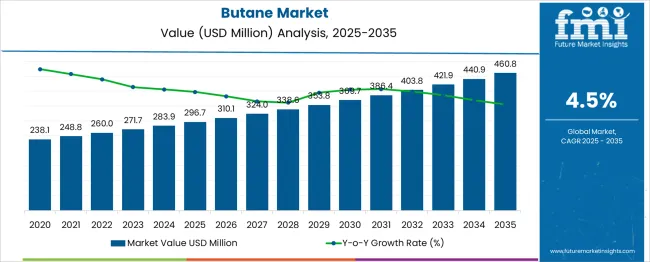

The Butane Market is estimated to be valued at USD 296.7 million in 2025 and is projected to reach USD 460.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Butane Market Estimated Value in (2025E) | USD 296.7 million |

| Butane Market Forecast Value in (2035F) | USD 460.8 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The butane market is witnessing steady growth fueled by rising energy demand and expanding applications across various industries. Liquefied Petroleum Gas (LPG), which contains a significant proportion of butane, has gained popularity as a clean and efficient fuel source for residential, commercial, and industrial uses. Increasing urbanization and the need for reliable energy access have supported the growth of LPG consumption globally. Environmental concerns and regulatory shifts toward lower-emission fuels have also accelerated the adoption of butane-rich LPG.

Technological improvements in storage and distribution infrastructure have enhanced supply chain efficiency and safety. Additionally, butane's role as a feedstock in the petrochemical industry and its use in portable fuel applications contribute to sustained demand.

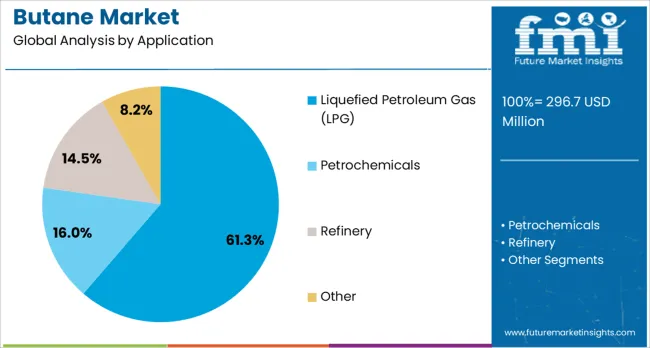

Market expansion is expected to continue as energy diversification and cleaner fuel initiatives gain momentum. Segment growth is primarily driven by the Liquefied Petroleum Gas (LPG) application, accounting for a major share of consumption.

The butane market is segmented by application and geographic regions. By application of the butane market is divided into Liquefied Petroleum Gas (LPG), Petrochemicals, Refinery, and Other. Regionally, the butane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Liquefied Petroleum Gas (LPG) segment is projected to hold 61.3% of the butane market revenue in 2025, establishing it as the leading application. This dominance is attributed to LPG’s widespread use as a fuel for cooking, heating, and automotive purposes. Its advantages such as high energy content, ease of storage, and cleaner combustion compared to traditional fuels have led to increasing preference.

LPG is favored in regions with limited natural gas infrastructure and where cleaner fuel solutions are being promoted to reduce air pollution. Additionally, LPG serves as a crucial energy source in industrial operations that require portable and reliable fuel.

The versatility and regulatory support for LPG applications continue to strengthen the butane market’s growth within this segment.

Butane demand is expanding across LPG, aerosol propellant, and feedstock applications as industrial use and cooking fuel consumption grow. In 2024, approximately 35 % of new compact cylinders in emerging markets contained butane blends optimized for indoor use. Market momentum is supported by rising LPG conversion programs and increasing penetration in portable energy devices.

Household and commercial sectors are moving toward butane-propane fuel blends optimized for indoor appliance use. In regions of Latin America and South Asia, blended LPG cylinders using 30–40 % butane are replacing pure propane due to smoother flame stability and lower emissions. These blends reduced refill frequency by 12 % per month while reducing soot formation during indoor cooking. Manufacturers are repackaging cylinders with lightweight composite shells and integrated safety valves; adoption in urban cookstove programs increased by 18 %. Blending enables bulk cylinder exchange programs to improve inventory turnover by 14 % and reduce courier refill logistics by up to 16 %.

Despite gains, butane market expansion faces hurdles from supply volatility, fuel standards, and regulatory complexity. Butane prices fluctuate 20–25 % seasonally due to seasonal crop harvest cycles and propane production linkage, compressing margins for cylinder refilling businesses. Compressed storage and filler certification in colder zones leads to higher indoor dew point risk, requiring dew-point control packages in 9 % of cylinder batches. Safety code validation across regions adds 6 weeks to new cylinder format approvals. Distribution networks often lack insulated transport for butane blends in emerging zones, causing operational delays averaging 5–7 days per refill cycle. These limitations restrict scaling of compact LPG cylinders and curb uptake outside premium or urban segments.

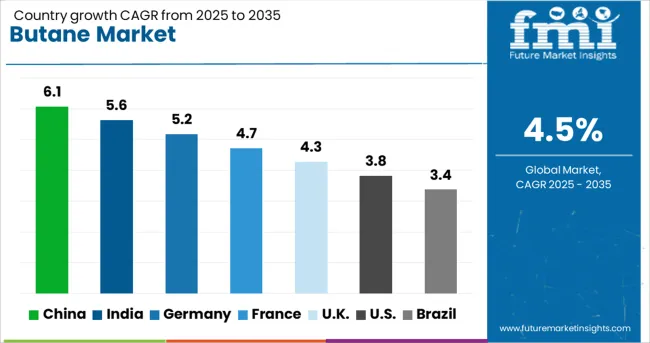

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global butane market is projected to expand at a 4.5% CAGR between 2025 and 2035. China, with a 6.1% CAGR, surpasses the global rate by +36%, supported by petrochemical capacity additions and increased LPG applications. India grows at 5.6%, reflecting a +24% premium, aided by demand from residential and industrial segments. Germany, at 5.2%, holds a +16% margin, driven by seasonal heating needs and energy diversification. The UK aligns closely with the global rate at 4.3% (–4%), while the US, with 3.8%, trails by –16%, reflecting moderated domestic demand and fuel substitution trends. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The butane market in China continues to expand with a projected CAGR of 6.1% between 2025 and 2035. Industrial growth and LPG demand in rural energy programs are driving bulk consumption. Butane is also increasingly used in feedstock applications for olefin production and synthetic rubber processing. Refinery expansions and petrochemical integrations have supported steady uptake. Domestic players such as Sinopec and PetroChina are investing in isomerization capacity and supply-chain infrastructure to stabilize seasonal butane supply. Rising exports of butane derivatives into Southeast Asia further reinforce demand across production hubs in Guangdong and Shandong.

India is expected to post a CAGR of 5.6% in the butane market through 2035, led by growing petrochemical manufacturing and residential LPG demand. Butane blending in LPG cylinders is rising due to distribution across remote regions. Refineries are also optimizing crude runs to generate higher butane yields. IOCL and HPCL are adding storage terminals in Visakhapatnam and Gujarat, improving supply logistics. Aromatics plants in Maharashtra and Tamil Nadu use butane as a feedstock, increasing localized consumption in coastal states. Regulatory support for import duty exemptions is also improving import feasibility.

Germany's butane market is projected to expand at a CAGR of 5.2% from 2025 to 2035. Butane is used across aerosol propellants, insulation foams, and chemical feedstock applications. Demand has grown due to localized chemical synthesis activities in North Rhine-Westphalia and Saxony-Anhalt. BASF and Evonik are key stakeholders in butane-based intermediate production. Industrial heating and mobile LPG use have also contributed to stable uptake, particularly in colder months. Energy diversification policies continue to allow butane usage as a bridge fuel in industrial energy systems.

The butane market in the United Kingdom is forecasted to grow at 4.3% CAGR through 2035. Consumption remains linked to seasonal residential LPG usage and portable energy systems. Butane is also used in small-scale chemical processing and recreational fuel products. Calor Gas and Flogas remain the two major distributors with extended networks for household cylinders. Demand also stems from off-grid energy applications, especially in Scotland and Northern Ireland. Butane usage in low-pressure gas appliances has remained consistent, with minor increases in tourism-based LPG product demand.

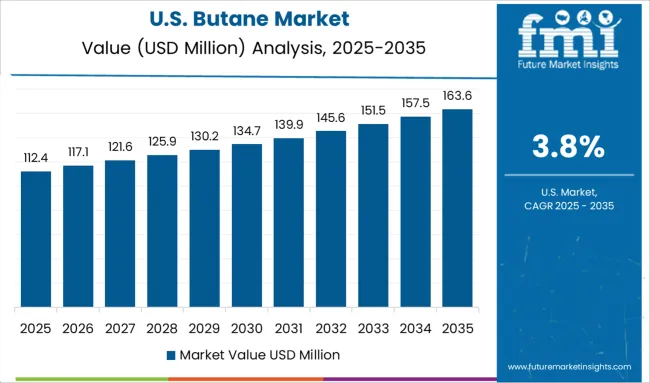

The United States butane market is expected to record a CAGR of 3.8% during 2025–2035. Butane is utilized in isobutane isomerization, gasoline blending, and aerosol production. Declining residential use has been offset by growing petrochemical consumption. Refineries in Texas and Louisiana are adapting alkylation units for higher butane throughput. ExxonMobil and Phillips 66 lead in pipeline-based butane transport to downstream users. Demand is also supported by high-purity butane exports to Mexico and Canada, which rely on US Gulf Coast infrastructure.

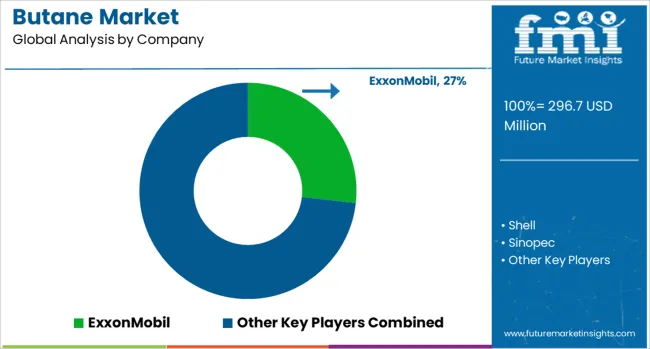

The global butane market is led by ExxonMobil, with major producers including Shell, Sinopec, and British Petroleum operating integrated refining networks to supply fuel blending and petrochemical feedstock. These players maintain strategic reserves to manage seasonal demand fluctuations, particularly for winter heating in North America and Northeast Asia. Valero Energy and ConocoPhillips specialize in gasoline blending optimization, while CNPC focuses on China's growing LPG demand for residential use. The market is adapting to stricter environmental policies, with producers investing in bio-butane alternatives and cleaner fuel formulations. Emerging applications in pharmaceutical extraction and portable heating systems are gaining traction, though long-term demand faces pressure from energy transition policies. Regional dynamics show North America prioritizing petrochemical feedstock, while developing markets increase LPG adoption for cooking fuel substitution

On June 4, 2025, the Canada Energy Regulator confirmed a 15% increase in Canadian butane exports in 2024 (to 56,100 bpd), all destined for the USA, with new terminals underway to enable future exports to Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 296.7 Million |

| Application | Liquefied Petroleum Gas (LPG), Petrochemicals, Refinery, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil, Shell, Sinopec, British Petroleum, Conoco Phillips, Chevron, Valero Energy, and CNPC |

| Additional Attributes | Dollar sales by product type (n-butane, isobutane) and application (LPG blending, petrochemicals, refrigeration), demand dynamics across refinery operations, aerosol propellants, and feedstock substitution, regional trends led by Asia‑Pacific with North America expanding shale-based output, innovation in catalytic cracking efficiency and storage terminal automation, and environmental impact of flare minimization mandates and VOC emission compliance. |

The global butane market is estimated to be valued at USD 296.7 million in 2025.

The market size for the butane market is projected to reach USD 460.8 million by 2035.

The butane market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in butane market are liquefied petroleum gas (lpg), _residential/commercial, _chemical/petrochemical, _industrial, _auto fuel, _refinery, _others, petrochemicals, refinery and other.

In terms of , segment to command 0.0% share in the butane market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA