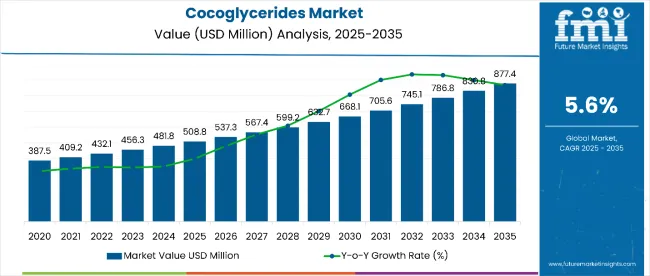

The cocoglycerides market is estimated to be valued at USD 508.8 million in 2025 and is projected to reach USD 877.4 million by 2035, registering a CAGR of 5.6% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 368.6 million over the forecast period.

| Metric | Value |

|---|---|

| Cocoglycerides Market Estimated Value in (2025E) | USD 508.8 million |

| Cocoglycerides Market Forecast Value in (2035F) | USD 877.4 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

This reflects a 1.68 times growth at a compound annual growth rate of 5.6%. The market's evolution is expected to be shaped by rising demand for natural emollients and emulsifiers in cosmetic formulations, increasing consumer preference for coconut-derived ingredients, and expanding applications across skincare, haircare, and personal care product categories.

By 2030, the market is likely to reach approximately USD 688.8 million, accounting for USD 180 million in incremental value over the first half of the decade. The remaining USD 188.6 million is expected during the second half, suggesting a moderately back-loaded growth pattern. Product innovation focusing on multifunctional cocoglycerides is gaining traction due to their superior emollient properties, stability enhancement capabilities, and compatibility with clean-label formulations.

Companies such as Cargill and BASF SE are advancing their competitive positions through investment in sustainable sourcing technologies and advanced processing capabilities. Innovation-led product development is supporting expansion into premium cosmetic applications, natural personal care formulations, and specialty pharmaceutical applications. Market performance will remain anchored in ingredient quality standards, regulatory compliance frameworks, and sustainable sourcing initiatives.

The market holds approximately 38% of the coconut-derived cosmetic ingredients market, driven by their excellent emollient properties and natural origin appeal among beauty-conscious consumers. It accounts for around 15% of the natural emulsifiers market, supported by increasing demand for plant-based cosmetic formulations and clean-label personal care products.

The market contributes nearly 28% to the specialty cosmetic emollients market, particularly for premium skincare applications requiring superior moisturizing and texture-enhancing properties. It holds close to 22% of the multifunctional cosmetic ingredients market, where cocoglycerides serve dual roles as emollients and stabilizers. The share in the natural personal care ingredients market reaches about 12%, reflecting growing consumer preference for coconut-derived and sustainable beauty ingredients.

The market is undergoing structural change driven by rising demand for natural and sustainable cosmetic ingredients and clean-label beauty formulations. Advanced processing methods using controlled fractionation and purification techniques have enhanced product purity, functional performance, and application versatility, making cocoglycerides a preferred alternative to synthetic emollients and petroleum-derived ingredients.

Manufacturers are introducing specialized grades with enhanced stability, improved sensory characteristics, and multifunctional properties tailored for premium cosmetic and pharmaceutical applications.

Cocoglycerides’ natural origin from coconut oil, excellent emollient properties, and multifunctional capabilities as both moisturizer and emulsifier make them highly attractive ingredients for modern cosmetic and personal care formulations seeking natural alternatives to synthetic compounds.

Growing consumer awareness of ingredient safety and sustainability is further propelling adoption, especially among millennials and Gen Z consumers who prioritize clean-label beauty products and environmentally conscious brands. Scientific validation of cocoglycerides’ skin-conditioning benefits, along with improved processing technologies for enhanced purity and performance, is also driving market expansion.

As the global beauty industry shifts toward natural and organic formulations and regulatory frameworks increasingly favor bio-based ingredients, the market outlook remains favorable. With continued innovation in application technologies, expanding usage in premium skincare formulations, and growing adoption in emerging markets, cocoglycerides are well-positioned to capture increasing share across cosmetic, personal care, and specialty pharmaceutical applications.

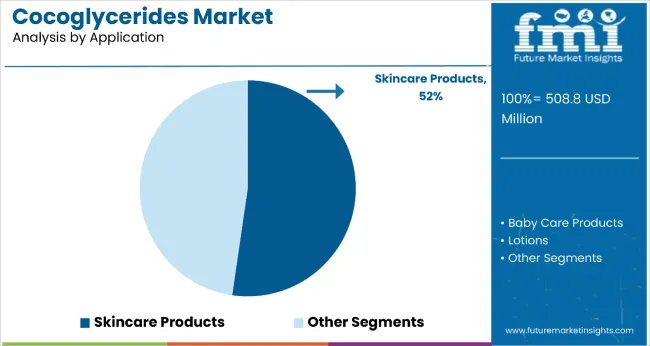

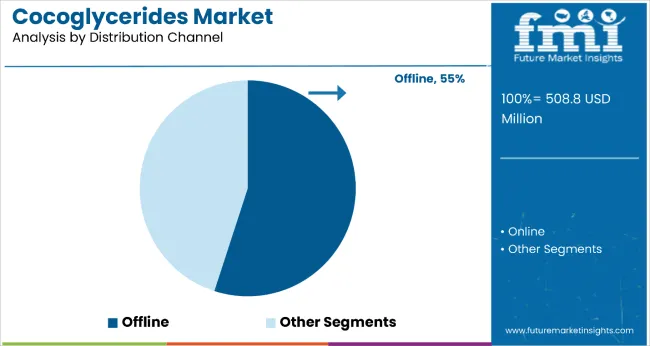

The market is segmented by application, distribution channel, and region. By application, the market is divided into baby care products, lotions, powder, cream, oils, bath products, eye lotion, eye makeup, eye liner, fragrance products, personal hygiene, and skincare products. In terms of distribution channel, the market is bifurcated into online and offline. Regionally, the market is characterized into North America, Latin America, Asia Pacific, Eastern Europe, Western Europe, and Japan.

The skincare products segment holds a leading 52% market share in the application category, driven by the superior emollient and moisturizing properties of cocoglycerides that align well with modern skincare formulations. These coconut-derived ingredients are widely used in face creams, body lotions, serums, and specialty treatments due to their multifunctionality and gentle yet effective conditioning effects.

Their compatibility with both oil-in-water and water-in-oil systems adds formulation flexibility, making them highly versatile across premium skincare ranges. As clean beauty trends gain momentum, consumers are prioritizing natural ingredients with proven efficacy and safe skin benefits.

Manufacturers are responding with advanced cocoglycerides grades that offer enhanced penetration, stability, and synergy with actives, catering to growing demand for high-performance, natural skincare. The segment’s continued dominance is underpinned by rising consumer interest in sustainable, ingredient-transparent beauty products.

The offline distribution channel dominates with 55.0% market share in 2025, as consumers continue to favor in-store purchases for personal care and cosmetic products. Supermarkets, pharmacies, and specialty beauty stores remain trusted touchpoints for product evaluation, tactile experience, and expert recommendations.

Offline shopping also caters well to premium and high-involvement products such as skincare and baby care, where consumers often seek authenticity assurance and compatibility trials.

In-store promotions, shelf visibility, and real-time customer engagement contribute significantly to brand loyalty and conversion rates. Despite the rise of e-commerce, offline retail maintains a strong foothold, particularly in regions with limited digital infrastructure. The segment’s resilience is supported by evolving retail strategies focused on experiential shopping and hybrid models.

From 2025 to 2035, natural ingredient validation and clean beauty trends were central to market expansion, with sustainability-focused brands adopting cocoglycerides as preferred alternatives to synthetic emollients. Advanced processing technologies ensuring consistent quality and enhanced functionality became key differentiators. Growing consumer awareness of coconut-derived ingredients’ benefits and environmental advantages supported market growth across all application segments.

Clean Beauty Movement Drives Cocoglycerides Adoption

The accelerating shift toward clean, natural beauty products has been identified as the primary catalyst for growth in the cocoglycerides market. By 2025, demand was elevated as cosmetic formulators recommended plant-based emollients for sensitive skin applications and organic product certifications. Scientific validation of cocoglycerides’ skin-conditioning benefits and safety profile has demonstrated superior compatibility with natural formulation systems compared to synthetic alternatives.

Multifunctional Ingredient Innovation Creates Market Opportunities

In 2024, cosmetic manufacturers began integrating advanced cocoglycerides grades with enhanced emulsification and stabilization properties, supported by improved processing technologies that preserve natural characteristics while optimizing performance.

By 2025, specialized cocoglycerides variants were being deployed in premium formulations requiring multifunctional ingredients that combine emollient, emulsifier, and texture-enhancing properties. These implementations demonstrate that cocoglycerides can evolve from basic emollient ingredients to sophisticated multifunctional components enabling innovative cosmetic formulations.

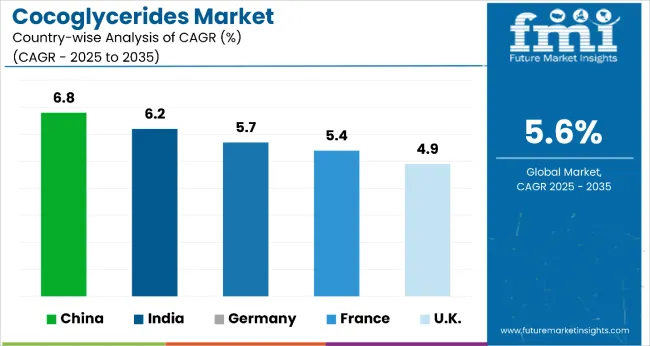

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.2% |

| Germany | 5.7% |

| France | 5.4% |

| UK | 4.9% |

China leads the cocoglycerides market with a strong CAGR of 6.8%. Growth is driven by domestic cosmetics manufacturing and support for natural formulations. India follows with a 6.2% CAGR, fueled by Ayurvedic integration and rising clean beauty demand. Germany sees 5.7% growth, led by organic-certified ingredients. France grows at 5.4%, supported by dermocosmetics and REACH compliance. The UK, at 4.9%, trails but remains active with clean-label trends, vegan beauty products, and innovation from DTC and indie brands.

The report covers an in-depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

The cocoglycerides market in China is projected to grow at a CAGR of 6.8% from 2025 to 2035, outperforming the global average by 1.5%. The growth is linked to expanding domestic cosmetic manufacturing in Guangdong, Shanghai, and Zhejiang provinces. Natural ingredient formulations are widely adopted in premium skincare and beauty products targeting affluent urban consumers.

Output has been expanded by government support for sustainable ingredient sourcing and clean beauty product development. Processed cocoglycerides are increasingly integrated into domestic brand formulations and export-oriented cosmetic manufacturing.

More than 55% of production supports high-end skincare applications catering to demand from tier-1 cities and international markets. Local brands have also increased cocoglycerides integration in natural beauty products, especially targeting millennials and Gen Z consumers.

Cocoglycerides revenue in India is forecast to grow at a CAGR of 6.2% from 2025 to 2035, ahead of the global average by 0.9%. Urban regions, particularly Mumbai, Delhi, and Bangalore, have expanded consumption of premium beauty products containing natural emollients and coconut-derived ingredients.

Government-backed initiatives are supporting Ayurvedic cosmetic formulations integrating traditional and modern ingredients. Beauty brands have shifted toward natural ingredient portfolios to address growing consumer awareness of clean beauty products. Export-grade cosmetic ingredients are gaining traction in European and North American markets.

Domestic manufacturing of cocoglycerides-containing products is increasing as local brands expand premium product lines. Regional distribution networks for natural cosmetic ingredients are strengthening across tier-2 and tier-3 cities.

Demand for cocoglycerides in Germany is expected to grow at a CAGR of 5.7% from 2025 to 2035, exceeding the global rate by 0.4%. Growth is centered on premium cosmetic formulation and organic beauty product development in cities such as Munich, Hamburg, and Berlin. Natural emollients with certified organic status are being specified for luxury skincare formulations and pharmaceutical applications.

Import volumes from sustainable suppliers have increased, particularly from certified organic and fair-trade sources. Processed products with EU organic certification are favored under strict quality and environmental standards. Most adoption is driven by luxury beauty brands and specialized cosmetic manufacturers focusing on natural ingredient formulations. Advanced cocoglycerides grades have also gained share in dermatological applications, especially in sensitive skin and therapeutic cosmetic products.

Sales of cocoglycerides in France are witnessing a steady CAGR of 5.4%, driven by its leadership in high-end cosmetics, skincare, and dermocosmetics. The nation’s strong heritage in personal care formulation, supported by major cosmetic clusters in Paris and Lyon, makes it a hotspot for coconut-derived emulsifiers. Cocoglycerides are being increasingly adopted in anti-aging and baby care products due to their mild, non-comedogenic, and biodegradable properties.

France’s strict adherence to EU REACH standards and push toward natural, plant-based ingredients also encourage companies to shift from synthetic to bio-based esters. French cosmetic giants are incorporating these emollients into natural formulations to appeal to ingredient-conscious consumers. Furthermore, its pharma-cosmetic segment is integrating cocoglycerides in topical ointments and sensitive skin applications.

The UK cocoglycerides revenue is advancing at a CAGR of 4.9%, backed by its proactive clean-label movement, ethical sourcing frameworks, and premiumization trends in personal care. Cocoglycerides are gaining traction as sustainable emollients in a wide range of applications-from moisturizers and body oils to food emulsifiers.

UK formulators prefer multifunctional ingredients like cocoglycerides for their moisturizing, thickening, and stabilizing properties, especially in organic and vegan-certified products. Stringent labeling requirements and growing consumer aversion to synthetic additives are driving up demand for naturally derived esters.

In addition, the rise of DTC (direct-to-consumer) brands is accelerating innovations that highlight ingredients like cocoglycerides in marketing claims. With established players like Unilever and emerging indie brands alike reformulating their products, the UK is cementing itself as a cocoglyceride-forward market.

The market is moderately consolidated, with Cargill leading at an estimated 16.8% market share. The company holds a dominant position through its integrated coconut oil supply chain, advanced processing capabilities, and established relationships with major cosmetic and personal care manufacturers requiring consistent quality natural ingredients.

Key players include Archer Daniels Midland Company, BASF SE, KLK OLEO, Stepan Company, Lonza Group Ltd., Kao Corporation, DeWolf Chemical, COSME ITALY, and Nicozyme Inc., each providing specialized cocoglycerides solutions including various grades and purities for cosmetic, personal care, and pharmaceutical applications, supported by technical expertise and regulatory compliance capabilities.

Market demand is driven by growing consumer preference for natural ingredients, expanding clean beauty trends, and increasing regulatory support for bio-based cosmetic ingredients. Competition focuses on product quality consistency, sustainable sourcing practices, and technical support for cosmetic formulation optimization.

Key Developments in Cocoglycerides Market

| Item | Value |

|---|---|

| Quantitative Units | USD 508.8 Million |

| Application | Baby Care Products, Lotions, Powder, Cream, Oils, Bath Products, Eye Lotion, Eye Makeup, Eye Liner, Fragrance Products, Personal Hygiene, Skincare Products |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia, and 40+ countries |

| Key Companies Profiled | Cargill, Archer Daniels Midland Company, Galam Ltd., Kao Corporation, Nicozyme Inc., Lonza Group Ltd., Stepan Company, COSME ITALY, DeWolf Chemical, BASF SE, KLK OLEO. |

| Additional Attributes | Dollar sales by application and form categories, growing usage in natural cosmetic formulations and clean beauty products, stable demand in premium skincare and pharmaceutical applications, innovations in processing technologies and quality enhancement improve functionality, sustainability, and regulatory compliance |

The global cocoglycerides market is estimated to be valued at USD 508.8 million in 2025.

The market size for the cocoglycerides market is projected to reach USD 877.4 million by 2035.

The cocoglycerides market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in cocoglycerides market are baby care products, lotions, powder, cream, oils, bath products, eye lotion, eye makeup, eye liner, fragrance products, personal hygiene and skincare products.

In terms of distribution channel, online segment to command 54.2% share in the cocoglycerides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA