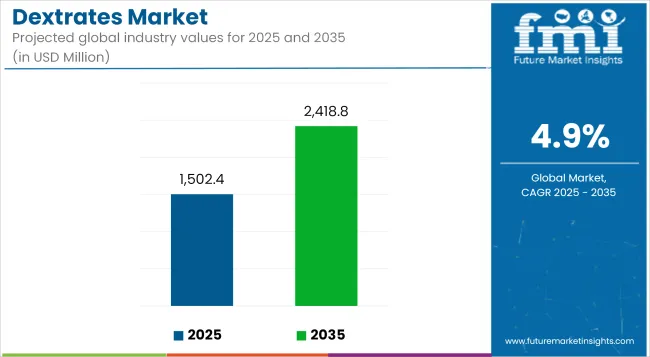

The dextrates market is projected to grow from USD 1502.4 million in 2025 to USD 2418.8 million by 2035, reflecting a CAGR of 4.9% during the forecast period. This growth is being driven by the increasing demand for dextrates in various industries, including food and beverage, pharmaceuticals, and cosmetics. Dextrates, primarily derived from corn starch, are being utilized as a source of energy and carbohydrate-based ingredients in functional foods, beverages, and dietary supplements. The growing popularity of energy drinks, sports nutrition products, and healthy snacks is expected to fuel the market's expansion.

As demand for orally administered solid dosage forms continues to escalate, dextrates are increasingly relied upon for their dual role as diluents and stabilizers in both immediate and controlled-release formulations. The industry's focus has gradually shifted toward advanced excipient technologies that offer improved compressibility and stability, boosting adoption in high-speed manufacturing environments.

Demand is being propelled by the pharmaceutical industry's shift toward complex formulations, where multi-functional excipients are preferred for efficiency and performance. The use of dextrates-particularly in direct compression applications-has expanded due to their favorable flow and compressibility characteristics.

Moreover, clean-label trends and the growing scrutiny of excipient origin and quality have enhanced the demand for highly purified carbohydrate-based fillers. However, the market is not without its restraints. Volatility in raw material availability, limited awareness in developing regions, and regulatory bottlenecks for excipient approval have created friction in scaling usage beyond established applications. Product innovation is also being cautiously paced, as companies prioritize regulatory compliance and long-term stability over radical formulation shifts.

Over the next decade, the dextrates market is expected to see increased penetration in pediatric and geriatric formulations, where taste masking and controlled dissolution are critical. By 2035, a growing share of demand is projected to emerge from customized and functional excipient systems aimed at enhancing patient compliance and drug efficacy.

Market players are likely to continue investing in enhanced processing technologies, aiming to reduce batch variability and boost flow performance. The transition toward digitalized manufacturing and real-time quality monitoring in pharmaceutical production is also anticipated to further support the consistent growth of dextrates as essential formulation components across both branded and generic pharmaceutical sectors.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1502.4 Million |

| Projected Global Industry Value (2035F) | USD 2418.8 Million |

| Value-based CAGR (2025 to 2035) | 4.9% |

However, the Dextrates Market encounters specific challenges such as stringent regulatory requirements and the elevated cost of production. In addition, competition within the market from alternative sweeteners and excipients poses a threat to the broader adoption of dextrates.

Although these obstacles exist, ongoing research and development efforts aimed at enhancing the functional properties of dextrates and reducing production costs are likely to mitigate these challenges. The future of the market looks promising with continuous innovations, alongside the expanding applications of dextrates in pharmaceuticals and food products, ensure sustained growth.

Dextrates hold approximately 19.4% market share in the nutraceutical excipient segment as of 2025. This share is expected to rise steadily as formulation innovation expands in functional foods and supplements.

Dextrates have found a strategic niche within the nutraceuticals space, particularly in chewable and effervescent tablets, where their rapid solubility and neutral taste profile align with consumer expectations. Amid increased demand for compact dosage formats with enhanced bioavailability, anhydrous dextrates are being favored for their excellent compression characteristics and stability, without the need for additional flow aids.

The European Food Safety Authority (EFSA) permits the use of dextrates (E1200) in dietary supplements, driving adoption in the EU nutraceutical sector. Companies like Roquette and DFE Pharma have strengthened their offerings in this application space by expanding GMP-compliant excipient portfolios tailored for health supplements.

In 2024, Roquette introduced the PEARLITOL® Flash range-which synergizes dextrates with mannitol-specifically targeting fast-disintegrating oral formats in OTC and wellness products. The Asia-Pacific market, led by Japan and South Korea, is expected to witness higher growth in nutraceutical usage due to aging demographics and growing consumer inclination toward non-pharmaceutical health products. Overall, the role of dextrates in nutraceuticals is shifting from basic fillers to enablers of format innovation and patient compliance.

Veterinary pharmaceutical applications account for an estimated 7.6% of the global dextrates market in 2025, with forecasted growth supported by expanding demand for companion animal health products.

While traditionally centered on human drug delivery, dextrates are now increasingly being used in veterinary oral dosage formulations due to their favorable processing attributes and safety profile. The shift toward precision dosing and palatable drug delivery in pets has placed greater importance on excipients that ensure uniformity, compressibility, and taste masking.

Dextrates fulfill these criteria and are gaining traction in chewable tablets and oral suspensions for dogs and cats. Zoetis and Virbac have incorporated dextrates in several formulations to enhance bioavailability and palatability. In markets such as the USA and Europe, where the Veterinary Medicinal Products Regulation (EU 2019/6) and FDA CVM guidance stress excipient safety, dextrates offer a compliant and functionally reliable choice.

Furthermore, growth in livestock therapeutics-particularly in bovine and swine dosing programs-has opened new demand pockets for stable, easy-to-administer oral dosage systems, where dextrates serve as flow enhancers in bolus and granulated premixes. This segment’s growth trajectory is likely to accelerate in tandem with increased investments in animal health R&D and precision veterinary care.

Increased use of dextrates in oral formulations and capsules.

Dextrates are preferred in oral formulations and capsules more and more for their very special characteristics. Owing to their excellent flowability and compressibility, the particles can be utilised in manufacturing processes to create precision and standardisation in the resulting product. Also, dextrates increase the disintegration and dissolution profiles of the oral form of drugs making the active pharmaceutical ingredients more available.

This makes them invaluable when it comes to preparing tablet and capsule preparations in order to effectively deliver the active constituent. Also, dextrates are non hygroscopic, that is, they do not tend to pick up humidity from the atmosphere and this has a positive impact on the preserve and longevity of the pharmaceutical products. Thus, they are emerging as the favored option for pharmaceutical firms who seek to produce excellent, stable and efficient EDs.

Growing use in sugar-free and low-calorie food items.

The application of dextrates is increasing as they are used in foods described as sugar-free and low in calories because of the read more Convertible preference for healthy foods among consumers. Dextrates, which are formed from glucose, maintain a sweet taste without the energy value of regular sugars, making the additions of this component in question an excellent candidate for calorie-reducing food products.

They also have excellent solubility and stability properties that improve the microstructure and long storage stability of low sugar products.In the confectionery industry dextrates are employed to reproduce sugarless candies and chewing gums that provide similar taste and texture like regular candy products containing sugar.

These functions include holding of moisture and enhancing texture making low calorie cookies and cakes an option for health conscious customers. Furthermore, dextrates are used in the production of beverages also because of the balanced sweetening effects and the capability to hide the bitter-irritant aftertaste of synthetic sweetening agents.

Stricter regulations impacting market dynamics.

New legislation measures are changing the dextrates market and pose threats and trends to the market players. Regulatory authorities and governments are enforcing regulatory policies across firms to reduce consumer risks, conserve natural resources and enhance on product quality.

It comprises of numerous babits requiring full disclosure of ingredients, restrictions on additives and stringent manufacturing requirements. In turn, this means that many business structures have to spend millions of dollars on compliance standards, from which increase overall corporate costs and possibly influence profits or losses.

Even as these regulations assist in safeguarding the consumer and the environment in equal measure, they impune that companies have to be ready to twist and turn. The compliance is quite formal and can take time before compliance is achieved, hence slowing down entry into a certain market and product development.

In turn, there are organisations that go out of their way trying to understand and implement these regulations to their advantage as a marketing strategy, marketing the fact that they provide services and/or products which are safe and of high quality.

This can foster consumer trust and hence, gain market loyalty to foster the growth of the market. This means it require that business should constantly update themselves on the ever changing regulations in order to be well equipped to maneuver in the business environment in orders to benefit from any arising opportunities.

Innovations in production processes to enhance quality.

The enhancement technology used in preparing dextrates have led to major enhancement in their functionality. Advanced understanding of enzymatic hydrolysis, purification advancements, and formulation improvements have assured improvements in the dextrates properties for multiple uses.

These have led to the formation of dextrates with higher solubility, storage stability and improved sensory properties which have been made available owing to the changing requirements in the pharmaceutical and food industries.

For example, continuing discoveries in encapsulation techniques have allowed the formulation of dextrates into controlled release form which increases the bio-availability and productivity of drugs. In addition, because of the application of more efficient purification procedures the dextrates produced have even less impurities and are of the same quality repeatedly.

Some of the manufacturing activities have expended their R&D units constantly to help support production of dextrates that perform better and meet standard regulatory compliance. More advances in the technological growth in dextrates synthesis and enhanced efficacy are expected as technology progresses.

Tier 1 : Paulaur Corporation, Spectrum Chemical Manufacturing Corp., and Colorcon dominate this market because of their rich dextrates portfolios and experience. Paulaur Corporation is relied upon for dextrates of many types in an assortment of formulations; it focuses strongly on research and development to stay current in dynamic markets.

Spectrum Chemical Manufacturing Corp provides a full line of high purity chemicals and excipients meeting quality and compliance requirements. Colorcon focuses on high performance excipients and coatings for oral solid dosage forms and offers tech support as well as training for formulation enhancement.

These firms have international networks and significant investment in innovation and quality and are therefore market makers.

Tier 2 : JRS Pharma and Roquette are existing players with good market penetration and good specialists in providing services and products in the field of niches. The company JRS Pharma produces many types of material for medicine and supplements while progressively expanding their product applications in both industries.

About the company Roquette, specialized in plant-based ingredients and being engaged in sustainability, contributes to clean-label trend. It is a major plus for both companies because they both embark on great research and development to steer their product offerings to meet prevalent industry standards.

However, due to their capability to provide focused services and extending having solid Customer connections they preserve major market number shares but are slightly below the Tier 1 firms.

Tier 3 : UP (Universal Preserv-A-Chem Inc.). A few new firms which are gaining as the major players in dextrates market include Press Club Nutrition Ltd. and Quadra Chemicals Ltd by offering innovative products and services to the market.

While UPI is a versatile polymer, its specialty is known as its dextrates that are used in pharmaceuticals and in foods primarily for binding and sweetening properties. The Press Club Nutrition Ltd. company is in the functional food ingredients for sports nutrition and health & wellness food and beverages which applies innovation in creating products to suit the market.

Quadra Chemicals Ltd. deals in a number of high quality excipients and functional ingredients with focused qualities of quality and sustainability. Such companies are generally considered to be rather young and flexible; thus, they are recognized as rather promising market players.

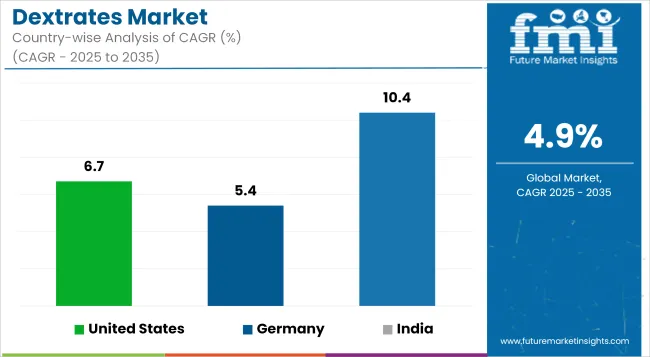

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 6.4% and 4.9% respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 6.7% |

| Germany | 5.4% |

| India | 10.4% |

As diabetes and obesity rise in numbers more people use sugar substitutes in USA. more Americans with diabetes and obesity now select dextrates as an alternative to regular sugar.These substitutes with origin from starch are gradually being taken to be healthier than normal sugars.

Since the population is now more aware about their health and is moving away from foods that contain high sugar content, dextrates are being used more and more as additives for food and drugs. Hence, their flexibility of offering the taste of sweet products while containing much less energy than sugar should cater for the needs of a consumer who wants to have his/her calorie intake reduced.

This shift towards the usage of sugar substitutes such as dextrates is hoped to spur advanced evolvement in the market, thus improving people’s’ health standards.

Germany is a competitive export market for high quality pharmaceutical products including dextrates that continues to grow steadily. With high quality focus and technically superior production lines now in place, Germany leads the world in exported pharmaceuticals. Dextrates widely employed in the pharmaceutical production as the carrier and tablets, have a great advantage exploiting this reputation.

Thus, German pharmaceuticals including dextrate are safe and effective owing to the nation’s strong support of an environment of sound infrastructure and an appropriate regime in pharmaceuticals. This export market is very healthy for Germany and it also helps in the development of health in the world through a range of efficient and trusted products.

The pace of urbanization India is quite high and is contributing towards major changes in life styles and Health Consciousness in the citizens. With people moving to towns and cities, they join the rest in adopting modern non healthy diets and lifestyles.

It has contributed to changes in life styles leading to new diseases like diabetes and obesity hence increased concentration on health. Hence, it rises a need for better food products with dextrates used as a sugar substitute. Dextrates with starch origin are about 1/3 less calories than traditional sugars which work well for the target consumer market.

The rising health consciousness and the ready availability of urban lifestyle is being a major factor that is propelling the dextrates market in India to access both food and pharmaceutical products based industries that are venturing into the use of such substitutes.

The dextrates market is marked by intense competition among leading companies such as Paulaur Corporation, Spectrum Chemical Manufacturing Corp., UPI (UNIVERSAL PRESERVACHEM INC.), and JRS Pharma.

These industry giants are investing in research and development to enhance the quality and applications of dextrates, particularly in pharmaceuticals and food products. The market's growth is driven by the increasing demand for effective pharmaceutical excipients and healthier food ingredients.

Despite the competitive landscape, these companies strive to differentiate themselves through innovation, quality assurance, and customer satisfaction, ensuring their strong presence in the global market. However, they face challenges such as regulatory requirements and the availability of alternative excipients, which could impact their market share

The market is expected to grow at a CAGR of 4.9% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 2418.8 Million.

Asia Pacific is expected to dominate the global consumption.

Bioriginal Food Science Corporation, The Green Labs, John Aromas, Kerry Inc., Cyvex Nutrition, Inc

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA