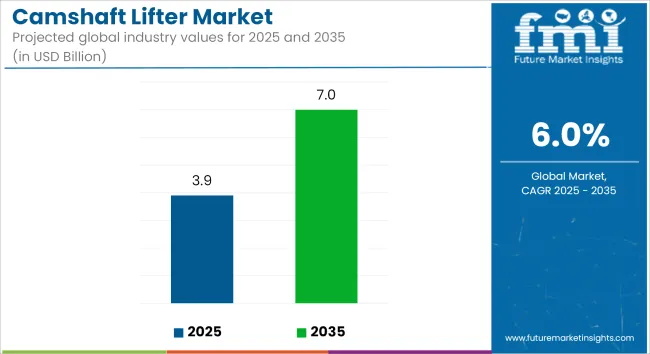

The global camshaft lifters market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 7.0 billion by 2035, advancing at a compound annual growth rate (CAGR) of 6.0% over the forecast period. This expansion is being driven by rising demand for low-friction valvetrain components and continuous upgrades in internal combustion engine performance across automotive and motorsport sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.9 Billion |

| Industry Value (2035F) | USD 7.0 billion |

| CAGR (2025 to 2035) | 6.0% |

Recent product developments have centered on precision-machined solid and hydraulic lifters designed to enhance valvetrain stability under elevated loads. In 2024, Kelford Cams launched its Racer Series solid lifters, developed for GM Holden platforms using 3-bolt camshaft configurations. The company confirmed that these lifters were engineered with premium surface hardening and tighter internal tolerances to support elevated RPM ranges in competitive motorsport conditions.

In the same period, Hughes Engines published updated technical guidelines related to flat tappet camshaft lifter installation for Chrysler platforms. The company emphasized the importance of matching cam profiles with lifter diameter and face angle to avoid premature lobe wear. Its guidance stated that "valvetrain integrity depends on correct lifter preload and oil flow during initial operation"-highlighting the risks associated with improper break-in and low-zinc lubricants.

Hydraulic lifters continued to gain prominence in OEM passenger car engines due to their ability to self-adjust lash and maintain valve clearance across a wide thermal range. Reports from Tomorrow’s Technician in 2024 confirmed that modern hydraulic lifters now incorporate advanced oil metering and anti-pump-up features, reducing noise and improving reliability in variable valve timing systems.

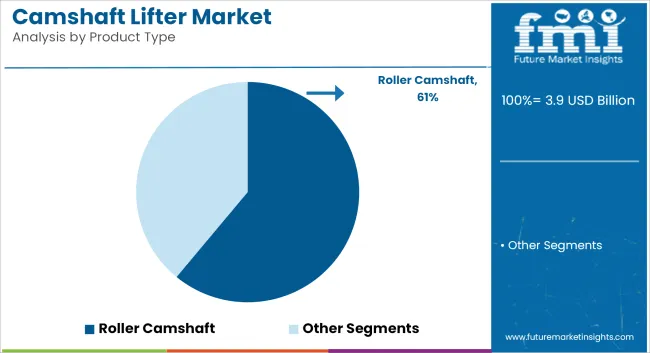

Roller lifter adoption has accelerated in both naturally aspirated and turbocharged applications, particularly in North America and Asia-Pacific. Manufacturers have increased production of low-friction roller units to meet higher fuel economy targets and to support camshaft designs with aggressive lift profiles.

The aftermarket has maintained a strong presence, especially in performance-focused segments. Solid lifters have remained preferred in motorsports environments where mechanical lash adjustments are tolerable in exchange for valvetrain control at high engine speeds.

Roller camshafts are estimated to account for approximately 61% of the global camshaft lifter market share in 2025 and are projected to grow at a CAGR of 6.2% through 2035. Their adoption is driven by lower friction, improved wear resistance, and enhanced valve actuation efficiency compared to flat tappet designs. In 2025, OEMs favor roller camshaft lifters in both gasoline and diesel engines, particularly in turbocharged and direct injection platforms, to meet stringent fuel economy and emission regulations.

These lifters enable smoother engine operation and longer maintenance intervals, supporting their use in mid-size sedans, pickups, and performance-oriented passenger cars. Manufacturers continue to invest in materials like hardened steel and advanced coatings to improve load-bearing capacity and reduce internal engine noise.

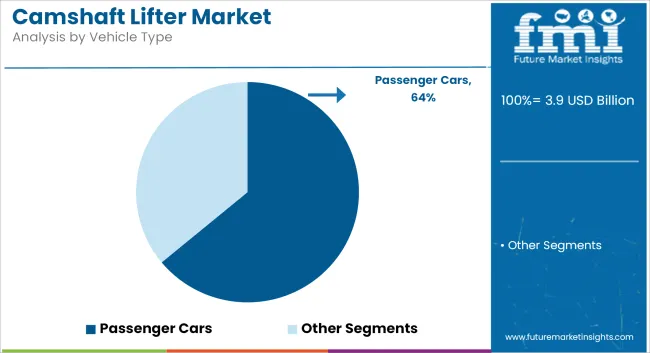

Passenger cars are projected to hold approximately 64% of the global camshaft lifter market share in 2025 and are expected to grow at a CAGR of 6.1% through 2035. Growth is supported by high production volumes and the continued use of ICE and hybrid ICE-based powertrains in global passenger vehicle fleets. In 2025, camshaft lifters are critical to precise valve timing and combustion efficiency, especially in engines equipped with variable valve timing (VVT) systems.

The rise of dual overhead cam (DOHC) configurations in compact and mid-size vehicles further reinforces the need for durable and efficient lifters. As OEMs work to optimize valvetrain performance in compliance with emissions and performance targets, passenger cars will remain the primary consumer segment for camshaft lifter components.

Challenge: Transition to Electric Vehicles

The rising use of electric vehicles presents a major hurdle for the camshaft lifters market. The growing shift away from internal combustion engines threatens future demand for these parts because EVs do not rely on camshafts and lifters. Electric mobility is being pushed forward in time as governments around the world are planning to ban gasoline and diesel fuel autos. Camshaft lifter makers are destined to transform and broaden into aternates within the goods domain, hybrid engine components, or another item like performance open market commodities.

Opportunity: Innovation in Performance and Fuel Efficiency

In spite of the challenge posed by EV adoption, there is still a good opportunity in the innovation of advanced camshaft lifter technologies to enhance fuel efficiency and engine performance. Lightweight materials, low-friction coatings, and hydraulic variable valve lifters are improving ICE efficiency, complying with strict emission regulations while preserving power output.

Moreover, the racing and aftermarkets offer a profitable market for race-specific camshaft lifters for racing, off-road, and aftermarket applications. By targeting these niche segments, manufacturers can maintain sales pace with the changing automotive environment.

The camshaft lifters market in the USA is growing steadily with rising automobile production, increased demand for high-performance engines, and growth of the automotive aftermarket industry. The demand for low-emission and fuel-efficient vehicles is leading the way in driving innovation in engine parts, including camshaft lifters.

The use of sophisticated valve management systems, for example, variable valve timing (VVT) systems, is also gaining momentum, especially in hybrid and high-performance vehicles. Moreover, the market for replacement components in older vehicles and increasing popularity of engine tunings among auto buffs are further fueling market growth.

The increasing transition to electric vehicles (EVs), however, poses a problem, as EVs do not need conventional internal combustion engine parts such as camshaft lifters, prompting companies to concentrate on hybrid and high-performance gasoline engines.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

The UK market for camshaft lifters is expanding moderately, driven by a well-established automotive sector, rising sales of high-performance and luxury cars, and technology in fuel efficiency. Hybrid powertrains that are increasing in popularity in the face of stringent emission regulations are driving demand for engine parts that are improving fuel economy and decreasing carbon emissions. Also driving demand for camshaft lifters is the aftermarket, as the majority of vehicles on the UK vehicle fleet are old models that are in need of maintenance and part replacement.

But the growing penetration of electric vehicles in the market is decelerating demand for conventional internal combustion engine parts, prompting manufacturers to concentrate on performance engines and hybrid vehicle applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

Germany, France, and Italy are driving the EU camshaft lifters market, with all three countries having a solid automotive manufacturing industry and good demand for fuel-efficient and performance-oriented engines. Euro 7 emission regulations is forcing the manufacturers to invest in complex camshaft and valve train systems which are highly functional from the aspect of performance, providing minimal emissions. The luxury/performance vehicle segment, with titleholders like BMW, Mercedes-Benz and Ferrari, still pushes high-performance camshaft lifters.

In addition, increasing interest in plug-in hybrid vehicles (PHEVs) and hybrid vehicles is helping camshaft lifters demand to remain stable even as electric vehicle adoption continues to grow. (Even the already lucrative aftermarket is growing as most European buyers prefer to upgrade and service existing ICE vehicles rather than jump straight to electric.).

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

Japan’s camshaft lifters market is supported by the country’s strong automotive industry, high investment in hybrid vehicle technology, and demand for fuel-efficient internal combustion engines. Leading automakers like Toyota, Honda, and Nissan continue to integrate advanced camshaft lifters in their hybrid vehicle lineups to enhance fuel efficiency and optimize engine performance.

The aftermarket segment for camshaft lifters is also significant, as many Japanese consumers maintain their vehicles for extended periods, requiring periodic replacements and upgrades. While battery electric vehicle (BEV) adoption is increasing in Japan, hybrid vehicles remain dominant, ensuring continued demand for camshaft lifters. Additionally, performance-oriented engines in motorsports and tuning culture contribute to the sustained demand for high-performance camshaft lifters.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korea camshaft lifters market is building up gradually along with increasing local vehicle production, expansion of automobile export market, and increasing interest in hybrid automobiles. Large motor vehicle manufacturers such as Hyundai and Kia are pumping money into internal combustion engine innovations of the future, particularly on hybrid cars that still employ sophisticated camshaft and valve train technology. In addition, the aftermarket segment is expanding, with replacement parts for older models and performance upgrades being purchased by the majority of consumers.

South Korea's increasing motorsport and tuning culture is also contributing to demand, as enthusiasts are snapping up high-performance camshaft lifters for tunned engines. However, with the increase in EV use, businesses are shifting focus towards hybrid car use and performance-focused gasoline engines..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

The Camshaft Lifters industry is growing rapidly because of the demand for high-performance automobile parts that optimize engine efficiency and longevity. Camshaft lifters, used for controlling valve movement in internal combustion engines, find extensive application in passenger cars, commercial vehicles, and racing sports.

Improved engine components, increasing automotive output, and growing adoption of fuel-efficient vehicles are promoting market growth. Top players are making investments in research and development, strategic collaborations, and optimization of production in order to further enhance their presence in the market.

The camshaft lifters market also consists of various regional and emerging manufacturers, including:

The market is estimated to reach a value of USD 3.9 billion by the end of 2025.

The market is projected to exhibit a CAGR of 6.0% over the assessment period.

The market is expected to clock revenue of USD 7.0 billion by end of 2035.

Key companies in the Camshaft Lifters Market include Rane Holdings Limited, SSV Technocrates, Schaeffler, Shri Ram International, Wuxi Xizhou Machinery Co., Ltd.

On the basis of vehicle type, passengers cars and HCV to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Camshaft Bearings Market

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA