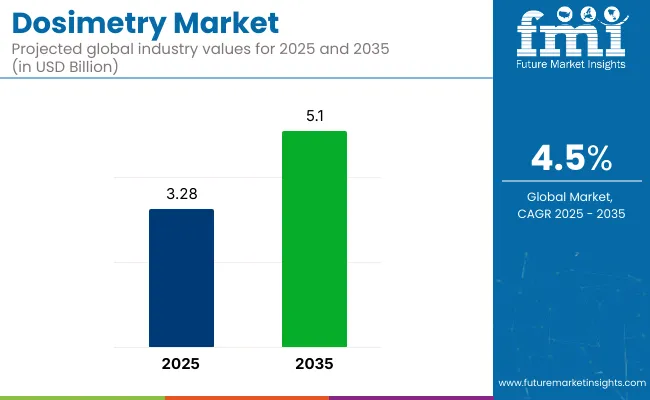

The dosimetry market is valued at USD 3.28 billion in 2025 and is slated to exhibit USD 5.1 billion by 2035, which shows a CAGR of 4.5%. This growth is primarily driven by the increasing demand for dosimetry solutions in radiation therapy, especially due to the rising prevalence of cancer and other diseases that require radiation treatment.

| Attributes | Key Insights |

|---|---|

| Dosimetry Market Size (2025) | USD 3.28 billion |

| Market Valuation (2035) | USD 5.1 billion |

| Value-based CAGR (2025 to 2035) | 4.5% |

Accurate dosimetry ensures precise delivery of radiation doses, improving treatment outcomes and minimizing side effects. Additionally, dosimetry tools are critical in diagnostic imaging and radiology, helping to measure radiation exposure and ensuring patient safety during medical procedures. The growing focus on radiation safety in industries like nuclear energy is also contributing to the market's growth.

Looking ahead, the dosimetry market is likely to continue its upward trajectory, driven by technological advancements. The shift from traditional analog dosimetry systems to digital systems, which offer greater precision and efficiency, is expected to accelerate market growth. Digital systems provide more accurate data, enhancing radiation therapy planning and improving safety protocols.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) in dosimetry systems is expected to enhance the personalization of radiation therapies, improving treatment outcomes. The increasing adoption of wearable dosimeters, capable of monitoring real-time radiation exposure in medical professionals and workers in radiation-heavy industries, is likely to drive further market expansion. As the need for real-time monitoring increases, wearable solutions will become more critical for ensuring safety.

Government regulations will play a vital role in shaping the dosimetry market’s future. Regulatory bodies like the USA Food and Drug Administration (FDA) and the International Atomic Energy Agency (IAEA) enforce strict guidelines to ensure the safety and reliability of dosimetry systems.

These regulations push manufacturers to innovate and meet high standards, fueling demand for advanced dosimetry technologies. As regulatory requirements evolve, the need for precise, reliable dosimetry systems will continue to drive market growth.

The market is segmented based on product type, modality, energy, end user, and region. By product type, the market is divided into personal electronic dosimeter, self-reading dosimeters, and processed dosimeters. In terms of modality, it is segmented into wearable and non-wearable. Based on energy, the market is categorized into active dosimeters and passive dosimeters.

By end user, the market is segmented into industrial, medical, oil and gas, defence and homeland security, mining, environmental, and others (nuclear power plants, research laboratories, aerospace, and food industry). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

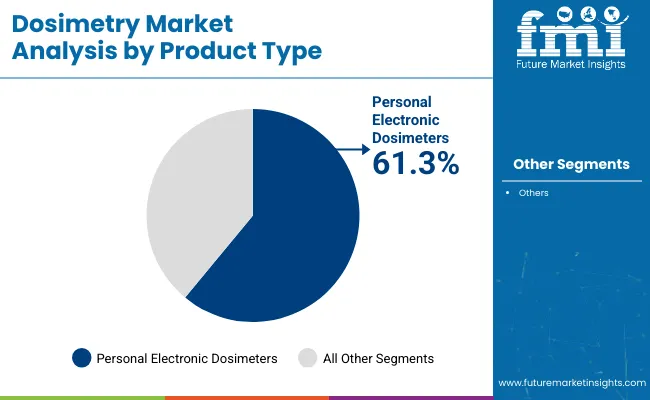

The personal electronic dosimeters segment is anticipated to maintain leadership in 2025, accounting for 61.3% market share, a slight increase over 2024’s 60.8% share. The surge stems from the expanding demand for accurate and real-time radiation exposure tracking, particularly across healthcare, nuclear, and defense sectors. These dosimeters offer instant feedback and advanced data storage, ensuring worker safety in radiation-prone environments.

| Product Type Segment | Market Share (2025) |

|---|---|

| Personal Electronic Dosimeters | 61.3% |

The product’s lightweight, durable design and compatibility with software-based analytics tools have led to widespread adoption in nuclear plants, hospitals, and research laboratories. Innovations by companies such as Mirion Technologies and Thermo Fisher Scientific, including Bluetooth connectivity and cloud data integration, are expanding product scope. Furthermore, tightening occupational safety regulations worldwide are propelling the segment’s usage across industrial and environmental sectors.

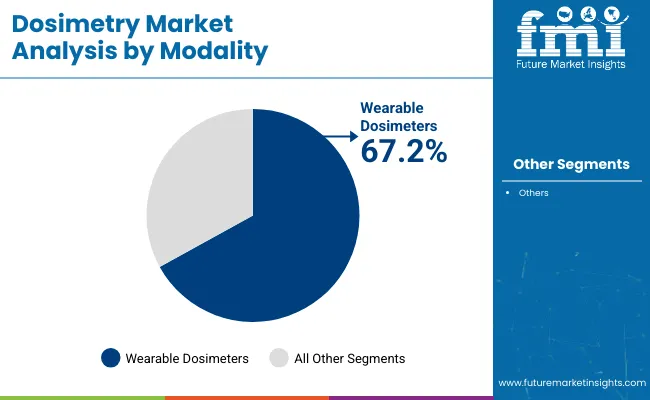

The wearable dosimeters segment is forecast to capture a 67.2% market share in 2025, up slightly from 66.8% in 2024, sustaining its leadership in the modality category. These dosimeters’ ability to provide continuous radiation monitoring without impeding user movement is key to their dominance. Widely used in healthcare, nuclear facilities, and defense, wearable dosimeters have seen increasing acceptance due to their ergonomic design, ease of use, and adaptability to varying operational environments.

| Modality Segment | Market Share (2025) |

|---|---|

| Wearable Dosimeters | 67.2% |

Manufacturers like LANDAUER and Polimaster are integrating features such as real-time alarms, wireless data transmission, and waterproof casings, further solidifying market preference. The proliferation of radiological emergency preparedness protocols in homeland security and environmental monitoring also accelerates this segment's demand. The shift towards wearable solutions highlights the market's direction towards safety, convenience, and data-driven radiation management systems.

The active dosimeters segment is expected to register a CAGR of 5.4% from 2025 to 2035, outpacing the passive dosimeters category. This growth is driven by the rising preference for real-time radiation monitoring solutions that offer instant alerts and accumulated dose readouts, especially in high-risk industries like nuclear energy, medical imaging, and defense operations.

Active dosimeters, which rely on electronic components, provide superior functionality compared to their passive counterparts, including data storage, Bluetooth connectivity, and digital display features. With increasing regulatory scrutiny and worker safety norms in sectors such as mining, oil & gas, and environmental monitoring, demand for active dosimeters is expected to remain robust.

Key players such as Mirion Technologies and Thermo Fisher Scientific are continuously investing in compact and wearable active dosimetry devices with improved battery life and sensitivity, further bolstering this segment’s prospects.

| Energy Segment | CAGR (2025 to 2035) |

|---|---|

| Active Dosimeters | 5.4% |

The medical end user segment is projected to expand at a CAGR of 5.8% between 2025 and 2035, making it the fastest-growing among all end-user categories. The growth is primarily attributed to the increasing use of radiation-based diagnostic and therapeutic techniques such as CT scans, PET imaging, and radiotherapy. The rising cancer incidence worldwide and the need for radiation exposure monitoring among oncologists, radiologists, and technical staff are critical growth drivers.

Moreover, advancements in nuclear medicine and radiopharmaceutical development have spurred the necessity for precise dosimetry equipment in healthcare facilities. The growing awareness regarding occupational radiation hazards and strict regulatory frameworks enforced by agencies like the FDA and IAEA have further compelled hospitals and diagnostic centers to adopt modern dosimetry solutions, particularly electronic and wearable devices. Leading suppliers, including LANDAUER and Mirion Technologies, are expanding their offerings tailored for medical environments.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Medical | 5.8% |

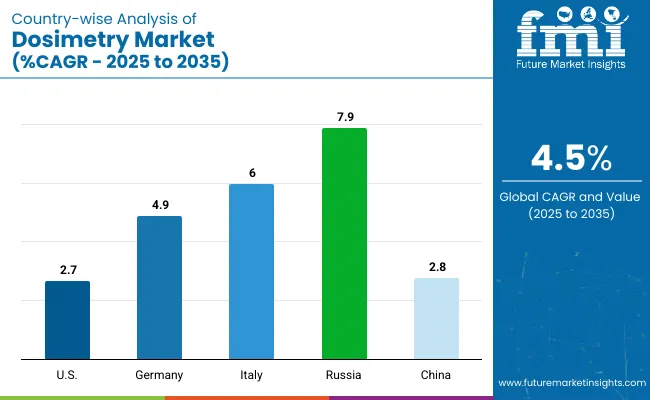

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| USA | 2.70% |

| Germany | 4.90% |

| Italy | 6.0% |

| Russia | 7.90% |

| China | 2.80% |

Sales of dosimeters in the United States are predicted to steadily expand at a 2.7% CAGR over the forecast period. The increasing cancer and geriatric population are contributing to this market’s growth. Further, investment in the latest technology to improve health protection is projected to sustain key players in this market throughout the years ahead.

Players are further investing in effective customer service departments to help customers select the appropriate radiation monitoring device to cost-effectively and safely meet their state and federal requirements. Some of the frequent users of dosimeters are diagnostic labs, dental labs, educational laboratories, hospitals, diagnostic labs, industrial testing facilities, and veterinary offices.

Use of active dosimetry systems is increasing among medical staff and physicians as it offers immediate insights regarding radiation exposure, helping them to take prompt action to effectively utilize radiation reduction measures.

The demand for dosimeters in Germany is anticipated to increase at an average of 4.9% CAGR over the next 10 years. The widespread prevalence of cancer, especially skin cancer, is a chief factor that is fueling the dosimetry market in the country. Cases of melanoma cancer are projected to accelerate rapidly in Germany, translating to profitable prospects for providers of dosimeters in the country.

Other key aspects that are supporting the market growth are surging radiation-based treatment and growing awareness about dosimeters. Key players in the country are emphasizing transparency in transactions, affordable price range, and superior quality personnel monitoring service to build consumer loyalty and encourage repeat business.

The sales of dosimeters in Russia are projected to witness a compelling 7.9% CAGR over the assessment period. The business of dosimeters appears to be as promising as the predictions.

Key players in the country are offering a wide portfolio of dosimetry technology in the industry, ranging from electrometers and dosemeters to smart solutions for quality assurance of sophisticated clinical radiation equipment.

Players in Russia are also offering a complete line of software and hardware products that target aspects like radiation protection and health physics to meet the present nuclear industry challenges.

The dosimetry industry in Italy is experiencing a growth rate of 6% over the forecast period. Key players in Italy offer a diversified range of comprehensive solutions designed for use in radiographic imaging rooms.

The primary reason behind the significant use of dosimeters among interventional staff is that their radiation exposure is higher than in other medical professions owing to scattered radiation. This makes the use of real-time dosimetry a top choice to easily observe, minimize, and manage radiation exposure so that they concentrate on protecting lives.

Growth of the dosimetry industry in China is projected to be at a consistent 2.8% CAGR. The country has observed significant installments of dosimeters in the historical period. Looking ahead, the installment rate is predicted to increase, especially in healthcare facilities, to monitor and manage the radiation exposed to hospital staff.

Since cancer cases are climbing, and simultaneously the diagnosis rates, the demand for new radiation therapy is also rising. Key players are thus investing in new radiation therapy to offer effective treatment solutions.

Additionally, the growing demand to modernize equipment and enhance clinical efficiency is going to be the driving force behind innovative new dosimetry solutions.

The dosimetry market is fragmented in nature, with limited players providing dosimeter solutions. Players are forming strategic alliances and focusing on system automation to gain more customers.

Key industry participants are developing affordable and reliable dosimeters that cater to various fields. Additionally, they are investing their funds in research and development to develop innovations that will help reduce the cancer burden on medical facilities.

A go-to strategy of competitive players is distribution agreements. Leading players are coming into distribution agreements to ensure stable earnings from end users. Players are also planning to expand into other geographical markets to raise their revenue sources and visibility.

Market contenders are making their pricing completely transparent to ensure their customers that there are no setup charges, no hidden fees, no mailing fees, and no processing fees. Consistently developing high-quality dosimeters, in addition to transparent transactions, are predicted to hold customers loyal to the company for a long time.

Latest Developments Giving Shape to the Landscape

The dosimetry market is expected to grow from USD 3.28 billion in 2025 to USD 5.1 billion by 2035, with a CAGR of 4.5%.

The personal electronic dosimeter segment is projected to dominate the market with 61.3% market share in 2025.

The wearable dosimeter segment is expected to hold 67.2% market share in 2025 and continue growing.

The active dosimeters segment is projected to register a CAGR of 5.4% from 2025 to 2035.

The medical sector is projected to grow at a CAGR of 5.8% between 2025 and 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA