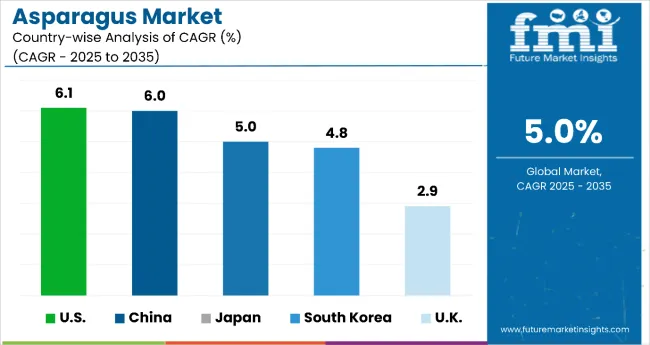

| Country | CAGR |

|---|---|

| USA | 6.1% |

| China | 6.0% |

| Japan | 5.0% |

| South Korea | 4.8% |

| UK | 2.9% |

The USA leads with the highest projected CAGR of 6.1% from 2025 to 2035, driven by advanced mechanization, precision farming, and strong export potential. China follows closely at 6.0%, leveraging its large-scale production capacity, favorable climate, and strong export performance to premium markets. Japan’s CAGR of 5.0% reflects its high-value focus, premium consumer demand, and technological adoption in hydroponics and greenhouse farming. South Korea, with 4.8%, shows rapid evolution due to a growing health-conscious population, expanding imports, and government-backed crop diversification. The UK, at 2.9%, records the slowest growth, constrained by its seasonal production cycle and climate limitations, though it benefits from strong seasonal branding and sustainable sourcing initiatives.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

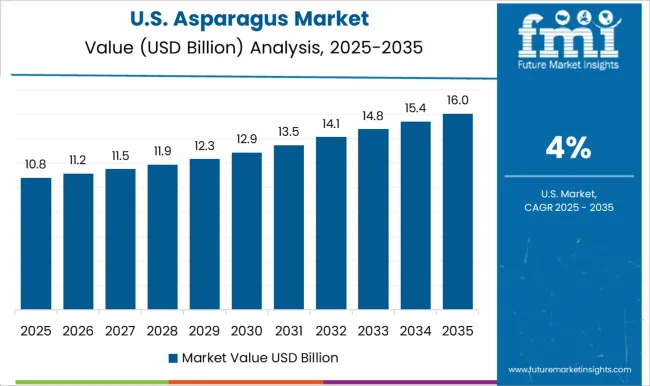

The USA asparagus market is projected to grow at a CAGR of 6.1% from 2025 to 2035, witnessing strong expansion supported by advanced mechanization, environmentally responsible farming practices, and increasing demand for fresh and organic produce. Year-round supply is facilitated through imports during off-season, while domestic production benefits from precision agriculture and efficient cold-chain systems. Health-conscious consumers and premium retail channels drive high-value sales. Strategic investments in vertical farming and greenhouse technologies are further enhancing yields. Export opportunities to neighboring markets and Asia strengthen its global positioning. Collaborations between producers and foodservice chains are also boosting consumption.

Revenue from asparagus in China is projected to grow at a CAGR of 6.0% from 2025 to 2035, and the country maintains its position as one of the largest global asparagus producersdue to vast agricultural land, favorable climatic conditions, and strong domestic demand. The country’s export strength, especially to Japan, Europe, and North America, remains a key revenue driver. Government-backed modernization programs are introducing mechanization and greenhouse farming to boost productivity. Growing middle-class incomes and changing dietary habits are increasing per capita consumption. Expansion of cold storage facilities and e-commerce grocery platforms ensures wider distribution and better shelf life. China’s focus on premium-quality production for export markets is enhancing global competitiveness.

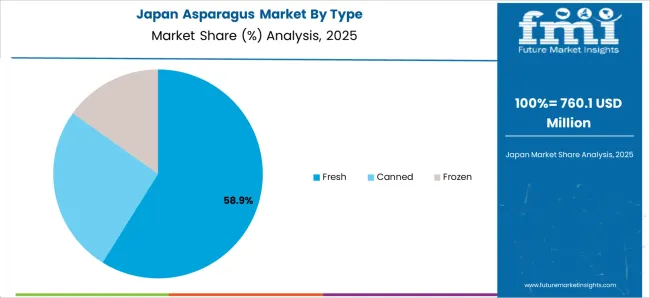

Sales of asparagusin Japan are projected to grow at a CAGR of 5.0% from 2025 to 2035, driven by high consumer standards, focus on freshness, and willingness to pay premium prices for quality produce. Domestic production is concentrated in regions like Hokkaido, while imports from the USA, China, and Australia fill supply gaps. Growing demand for ready-to-cook and pre-trimmed asparagus aligns with busy urban lifestyles. Health-driven consumption is expanding as asparagus gains popularity in functional diets. Innovations in hydroponics and climate-controlled cultivation are enabling off-season availability. Retail marketing strategies highlighting local origin and freshness are further boosting domestic sales.

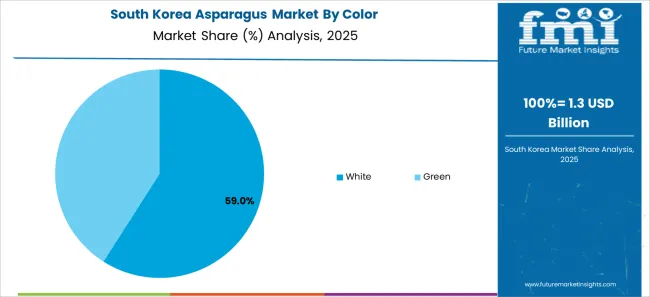

Revenue from asparagus in South Korea is projected to grow at a CAGR of 4.8% from 2025 to 2035, a small but fast-evolving, fueled by the country’s growing health-conscious middle class and interest in premium imported produce. Domestic cultivation is limited, leading to heavy reliance on imports from China, Peru, and the USA Retailers are increasingly offering pre-packaged and organic asparagus to cater to urban consumers. Government programs promoting agricultural diversification are encouraging farmers to invest in asparagus cultivation. Demand in high-end restaurants and hotels remains a steady driver. The rise of online grocery platforms is also broadening consumer access.

The UK asparagus revenue is projected to grow at a CAGR of 2.9% from 2025 to 2035, characterized by strong seasonal domestic production, complemented by imports from Peru, Mexico, and Spain to meet year-round demand. Consumers associate asparagus with premium quality, particularly during the local harvest season. Sustainable sourcing and organic certification are increasingly important purchase drivers. Retailers and restaurants actively promote British asparagus during its short peak season to boost local farming. Climate change adaptation measures, such as earlier planting and protected cropping, are helping extend the domestic harvest. The rise of plant-based diets is also bolstering demand.

The market is moderately consolidated, with leading players leveraging vertically integrated operations, advanced cultivation techniques, and strong export capabilities to maintain a competitive edge. Prominent companies emphasize quality, freshness, and environmentally responsible farming to appealto both domestic and international buyers. Efficient cold-chain logistics, seasonal marketing strategies, and diversified product offerings including fresh, frozen, and canned asparagus enhance market reach and resilience against seasonal supply fluctuations.

Key players include Altar Produce LLC, DanPer Trujillo S.A.C., Sociedad Agrícola Virú S.A., Southern New England Asparagus Growers Association, Limgroup B.V., Jiangsu Wanjiang Group, TEBO Group, and Ica Fruta S.A.C. These companies focus on innovation in post-harvest handling, greenhouse and hydroponic cultivation, and value-added processing.

Market demand is fueled by rising health consciousness, plant-based dietary trends, growing organic product adoption, and expanding retail and e-commerce penetration in both developed and emerging regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.4 billion |

| Product Type | Fresh, Canned, and Frozen |

| Color | White and Green |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Altar Produce LLC, Sociedad Agrícola Virú, DanPer Trujillo S.A.C., Limgroup B.V., TEBOZA BV, Thiermann Spagel Farm, Ilios - The Greek Company, Bejo Seeds Ltd, Spargelhof Elsholz Gbr, Cutter Seed |

The global asparagus market is estimated to be valued at USD 26.4 billion in 2025.

The market size for the asparagus market is projected to reach USD 42.0 billion by 2035.

The asparagus market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in asparagus market are fresh, canned and frozen.

In terms of color, white segment to command 61.5% share in the asparagus market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asparagus Extract Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Asparagus Product Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA