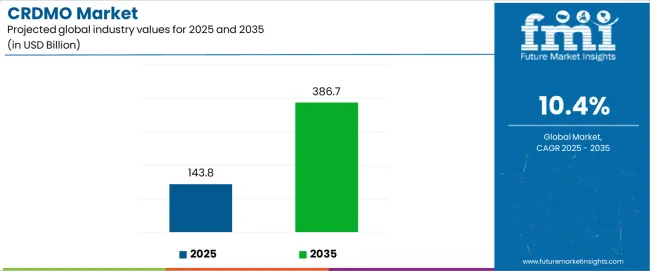

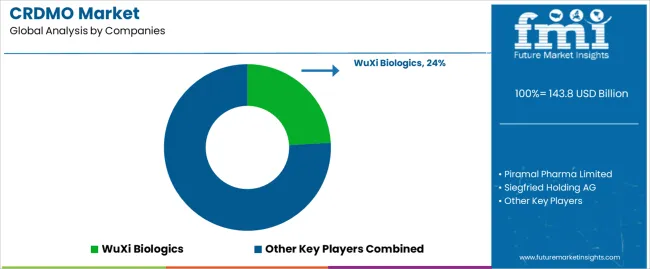

The contract research, development, and manufacturing organization (CRDMO) industry is set for transformative expansion between 2025 and 2035, with growth expected from USD 143.8 billion to USD 386.7 billion, at a CAGR of 10.4%. This acceleration highlights how pharmaceutical companies are reconfiguring their operating models toward integrated outsourcing partnerships that combine R&D capabilities, process development expertise, and commercial-scale manufacturing. Several dynamics explain this momentum and the structural changes underway. The primary growth driver is the increasing complexity of drug pipelines, particularly biologics, cell and gene therapies, and nucleic acid-based drugs, which demand specialized expertise and infrastructure. Pharmaceutical companies are focusing on accelerating time-to-market and controlling costs, making integrated CRDMO partnerships more attractive. The rise of small and mid-sized biotech firms with limited in-house capacity is also strengthening reliance on CRDMOs for both early-stage development and late-stage manufacturing. Growing regulatory scrutiny is another driver, as CRDMOs with established compliance frameworks are being favored by drug developers seeking risk mitigation.

A major opportunity lies in the expanding role of CRDMOs in personalized medicine and niche therapeutics. The growing prevalence of precision therapies requires flexible, small-batch manufacturing, which CRDMOs are uniquely positioned to provide. Digitalization and automation in drug development present another opportunity, as organizations leveraging AI-driven trial simulations, predictive modeling, and smart manufacturing will capture market share. Geographic diversification also stands out as a key opportunity, with Asia, especially China and India, emerging as attractive hubs for cost-effective development and large-scale production, while Western players consolidate high-value segments such as advanced biologics. Despite strong momentum, challenges persist. Capacity bottlenecks, especially in biologics manufacturing, remain a pressing concern. Maintaining quality and compliance while scaling operations across multiple geographies requires significant investment. Pricing pressure from pharmaceutical clients could also affect margins, especially as consolidation increases competition among service providers. Furthermore, integrating advanced digital solutions into legacy operations will require sustained capital outlays and skilled labor, potentially slowing adoption for mid-tier CRDMOs.

The CRDMO market is on track to become the backbone of global drug innovation by 2035, providing seamless support from discovery to commercialization. As pharmaceutical firms continue shifting toward asset-light models, CRDMOs offering end-to-end services, global manufacturing footprints, and proven regulatory expertise will dominate the competitive landscape. Long-term growth will be shaped not only by outsourcing demand but also by strategic investments in advanced manufacturing technologies, AI-enabled development, and regional expansion strategies.

Between 2025 and 2030, the CRDMO market is projected to expand from USD 143.8 billion to USD 244.1 billion, resulting in a value increase of USD 100.3 billion, which represents approximately 41% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of integrated pharmaceutical services, increasing complexity of drug development processes, and growing demand for specialized manufacturing capabilities. Service providers are expanding their comprehensive offerings to address the growing complexity of modern pharmaceutical development from discovery through commercial manufacturing.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 143.8 billion |

| Forecast Value in (2035F) | USD 386.7 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

From 2030 to 2035, the CRDMO market is forecast to grow from USD 244.1 billion to USD 386.7 billion, adding another USD 142.6 billion, which constitutes 59% of the ten-year expansion. This period is expected to be characterized by expansion of advanced biomanufacturing capabilities, integration of artificial intelligence and automation technologies, and development of specialized platforms for cell and gene therapy production. The growing adoption of personalized medicine and advanced therapeutic modalities will drive demand for more sophisticated development and manufacturing solutions with specialized technical expertise.

Between 2020 and 2025, the CRDMO market experienced accelerated expansion, driven by increasing pharmaceutical outsourcing trends and growing recognition of integrated service models. The CRDMO market developed as pharmaceutical and biotechnology companies recognized the advantages of partnering with providers offering end-to-end capabilities from discovery through commercial manufacturing. The COVID-19 pandemic further emphasized the importance of flexible and scalable manufacturing networks, accelerating adoption of CRDMO partnerships.

Market expansion is being supported by the rapid increase in pharmaceutical outsourcing worldwide and the corresponding need for integrated service providers offering comprehensive capabilities across drug development and manufacturing. Modern pharmaceutical companies rely on specialized partners to manage complex development processes including discovery research, preclinical development, clinical trial materials production, and commercial manufacturing. Even established pharmaceutical companies require specialized capabilities for advanced therapeutic modalities including biologics, cell and gene therapies, and complex drug delivery systems.

The growing complexity of pharmaceutical development and increasing regulatory requirements are driving demand for specialized service providers with appropriate expertise, infrastructure, and regulatory compliance capabilities. Pharmaceutical companies are increasingly requiring comprehensive documentation and quality systems following development and manufacturing activities to maintain regulatory approval and ensure product quality. International regulatory harmonization and quality standards are establishing standardized development and manufacturing protocols that require specialized capabilities and trained scientific personnel.

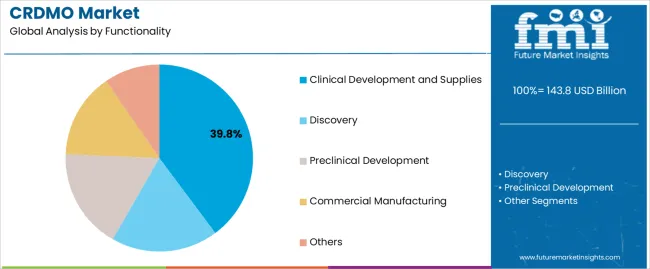

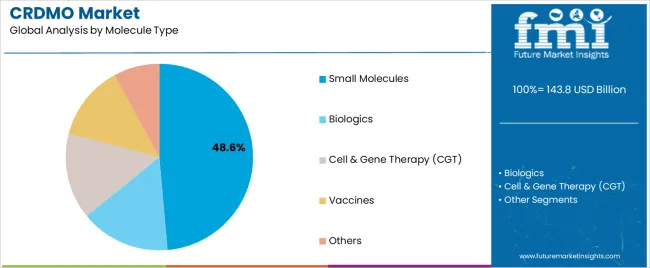

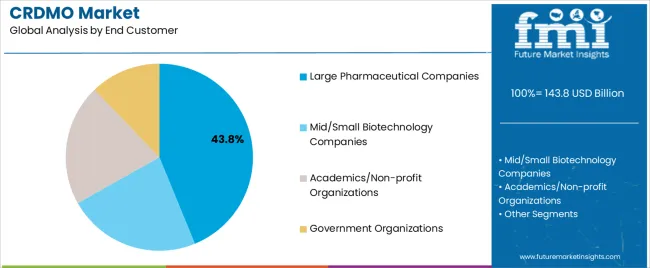

The CRDMO market is segmented by functionality, molecule type, development stage, end customer, and region. By functionality, the market is divided into discovery, preclinical development, clinical development and supplies, commercial manufacturing, and others. Based on molecule type, the CRDMO market is categorized into small molecules, biologics, cell and gene therapy (CGT), vaccines, and others. In terms of development stage, the market is segmented into preclinical, Phase I, Phase II, Phase III, and commercial stages. By end customer, the CRDMO market is classified into large pharmaceutical companies, mid/small biotechnology companies, academics/non-profit organizations, and government organizations. Regionally, the market is divided into North America, Europe, East Asia, South Asia and Pacific, Latin America, and Middle East and Africa.

Clinical development and supplies are projected to account for 39.8% of the CRDMO market in 2025. This leading share is supported by the extensive requirements for clinical trial materials production and regulatory support services across all phases of clinical development. Clinical development encompasses multiple activities including formulation development, analytical method development, clinical trial materials manufacturing, and regulatory affairs support. The segment benefits from increasing clinical trial complexity and comprehensive regulatory requirements across global markets.

Small molecules are expected to represent 48.6% of CRDMO service demand in 2025. This significant share reflects the continued importance of traditional pharmaceutical compounds in drug development pipelines and the established infrastructure for small molecule development and manufacturing. Modern small molecule development often requires sophisticated synthetic chemistry capabilities, advanced analytical methods, and specialized manufacturing technologies. The segment benefits from growing complexity of small molecule therapeutics and increasing demand for specialized synthetic chemistry expertise.

Commercial stage development and manufacturing are projected to contribute 32.9% of the CRDMO market in 2025, representing the largest single development stage segment. Commercial activities include full-scale manufacturing, supply chain management, packaging, and distribution services for approved pharmaceutical products. Commercial manufacturing typically involves the highest value services and longest-term client relationships. The segment is supported by a growing number of pharmaceutical approvals and increasing demand for flexible commercial manufacturing capabilities.

Large pharmaceutical companies are estimated to hold 43.8% of the CRDMO market share in 2025. This substantial share reflects the outsourcing strategies of major pharmaceutical corporations seeking to optimize their development and manufacturing operations through specialized partnerships. Large pharmaceutical companies typically engage CRDMO providers for multiple services including specialized capabilities, capacity expansion, and geographic diversification. The segment provides stable long-term relationships and typically involves high-value service agreements across multiple therapeutic areas and development stages.

The CRDMO market is advancing rapidly due to increasing pharmaceutical outsourcing trends and growing demand for integrated service offerings. The CRDMO market faces challenges, including intense competition for specialized talent, the need for continuous investment in advanced technologies, and varying regulatory requirements across different markets. Technology advancement and capacity expansion initiatives continue to influence service capabilities and market development patterns.

The growing development of advanced biomanufacturing platforms is enabling more effective production of complex therapeutic modalities including biologics, cell therapies, and gene therapies. Advanced biomanufacturing facilities incorporating single-use technologies provide enhanced flexibility and reduced contamination risk for clients while expanding therapeutic development options. These capabilities are particularly valuable for biotechnology companies and academic institutions developing innovative therapies that require specialized production expertise without extensive facility investment.

Modern CRDMO providers are incorporating artificial intelligence, machine learning, and advanced automation systems that improve development timelines and reduce costs. Integration of digital technologies, predictive analytics, and automated manufacturing systems enables more efficient service delivery and comprehensive data management. Advanced technologies also support development of next-generation therapeutic modalities including precision medicine approaches, personalized therapies, and novel drug delivery systems requiring sophisticated analytical and manufacturing capabilities.

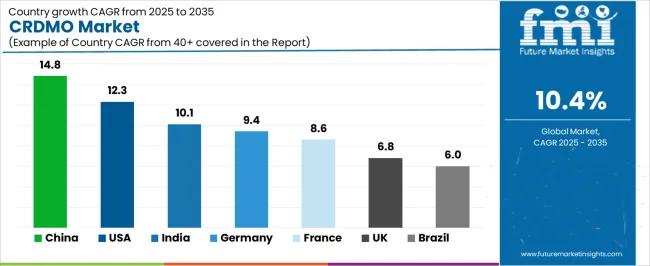

| Country | CAGR (2025–2035) |

|---|---|

| China | 14.8% |

| India | 10.1% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 6.8% |

| USA | 12.3% |

| Brazil | 6.0% |

Revenue from CRDMO services in China is projected to exhibit a strong growth rate of 14.8% CAGR from 2025 to 2035, with the CRDMO market expected to reach significant scale by 2035. This growth is driven by rapid expansion of biotechnology infrastructure and increasing pharmaceutical outsourcing activities. The country's growing pharmaceutical industry and modernizing regulatory environment are creating significant demand for integrated development and manufacturing services. Major international CRDMO providers and domestic companies are establishing comprehensive service capabilities to support the growing population of pharmaceutical and biotechnology companies across urban and rural markets.

Government biotechnology development programs are supporting establishment of specialized pharmaceutical parks and standardized service protocols that enhance development capabilities and reduce regulatory complexity throughout major metropolitan areas. Healthcare industry modernization initiatives are facilitating adoption of international-standard development and manufacturing practices and training programs that enhance service capabilities and technical expertise across pharmaceutical networks. Advanced development platforms are being integrated into pharmaceutical education and research institutions, ensuring future scientists understand modern development approaches and technology applications.

Demand for CRDMO services in India is expanding rapidly, with a CAGR of 10.1% from 2025 to 2035, supported by cost-effective service delivery capabilities and a growing pharmaceutical industry sophistication. The country's established pharmaceutical manufacturing base and expanding biotechnology sector are driving demand for integrated development and manufacturing services. Contract service providers and specialized development companies are gradually establishing comprehensive capabilities to support diverse client requirements from discovery through commercial manufacturing.

Pharmaceutical industry development and biotechnology sector expansion are creating opportunities for specialized service providers that can support international quality standards and regulatory compliance requirements. Professional training and certification programs are developing scientific expertise among technical personnel, enabling comprehensive development and manufacturing services that meet international quality standards and client expectations nationwide. Modern pharmaceutical facilities are incorporating advanced development and manufacturing capabilities that optimize project timelines and reduce development costs across diverse therapeutic areas.

Revenue from CRDMO services in Germany is growing steadily, driven by CAGR of 9.4% from 2025 to 2035, supported by advanced pharmaceutical infrastructure and established regulatory expertise that enable complex development and manufacturing projects. The country's sophisticated biotechnology sector and stringent quality standards facilitate adoption of innovative development approaches and advanced manufacturing technologies. Hospital-based research institutions and specialized biotechnology companies are investing in comprehensive development capabilities to serve international client requirements.

Pharmaceutical industry excellence is facilitating integration of advanced development technologies that support optimal project outcomes across diverse therapeutic areas and development stages. Professional development programs are enhancing scientific capabilities among research personnel, enabling specialized development services that address evolving client needs and regulatory complexity throughout European healthcare networks. Advanced technical platforms are being standardized across institutional networks to ensure consistent service quality and optimal client outcomes.

Demand for CRDMO services in the USA is projected to grow at a CAGR of 12.3%, supported by the country's emphasis on pharmaceutical innovation and comprehensive service integration. American biotechnology companies and pharmaceutical corporations are implementing advanced development and manufacturing capabilities that meet rigorous quality standards and regulatory requirements. The CRDMO market is characterized by focus on technological innovation, integrated service platforms, and compliance with comprehensive healthcare safety regulations.

Pharmaceutical industry investments are prioritizing advanced development technologies and integrated service platforms that demonstrate superior client outcomes and operational efficiency while meeting American healthcare quality and safety standards. Professional certification programs are ensuring comprehensive scientific expertise among service providers, enabling specialized development capabilities that support diverse therapeutic approaches and client requirements throughout the healthcare system. Research and development initiatives continue advancing pharmaceutical science and development methodologies that optimize therapeutic outcomes and reduce development timelines.

Demand for CRDMO services in the United States is projected to grow at a CAGR of 12.3% from 2025 to 2035, supported by the country's emphasis on pharmaceutical innovation and comprehensive service integration. American biotechnology companies and pharmaceutical corporations are implementing advanced development and manufacturing capabilities that meet rigorous quality standards and regulatory requirements. The CRDMO market is characterized by a focus on technological innovation, integrated service platforms, and compliance with comprehensive healthcare safety regulations.

Biotechnology industry development is enabling integration of advanced development technologies that support innovative therapeutic approaches and regulatory compliance throughout French healthcare networks. Professional education and research programs are enhancing clinical development capabilities among scientific personnel, enabling specialized service delivery that supports advancing therapeutic requirements and international client expectations across diverse pharmaceutical applications.

The CRDMO market in Europe is projected to grow from USD 29.5 billion in 2025 to USD 68.8 billion by 2035, registering a CAGR of 8.9% over the forecast period. Germany is expected to maintain its leadership position, expanding its share from 27.9% in 2025 to 38.1% by 2035, supported by its advanced pharmaceutical infrastructure and comprehensive bio manufacturing ecosystem.

France is projected to increase its share from 17.2% to 21.8%, attributed to growing biotechnology sector investments and expanding clinical development activities in hospital and research settings. Italy will demonstrate strong growth from 12.1% to 15.8%, while Spain shows steady expansion from 8.3% to 10.4%. BENELUX and Nordic regions demonstrate solid growth potential, with BENELUX expanding from 6.0% to 7.5% and Nordic countries growing from 3.4% to 4.0%.

In Europe, clinical development and supplies dominate the functionality landscape with approximately 42% market share in 2025, driven by extensive clinical trial activities and established regulatory expertise across European research institutions. Commercial manufacturing maintains 28% share, supporting the significant pharmaceutical production base throughout European manufacturing centers.

Small molecules lead molecule type preferences with 52% market share, reflecting European pharmaceutical industry focus on traditional drug development and established synthetic chemistry capabilities. Biologics account for 26% share, particularly strong in Germanic and Nordic regions where advanced biotechnology infrastructure supports complex bio manufacturing operations.

The CRDMO market is highly competitive, with several key players offering integrated services across drug development and manufacturing. WuXi Biologics stands at the forefront, providing end-to-end solutions from discovery to commercial manufacturing. Its global network and extensive capabilities in biologics and contract manufacturing give it a significant edge. Piramal Pharma Limited competes through its wide range of services, specializing in both drug substance and drug product development. With its strong presence in the Indian and global markets, Piramal offers an attractive value proposition for both large and mid-size pharmaceutical companies.

siegfried Holding AG and Aragen Life Sciences Ltd. position themselves through specialized services in small molecules and biologics, respectively. siegfried’s expertise in API production and formulation services allows it to target complex drug products, while Aragen excels in providing a complete suite of services for biologics, from discovery through to clinical trials. WuXi AppTec, with its integrated services across pharmaceuticals, biotechnology, and medical devices, offers another formidable competitive edge, particularly in drug discovery and preclinical development.

Smaller players like Jubilant Biosys and TCG Lifesciences provide niche services in specific therapeutic areas and cater to both large pharma and emerging biotech companies. The competitive landscape is also shaped by regional players like Sai Life Sciences and Dishman Carbogen Amcis, which continue to strengthen their market positions with strong local manufacturing capabilities and partnerships with global clients.

| Item | Value |

|---|---|

| Quantitative Units | USD 386.7 billion |

| Functionality | Discovery, Preclinical Development, Clinical Development and Supplies, Commercial Manufacturing, Others |

| Molecule Type | Small Molecules, Biologics, Cell & Gene Therapy (CGT), Vaccines, Others |

| Development Stage | Preclinical, Phase I, Phase II, Phase III, Commercial |

| End Customer | Large Pharmaceutical Companies, Mid/Small Biotechnology Companies, Academics/Non-profit Organizations, Government Organizations |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Germany, France, United Kingdom, Japan, Brazil, South Korea |

| Key Companies Profiled | WuXi Biologics; Piramal Pharma Limited; siegfried Holding AG; Aragen Life Sciences Ltd.; WuXi AppTec; Sai Life Sciences Limited; Aurigene Pharmaceutical Services Ltd.; TCG Lifesciences Pvt. Ltd.; Jubilant Biosys Limited; Suven Pharmaceuticals Ltd. |

| Additional Attributes | Dollar revenue by functionality, molecule type, development stage, and end customer, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established multinational providers and emerging regional specialists, client preferences for integrated versus specialized service approaches, integration with digital development platforms and artificial intelligence technologies, innovations in biomanufacturing capabilities and continuous processing systems, and adoption of advanced therapeutic modalities with cell and gene therapy platforms, personalized medicine approaches, and next-generation drug delivery systems for enhanced therapeutic outcomes. |

The global CRDMO market is estimated to be valued at USD 143.8 billion in 2025.

The market size for the CRDMO market is projected to reach USD 386.7 billion by 2035.

The CRDMO market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in CRDMO market are clinical development and supplies, discovery, preclinical development, commercial manufacturing and others.

In terms of molecule type, small molecules segment to command 48.6% share in the CRDMO market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA