The Dicyandiamide Market is estimated to be valued at USD 408.0 million in 2025 and is projected to reach USD 717.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. This expansion represents a compound annual growth rate (CAGR) of 5.8% during the forecast period. The growth outlook reflects rising demand for dicyandiamide across pharmaceuticals, agriculture, and flame-retardant applications. Increasing use as a curing agent in epoxy resins, coupled with its role in guanidine salt production and fertilizer additives, is contributing to sustained adoption. Regulatory trends emphasizing efficiency in agrochemicals and advancements in specialty chemicals are also boosting the market trajectory. With steady industrial demand and diversified applications, the dicyandiamide market is positioned for consistent medium-term growth.

| Metric | Value |

|---|---|

| Dicyandiamide Market Estimated Value in (2025 E) | USD 408.0 million |

| Dicyandiamide Market Forecast Value in (2035 F) | USD 717.0 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The dicyandiamide market is witnessing a stable upward trajectory, supported by its critical role as an intermediate in pharmaceutical, adhesive, and resin production. The global demand for dicyandiamide has been reinforced by expanding application in flame retardants, coatings, and water treatment formulations, particularly within regulated industrial zones. Increased investment in pharmaceutical ingredient manufacturing and specialty chemical synthesis has enhanced the relevance of high-purity and industrial-grade dicyandiamide.

Regulatory guidelines encouraging the use of more stable and low-toxicity intermediates have contributed to the material’s sustained use in medical and consumer-grade compounds. Additionally, emerging economies have been ramping up their domestic pharmaceutical and electronics sectors, requiring consistent access to raw materials like dicyandiamide.

The global transition toward sustainable production practices and precision manufacturing has also emphasized the importance of tightly controlled chemical intermediates, further strengthening the market outlook As supply chains become more vertically integrated and technology-intensive, dicyandiamide is expected to remain a key intermediate with diverse growth pathways across industries.

The dicyandiamide market is segmented by grade, application, and geographic regions. By grade, the dicyandiamide market is divided into Industrial Grade, Electronic Grade, and Pharmaceutical Grade. In terms of application, the dicyandiamide market is classified into Pharmaceuticals, Adhesives, Fertilizers, Flame Retardants, and Others. Regionally, the dicyandiamide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial grade segment is expected to account for 46.2% of the total dicyandiamide market revenue share in 2025, indicating its dominant presence in bulk chemical processing and technical applications. This segment’s leadership is supported by its widespread usage in adhesives, laminates, water treatment chemicals, and flame-retardant formulations. Industrial-grade dicyandiamide is preferred for its consistent reactivity and favorable cost-performance ratio, particularly in processes where ultra-high purity is not mandatory.

The growing demand for industrial adhesives, resin curing agents, and coatings has expanded the consumption base for this grade, especially in the Asia Pacific and North American markets. Its thermal stability, compatibility with formaldehyde-based systems, and effectiveness in slow-release fertilizer formulations have reinforced its position in both agriculture and chemical manufacturing sectors.

Furthermore, industrial users have increasingly adopted automation and quality control systems that favor consistent material grades, driving continued demand As global infrastructure and utility investments continue, industrial grade dicyandiamide is poised to maintain its critical role in large-scale manufacturing applications.

The pharmaceuticals segment is projected to represent 39.7% of the dicyandiamide market revenue share in 2025, highlighting its significant contribution to specialty chemical synthesis. Growth in this segment is being propelled by the increasing use of dicyandiamide as an intermediate in the manufacture of anti-diabetic and cardiovascular drugs. The compound’s suitability for forming guanidine derivatives, which are essential in pharmaceutical APIs, has elevated its value within regulated drug production pipelines.

The expansion of active pharmaceutical ingredient (API) production, particularly in India and China, has led to heightened sourcing of intermediates like dicyandiamide under strict quality and compliance standards. Enhanced demand for stability, controlled molecular interaction, and precision formulation in pharmaceutical products has further aligned with the characteristics of this compound.

Additionally, the adoption of modern synthesis techniques in drug development has increased the reliance on multifunctional intermediates, thereby solidifying the role of dicyandiamide in pharmaceutical applications. The alignment with good manufacturing practices and global pharmacopoeia standards continues to drive its market relevance.

The dicyandiamide market is experiencing steady growth driven by its widespread use in various industries, including agriculture, chemicals, electronics, and pharmaceuticals. Dicyandiamide is primarily used as a raw material in the production of fertilizers, specifically as a nitrogen-release agent in slow-release fertilizers, which helps improve soil quality and crop yield. Additionally, its applications in the production of resins, flame retardants, and electroplating materials are contributing to its market demand. As industries continue to seek more efficient, cost-effective, and environmentally friendly solutions for their operations, the demand for dicyandiamide is expected to grow, particularly in emerging markets.

The dicyandiamide market is primarily driven by the growing demand for fertilizers and agricultural solutions. Dicyandiamide is used as a key component in slow-release nitrogen fertilizers, which are increasingly popular due to their ability to reduce nitrogen loss in the soil and improve fertilizer efficiency. As global food production needs rise with the expanding population, the demand for efficient, sustainable farming practices is growing, further driving the adoption of slow-release fertilizers. Additionally, the agricultural sector’s need for enhanced crop yields and soil health is fueling the demand for dicyandiamide, as it helps improve the effectiveness of fertilizers and reduce environmental impact.

Despite its benefits, the dicyandiamide market faces challenges, particularly regarding price volatility and environmental concerns. The price of raw materials used in the production of dicyandiamide, such as ammonia and cyanamide, can fluctuate, affecting the overall cost of dicyandiamide production. These price fluctuations can make it difficult for manufacturers to maintain stable pricing. Additionally, concerns regarding the environmental impact of chemicals used in fertilizers and other applications, including dicyandiamide, are growing. As sustainability becomes an increasing priority, there is a need for manufacturers to address these concerns and ensure that their products are in compliance with environmental regulations, which may involve additional costs for product development and regulatory compliance.

The dicyandiamide market presents significant opportunities, particularly with its expanding applications in industrial and electronics sectors. In the electronics industry, dicyandiamide is used in the production of resins, flame retardants, and electroplating materials, driving demand for this versatile compound. With the growing electronics market, particularly in emerging economies, dicyandiamide is becoming a key component in the production of high-performance materials for advanced electronics. Additionally, as industries seek more efficient materials for manufacturing, dicyandiamide’s role in improving the properties of resins and plastics offers significant growth opportunities. The continued development of high-performance materials in various industrial applications is expected to further boost the demand for dicyandiamide in these sectors.

A key trend in the dicyandiamide market is the increasing use of slow-release fertilizers and the push for sustainable agricultural practices. With the rising global demand for food, the agricultural industry is looking for more efficient and environmentally friendly ways to increase crop yields while reducing the environmental impact of traditional fertilizers. Slow-release fertilizers, which reduce nitrogen loss and minimize the risk of water pollution, are gaining popularity, and dicyandiamide plays a crucial role in their development. As farmers and manufacturers alike focus on sustainability, the market for slow-release fertilizers, and thus dicyandiamide, is expected to continue expanding, driven by the need for more efficient and sustainable farming practices worldwide.

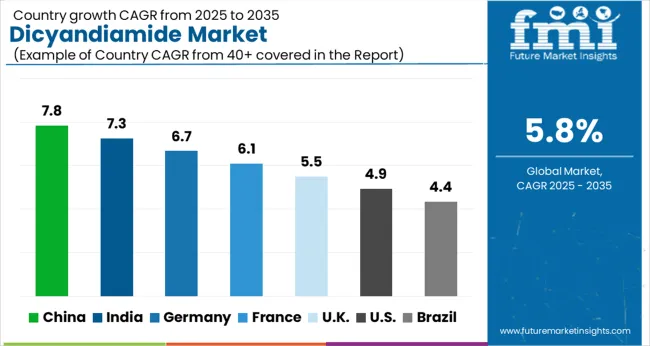

| Countries | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

Global dicyandiamide market demand is projected to rise at a 5.8% CAGR from 2025 to 2035. Of the profiled markets out of 40 covered, China leads at 7.8%, followed by India at 7.3%, and France at 6.1%, while the United Kingdom records 5.5% and the United States posts 4.9%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing demand from agricultural and chemical industries in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established market structures. The analysis includes over 40+ countries, with the leading markets detailed below.

The dicyandiamide market in China is expanding at a CAGR of 7.8%, driven by the growing demand from agriculture, textiles, and chemical industries. As one of the largest producers of agricultural products globally, China uses dicyandiamide in fertilizers to improve crop yield and soil health. Additionally, the country’s expanding textile industry uses dicyandiamide in the production of synthetic fibers. The growing demand for chemical intermediates and the country’s push for industrial modernization are also key factors driving the market for dicyandiamide. China’s large-scale industrial and agricultural activities continue to fuel demand, making it the largest market for dicyandiamide globally.

The dicyandiamide market in India is projected to grow at a CAGR of 7.3%, supported by expanding agricultural demand, industrial activities, and the growth of the chemical and textile industries. As India continues to focus on improving agricultural productivity, the need for fertilizers and crop protection chemicals containing dicyandiamide is increasing. Additionally, the rise in textile and fiber production in India is contributing to market growth, as dicyandiamide is used in the manufacturing of synthetic fibers. The growth of India’s chemical industry, coupled with increasing government support for agricultural innovation, is driving the demand for dicyandiamide.

The dicyandiamide market in France is growing at a CAGR of 6.1%, driven by demand from agriculture, chemicals, and industrial applications. As the leading agricultural producer in Europe, France’s need for fertilizers and crop protection products that contain dicyandiamide is significant. The country’s emphasis on crop quality and soil health has led to an increased reliance on fertilizers that enhance agricultural productivity. Additionally, the French chemical industry uses dicyandiamide as a key raw material for producing various chemical intermediates. The demand for synthetic fibers in France, especially in the textile industry, also supports market growth.

The United Kingdom’s dicyandiamide market is growing at a CAGR of 5.5%, with demand driven primarily by the agricultural and chemical industries. The UK’s need for high-quality fertilizers and plant growth regulators that contain dicyandiamide is significant, as the country focuses on improving crop yield and soil health. The chemical sector, which relies on dicyandiamide as an intermediate for producing various compounds, is also contributing to market growth.The UK’s increasing focus on sustainable agriculture and innovation in crop protection products drives the adoption of dicyandiamide in farming practices.

The USA dicyandiamide market is growing at a CAGR of 4.9%, with steady demand from the agricultural and chemical sectors. The use of dicyandiamide in fertilizers and crop protection products remains significant in the USA, as the agricultural industry continues to prioritize yield improvement and soil health. Additionally, dicyandiamide is used in the USA chemical industry to produce various industrial chemicals, including those used in plastics, rubber, and coatings. While the market is mature, the increasing focus on agricultural innovation and industrial efficiency continues to support the market for dicyandiamide in the USA

The dicyandiamide market is driven by key manufacturers offering high-quality products used in a wide range of industries, including agriculture, pharmaceuticals, and plastics. AlzChem Group AG is a leading player, known for producing high-purity dicyandiamide that is widely used in the production of agricultural chemicals, pharmaceuticals, and as an additive in resins. Ningxia Sunnyfield Chemical Co., Ltd. is a prominent manufacturer of dicyandiamide, providing effective solutions to the chemical industry, with a focus on high production efficiency and quality.

Ningxia Yinglite Chemical Co., Ltd. offers dicyandiamide for agricultural and industrial applications, focusing on ensuring reliable quality and cost-effective solutions. Ningxia Darong Industry Group Co., Ltd. specializes in dicyandiamide for use in various chemical processes, including agriculture and polymers, offering robust and high-performance products. Ningxia Jiafeng Chemicals Co., Ltd. provides high-purity dicyandiamide for industries such as plastics and fertilizers, known for meeting the growing demand for efficient chemical processing. Ningxia Blue-White-Black Activated Carbon Co., Ltd. manufactures dicyandiamide as a key raw material for producing resins and other chemicals, with a strong focus on sustainability and high production standards. Ningxia Beilite Chemical Co., Ltd. offers dicyandiamide products primarily used in agricultural applications, catering to the growing demand for fertilizers and other crop protection chemicals.

Ningxia Pingluo Baoma Chemical Co., Ltd. and Ningxia Xingping Fine Chemical Co., Ltd. provide dicyandiamide solutions for various industrial applications, ensuring high quality and reliable production. Ningxia Yingkou Chemical Co., Ltd. and Ningxia Baiyun Carbon Co., Ltd. supply dicyandiamide for both industrial and agricultural applications, with a focus on innovation and efficiency. Ningxia Xingkai Chemical Co., Ltd. is also a key player, offering dicyandiamide solutions with a strong emphasis on meeting the diverse needs of chemical processing and agricultural industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 408.0 Million |

| Grade | Industrial Grade, Electronic Grade, and Pharmaceutical Grade |

| Application | Pharmaceuticals, Adhesives, Fertilizers, Flame Retardants, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AlzChem Group AG, Ningxia Sunnyfield Chemical Co., Ltd., Ningxia Yinglite Chemical Co., Ltd., Ningxia Darong Industry Group Co., Ltd., Ningxia Jiafeng Chemicals Co., Ltd., Ningxia Blue-White-Black Activated Carbon Co., Ltd., Ningxia Beilite Chemical Co., Ltd., Ningxia Pingluo Baoma Chemical Co., Ltd., Ningxia Xingping Fine Chemical Co., Ltd., Ningxia Yingkou Chemical Co., Ltd., Ningxia Baiyun Carbon Co., Ltd., and Ningxia Xingkai Chemical Co., Ltd. |

| Additional Attributes | Dollar sales by product type (agriculture-grade, industrial-grade dicyandiamide) and end-use segments (agriculture, pharmaceuticals, plastics, resins, electronics). Demand dynamics are driven by the increasing use of dicyandiamide in agriculture for fertilizers, the growing demand for polymers and resins in industrial applications, and the need for high-performance chemicals in pharmaceutical production. Regional trends show strong growth in Asia-Pacific, particularly in China, where a large number of manufacturers and industrial applications drive market expansion. |

The global dicyandiamide market is estimated to be valued at USD 408.0 million in 2025.

The market size for the dicyandiamide market is projected to reach USD 717.0 million by 2035.

The dicyandiamide market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in dicyandiamide market are industrial grade, electronic grade and pharmaceutical grade.

In terms of application, pharmaceuticals segment to command 39.7% share in the dicyandiamide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA