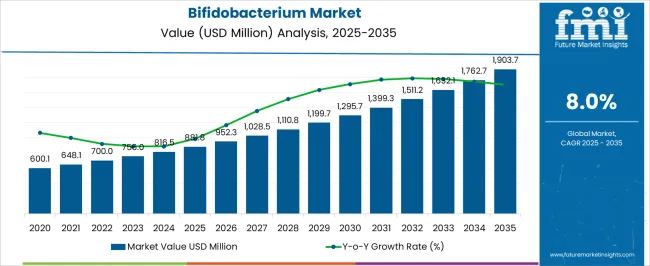

The Bifidobacterium Market is estimated to be valued at USD 881.8 million in 2025 and is projected to reach USD 1903.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. Between 2028 and 2030, the market expands from USD 1,110.8 million to USD 1,295.7 million, with yearly growth rates holding close to the average CAGR of 8%, signaling strong and stable demand. Moving towards 2035, the market progresses steadily, achieving USD 1,903.7 million, with each year witnessing incremental gains in line with sustained growth momentum. The year-over-year growth percentages hover around 7.5% to 8.5%, showing resilience and consistent expansion throughout the forecast period. This pattern illustrates a robust market trajectory driven by increasing applications and growing consumer interest in probiotic products containing bifidobacterium strains.

| Metric | Value |

|---|---|

| Bifidobacterium Market Estimated Value in (2025 E) | USD 881.8 million |

| Bifidobacterium Market Forecast Value in (2035 F) | USD 1903.7 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The bifidobacterium market is undergoing significant expansion, driven by increasing consumer awareness of gut health, a shift toward preventive healthcare, and the rising integration of probiotics into mainstream dietary routines. Ongoing clinical validation of bifidobacterium’s role in supporting immune response, digestive wellness, and mental health has strengthened its adoption in nutraceutical and food formulations.

Regulatory acceptance of specific strains in various geographies, coupled with advancements in encapsulation and freeze-drying technologies, is improving product stability and efficacy. Major players are investing in tailored probiotic blends targeting age-specific and condition-specific health outcomes, thereby broadening the consumer base.

The growing penetration of online supplement sales, alongside innovation in functional food formats, is expected to support long-term demand. Future growth is also likely to be shaped by ongoing microbiome research and product launches aligned with clean-label and vegan claims.

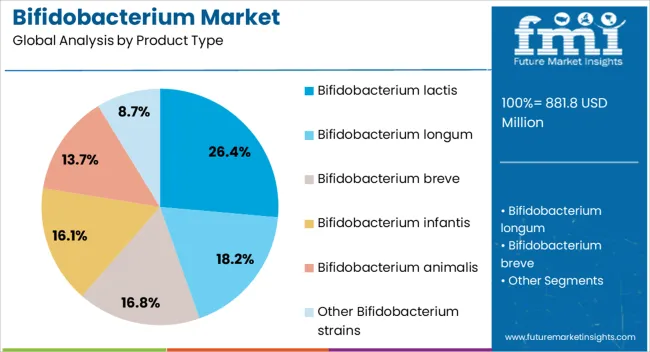

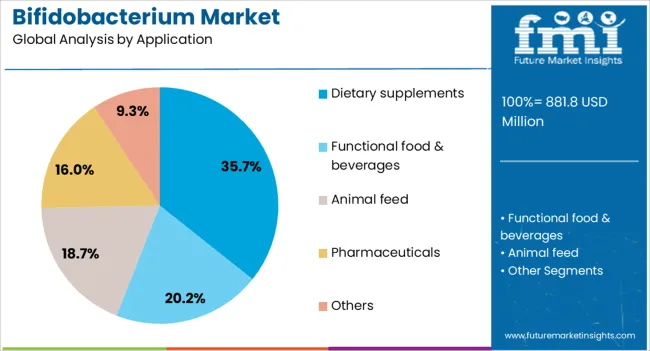

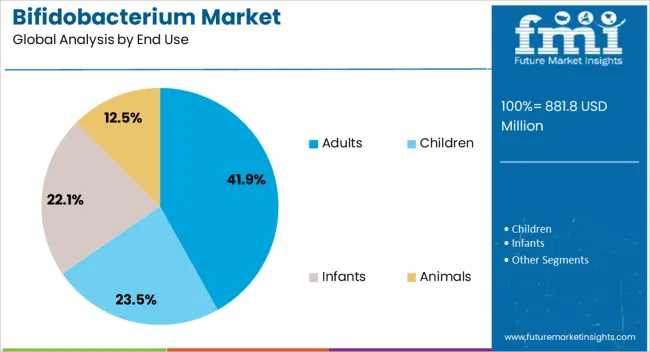

The bifidobacterium market is segmented by product type, application, end use, distribution channel, and geographic regions. By product type, the bifidobacterium market is divided into Bifidobacterium lactis, Bifidobacterium longum, Bifidobacterium breve, Bifidobacterium infantis, Bifidobacterium animalis, and Other Bifidobacterium strains. In terms of application, the bifidobacterium market is classified into Dietary supplements, Functional food & beverages, Animal feed, Pharmaceuticals, and Others. The end use of the bifidobacterium market is segmented into Adults, Children, Infants, and Animals. The bifidobacterium market is segmented by distribution channel into Pharmacies & drugstores, Online retail, Supermarkets, Health stores, and Others. Regionally, the bifidobacterium industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Bifidobacterium lactis is expected to account for 26.40% of the total market revenue in 2025, making it the leading product type. Its stronghold is being reinforced by clinical efficacy in promoting digestion, lactose tolerance, and immune modulation.

The strain’s proven survivability during gastrointestinal transit and compatibility with dairy and non-dairy formats has led to widespread use across dietary supplements and functional foods. Commercial availability in both standalone and multi-strain blends has facilitated its integration into diverse health and wellness applications.

Regulatory approvals in North America, Europe, and parts of Asia have further strengthened its status in both retail and clinical nutrition channels. Its adaptability to a wide age spectrum, from infant to elderly nutrition, has reinforced its leadership in an increasingly personalized probiotic landscape.

Dietary supplements are projected to hold 35.70% of the market share in 2025, positioning them as the leading application area for bifidobacterium products. This segment’s expansion is being fueled by increasing consumer demand for natural, non-pharmaceutical health solutions that support gut and immune health.

Enhanced formulation techniques such as microencapsulation have improved probiotic viability, enabling shelf-stable products with higher efficacy. Retail expansion through e-commerce and pharmacies has made supplements more accessible to a broader demographic.

The rising prevalence of lifestyle-induced digestive disorders and a shift toward self-directed health management are pushing consumers toward probiotic supplementation. Additionally, dietary supplements allow for targeted dosing and flexibility in form factors, such as capsules, powders, and gummies, which appeals to health-conscious consumers seeking convenience and control over intake.

The adult population is expected to contribute 41.90% of the total market revenue in 2025, establishing it as the top end-use segment for bifidobacterium-based products. This segment’s lead is being driven by increased incidence of gastrointestinal issues, heightened awareness of immunity, and proactive interest in maintaining long-term wellness.

Adults often seek dietary interventions to manage stress, support digestive regularity, and improve energy metabolism, all of which are areas where bifidobacterium strains have shown benefits. Marketing campaigns targeting working professionals, aging consumers, and fitness enthusiasts have helped establish strong brand engagement within this group.

Furthermore, the convenience of supplement formats and expanding choices in fortified beverages and foods are contributing to consistent demand among adult consumers. With clinical research increasingly tailored to adult health outcomes, the segment is poised to maintain its dominant position in the forecast period.

The bifidobacterium market is expanding as interest in gut health and probiotics grows globally. Bifidobacteria are recognized for their ability to improve digestive health, boost immunity, and potentially impact mental wellness through the gut-brain axis. Increasing consumer awareness of microbiome benefits is driving demand across dietary supplements, functional foods, and infant formulas. Advances in strain development and formulation techniques enhance product efficacy. Challenges such as regulatory variations and maintaining bacterial viability persist. Market growth is supported by rising research investments and innovation in personalized nutrition.

Bifidobacterium strains are widely used in supplements, fermented foods, and beverages to promote digestive balance and immune function. Scientific studies highlighting their role in reducing inflammation, improving lactose digestion, and supporting mental health expand consumer interest. Infant formulas fortified with bifidobacteria address early gut microbiota development, fueling demand in pediatric nutrition. Additionally, emerging evidence links bifidobacteria to skin health and metabolic benefits, encouraging product diversification. The expanding understanding of probiotic mechanisms propels the integration of bifidobacteria into novel functional formulations targeting specific health outcomes.

Maintaining the viability and stability of bifidobacterium strains during processing and storage is a major challenge for manufacturers. These bacteria are sensitive to heat, oxygen, and moisture, requiring advanced encapsulation and delivery technologies to ensure product efficacy. Regulatory frameworks differ globally, with some regions imposing strict safety and efficacy data requirements for probiotic claims. Navigating these complex regulations slows product launches and complicates marketing strategies. Ensuring clear, science-backed health claims is essential to build consumer trust and avoid regulatory penalties. Industry players invest in quality assurance, standardized testing, and compliance certifications to address these challenges.

Technological advancements in microbiology and bioengineering are enabling the development of novel bifidobacterium strains with enhanced health benefits and improved resilience. Tailored strains target specific conditions like irritable bowel syndrome, allergies, and metabolic disorders. Encapsulation techniques such as microencapsulation and freeze-drying protect bacterial viability and optimize delivery to the gut. Formulations combining bifidobacteria with prebiotics and other bioactives create synbiotic products with synergistic effects. These innovations increase product differentiation and efficacy, meeting growing consumer demand for targeted, science-backed probiotics. Collaboration with research institutions accelerates clinical validation and supports market credibility.

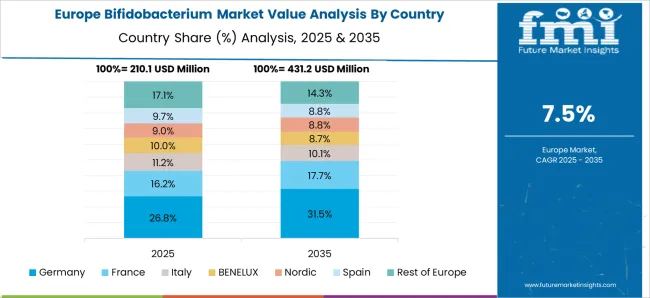

Asia-Pacific is emerging as a key growth region for bifidobacterium products, driven by rising health awareness, expanding middle-class populations, and increasing adoption of functional foods and supplements. North America and Europe remain strong markets due to established probiotic consumption and advanced regulatory environments. Market penetration is expanding in developing countries through urbanization and improved healthcare infrastructure. E-commerce platforms facilitate wider distribution and consumer access. Regional manufacturers are customizing products to local tastes and health needs, while global players invest in strategic partnerships and acquisitions to enhance presence. The growing focus on preventive healthcare and wellness lifestyles continues to support market growth worldwide.

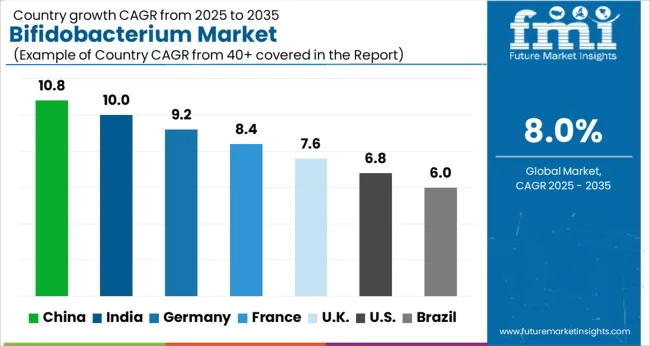

The global bifidobacterium market is growing at an 8.0% CAGR, driven by rising consumer awareness of probiotics and gut health benefits. Among the BRICS nations, China leads with 10.8% growth, supported by expanding pharmaceutical and nutraceutical industries, followed by India at 10.0%, fueled by increasing demand for dietary supplements and fermented foods. In the OECD region, Germany records 9.2% growth, reflecting strong regulatory frameworks and innovation in probiotic formulations. The United Kingdom grows at 7.6%, driven by health-conscious populations and product diversification. The United States, a mature market, shows 6.8% growth, shaped by stringent quality standards and evolving consumer preferences. These countries collectively influence market trends through advancements in research, production technology, and regulatory compliance. This report includes insights on 40+ countries; the top countries are shown here for reference.

China bifidobacterium market is expanding rapidly with a 10.8% CAGR, driven by rising health awareness and increasing demand for probiotic supplements. Consumers are focusing more on gut health and immunity, boosting adoption in functional foods, dairy products, and dietary supplements. Compared to Western countries, China benefits from growing traditional medicine integration with modern probiotics, enhancing product appeal. The rise of e-commerce platforms improves accessibility, while domestic manufacturers innovate with strain-specific formulations to target digestive and immune health. Increasing research investments and clinical trials support product efficacy claims, building consumer trust. Government initiatives to promote health and nutrition further stimulate market growth. The trend toward natural and preventive health solutions strengthens bifidobacterium’s role as a key probiotic in China’s expanding health and wellness sector.

Germany bifidobacterium market is advancing at a 9.2% CAGR, driven by strong consumer focus on digestive health and scientific validation of probiotic benefits. German consumers prefer high-quality, clinically tested products integrated into functional foods and dietary supplements. Compared to Asian markets, Germany places greater emphasis on regulatory compliance and product safety. The aging population increases demand for probiotics that support gut health and immune function. Organic and natural product trends complement bifidobacterium adoption in health-conscious segments. Distribution through pharmacies, health food stores, and e-commerce platforms ensures widespread availability. Collaborations between universities and biotech companies foster innovation in strain development and efficacy. Sustainability and ethical production practices also influence consumer preferences.Germany maintains a mature market with steady growth fueled by health trends and rigorous product standards.

United Kingdom bifidobacterium market is growing at a 7.6% CAGR, supported by increasing public awareness of gut health and probiotic benefits. Consumers are adopting bifidobacterium-enriched supplements and functional foods to improve digestion and boost immunity. Compared to Germany, the UK market shows strong interest in innovative delivery formats such as powders, capsules, and fortified beverages. The rising trend of personalized nutrition encourages tailored probiotic solutions. Health professionals play a key role in recommending probiotics as part of preventive healthcare. Retail expansion through supermarkets, pharmacies, and online channels enhances product accessibility. Regulatory frameworks ensure product quality and consumer safety, building trust. The growing focus on mental health and the gut-brain connection further supports bifidobacterium demand in the UK

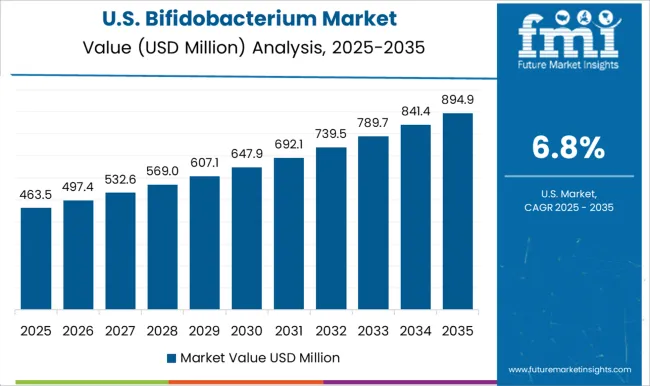

United States bifidobacterium market is advancing at a 6.8% CAGR, driven by consumer demand for natural health products and preventive care. Increasing scientific research highlights bifidobacterium’s role in digestive balance, immune support, and allergy relief. Compared to European and Asian markets, the USA shows strong preference for probiotic supplements with multi-strain formulations and added functional benefits. The rise of health-conscious consumers and fitness enthusiasts boosts demand across dietary supplements and fortified foods. Online retail and direct-to-consumer channels expand product reach and convenience. Regulatory scrutiny ensures product safety, fostering consumer confidence. Innovation in probiotics combined with marketing focused on wellness lifestyles enhances market growth. The United States market reflects a mature yet expanding landscape, with opportunities for new product development and niche targeting.

India bifidobacterium market is growing strongly at a 10.0% CAGR, supported by increasing consumer interest in digestive health and wellness. Rising awareness about probiotics in urban and semi-urban areas is driving demand for bifidobacterium-enriched yogurts, supplements, and beverages. Compared to China, India’s market is propelled by a younger demographic adopting healthier lifestyles and preventive healthcare. Government campaigns promoting nutrition and sanitation contribute to market penetration. Local manufacturers are developing affordable products adapted to regional tastes and dietary patterns. Additionally, increasing collaboration between research institutes and industry players helps improve product innovation and efficacy. Growing availability through pharmacies, health stores, and online platforms enhances consumer reach. The rising trend toward natural health products and immunity-boosting supplements reinforces bifidobacterium’s market potential in India.

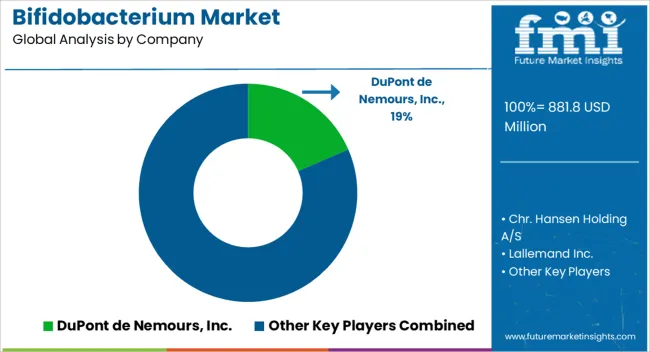

The Bifidobacterium market is expanding steadily, driven by rising consumer awareness of gut health and increasing demand for probiotic-enriched foods and supplements. DuPont de Nemours, Inc. is a dominant player, leveraging its advanced fermentation technologies and extensive product portfolio to supply high-quality Bifidobacterium strains for both food and pharmaceutical applications. Chr. Hansen Holding A/S is also influential, known for its robust research pipeline and wide range of probiotic cultures tailored for dairy, nutrition, and health industries.

Lallemand Inc. and Kerry Group emphasize innovation and sustainable production methods, offering specialized Bifidobacterium strains that address specific health benefits, such as immune support and digestive wellness. Global consumer brands like Yakult Honsha Co., Ltd. and Morinaga Milk Industry Co., Ltd. capitalize on strong brand recognition and extensive distribution networks to promote probiotic beverages and nutritional products containing Bifidobacterium. Nestlé S.A. and Danone S.A. incorporate these probiotics into diverse product lines, combining scientific research with consumer trust to expand market reach.

Smaller yet specialized companies such as Probi AB and Bifodan A/S focus on niche applications, providing highly targeted Bifidobacterium strains for clinical nutrition and dietary supplements. This mix of multinational corporations and focused biotech firms intensifies competition and fosters innovation, with an increasing focus on strain specificity, clinical validation, and personalized nutrition to meet evolving consumer health needs worldwide.

Companies are increasingly developing products with specific Bifidobacterium strains to address particular health needs, such as Bifidobacterium longum, Bifidobacterium bifidum, and Bifidobacterium infantis, among others. Research continues to uncover the specific benefits of each strain, allowing manufacturers to offer more targeted solutions for digestive health, immune support, and even mental health.

| Item | Value |

|---|---|

| Quantitative Units | USD 881.8 Million |

| Product Type | Bifidobacterium lactis, Bifidobacterium longum, Bifidobacterium breve, Bifidobacterium infantis, Bifidobacterium animalis, and Other Bifidobacterium strains |

| Application | Dietary supplements, Functional food & beverages, Animal feed, Pharmaceuticals, and Others |

| End Use | Adults, Children, Infants, and Animals |

| Distribution Channel | Pharmacies & drugstores, Online retail, Supermarkets, Health stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Lallemand Inc., Kerry Group, Probi AB, Morinaga Milk Industry Co., Ltd., Yakult Honsha Co., Ltd., Nestlé S.A., Danone S.A., and Bifodan A/S |

| Additional Attributes | Dollar sales in the Bifidobacterium Market vary by product type (probiotics, dietary supplements, pharmaceuticals), application (digestive health, immunity, infant nutrition), end-use industry (food & beverage, healthcare, animal feed), and region (North America, Europe, Asia-Pacific). Growth is driven by rising health awareness, demand for natural products, and expanding probiotic usage. |

The global bifidobacterium market is estimated to be valued at USD 881.8 million in 2025.

The market size for the bifidobacterium market is projected to reach USD 1,903.7 million by 2035.

The bifidobacterium market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in bifidobacterium market are bifidobacterium lactis, bifidobacterium longum, bifidobacterium breve, bifidobacterium infantis, bifidobacterium animalis and other bifidobacterium strains.

In terms of application, dietary supplements segment to command 35.7% share in the bifidobacterium market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA