The global diethanolamine (DEA) market is anticipated to grow from USD 19.4 billion in 2025 to USD 31.1 billion by 2035, achieving a CAGR of 4.8% during the forecast period. Market expansion is being driven by rising demand across agrochemicals, personal care, oil refining, and pharmaceutical applications, where DEA is being used as a versatile intermediate and additive.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 19.4 billion |

| Projected Market Size in 2035 | USD 31.1 billion |

| CAGR (2025 to 2035) | 4.8% |

DEA is being utilized extensively as a neutralizer, emulsifier, and corrosion inhibitor in formulations that require chemical stability and multifunctionality. In agrochemical production, DEA is being incorporated into glyphosate-based herbicides to improve solubility and performance. As agricultural productivity goals rise globally, DEA is playing a critical role in enabling high-efficiency pesticide formulations. Intensification of farming practices and adoption of advanced crop protection technologies are contributing to consistent demand in this sector.

In personal care manufacturing, DEA is being formulated into shampoos, liquid soaps, shaving creams, and skincare products. Its properties as a surfactant and pH adjuster are being valued for product texture, foaming ability, and long-term formulation stability. With urban population growth and rising disposable incomes, demand for low-cost, multi-functional ingredients is increasing across emerging economies. The personal care sector is continuing to rely on DEA derivatives despite growing regulatory focus on ingredient safety, with reformulation efforts prioritizing performance retention.

In chemical process industries, DEA is being employed for gas sweetening, particularly in sour gas treatment and refinery operations. Its application in amine gas treating units is being extended as refining capacity expands in industrial hubs. The compound’s use in corrosion inhibition and solvent extraction is also supporting its role in metalworking fluids and lubricant additive production.

Regulatory compliance and environmental performance requirements are shaping production standards and downstream formulation practices. DEA’s chemical compatibility, thermal stability, and buffering capabilities are being leveraged in controlled industrial settings, where product purity and operational consistency are critical.

The market is expected to remain influenced by agricultural productivity trends, consumer care innovation, and energy infrastructure development. As global industries pursue efficiency, versatility, and cost optimization, DEA is projected to maintain a strong presence across high-impact application domains through 2035.

Chemical intermediate applications are estimated to account for approximately 34% of the global diethanolamine market share in 2025 and are projected to grow at a CAGR of 4.9% through 2035. Diethanolamine (DEA) is widely used as a key building block in the production of ethanolamides and alkylalkanolamines, which are essential in formulating emulsifiers, corrosion inhibitors, and cleaning agents.

Its reactivity with fatty acids and alkyl halides supports its role in a variety of downstream chemical manufacturing processes. Industrial users across Asia-Pacific, North America, and Europe continue to rely on DEA for scalable and cost-effective synthesis in detergents, metalworking fluids, and herbicide production. Manufacturers are also focused on refining DEA quality grades to meet evolving purity requirements across pharmaceutical and agrochemical formulations.

The oil and gas industry is projected to hold approximately 28% of the global diethanolamine market share in 2025 and is expected to grow at a CAGR of 5.0% through 2035. DEA plays a critical role in gas treatment applications, particularly in the removal of acidic components like hydrogen sulfide (H₂S) and carbon dioxide (CO₂) from natural gas streams.

Its cost-efficiency, low volatility, and chemical stability make it a reliable solvent in amine gas treating systems. With increased natural gas processing in the Middle East, the United States, and parts of Africa, demand for DEA remains stable in upstream and midstream segments. Additionally, DEA-based corrosion inhibitors continue to be used in drilling muds and pipeline protection, further reinforcing its position in the oil and gas value chain. As global energy operations prioritize cleaner fuel production and equipment longevity, DEA remains essential in enhancing process performance and compliance.

Health concerns and regulatory scrutiny limit usage in personal care and consumer goods.

Potential carcinogenicity of diethanolamine (DEA) compounds, as well as the increasing requirements on nitrosamine formation in personal care formulations, are driving new limits in the diethanolamine market segmentation. International regulatory agencies namely the EU’s REACH and USA FDA have issued warnings or restrictions on DEA in cosmetics and toiletries. This regulatory pressure is forcing manufacturers to change formulas or use safer alternatives to DEA.

In addition, the DEA production economics are affected by the variations in raw material rates, mainly ethylene oxide, and ammonia. Traders have to deal with trade uncertainty and supply issues there, particularly in a region reliant on petrochemical imports. Environmental groups and public health advocates are focusing more and more attention on DEA-based products, a shift that is influencing consumer sentiment and brand reputations.

Industrial versatility and demand in high-growth sectors provide expansion pathways.

Regulatory barriers exist for consumer products, but DEA retains dominance over industrial processes. There are certain long-term growth tendencies in the form of rising demand for ethanolamine-based lubricant formulations, corrosion inhibitors, cognizance toward agrochemical formulations. In developing countries that have recently begun investing heavily in infrastructure upgrades, there is a growing dependence on DEA for removal of CO₂ and H₂S in water treatment plants and natural gas processing facilities.

Moreover, manufacturers now look for bio-based production alternatives and green chemistry routes to develop DEA with lower toxicity and environmental compatibility. Improvements in process efficiency, closed-loop production systems and downstream integration reduce operational costs and can help meet regulatory compliance. There are also opportunities in developing markets, where industrialization and agricultural intensification drives continuous demand for emulsifiers and additives based on DEA.

There is a high demand for surfactants in agrochemicals and personal care product manufacturers, which drives the USA diethanolamine market. Commercially, the chemical is used extensively in herbicide formulations, particularly in glyphosate production, and thus, the agriculture sector is a significant driver.

Regulatory focus on emissions and chemical handling from industry has driven many manufacturers to invest in cleaner production technologies. Industrial centers throughout Texas and Louisiana are boosting capacity with an emphasis on export-ready diethanolamine grades. Moreover, the escalating requirement of water treatment chemicals and oilfield emulsifiers is bolstering the long-run market growth.

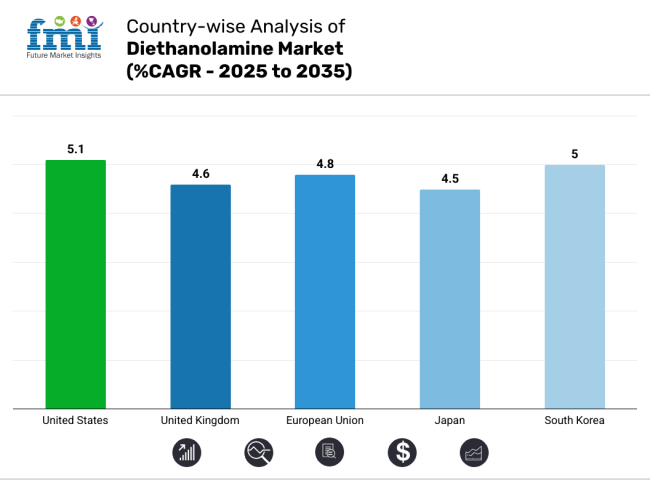

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

In the UK, the demand for diethanolamine is gradually growing in the cosmetics and personal care due to the growing consumer needs for multifunctional formulations. DEA is being incorporated into pH stabilizers and emulsifiers by domestic manufacturers for lotions and shampoos.

A UI copy would better show how the country’s move toward REACH-compliant formulations is driving innovation of eco-safe blends and bio-based chemical alternatives. Demand from agriculture for herbicide adjuvants and corrosion inhibitors in HVAC and metalworking sectors also supports growth. Gadot and Ganapia are developing sustainable methods of sourcing DEA from ethanolamine derivatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

In European Union (EU) countries, the diethanolamine market is other than moderate growth as it has extensive industrial applicability in lubricants, textile finishing, and cement additives. Germany, France and Italy all have skin in the game, with ambitions in improving production efficiency and minimizing waste of byproducts.

Rigorous chemical safety rules are driving the move to employ DEA in low-toxicity surfactant formulations and biodegradable solvents. Investments in green chemistry are prompting democratic plant-based ethanolamine routes. Regional demand is also buttressed by steady exports to Eastern Europe and North Africa.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The growth of the diethanolamine market in Japan can be attributed to the steady demand in industrial water treatment processes, metalworking fluids and pharmaceutical intermediates. However, manufacturers are moving towards high-purity DEA variants in order to address electronics-grade applications as well as specialty cleaning agents.

In Japan, much of the country’s industrial activity in Kansai and Kanto regions are installing automated handling systems to meet worker safety regulations. DEA still finds itself used vigorously in the detergent manufacturing processes due to its emulsifying and foaming properties. Furthermore, R&D institutions are investigating new DEA derivatives for polymer modification.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

With increased demand from paints & coatings, cement, and agricultural industry, South Korea's market is growing. DEA is increasingly being utilized as a concrete admixture for improving performance in large infrastructure projects. Chemical manufacturers are scaling up production of surfactants based on this ingredient in drugstore cosmetic and hygiene products.

Government environmental regulations are driving industry stakeholders to adopt safer storage, transportation and blending practices. Sustainable DEA production methods through bio-catalysis and waste stream conversion are being explored by R&D labs based in Seoul.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The DEA market is witnessing heightened competition due to increasing regulatory scrutiny and evolving downstream application needs. Leading producers are optimizing manufacturing technologies to ensure high purity levels and minimize diethanolamine impurities that could pose safety concerns.

Investments in bio-based alkanolamines and alternative chemistries are growing, especially in Europe, where REACH regulations and toxicity labeling have prompted cautious use in consumer applications. Strategic collaborations, plant capacity expansions, and supply chain localization are key focus areas for players aiming to meet demand from detergent, agricultural, and industrial users globally.

The overall market size for the diethanolamine market was USD 19.4 billion in 2025.

The diethanolamine market is expected to reach USD 31.1 billion in 2035.

The demand for diethanolamine is rising due to its widespread use as a chemical intermediate in the production of surfactants, emulsifiers, and personal care products. The growing demand from the textile industry for softening agents and wetting agents is also contributing to market growth.

The top 5 countries driving the development of the diethanolamine market are the USA, China, India, Germany, and Japan.

Chemical intermediate applications and textile end-use are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA