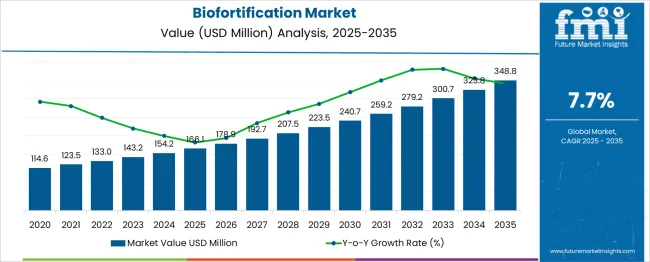

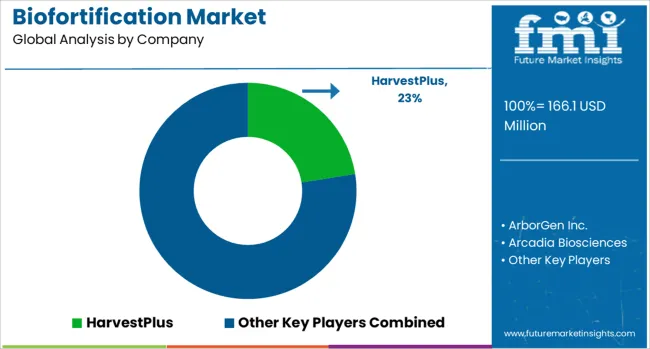

The Biofortification Market is estimated to be valued at USD 166.1 million in 2025 and is projected to reach USD 348.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Biofortification Market Estimated Value in (2025 E) | USD 166.1 million |

| Biofortification Market Forecast Value in (2035 F) | USD 348.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The biofortification market is expanding as efforts intensify to address micronutrient deficiencies through enhanced crop nutrition. Increasing awareness of nutritional security and the health impacts of nutrient-poor diets has driven investments in biofortified crops. Initiatives by public health organizations and governments have supported the development and dissemination of nutrient-enriched staple foods to vulnerable populations.

Technological advances have enabled the enhancement of essential micronutrients in crops without compromising yield or taste. Growing consumer demand for healthier food options and sustainable agriculture practices has further fueled market expansion.

The focus on improving dietary zinc levels is aligned with addressing widespread zinc deficiency-related health issues. Overall, the market is expected to benefit from increased adoption of biofortified cereals, supported by conventional plant breeding techniques that offer cost-effective and scalable solutions.

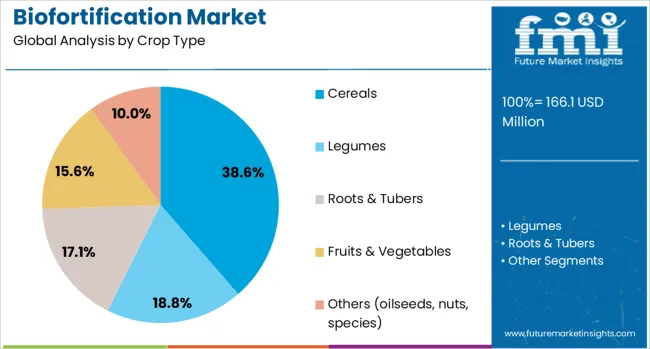

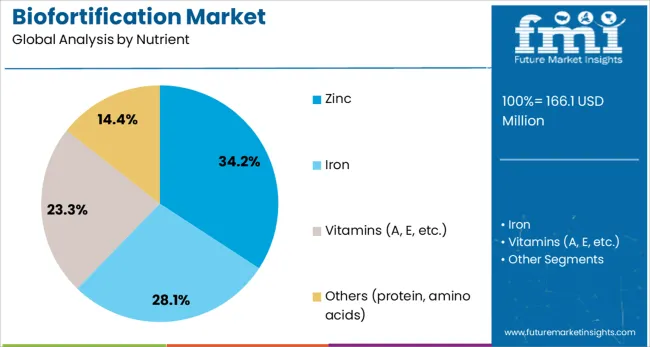

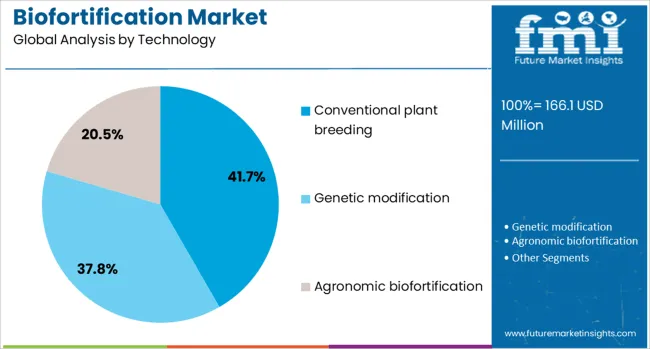

The biofortification market is segmented by crop type, nutrient, technology, and end use and geographic regions. By crop type of the biofortification market is divided into Cereals, Legumes, Roots & Tubers, Fruits & Vegetables, and Others (oilseeds, nuts, species). In terms of nutrient of the biofortification market is classified into Zinc, Iron, Vitamins (A, E, etc.), and Others (protein, amino acids). Based on technology of the biofortification market is segmented into Conventional plant breeding, Genetic modification, and Agronomic biofortification. By end use of the biofortification market is segmented into Food industry, Feed industry, Healthcare & nutraceuticals, and Others (biofuel, cosmetics, textile). Regionally, the biofortification industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cereals segment is projected to contribute 38.6% of the biofortification market revenue in 2025, leading the crop type categories. This growth has been influenced by the global reliance on cereals as staple foods, particularly in developing regions. Cereals such as rice, wheat, and maize provide a significant portion of daily caloric intake, making them ideal candidates for nutrient enhancement.

Biofortified cereals have been developed to improve the intake of essential micronutrients among populations with limited dietary diversity. Agricultural programs have focused on distributing biofortified cereal seeds to increase crop adoption.

The segment’s expansion is supported by consumer demand for nutrient-rich staple foods and government policies promoting food security.

The zinc segment is expected to account for 34.2% of the biofortification market revenue in 2025, establishing it as a leading nutrient focus. Zinc is essential for immune function, growth, and development, and its deficiency is prevalent in many parts of the world. The incorporation of zinc into staple crops has been recognized as a sustainable approach to reduce deficiency-related health risks.

Research advancements have enhanced zinc uptake and bioavailability in crops without affecting agricultural productivity. Public health campaigns and nutritional guidelines have increasingly highlighted zinc’s importance, driving acceptance and demand for zinc-biofortified foods.

The zinc nutrient segment is likely to maintain growth due to its critical role in human health and ongoing efforts to combat malnutrition.

The conventional plant breeding segment is projected to hold 41.7% of the biofortification market revenue in 2025, leading technological approaches. This method has been favored due to its cost-effectiveness, scalability, and acceptance among farmers and regulators. Conventional breeding allows for the natural enhancement of nutrient content by selecting and crossbreeding high-nutrient varieties over generations.

The technology avoids the use of genetic modification, making it more widely acceptable in regions with strict GMO regulations. Ongoing improvements in breeding techniques have accelerated the development of biofortified crop varieties with enhanced nutrient profiles.

The conventional plant breeding segment’s prominence is supported by its alignment with sustainable agricultural practices and its potential to reach smallholder farmers effectively.

Demand for biofortified crops is rising as micronutrient deficiency gains urgency in public health campaigns. Sales of staple seeds enriched with iron, vitamin A, and zinc are expanding across South Asia and Sub-Saharan Africa. Growth is strongest in agricultural development and government-sponsored breeding initiatives aimed at nutrition outcomes.

Demand for biofortified varieties such as iron-fortified millet, vitamin A maize, and zinc-enriched rice grew by 33% in 2025, spurred by health ministries and NGOs addressing anemia and malnutrition. Field adoption rates exceeded 40% in pilot districts of India and Nigeria. Households consuming biofortified staples reported 27% improvements in hemoglobin levels and child growth indicators over a 12-month period. Breeders deploying nutrient-dense seed lines reduced cultivation risk by using locally adapted traits, leading to 45% higher repeat seed adoption after the first harvest cycle. Public extension services and subsidy schemes continue to scale farm-level implementation.

Sales of certified biofortified seed kits rose 29% year over year in 2025, with distribution through public seed systems and digital agronomy apps. Government-subsidized packages bundled iron-enriched beans and zinc maize, alongside training and soil analysis services. Farmers using these kits achieved 35% higher planting area uptake within two growing seasons. In East Africa and Bangladesh, retail fertilizer and seed outlets co-promoted biofortified varieties, generating 22% higher retailer engagement rates via nutrition-linked messaging. NGOs bundling micronutrient seeds with mobile nutrition education saw household-level behavioral uptake increase by 31%, catalyzing cross-regional market expansion.

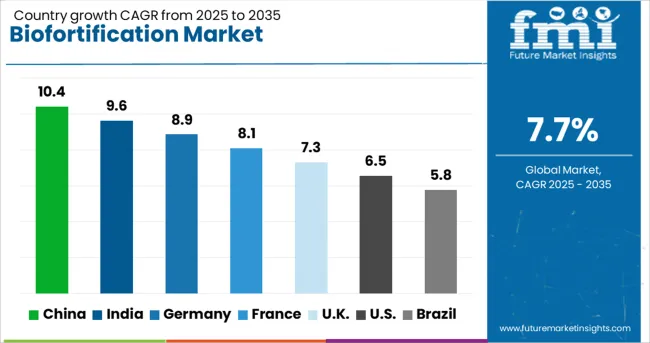

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| Uk | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The global market is projected to grow at a CAGR of 7.7% from 2025 to 2035, driven by rising demand for nutrient-enriched crops, food security policies, and awareness of micronutrient deficiencies. China leads with a 10.4% CAGR, supported by state-sponsored programs targeting rural nutrition and large-scale biofortified rice and wheat cultivation. India follows closely at 9.6%, where initiatives like iron-rich pearl millet and zinc-fortified wheat are central to public health efforts. Germany is growing at 8.9%, driven by consumer preference for functional foods and government-backed bioeconomy research. The UK, at 7.3%, benefits from fortified crop trials and academic partnerships. The US, with 6.5% CAGR, is propelled by private sector R&D and applications in school feeding programs. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 10.4% CAGR, supported by state-funded nutrition enhancement programs and extensive cultivation of biofortified rice and wheat. Government initiatives aim to reduce micronutrient deficiencies through large-scale deployment of zinc, iron, and vitamin A-enriched crops. Research institutions collaborate with seed companies to develop biofortified hybrids optimized for local soil conditions and yield performance. Pilot projects in rural regions are integrating biofortification within national food security frameworks. Rising consumer awareness of nutrient-dense foods further promotes adoption across both rural and semi-urban households. Export-oriented production of fortified grains is also gaining traction as part of China’s agri-tech strategy.

India is expected to grow at a 9.6% CAGR, driven by government-backed initiatives targeting iron and zinc deficiencies through fortified cereals and pulses. Programs like the HarvestPlus collaboration and state-supported distribution of biofortified pearl millet, wheat, and lentils are scaling across food subsidy networks. Public health campaigns are emphasizing biofortified staples in midday meal schemes and maternal nutrition programs. Seed companies are launching improved biofortified varieties suitable for rainfed agriculture, reducing dependency on chemical fortification in packaged foods. Digital platforms for agri-input distribution are expanding farmer access to high-yield fortified seeds. Consumer adoption is increasing in health-conscious urban segments, supporting retail diversification.

Germany is forecast to grow at an 8.9% CAGR, supported by strong demand for functional foods and advances in plant breeding technology. Academic research programs under the EU’s bioeconomy framework are funding biofortification projects in cereals, oilseeds, and horticultural crops. Consumer focus on health and preventive nutrition is driving integration of fortified grains into bakery, pasta, and processed food categories. Leading agritech firms are investing in gene-editing techniques to accelerate micronutrient enrichment in crops. Retailers are promoting fortified staples through private-label health brands, while institutional buyers integrate fortified ingredients in school and hospital meals. Export prospects remain strong for fortified grains targeting Nordic and Eastern European markets.

The United Kingdom is projected to grow at a 7.3% CAGR, supported by fortified crop trials and partnerships between universities and seed technology firms. Research programs focus on developing iron-enriched legumes and zinc-rich wheat varieties suitable for local farming conditions. Food manufacturers are incorporating fortified raw materials into cereals and bakery goods to meet nutritional labeling targets. Government grants are promoting biofortification within domestic agricultural innovation strategies. Consumer education campaigns emphasizing natural fortification over synthetic additives are shaping purchasing decisions. Digital grocery platforms highlight fortified product lines, creating visibility among health-conscious shoppers.

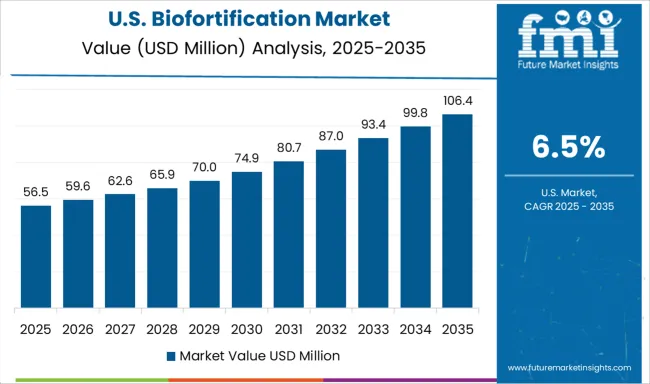

The United States is projected to grow at a 6.5% CAGR, supported by private-sector R&D and applications in institutional nutrition programs. Seed companies and biotech firms are investing in precision breeding and gene-editing solutions for iron and beta-carotene enrichment in corn and sweet potatoes. Biofortified crops are being piloted in USDA-backed school feeding initiatives, addressing nutritional gaps in children’s diets. Health-focused brands are incorporating fortified grains into snack bars, cereals, and meal kits. Strategic alliances between agritech innovators and food companies are accelerating commercialization of fortified staples. Increasing consumer demand for natural nutrient enhancement offers strong growth potential across premium retail channels.

HarvestPlus leads the market with a significant share, recognized for its pioneering work in developing nutrient-rich staple crops across developing regions. BASF SE, Bayer AG, and DuPont contribute significantly through R&D in crop genetics and trait enhancement. Arcadia Biosciences and ArborGen Inc focus on bioengineered solutions that improve micronutrient content. Food and nutrition companies like Nestlé S.A. are investing in biofortified ingredients to meet consumer demand for healthier products. The market is being driven by rising malnutrition concerns, government funding for food security, and the need for scalable low-cost nutrition delivery through staple crops such as rice, wheat, and maize.

In April 2024, HarvestPlus launched a biofortification initiative in Bangladesh and Uganda supported by The Church of Latter-day Saints. Iron beans and vitamin A crops were distributed through local seed partners to reach 58,000 smallholder farmers, addressing critical micronutrient deficiencies.

| Item | Value |

|---|---|

| Quantitative Units | USD 166.1 Million |

| Crop Type | Cereals, Legumes, Roots & Tubers, Fruits & Vegetables, and Others (oilseeds, nuts, species) |

| Nutrient | Zinc, Iron, Vitamins (A, E, etc.), and Others (protein, amino acids) |

| Technology | Conventional plant breeding, Genetic modification, and Agronomic biofortification |

| End use | Food industry, Feed industry, Healthcare & nutraceuticals, and Others (biofuel, cosmetics, textile) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HarvestPlus, ArborGen Inc., Arcadia Biosciences, BASF SE, Bayer AG, Charles River Laboratories, Corteva, DuPont, Intertek Group plc, LemnaTec GmbH, Mahyco, Nestlé S.A., Okanagan Specialty Fruits Inc., and Syngenta |

| Additional Attributes | Dollar sales by crop type (rice, maize, sweet potato, legumes) and target nutrient (zinc, iron, vitamins), demand dynamics across food security vs commercial nutraceutical sectors, regional leadership in Asia‑Pacific with North American share, innovation in precision breeding and biotech, and environmental impact of reduced fertilizer use and climate resilience. |

The global biofortification market is estimated to be valued at USD 166.1 million in 2025.

The market size for the biofortification market is projected to reach USD 348.8 million by 2035.

The biofortification market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in biofortification market are cereals, legumes, roots & tubers, fruits & vegetables and others (oilseeds, nuts, species).

In terms of nutrient, zinc segment to command 34.2% share in the biofortification market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA