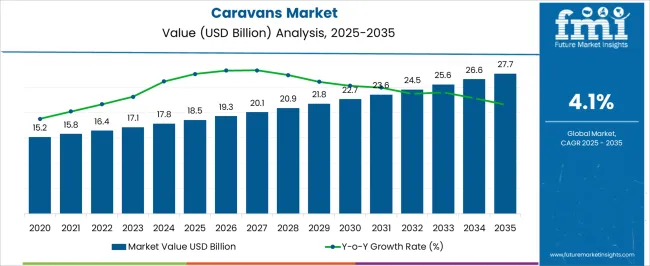

The Caravans Market is estimated to be valued at USD 18.5 billion in 2025 and is projected to reach USD 27.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. From 2020 to 2024, the market expanded from USD 15.2 billion to USD 17.8 billion, with annual growth rates ranging between 3.7% and 4.2%. This period experienced gradual adoption, with consumers and businesses increasing interest in recreational vehicles and mobile accommodation solutions. Year-on-year growth was supported by rising demand for flexible travel and leisure options, as well as incremental investments in production capacity. Early market expansion focused on meeting localized demand and improving distribution networks.

From 2025 to 2030, the market enters a scaling phase, rising from USD 18.5 billion to USD 22.7 billion, with YoY growth averaging 3.9–4.4%. Growth during this period is driven by wider adoption across key regions, with production and sales channels expanding to meet increased demand. Between 2030 and 2035, the market grows steadily to USD 27.7 billion, with annual growth rates around 4.0–4.2%. The YoY analysis highlights consistent expansion, with demand spread across leisure, tourism, and rental segments, reflecting broader acceptance of caravans as a mainstream mobility and accommodation solution.

| Metric | Value |

|---|---|

| Caravans Market Estimated Value in (2025 E) | USD 18.5 billion |

| Caravans Market Forecast Value in (2035 F) | USD 27.7 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The caravans market is experiencing steady expansion, driven by rising interest in leisure travel, tourism diversification, and the increasing popularity of outdoor recreational activities. Growing consumer preference for flexible, self-contained accommodation options has been influencing demand, particularly in developed markets with well-established camping and road travel cultures. Advances in manufacturing technologies, including lightweight materials and improved aerodynamics, are enhancing fuel efficiency and towing convenience, making caravans more accessible to a wider customer base.

Shifts in lifestyle trends, with greater emphasis on experiential travel and sustainable tourism, are supporting adoption across multiple demographics. The integration of modern amenities, connectivity features, and energy-efficient systems is attracting both first-time buyers and repeat customers seeking upgrades.

Additionally, the market is benefiting from supportive government initiatives in certain regions that promote domestic tourism and RV infrastructure development As consumer spending on leisure continues to grow, and caravan designs evolve to meet modern comfort and efficiency expectations, the market is positioned for sustained growth in both established and emerging economies.

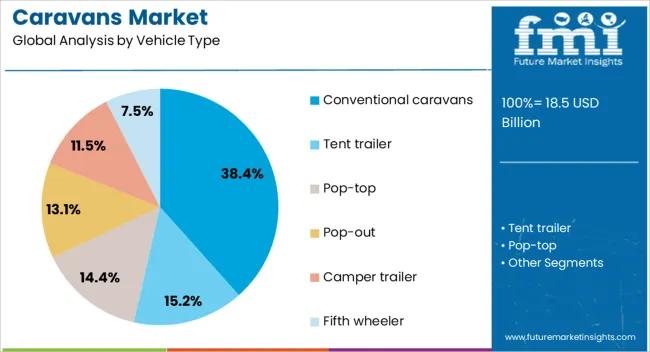

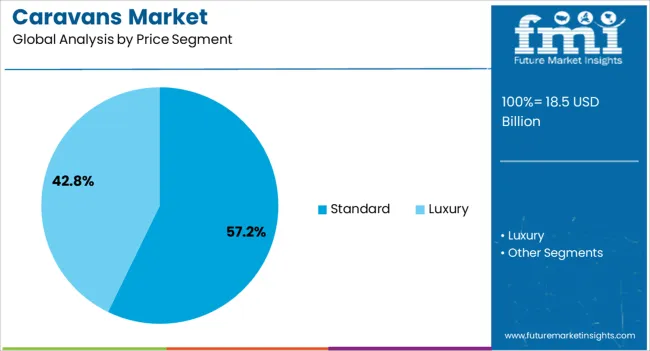

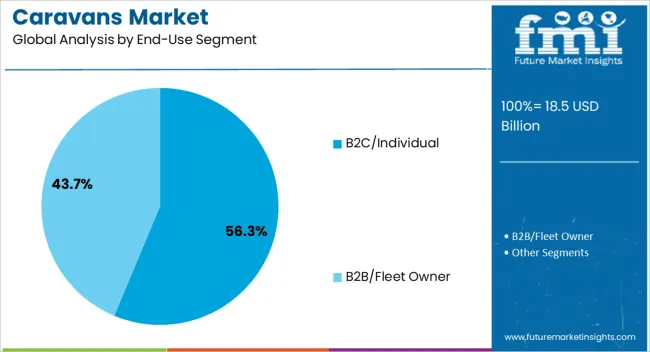

The caravans market is segmented by vehicle type, price segment, end-use segment, and geographic regions. By vehicle type, the caravan market is divided into Conventional caravans, Tent trailers, Pop-top, Pop-out, Camper trailers, and Fifth wheelers. In terms of price segment, caravans market is classified into Standard and Luxury. Based on end-use segment, caravans market is segmented into B2C/Individual and B2B/Fleet Owner. Regionally, the caravans industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional caravans segment is projected to hold 38.4% of the caravans market revenue share in 2025, making it the leading vehicle type. This dominance is being driven by their balanced combination of affordability, space, and functionality, which appeals to a broad range of buyers. Conventional caravans offer versatile layouts with essential amenities for long-distance travel, making them suitable for both short-term trips and extended vacations.

Their widespread availability through dealer networks and second-hand markets enhances accessibility, further strengthening segment adoption. Manufacturers are improving design efficiency, interior ergonomics, and durability, ensuring that conventional caravans meet modern expectations for comfort and ease of use.

The segment is also supported by strong brand recognition and consumer trust in established designs, which continue to perform well in diverse road and weather conditions. As the demand for reliable, cost-effective leisure vehicles remains strong, conventional caravans are expected to retain their leadership, supported by continuous incremental improvements and competitive pricing strategies.

The standard price segment is anticipated to account for 57.2% of the caravans market revenue share in 2025, making it the largest price category. This leadership is being supported by its ability to balance affordability with desirable features, appealing to a wide spectrum of customers. Standard-priced caravans typically provide sufficient amenities, comfort, and build quality to satisfy both occasional travelers and frequent users, without the premium cost associated with luxury models.

The segment benefits from strong demand among first-time buyers who prioritize value for money, as well as repeat customers seeking dependable replacements or upgrades within a reasonable budget. Growing competition among manufacturers in this price range is leading to the inclusion of advanced features such as energy-efficient systems, improved insulation, and enhanced safety technologies.

The availability of financing options and seasonal promotions further increases the accessibility of standard-priced caravans. As cost-conscious consumers remain a substantial portion of the market, the standard segment is expected to sustain its dominant share through consistent value offerings and product innovation.

The B2C or individual end-use segment is expected to capture 56.3% of the caravans market revenue share in 2025, securing its position as the leading end-use category. This dominance is being fueled by the growing appeal of caravanning as a leisure activity among families, retirees, and adventure-seeking individuals. Direct ownership allows consumers greater flexibility in travel planning, eliminating dependence on rental availability and enabling spontaneous trips.

The segment benefits from rising disposable incomes, which support discretionary spending on leisure vehicles, particularly in regions with strong tourism and camping cultures. Increased marketing efforts by manufacturers and dealerships, coupled with social media influence showcasing caravan lifestyles, are boosting consumer interest.

Enhanced product personalization options, allowing owners to select layouts, finishes, and features to suit their needs, are also contributing to growth. As more individuals seek independent, self-sufficient travel experiences, the B2C segment is expected to remain the largest revenue contributor, supported by evolving designs and the continued cultural shift toward flexible, experience-focused leisure travel.

The caravans market is growing due to rising interest in leisure travel, adventure tourism, and personalized mobile living solutions. Caravans provide mobility, self-sufficiency, and flexible accommodation, appealing to families, retirees, and outdoor enthusiasts. Demand is increasing in regions with developed road infrastructure and recreational parks. Technological improvements in lightweight materials, modular interiors, and energy-efficient systems enhance user comfort. Europe and North America lead adoption, while Asia-Pacific and Latin America are emerging markets. Manufacturers are focusing on durability, safety, and customization to meet diverse consumer preferences.

Consumers increasingly seek mobile accommodation options that allow travel without dependence on hotels or fixed lodging. Caravans provide freedom to explore remote destinations while offering essential amenities like kitchens, bathrooms, and sleeping areas. Families, retirees, and outdoor enthusiasts value the combination of mobility, privacy, and convenience, which traditional accommodations cannot match. Recreational parks and roadside infrastructure supporting caravan tourism further encourage adoption. In addition, seasonal travel trends and regional road-trip culture drive demand. Manufacturers are responding with modular layouts, ergonomic interiors, and integrated utility systems to meet user expectations. Until alternative mobile lodging solutions achieve similar convenience and comfort, caravans remain the preferred choice for travelers seeking flexibility, independence, and self-contained living experiences.

Caravan manufacturers are using lightweight materials such as aluminum, fiberglass, and high-strength composites to improve fuel efficiency, ease of towing, and structural durability. Energy-efficient systems, including solar panels, LED lighting, and water-saving appliances, enhance the comfort and sustainability of mobile living. Smart features, such as remote monitoring of temperature, battery levels, and security systems, improve convenience and safety for users. Advanced chassis, suspension, and braking technologies ensure stability and durability during travel. Until alternative mobile accommodation products achieve the same combination of comfort, efficiency, and ease of use, caravans with improved materials and technology will continue to attract consumers looking for practical and reliable solutions for extended travel.

Caravans must comply with vehicle safety standards, road regulations, and environmental norms in different regions. Requirements include braking systems, lighting, weight distribution, emissions standards, and towing certifications. Compliance ensures road safety, protects occupants, and allows manufacturers to sell in multiple markets. Inspections and approvals may vary by country, affecting lead time and production planning. Companies that invest in certified chassis, fire-resistant materials, and crash-tested components gain credibility and access to broader markets. Until regulatory standards are harmonized globally, manufacturers must adapt designs regionally, balancing compliance costs with performance and comfort to maintain market competitiveness.

Emerging economies in Asia-Pacific and Latin America show rising interest in caravans due to increasing disposable income, domestic tourism, and recreational infrastructure development. Governments promoting road networks, camping sites, and tourism facilities support the growth of mobile accommodation solutions. Manufacturers entering these regions benefit from early adoption trends and can offer affordable models suited to local preferences. Regional service networks, spare parts availability, and financing options influence consumer willingness to invest in caravans. Until competing travel and accommodation alternatives provide the same level of mobility and self-contained convenience, emerging markets present significant opportunities for market expansion and increased adoption of caravans for leisure and tourism.

| Countries | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

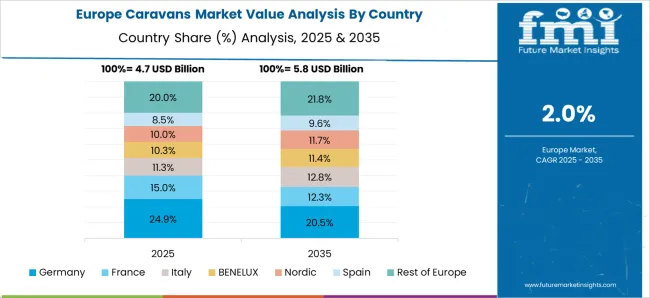

The global caravans market is projected to grow at a CAGR of 4.1% through 2035, supported by increasing demand across recreational, tourism, and travel applications. Among BRICS nations, China has been recorded with 5.5% growth, driven by large-scale production and deployment in recreational and tourism sectors, while India has been observed at 5.1%, supported by rising utilization in travel and leisure applications. In the OECD region, Germany has been measured at 4.7%, where production and adoption for tourism, recreational, and leisure sectors have been steadily maintained. The United Kingdom has been noted at 3.9%, reflecting consistent use in recreational and travel applications, while the USA has been recorded at 3.5%, with production and utilization across tourism, recreational, and leisure sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The caravans market in China is growing at a CAGR of 5.5%, driven by rising domestic tourism, increasing disposable incomes, and growing interest in outdoor recreational activities. Caravans are increasingly used for road trips, camping, and adventure tourism, offering mobility and comfort for travelers. The expansion of highways, camping facilities, and recreational infrastructure supports market growth. Technological innovations, such as lightweight designs, improved fuel efficiency, and modern amenities, enhance consumer adoption. Growing awareness of eco-friendly and energy-efficient recreational vehicles further fuels demand. The government’s support for domestic tourism and initiatives promoting outdoor leisure activities are positively impacting the market. Rising demand from both individual consumers and rental service providers ensures steady expansion of the caravans market in China.

The caravans market in India is expanding at a CAGR of 5.1%, driven by growing tourism, road travel culture, and interest in adventure and leisure activities. Caravans provide flexibility, mobility, and convenience for domestic travelers exploring remote or rural destinations. Infrastructure improvements, such as highways, camping sites, and tourism facilities, facilitate adoption. Technological advancements, including lightweight construction, enhanced interiors, and fuel-efficient models, attract consumers seeking comfort and practicality. Rising disposable income, urbanization, and increasing interest in family road trips encourage market growth. Rental services for caravans are also gaining traction in India, providing an affordable option for travelers. The combination of tourism development, technological innovation, and consumer interest ensures steady growth of the caravans market in India.

The caravans market in Germany is growing at a CAGR of 4.7%, fueled by strong recreational vehicle culture, tourism, and domestic leisure travel. Consumers prefer caravans for road trips, camping, and outdoor vacations, benefiting from well-developed infrastructure and campgrounds. Technological advancements in design, fuel efficiency, and onboard amenities improve the overall travel experience, supporting adoption. Germany’s focus on eco-friendly solutions encourages energy-efficient and sustainable caravan options. Government regulations for road safety, emissions, and vehicle standards ensure quality and reliability. Rental and leasing services for caravans also promote accessibility for consumers. High interest in outdoor leisure, coupled with innovations in recreational vehicles, ensures the steady growth of the caravans market in Germany.

The caravans market in the United Kingdom is expanding at a CAGR of 3.9%, supported by domestic tourism, road trips, and outdoor recreation. Caravans offer flexibility and convenience for vacations, camping, and adventure travel, catering to families and individual travelers alike. Technological innovations, including modern interiors, lightweight materials, and fuel-efficient designs, enhance market appeal. Government initiatives promoting domestic tourism, infrastructure development, and camping facilities further support adoption. Rental services for caravans provide cost-effective solutions for travelers, increasing accessibility. The combination of consumer interest in leisure travel, modern caravan designs, and infrastructure growth ensures steady expansion of the caravans market in the UK.

The caravans market in the United States is growing at a CAGR of 3.5%, driven by strong road trip culture, outdoor recreation, and domestic tourism. Caravans provide mobility, comfort, and convenience for travelers exploring rural, national park, and coastal destinations. Technological improvements, including enhanced fuel efficiency, spacious interiors, and advanced onboard amenities, support market growth. Rental services for caravans increase accessibility for consumers who prefer short-term usage over ownership. Government programs promoting tourism, outdoor activities, and infrastructure development contribute to market expansion. High interest in family vacations, adventure travel, and recreational vehicles ensures consistent growth of the caravans market in the USA.

The caravans market has witnessed significant growth in recent years, driven by rising consumer interest in outdoor leisure, domestic tourism, and mobile living solutions. Modern caravans are increasingly equipped with advanced amenities, energy-efficient systems, and smart technology, catering to the evolving expectations of travelers seeking comfort, convenience, and flexibility on the road. The market encompasses a wide range of vehicles, from compact touring caravans to luxurious motorhomes, appealing to both casual holidaymakers and long-term lifestyle users.

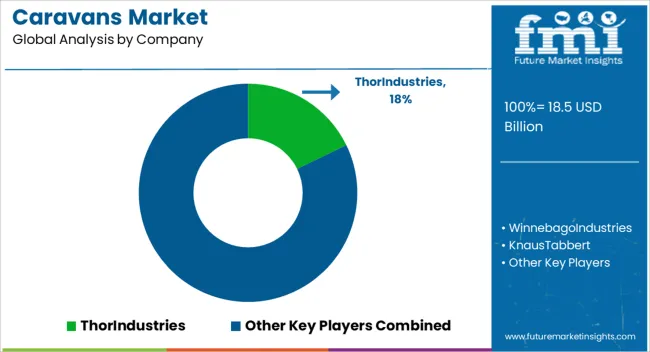

Key players in the market include Thor Industries, one of the largest manufacturers globally, known for its broad portfolio of innovative recreational vehicles. Winnebago Industries is another leading supplier, offering high-quality motorhomes and caravans designed for durability and comfort. European players such as Knaus Tabbert and TRIGANO are renowned for their stylish, functional designs and strong presence in the leisure vehicle segment. Other notable brands include Kabe, Swift, and Lunar, which focus on blending performance with luxury features, while Bailey of Bristol and Auto-Sleepers Group emphasize craftsmanship and long-standing heritage in the market. Aeon RV is also gaining traction with technologically advanced models catering to younger, tech-savvy consumers.

Market growth is supported by factors such as increasing disposable incomes, rising popularity of staycations, and advancements in vehicle design and energy efficiency. Leading caravan manufacturers are investing in sustainable materials, lightweight construction, and smart connectivity solutions to differentiate themselves in a competitive market. As consumer demand continues to evolve, these suppliers are driving innovation and expanding their portfolios to meet diverse lifestyle needs, ensuring continued growth in the global caravans market.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.5 Billion |

| Vehicle Type | Conventional caravans, Tent trailer, Pop-top, Pop-out, Camper trailer, and Fifth wheeler |

| Price Segment | Standard and Luxury |

| End-Use Segment | B2C/Individual and B2B/Fleet Owner |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ThorIndustries, WinnebagoIndustries, KnausTabbert, TRIGANO, Kabe, Swift, Lunar, BaileyofBristol, Auto-SleepersGroup, and Aeonrv |

| Additional Attributes | Dollar sales vary by caravan type, including travel trailers, camper vans, and fifth-wheel caravans; by application, such as recreational travel, tourism, and mobile living; by end-use consumer, spanning families, adventure travelers, and retirees; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising domestic tourism, growing adventure travel trends, and increasing disposable income. |

The global caravans market is estimated to be valued at USD 18.5 billion in 2025.

The market size for the caravans market is projected to reach USD 27.7 billion by 2035.

The caravans market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in caravans market are conventional caravans, tent trailer, pop-top, pop-out, camper trailer and fifth wheeler.

In terms of price segment, standard segment to command 57.2% share in the caravans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA