The autoclave market is expanding steadily due to the increasing demand for sterilization equipment across healthcare, pharmaceutical, and laboratory settings. Growth is being supported by rising awareness of infection control, the enforcement of stringent regulatory standards, and the need for reliable decontamination processes. Current market dynamics are marked by technological advancements that enhance sterilization efficiency, reduce cycle times, and improve operational safety.

Manufacturers are focusing on automation and digital integration to enhance monitoring accuracy and maintenance efficiency. The future outlook is favorable as healthcare infrastructure modernization, expanding clinical capacities, and growing biopharmaceutical production drive sustained adoption.

The growth rationale is based on the necessity of sterilization for ensuring patient safety, the scalability of autoclave systems for both small and large facilities, and continuous innovation in energy-efficient designs Collectively, these factors are expected to drive consistent demand, reinforce operational reliability, and strengthen the market’s long-term trajectory.

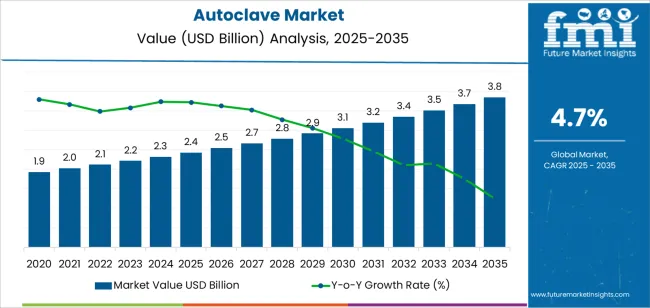

| Metric | Value |

|---|---|

| Autoclave Market Estimated Value in (2025 E) | USD 2.4 billion |

| Autoclave Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

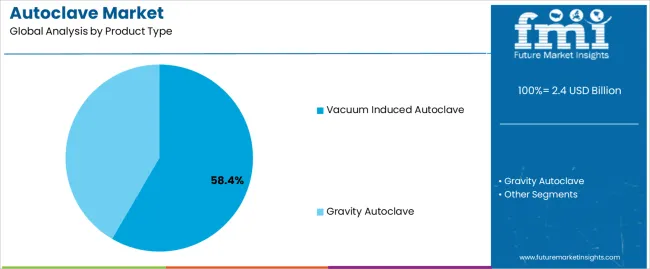

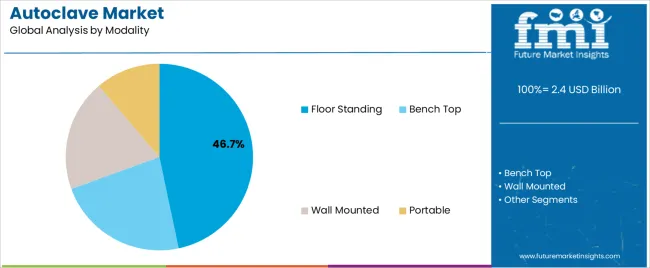

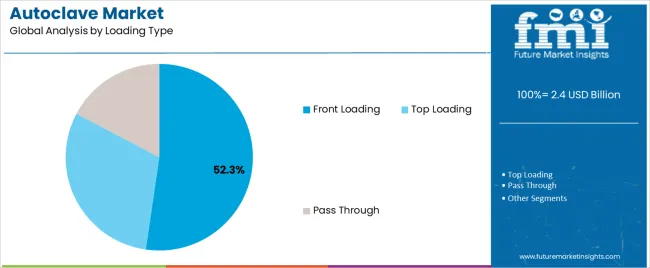

The market is segmented by Product Type, Modality, Loading Type, Chamber Type, and End User and region. By Product Type, the market is divided into Vacuum Induced Autoclave and Gravity Autoclave. In terms of Modality, the market is classified into Floor Standing, Bench Top, Wall Mounted, and Portable. Based on Loading Type, the market is segmented into Front Loading, Top Loading, and Pass Through. By Chamber Type, the market is divided into Cylindrical and Rectangular. By End User, the market is segmented into Hospitals, Office Based Clinics, Academic and Research Institutes, Research Laboratories, Pathology Laboratories, Biopharmaceutical Companies, and Food And Beverages Companies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vacuum induced autoclave segment, holding 58.40% of the product type category, has established dominance due to its superior sterilization performance and ability to remove air pockets effectively during the process. This capability ensures uniform steam penetration, which is critical for sterilizing complex instruments and medical devices.

Adoption has been driven by its high efficiency, shorter cycle times, and adaptability for diverse applications in hospitals, laboratories, and pharmaceutical production units. Continuous innovation in chamber design and control systems has further improved reliability and operational precision.

Regulatory compliance and the increasing preference for automated sterilization have reinforced market confidence in vacuum-based systems The segment’s growth is expected to continue as healthcare and industrial users seek advanced, validated, and energy-efficient sterilization solutions that ensure safety and performance consistency.

The floor standing segment, accounting for 46.70% of the modality category, has maintained its leading position owing to its high load capacity and suitability for intensive sterilization workloads. It is favored by hospitals, research institutes, and pharmaceutical manufacturing units requiring continuous, high-volume sterilization cycles.

Its dominance has been supported by advancements in material durability, digital control interfaces, and enhanced safety mechanisms that ensure consistent performance. The ability to accommodate larger instruments and bulk materials has further strengthened adoption.

Integration of automated pressure control and data logging systems has improved operational traceability and compliance with international safety standards As global healthcare and laboratory infrastructures continue to expand, demand for floor standing autoclaves is expected to remain strong due to their efficiency, scalability, and long service life.

The front loading segment, representing 52.30% of the loading type category, has emerged as the preferred configuration due to its ergonomic design and ease of operation in clinical and laboratory environments. Its compact structure allows efficient space utilization, making it suitable for both small and large facilities. User-friendly interfaces and advanced safety interlocks have enhanced usability and operator confidence.

Adoption has been further supported by its compatibility with a wide range of sterilization programs and materials. The growing focus on process standardization and compliance with global sterilization norms has reinforced its market position.

Manufacturers are increasingly introducing front loading autoclaves with improved cycle control and energy efficiency, ensuring reliability and cost-effectiveness These attributes are expected to sustain the segment’s market share and drive continued preference among healthcare and industrial users.

The global demand for the autoclave market was estimated to reach a valuation of USD 1,723.60 million in 2020, according to a report from Future Market Insights. From 2020 to 2025, the autoclave market witnessed significant growth, registering a CAGR of 5%.

| Historical CAGR 2020 to 2025 | 5% |

|---|---|

| Forecast CAGR 2025 to 2035 | 4.70% |

The market for autoclave is expected to grow in the future due to these factors

Increasing Focus on Infection Prevention and Control to Push Market Growth

An increasing focus on infection prevention and control in healthcare settings is driving the autoclave market. Sterilization procedures are being given top priority in hospitals and clinics throughout the globe in order to reduce hazards and guarantee patient safety, since healthcare associated infections continue to be a major problem.

Given the increased emphasis on infection control, autoclaves are becoming more and more in demand as essential tools for sterilizing medical equipment and instruments, which is driving market expansion. The market for autoclaves is growing as a result of strict regulations controlling sterilization standards.

Healthcare establishments are required by regulatory authorities to purchase dependable autoclaves that either meet or surpass these criteria for sterilizing procedures, as these agencies are always updating their rules and regulations. Healthcare facilities are under regulatory pressure to purchase sophisticated autoclave systems, which is fueling market growth and continuous demand.

High Initials Costs and Technological Challenges to Restrict Market Growth

A number of obstacles, including the high initial investment costs involved in purchasing and maintaining autoclave equipment, may hinder market growth in the global autoclave market.

Healthcare institutions may also face obstacles from complicated regulatory compliance requirements and the demand for substantial training in order to operate autoclaves efficiently, which would restrict their use and impede market development. Technological constraints or improvements in substitute sterilizing techniques may potentially provide obstacles to the autoclave market's further expansion.

This section focuses on providing detailed analysis of two particular market segments for the autoclave, the dominant product and the significant modality. The two main segments discussed below are the gravity autoclave and floor standing modality.

| Product Type | Gravity Autoclave |

|---|---|

| Market Share in 2025 | 53% |

In 2025, the gravity autoclave is likely to gain a market share of 53%. Gravity autoclaves are a reliable and affordable option that will likely see growth in this market. Gravity autoclaves are easier to build and operate than other types of autoclaves since they sterilize using air's inherent downward movement.

They are a desirable alternative for healthcare institutions, particularly in environments with limited resources, owing to their cheaper initial investment and ongoing maintenance costs, which encourages more adoption and fosters market expansion.

| Modality | Floor Standing |

|---|---|

| Market Share in 2025 | 34.80% |

In 2025, the floor standing modality segment is anticipated to acquire 34.80% market share. The floor standing modality autoclave is expected to gain popularity owing to its adaptability and ability to handle heavier loads of medical equipment and apparatus.

These autoclaves are ideal for busy healthcare establishments with high sterilization demands since they have a large chamber volume. Their strong design and innovative features, such as programmable cycles and effective drying systems, improve workflow management and sterilizing efficiency. They therefore appeal to medical professionals looking for dependable and effective sterilizing solutions, which promotes market acceptance.

This section will go into detail on the autoclave markets in a few key countries, including the United States, the United Kingdom,China, Japan and South Korea. This part will focus on the key factors that are driving up demand in these countries for the autoclave.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 2.90% |

| The United Kingdom | 4.10% |

| China | 2.90% |

| Japan | 1.30% |

| South Korea | 1.60% |

The United States autoclave ecosystem is anticipated to gain a CAGR of 2.90% through 2035. Factors that are bolstering the growth are:

The autoclave market in the United Kingdom is expected to expand with a 4.10% CAGR through 2035. The factors pushing the growth are:

The autoclave ecosystem in China is anticipated to develop with a 2.90% CAGR from 2025 to 2035. The drivers behind this growth are:

The autoclave industry in Japan is anticipated to reach a 1.30% CAGR from 2025 to 2035. The drivers propelling growth forward are:

The autoclave ecosystem in South Korea is likely to evolve with a 1.6% CAGR during the forecast period. The factors bolstering the growth are:

To stay competitive and take advantage of new chances, market players in the global autoclave market are concentrating on innovation, growth, and strategic partnerships. Companies spend money on research and development to bring in innovative technologies like automation, Internet of Things connectivity, and environmentally friendly sterilizing techniques.

Through joint ventures and acquisitions, they increase their geographic reach in order to get access to new markets and clientele. Strategic partnerships with regulatory agencies and healthcare providers support and strengthen efforts to create new products, which in turn propels market expansion.

The key players in this market include:

Significant advancements in the autoclave market are being made by key market participants, and their offerings include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.7% from 2025 to 2035 |

| Market value in 2025 | USD 2.4 billion |

| Market value in 2035 | USD 3.8 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Modality, Loading Type, Chamber Type, End User, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

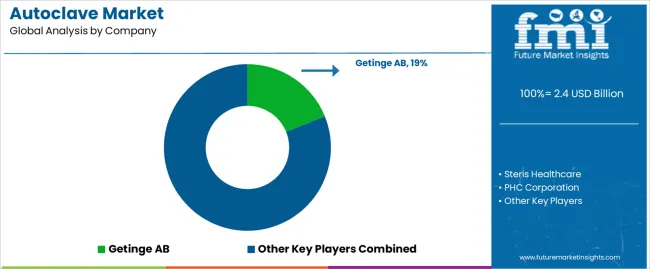

| Key Companies Profiled | Steris healthcare; Getinge AB; PHC Corporation; Shinva Medical Instruments Co. Ltd.; MELAG Medizintechnik GmbH & Co. KG; Astell Scientific; Consolidated Sterilizer Systems; Tuttnauer; Labtron Equipment; BMT Medical Technology S.R.O.; LTE Scientific |

| Customization Scope | Available on Request |

The global autoclave market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the autoclave market is projected to reach USD 3.8 billion by 2035.

The autoclave market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in autoclave market are vacuum induced autoclave and gravity autoclave.

In terms of modality, floor standing segment to command 46.7% share in the autoclave market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AAC (Autoclaved Aerated Concrete) Blocks Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Dental Autoclaves Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA