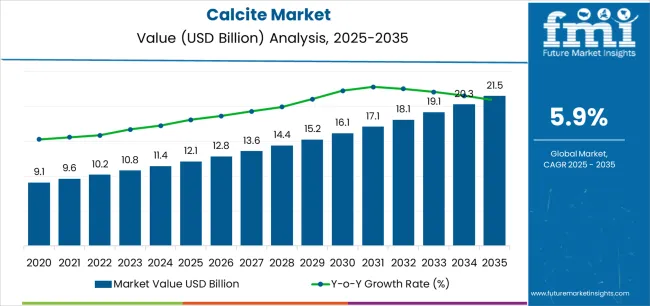

The global calcite market is projected to reach USD 21.5 billion by 2035, recording an absolute increase of USD 9.3 billion over the forecast period. The market is valued at USD 12.1 billion in 2025 and is set to rise at a CAGR of 5.9% during the assessment period. The market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for functional mineral fillers worldwide, driving demand for efficient mineral processing systems and increasing investments in green manufacturing and paper production projects globally. Competition from synthetic alternatives and transportation cost challenges may pose challenges to market expansion.

Between 2025 and 2030, the calcite market is projected to grow from USD 12.1 billion to USD 16.1 billion, representing a value increase of USD 4.0 billion, which accounts for 43.0% of the total forecast growth for the decade. This phase of development will be driven by increasing demand for eco-friendly paper production and lightweight polymer applications, innovations in ultrafine grinding technologies and surface treatment systems, and expanded integration with packaging materials and construction composites. Companies are strengthening their competitive positions through investments in advanced mineral processing technologies, sustainable quarrying practices, and strategic market expansion in paper manufacturing, plastics compounding, and specialty coatings sectors.

From 2030 to 2035, the market is expected to grow from USD 16.1 billion to USD 21.5 billion, adding another USD 5.3 billion, which represents 57.0% of the decade’s growth. This period will likely be marked by the expansion of specialized calcite systems, including nano-scale particle formulations and surface-modified grades tailored to specific application needs, strategic collaborations between mineral producers and end-user industries, and a stronger emphasis on circular economy principles and carbon footprint reduction. The growing focus on eco-friendly manufacturing and the development of bio-based composites will drive demand for advanced, high-performance calcite products across various industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 12.1 billion |

| Market Forecast Value (2035) | USD 21.5 billion |

| Forecast CAGR (2025-2035) | 5.9% |

The calcite market grows by enabling manufacturers to achieve superior material performance and cost optimization while meeting environmental requirements across diverse industrial sectors. Industrial producers face mounting pressure to reduce carbon footprint and material costs, with calcite-based functional fillers typically providing 30-40% cost reduction in polymer formulations while maintaining mechanical properties, making calcium carbonate essential for competitive manufacturing economics. The circular economy movement's need for natural mineral resources creates demand for high-purity calcite solutions that can enhance paper brightness, improve plastic processability, and ensure consistent performance across diverse production environments.

Government initiatives promoting paper recycling infrastructure and green construction materials drive adoption in paper & pulp, polymer & plastic, and paints & coatings applications, where mineral filler quality has a direct impact on product performance and manufacturing efficiency. The global shift toward bio-based materials and lightweight composites accelerates calcite demand as manufacturers seek natural alternatives to synthetic fillers that increase environmental impact. Regional availability constraints and transportation economics for bulk mineral products may limit adoption rates in regions distant from high-quality calcite deposits and areas with underdeveloped mineral processing infrastructure.

The market is segmented by product type, application, grade type, and region. By product type, the market is divided into Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC). Based on application, the market is categorized into Paper & Pulp, Polymer & Plastic, Paints & Coatings, Cement, Adhesives & Sealants, Agriculture, and Other. By grade type, the market includes Industrial Grade, Construction Grade, Paints & Coatings Grade, Food & Pharmaceutical Grade, Optical/Specialty Grade, and Other. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

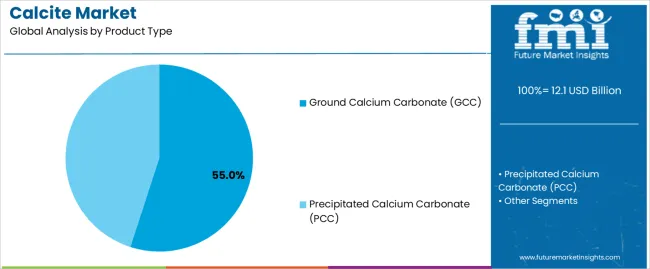

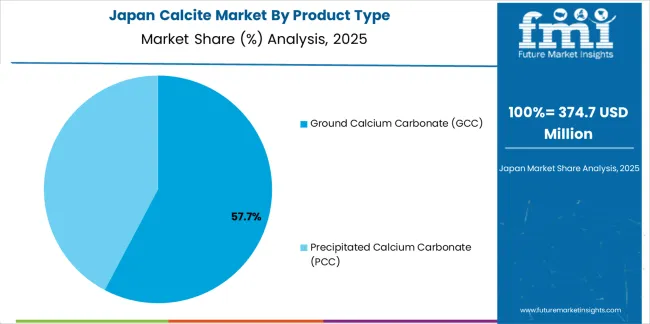

The Ground Calcium Carbonate (GCC) segment represents the dominant force in the calcite market, capturing approximately 55.0% of total market share in 2025. This advanced category encompasses formulations featuring mechanically processed natural limestone and marble with controlled particle size distribution, delivering comprehensive cost-performance benefits with established processing infrastructure. The GCC segment's market leadership stems from its exceptional production economics, abundant natural resource availability, and compatibility with high-volume industrial applications that prioritize cost efficiency and reliable mineral quality.

The Precipitated Calcium Carbonate (PCC) segment maintains a substantial 45.0% market share, serving manufacturers who require engineered particle morphology and ultra-high purity through chemical precipitation processes for specialty paper coating, pharmaceutical excipients, and advanced polymer applications. The PCC segment benefits from superior brightness characteristics, controlled crystal structure, and customized particle properties enabling premium positioning in quality-critical applications.

Key advantages driving the Ground Calcium Carbonate segment include:

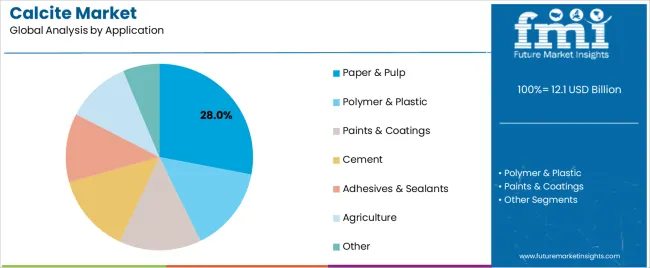

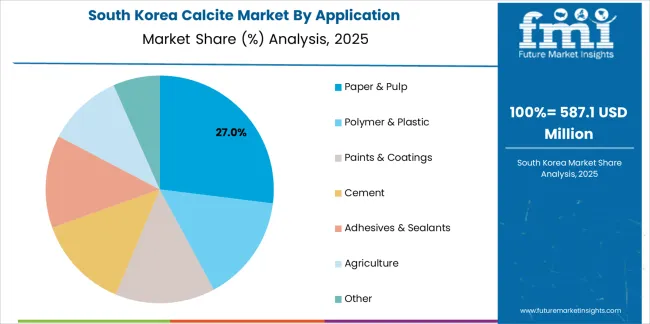

Paper & Pulp applications dominate the calcite market with approximately 28.0% market share in 2025, reflecting the essential role of calcium carbonate as functional filler and coating pigment improving paper brightness, opacity, and printability throughout manufacturing processes. The Paper & Pulp segment's market leadership is reinforced by widespread adoption across printing paper grades, packaging paperboard, and specialty paper applications, which provide cost reduction benefits and quality enhancement suitable for diverse end-use requirements.

The Polymer & Plastic segment represents significant market share through applications including PVC pipe formulations, masterbatch concentrates, and engineering plastics requiring mineral reinforcement and cost optimization. The Paints & Coatings segment accounts for substantial market presence, featuring extender pigment applications in architectural coatings, industrial paints, and protective coating systems. The Cement segment encompasses mineral filler applications in concrete manufacturing and construction materials. The Adhesives & Sealants segment serves sealant formulations and construction adhesives. Agriculture and Other segments include soil amendment applications and diverse specialty uses.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to industrial economics and sustainability outcomes. First, paper industry recovery in packaging segments creates increasing requirements for cost-effective fillers and coating pigments, with global paperboard production growing 3-5% annually in emerging markets, requiring reliable calcite supply chains for brightness and opacity enhancement. Second, plastic lightweighting initiatives drive polymer manufacturers toward mineral-filled formulations, with calcite-reinforced plastics achieving 15-25% material cost reduction while maintaining structural integrity in automotive and construction applications. Third, construction sector expansion accelerates cement and paint demand, with calcite serving as essential raw material in cement manufacturing and extender pigment in architectural coatings supporting infrastructure development across Asia-Pacific and Middle East regions.

Market restraints include transportation economics affecting delivered costs, particularly for bulk mineral products where freight charges can exceed 30-50% of total cost when shipping long distances from quarry locations to end-user facilities. Competition from alternative mineral fillers including talc, kaolin, and precipitated silica poses substitution risks in applications where specialized performance characteristics justify premium pricing over commodity calcite grades. Environmental permitting challenges for new quarry development create supply constraints, as limestone extraction operations require comprehensive impact assessments and community engagement processes that extend project timelines by 3-5 years in regulated markets.

Key trends indicate accelerated adoption of ultrafine and nano-scale calcite products, with particle size reduction technologies enabling enhanced performance in specialized applications including masterbatch concentrates where sub-micron particles improve dispersion quality and end-product properties. Technology advancement trends toward surface modification systems using stearic acid coating and silane coupling agents enhance calcite compatibility with hydrophobic polymer matrices, enabling higher loading levels and improved mechanical properties. The market thesis could face disruption if carbon capture utilization technologies enable economic production of synthetic calcium carbonate from industrial CO2 emissions, or if regulatory restrictions on quarrying operations significantly constrain new capacity development in key supply regions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| USA | 5.6% |

| UK | 5.0% |

| Japan | 4.4% |

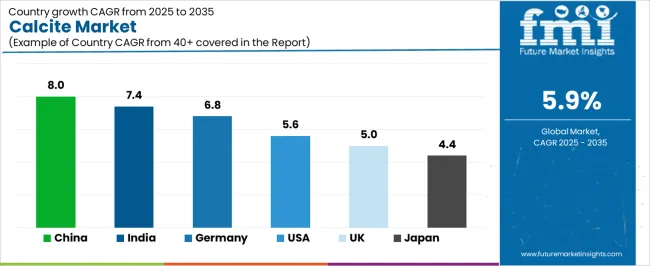

The calcite market is gaining momentum worldwide, with China taking the lead thanks to massive construction expansion and paper manufacturing modernization programs. Close behind, India benefits from infrastructure development and organized manufacturing growth, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where automotive lightweighting initiatives and green construction materials strengthen its role in European industrial supply chains. The USA demonstrates robust growth through paper packaging recovery and polymer compounding expansion, signaling continued investment in mineral processing infrastructure. Meanwhile, the UK stands out for its specialty grades development and construction sector modernization, while Japan continues to record steady progress driven by high-purity applications and advanced material development. Together, China and India anchor the global expansion story, while established markets build stability and innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

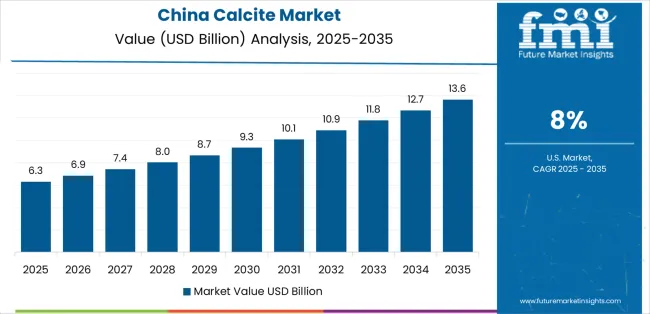

China demonstrates the strongest growth potential in the Calcite Market with a CAGR of 8.0% through 2035. The country's leadership position stems from comprehensive construction sector expansion, intensive paper manufacturing modernization, and aggressive infrastructure development targets driving adoption of mineral filler systems. Growth is concentrated in major industrial regions, including Guangdong, Zhejiang, Jiangsu, and Shandong, where paper mills, plastic compounding facilities, and paint manufacturers are implementing calcite-based formulations for domestic supply and export competitiveness. Distribution channels through mineral trading companies, direct manufacturer relationships, and integrated supply agreements expand deployment across packaging materials, construction composites, and automotive plastic applications. The country's Belt and Road Initiative provides policy support for mineral resource development, including investments in quarrying infrastructure and processing capacity expansion.

Key market factors:

In major industrial states, tier-2 manufacturing hubs, and infrastructure corridors, the adoption of calcite-based mineral systems is accelerating across paper manufacturers, plastic processors, and paint producers, driven by Make in India initiatives and construction sector expansion. The market demonstrates strong growth momentum with a CAGR of 7.4% through 2035, linked to comprehensive industrial development and increasing focus on cost-effective material solutions. Indian manufacturers are implementing quality calcite sourcing programs and mineral processing systems to improve product economics while meeting quality standards across domestic construction and packaging materials markets. The country's infrastructure investment programs create demand for cement-grade calcite, while growing plastic manufacturing drives adoption of mineral-filled polymer formulations.

Advanced industrial sector in Germany demonstrates sophisticated implementation of calcite-based systems, with documented case studies showing integration of specialty calcite grades achieving superior performance in automotive lightweight plastics and high-quality paper coatings. The country's manufacturing infrastructure in major industrial regions, including Bavaria, North Rhine-Westphalia, Baden-Württemberg, and Lower Saxony, showcases integration of premium calcite technologies with existing polymer processing and paper production systems, leveraging expertise in material science and precision manufacturing. German manufacturers emphasize quality certifications and performance consistency, creating demand for reliable calcite sources that support automotive specifications and food-contact compliance requirements. The market maintains strong growth through focus on specialty applications and export-oriented manufacturing, with a CAGR of 6.8% through 2035.

Key development areas:

The USA market leads in diverse calcite applications based on integration across paper packaging recovery, polymer compounding expansion, and specialty coatings development supporting manufacturing competitiveness. The country shows solid potential with a CAGR of 5.6% through 2035, driven by paper packaging growth and increasing demand for functional mineral fillers across major industrial regions, including the Southeast paper belt, Midwest manufacturing corridor, and Gulf Coast polymer processing hubs. American manufacturers are adopting high-quality calcite products for compliance with FDA food-contact standards and automotive material specifications, particularly in packaging paperboard requiring brightness enhancement and in engineered plastics demanding consistent mineral quality. Distribution channels through regional mineral suppliers, integrated paper companies, and specialty chemical distributors expand coverage across diverse industrial applications.

Leading market segments:

The UK calcite market demonstrates mature implementation focused on specialty grade development and high-value applications, with documented integration achieving premium positioning in pharmaceutical and food-grade calcium carbonate markets. The country maintains steady growth momentum with a CAGR of 5.0% through 2035, driven by paper sector modernization and specialty plastics development supporting industrial competitiveness. Major manufacturing regions, including Southeast England, Northwest England, and Scotland, showcase advanced calcite applications where mineral programs integrate strict quality control protocols, purity specifications, and comprehensive traceability systems aligned with pharmaceutical GMP standards and food contact regulations.

Key market characteristics:

Calcite market in Japan demonstrates sophisticated implementation focused on high-purity grades and specialty applications, with documented integration of ultrafine calcite products achieving exceptional performance in advanced materials and electronic applications. The country maintains steady growth momentum with a CAGR of 4.4% through 2035, driven by quality-focused manufacturing culture and emphasis on material performance optimization in demanding industrial sectors. Major industrial regions, including Kanto, Kansai, and Chubu, showcase advanced deployment of surface-treated calcite grades and nano-scale products that integrate seamlessly with existing polymer processing infrastructure and precision coating formulation systems.

Key market characteristics:

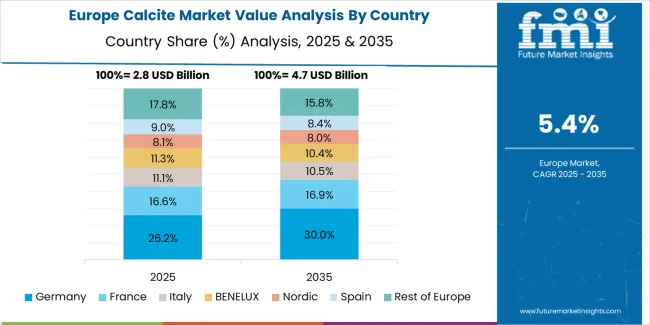

The calcite market in Europe is projected to grow from USD 3.2 billion in 2025 to USD 5.6 billion by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 26.5% market share in 2025, declining slightly to 26.2% by 2035, supported by its advanced manufacturing infrastructure and major industrial centers, including Bavaria, North Rhine-Westphalia, and Baden-Württemberg production regions.

The United Kingdom follows with a 17.2% share in 2025, projected to reach 16.9% by 2035, driven by comprehensive specialty grades development and pharmaceutical applications expansion programs implementing high-purity mineral standards. France holds a 15.8% share in 2025, expected to rise to 16.0% by 2035 through ongoing paper industry modernization and paint manufacturing growth. Italy commands a 13.5% share in both 2025 and 2035, backed by construction materials production and specialty applications. Spain accounts for 10.2% in 2025, rising to 10.4% by 2035 on construction sector recovery and paint industry expansion. The Netherlands maintains 5.8% in 2025, reaching 6.0% by 2035 on paper production consolidation and polymer processing growth. The Rest of Europe region is anticipated to hold 11.0% in 2025, expanding to 11.3% by 2035, attributed to increasing calcite adoption in Nordic paper industries and emerging Central & Eastern European manufacturing programs.

The Japanese calcite market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of ultrafine and high-purity calcium carbonate systems with existing pharmaceutical manufacturing, advanced plastics processing, and specialty paper production infrastructure across precision industries. Japan's emphasis on material purity and performance consistency drives demand for rigorously tested calcite grades that support pharmaceutical compliance commitments and electronic materials specifications in demanding industrial applications. The market benefits from strong partnerships between international mineral suppliers and domestic material distributors including major trading houses, creating comprehensive service ecosystems that prioritize product consistency and technical documentation programs. Manufacturing centers in Tokyo, Osaka, Nagoya, and other major industrial areas showcase advanced calcite implementations where mineral programs achieve 99.5%+ purity levels through controlled processing and comprehensive quality assurance protocols.

The South Korean calcite market is characterized by growing international mineral supplier presence, with companies maintaining significant positions through comprehensive technical services and specialty grade capabilities for advanced plastics and electronic materials applications. The market demonstrates increasing emphasis on nano-scale products and surface-modified grades, as Korean manufacturers increasingly demand high-performance calcite materials that integrate with domestic advanced polymer processing infrastructure and sophisticated coating formulation systems deployed across major industrial complexes. Regional mineral processors are gaining market share through strategic partnerships with international suppliers, offering specialized services including Korean regulatory compliance support and customized particle engineering programs for demanding industrial operations. The competitive landscape shows increasing collaboration between multinational mineral companies and Korean material science specialists, creating hybrid service models that combine international processing expertise with local application development and quality control capabilities.

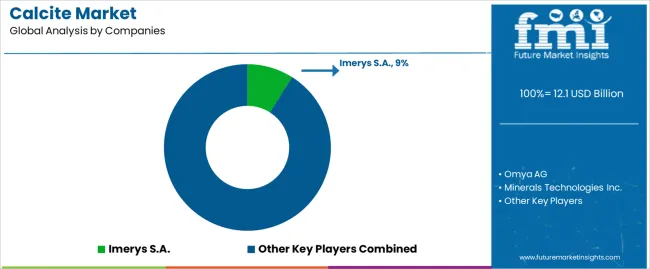

The calcite market features approximately 20-25 meaningful players with moderate fragmentation, where the top three companies control roughly 20-24% of global market share through established quarrying operations and comprehensive processing capabilities. Competition centers on mineral purity consistency, particle size control precision, and logistics network efficiency rather than price competition alone. Imerys S.A. leads with approximately 9% market share through its comprehensive calcium carbonate portfolio serving diverse global markets.

Market leaders include Imerys S.A., Omya AG, and Minerals Technologies Inc., which maintain competitive advantages through vertically integrated operations from limestone quarrying to finished product delivery, global production footprint providing regional market proximity, and deep technical expertise in grinding technologies and surface modification processes across multiple industrial applications, creating reliability and performance advantages with manufacturing customers. These companies leverage research and development capabilities in particle engineering optimization and ongoing technical support relationships to defend market positions while expanding into specialty grades and advanced surface treatment innovations.

Challengers encompass Huber Engineered Materials and Nordkalk Corporation, which compete through specialized product portfolios and strong regional presence in key industrial markets. Product specialists focus on specific grade types or application segments, offering differentiated capabilities in ultrafine grinding technologies, surface modification systems, and customized mineral formulations for premium applications.

Regional players and emerging mineral processors create competitive pressure through localized quarry advantages and rapid delivery capabilities, particularly in high-growth markets including China and India, where proximity to manufacturing clusters provides advantages in transportation costs and technical service responsiveness. Market dynamics favor companies that combine reliable mineral quality with comprehensive technical support offerings including particle size customization, surface treatment capabilities, and application development expertise that address complete formulation optimization requirements across paper manufacturing, polymer compounding, and coatings production operations.

Calcite represents natural mineral resources that enable manufacturers to achieve 30-40% cost reduction in polymer formulations compared to virgin resin systems, delivering superior manufacturing economics and functional performance with established processing reliability in demanding industrial applications. With the market projected to grow from USD 12.1 billion in 2025 to USD 21.5 billion by 2035 at a 5.9% CAGR, these versatile mineral systems offer compelling advantages - cost optimization, performance enhancement, and natural resource utilization - making them essential for Paper & Pulp applications (28.0% market share), Polymer & Plastic sectors, and industrial operations seeking alternatives to synthetic fillers that increase material costs and environmental impact. Scaling market adoption and extraction requires coordinated action across mineral policy, quality standards, quarry operators, processing companies, and industrial manufacturing sectors.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 12.1 billion |

| Product Type | Ground Calcium Carbonate (GCC), Precipitated Calcium Carbonate (PCC) |

| Application | Paper & Pulp, Polymer & Plastic, Paints & Coatings, Cement, Adhesives & Sealants, Agriculture, Other |

| Grade Type | Industrial Grade, Construction Grade, Paints & Coatings Grade, Food & Pharmaceutical Grade, Optical/Specialty Grade, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Imerys S.A., Omya AG, Minerals Technologies Inc., Huber Engineered Materials, Nordkalk Corporation |

| Additional Attributes | Dollar sales by product type, application, and grade type categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with mineral producers and processing networks, quarrying facility requirements and specifications, integration with sustainable manufacturing programs and circular economy initiatives, innovations in grinding technology and surface modification systems, and development of specialized calcite products with enhanced purity and particle engineering capabilities. |

The global calcite market is estimated to be valued at USD 12.1 billion in 2025.

The market size for the calcite market is projected to reach USD 21.4 billion by 2035.

The calcite market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in calcite market are ground calcium carbonate (gcc) and precipitated calcium carbonate (pcc).

In terms of application, paper & pulp segment to command 28.0% share in the calcite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Calcite in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA