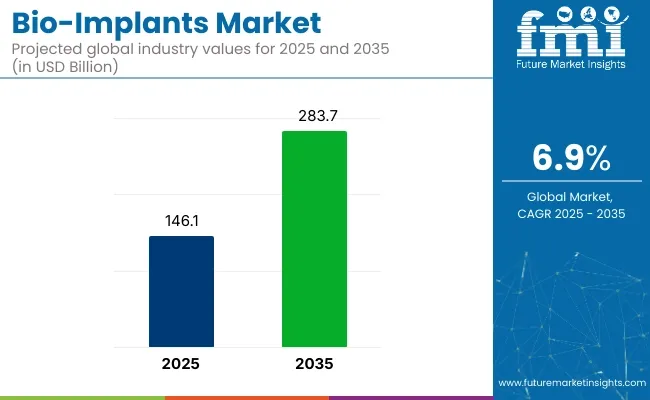

The global bio-implants market is estimated to reach USD 146.1 billion in 2025 and is projected to grow at a CAGR of 6.9%, reaching USD 283.7 billion by 2035. Bio-implants are medical devices made from biocompatible materials that are inserted into the human body to replace diseased tissues or organs.

These implants are widely used across various medical fields, including orthopedics, cardiovascular, dental, spinal, and ophthalmic treatments. Orthopedic bio-implants are the most common type, addressing musculoskeletal disorders. The growing prevalence of chronic conditions, such as osteoarthritis and cardiovascular diseases (CVDs), is driving the increasing adoption of bio-implants.

Technological advancements continue to drive the evolution of bio-implants. For instance, in June 2025, CollPlant Biotechnologies announced the successful printing of 200 cc breast implants, a commercial size, using its proprietary non-animal-derived recombinant human collagen (rhCollagen) bioinks.

This breakthrough in 3D printing for bio-implants could significantly enhance the customization and biocompatibility of implants. Additionally, in July 2024, Himed and Lithoz entered into a Material Research Partnership Agreement to develop novel bioceramic feedstocks. This collaboration aims to explore the integration of Himed’s calcium phosphate (CaP) with Lithoz’s ceramic binder in the CeraFab S65 medical 3D printer, which could result in advancements in bioceramic implants and improve the quality and application of bio-implants.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 146.1 Billion |

| Market Size in 2035 | USD 283.7 Billion |

| CAGR (2025 to 2035) | 6.9% |

Bio-implants can be derived from different sources. Autografts are implants taken from another part of the same patient’s body, while allografts come from different individuals of the same species. Xenografts, on the other hand, are sourced from different species. The majority of bio-implants are synthetically derived from man-made materials, which provide a range of advantages, including shorter recovery times and improved functionality.

Despite the potential risks of infection and transplant rejection, the benefits of bio-implants far outweigh these challenges. The rise in sedentary lifestyles, higher obesity rates, and the growing geriatric population have led to an increased prevalence of musculoskeletal disorders and CVDs, further fueling the demand for bio-implants.

The above table presents the expected CAGR for the global bio-implant market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2035, the business is predicted to surge at a CAGR of 7.8%, followed by a slightly lower growth rate of 7.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.8% |

| H2 (2024 to 2034) | 7.5% |

| H1 (2025 to 2035) | 6.9% |

| H2 (2025 to 2035) | 6.5% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.9% in the first half and remain relatively moderate at 6.5% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed a decrease of 100 BPS.

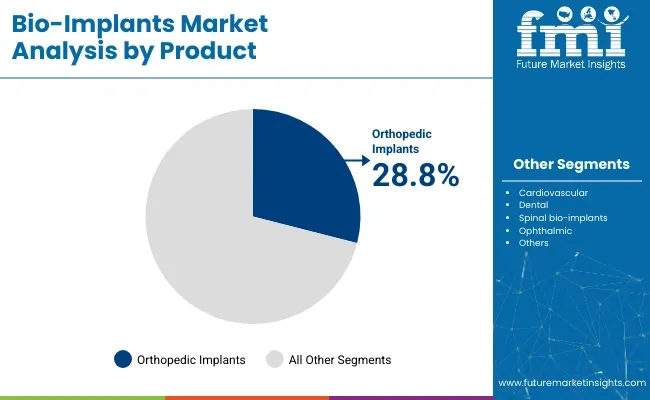

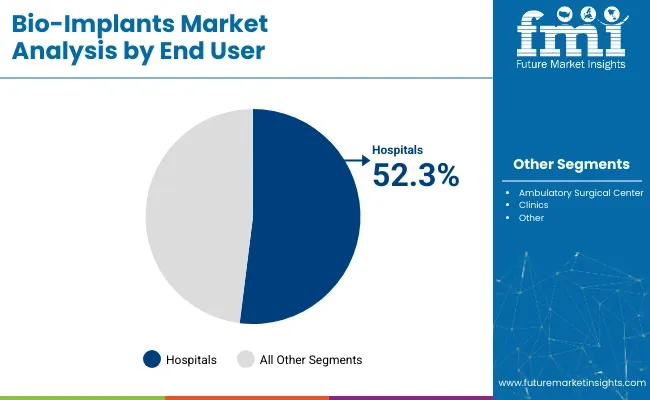

The bio-implants market is projected to grow significantly, with key drivers being the orthopedic implants segment and hospitals as the primary end-users. The orthopedic implants segment is anticipated to dominate the market in terms of value share, while hospitals are expected to continue leading the end-user category due to their capacity for high-volume surgeries and access to advanced technologies. Both segments are integral to the expansion of the bio-implants market.

Orthopedic implants are expected to capture 28.8% of the value share in the bio-implants market. The growing prevalence of orthopedic diseases, particularly among the aging population, is driving the demand for these implants. Companies like Stryker, Zimmer Biomet, Johnson & Johnson, and Medtronic are leaders in providing orthopedic implants that cater to the growing demand.

Stryker offers a wide range of joint replacement implants, while Zimmer Biomet is known for its innovations in spinal implants. The increasing life expectancy globally, along with the rising geriatric population, has resulted in a higher incidence of musculoskeletal disorders.

The demand for effective interventions, such as joint replacement surgeries, is therefore on the rise. Additive manufacturing technologies, including 3D printing, have allowed companies to develop implants with complex geometries and porous structures, which enhances the functionality of orthopedic implants. Innovations in materials like titanium alloys and biocompatible ceramics are also improving the strength and in vivo integration of implants.

Hospitals are expected to capture 52.3% of the bio-implants market share. With their large-scale infrastructure and higher budgets compared to other healthcare facilities, hospitals are able to procure advanced bio-implants for a variety of surgical procedures. Leading companies like Medtronic, Abbott, and Boston Scientific are key suppliers of bio-implants used in hospitals.

Medtronic, for instance, provides a wide range of implantable devices, including those for spinal and orthopedic surgeries. Due to the high volume of surgeries conducted in hospitals, there is an immense demand for bio-implants, such as joint replacement, spinal implants, and cardiovascular devices.

Hospitals have access to cutting-edge technology, including 3D-printed implants and implants equipped with integrated sensors for real-time patient monitoring. This technology is essential for improving patient outcomes and recovery times. The comprehensive healthcare infrastructure of hospitals facilitates multidisciplinary collaboration among specialists, which is critical for managing complex cases that require coordinated treatment and the use of multiple types of bio-implants.

Increased Prevalence of Musculoskeletal Disorder Drive Growth of Bio-Implants Market

The global health care expenditure is rising and so is the average global life expectancy. According to the data published by the Macrotrends LLC the average life expectancy in 2023 was 73.16 years which is 10.5% increase from 66.2 years in 2000. This reflects a constant rise in the geriatric population that are highly susceptible to numerous chronic ailment amongst which musculoskeletal disorder is common.

Osteoarthritis along with osteoporosis, degenerative spine conditions and other related condition are prevalent these days. Other than the aging population sedentary lifestyle and increasing obesity rate are also the reason for this conditions.

Further to these factors, an increase in lifestyle disorders related to the lack of activity and improper diet is making this condition even more popular. Many of these impacted patients eventually need a joint replacement surgery commonly for hip and knee. As the global population ages, the need for musculoskeletal implants will increase.

This includes joint replacements, spinal implants and others. Also novel Titanium alloys, ceramics, and advanced polymers are enhancing the durability and performance of these implants. This increasing demand is the driving force for bio-implant market, as both surgical techniques and implant technologies continue to evolve.

Rise in Cardiovascular Disease Increased the Demand for Cardiovascular Bio-Implants

The prevalence of cardiovascular disease is on rise. Rising Obesity rate and lack of physical activity are foremost cause of Cardiometabolic disorders. According to the data from British Heart Foundation in 2021, 250 million cases of prevalent coronary artery disease existed.

National Institutes of Health during the year 2023 have stated that in last 30 years, calcific aortic valve disease (CAVD) has increased sevenfold. Also heart failures are increasing at an alarming rate. All the above condition create demand for effective treatment solutions. Bio-implant reduce the reliance on long term medications and allows for faster recovery.

Coronary stents widen narrowed arteries and improves blood flow. This reduced the risk of heart attacks. Bioprosthetic valves are key devices to treat valvular diseases. Pacemakers and implantable cardioverter-defibrillators (ICDs) are used to manage abnormal heart rhythms which prevents arrhythmias.

The increasing incidence of CVDs directly leads to higher demand for these devices. Moreover, the advancement of biocompatible metals and tissue-engineered valves, enhances the effectiveness of bio-implant which is also contributing to the market growth.

Adoption of Regenerative Medicine Offers an Opportunity for Market Growth

Use of Regenerative medicine offers an enormous prospect towards growth in the bio-implant market with the introducing of advanced therapies that not only replace damaged tissues but also stimulate natural tissue repair and regeneration. The shift from traditional implants to regenerative-based solutions offers new potential. Patient can be treated for wide range of conditions.

Orthopedics is an area where regenerative medicine can transform the treatment of joint replacements. Traditional orthopedic implants for hip and knee wear out with time. This outcome requires revision surgeries.

Stem cell therapies along with biomaterial scaffolds offers promoting towards regeneration of damaged bone, cartilage, etc. Stem cells are taken from the patient body and could be injected into the injured area. This process would be helpful in regenerating tissues, and it would eventually diminish the need for a total joint replacement.

Furthermore, this method could make an existing implant last longer or even obviate it in some cases. In that way, the healthcare cost for the future will be diminished for the patient.

Regenerative medicine in the cardiovascular sector could provide for tissue repair in the heart following a myocardial infarction to overcome deficiencies with current medical interventions that use stents and the replacement of diseased valves in the heart.

Tissue-engineered valves and even therapies using stem cells are available to rebuild damaged cardiac tissues. These may further optimize long-term heart functions while minimizing subsequent surgeries.

High Cost and Risk of Complications Associated With Implant Rejection Hinder the Market Growth

Advanced bio-implants, especially those made from high-quality biomaterials such as titanium alloys, ceramics, and regenerative materials like stem cells or bioinks, are expensive to produce.

The high production costs are usually transferred to the patients through expensive surgeries and post-operative care. Therefore, most patients, especially in low-income regions, cannot afford such advanced treatments, and the market cannot grow to its full potential.

Another factor hindering the growth of the market for bio-implants is a complicated regulatory approval process. Bio-implants undergo critical clinical trials and approvals provided by regulatory bodies such as the FDA in the United States or the EMA in Europe.

This long process with high costs prevents introducing innovative bio-implant technologies into the market in a timely fashion and, therefore, from obtaining access to state-of-the-art solutions. Regulatory uncertainty and variations in standards across regions will also make it challenging to scale production and market a product globally.

Another challenge is the possibility of implant failure and complications. Advancements in material and technology have increased. But still implant longevity, infection, rejection, and wear-and-tear are still possible.

Patients would need to undergo revision surgery, which increases the costs and risks. These challenges can deter patients and healthcare providers further, which will slow market growth.

Companies in the Tier 1 sector account for 45.5% of the global market, ranking them as the dominant players in the industry. Tier 1 players’ offer a wide range of product and have established industry presence. Having financial resources enables them to enhance their research and development efforts and expand into new markets.

A strong brand recognition and a loyal customer base provide them with a competitive advantage. Prominent companies within Tier 1 include Medtronic, Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, Smith & Nephew, St Jude Medical (Abbott) and others

Tier 2 players dominate the industry with a 32.5% market share. Tier 2 firms have a strong focus on a specific Product and a substantial presence in the industry, but they have less influence than Tier 1 firms. The players are more competitive when it comes to pricing and target niche markets.

New Product and services will also be introduced into the industry by Tier 2 companies. Tier 2 companies include Arthrex, Inc., Exactech, Inc., Cochlear Ltd, Straumann AG and others.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 have smaller work force and limited presence across the globe. Prominent players in the tier 3 category are MiMedx Group, Alpha Bio Tec, Clinic Lemanic, Huhtamaki Oyj and others.

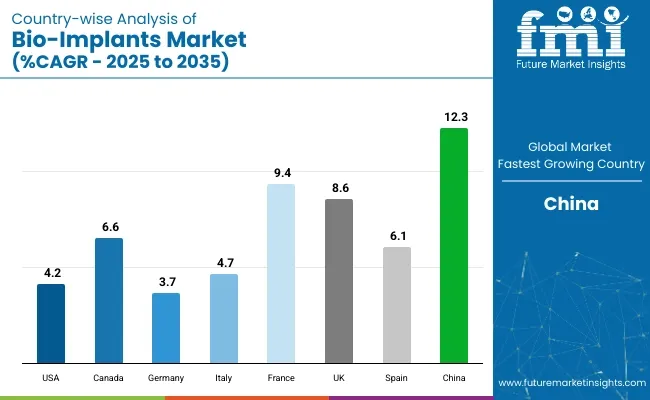

The section below covers the industry analysis for the bio-implant market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided.

The United States is anticipated to remain at the forefront in North America through 2035. India is projected to witness a CAGR of 13.1% from 2025 to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Canada | 6.6% |

| Germany | 3.7% |

| Italy | 4.7% |

| France | 9.4% |

| UK | 8.6% |

| Spain | 6.1% |

| China | 12.3% |

The United States have 57.8 million adult living above 65 years as per the 2022 data of The National Council of Aging. By the 2030 all the baby boomers will cross the 65 age mark.

As the geriatric population increase so does the disease complications such as cardiovascular, musculoskeletal disorders etc. as a result of which the adoption of cardiovascular implants, orthopedic devices, or spinal bio-implants are increase in the country. As per CDC 60% of adults live with at least one chronic condition, including diabetes and heart disease, which usually require bio-implants for effective management.

Design and material technology in bio-implants is improving the efficacy and safety of such devices. The introduction of minimally invasive surgical techniques allows for shorter recovery time. Also there have been development in the material used for bio implant construction.

This trend is well-supported by the huge investment in medical technology by the USA healthcare system, with national health spending projected to increase substantially over the coming years. Also, the leading medical device manufacturers present in the USA promote continuous innovation and product development, driving the market.

Germany has advanced healthcare infrastructure which has strong focus on R&D particularly in the fields of orthopedics and cardiovascular care, leading to the introduction of cutting-edge bio-implants that enhance patient outcomes.

According to the population of trading economic more than 22.3% were above 65 years. As the chronic disease increase with aging population the adoption of cardiovascular implants, dental implants, orthopedic implants, and spinal bio-implants is expected to increase.

The adoption of dental implant is also increasing. Patients with the problem of tooth loss are increasingly considering implants as a long-lasting solution, encouraged by advances in implant technology and better materials that contribute to the success rate and patient satisfaction related to implants.

In particular, the regulatory environment within Germany is supportive of enhancing adoption while ensuring safety and efficacy yet advancing technology. All these factors therefore create a conducive landscape that will enable the bio-implant market to have a good future in the Federal Republic of Germany.

Japan's bio-implant market is experiencing robust growth, driven primarily by its aging population. As per the world economic forum around 1 in 10 people in Japan is now above 80 years. Around 29.3% of the population is above 65 years of age.

This demographic shift increases the prevalence of chronic diseases necessitates medical interventions. Which include bio-implants for joint replacements and heart devices. With the increased demand by elderly for a better quality of life, there is a need for orthopedic and dental implants to solve age-related health problems such as osteoarthritis and tooth loss.

Greater awareness and acceptance of the use of bio-implants among the Japanese population also serve to increase market demand. Health campaigns and medical professionals have educated the patients of the benefits these devices leading to a higher adoption rate.

Japan's Healthcare system encounters budgetary dilemmas, since there's a rise in medical costs due to large aging population. However, bio-implants have to overcome such barriers, and further development of materials and surgical techniques should enhance the efficacy of bio-implants in the near future.

Market players are collaborating among with industry leader to develop novel bio material with improved characteristics. This collaboration not only allows the company to leave the proprietary technology of both the firms but also brings in talent with diverse expertise.

There have been a trend in adoption of human derived raw material in manufacturing the bio implant rather than animal derived material. As more and more startup are entering the market established player are adopting numerous strategies to counter the growing competition.

One of these strategies is to acquire the small emerging startup. This move allows the big company to further expand their portfolio into other area and generate new revenue stream.

Recent Industry Developments in the Bio-Implants Market:

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 146.1 billion |

| Market Size in 2035 | USD 283.7 billion |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Categories Analyzed | Cardiovascular Implants, Dental Implants, Spinal Bio-Implants, Orthopedic Implants, Ophthalmic Implants, Others |

| Material Types Analyzed | Ceramics, Polymers, Alloys, Biomaterial Metals |

| Origin Types Analyzed | Autograft, Allograft, Xenograft, Synthetic |

| End-User Categories Analyzed | Hospitals, Ambulatory Surgical Centers, Clinics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East, Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, GCC Countries, South Africa |

| Key Players influencing the Market | Smith & Nephew, Arthrex, Inc., Clinic Lemanic, Alpha Bio Tec, MiMedx Group, Medtronic, St Jude Medical (Abbott), Stryker Corporation, DePuy Synthes, Biomet (Zimmer), Exactech, Inc., Cochlear Ltd, Straumann AG, Huhtamaki Oyj, Others |

| Additional Attributes | Dollar sales by product type (cardiovascular, dental, spinal, etc.), Dollar sales by material (ceramics, polymers, alloys, etc.), Growth trends across different origin types (autograft, allograft), Regional adoption trends in developed and emerging markets |

In terms of product, the industry is segmented into cardiovascular implants, dental implants, spinal bio-implants, orthopedic implants, ophthalmic implants, others, and others.

In terms of material, the industry is bifurcated ceramics, polymers, alloys, and biomaterials metals.

In terms of origin, the industry is segmented into autograft, allograft, xenograft, and synthetic.

In terms of end user, the industry is segmented into hospitals, ambulatory surgical center, clinics, and other.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East, and Africa have been covered in the report.

Bio-Implant industry is expected to increase at a CAGR of 6.9% between 2025 and 2035.

The orthopedic implants segment is expected to occupy a 28.8% market share in 2025.

The market for bio-implant is expected to reach USD 283.7 billion by 2035.

The United States is forecast to see a CAGR of 4.2 % during the assessment period.

The key players in the bio-implant industry include Smith & Nephew, Arthrex, Inc., Clinic Lemanic, Alpha Bio Tec, MiMedx Group, Medtronic, St Jude Medical (Abbott), Stryker Cooperation, DePuy Synthes, Biomet (Zimmer), Exactech, Inc., Cochlear Ltd, Straumann AG, Huhtamaki Oyj, and Others.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA