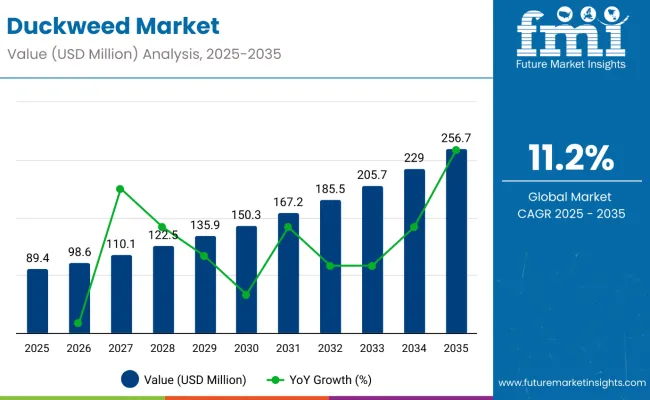

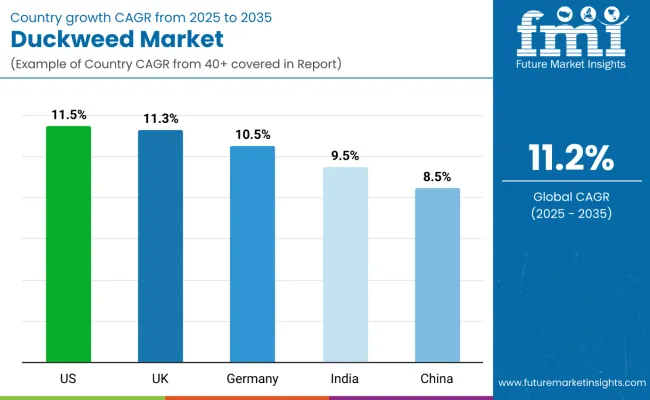

The global duckweed market was valued at approximately USD 89.4 million in 2025. It is projected to grow at a compound annual growth rate (CAGR) of 11.2% between 2025 and 2035. By 2035, the market size is expected to reach around USD 256.7 million. Growth is driven by the rising demand for alternative protein sources, biofuel production, and wastewater treatment applications. Duckweed is valued for its high protein content, rapid growth, and nutrient density.

It is widely adopted in the food and feed industries. The potential of duckweed as a sustainable protein source was highlighted by Ryan Gill, CEO of Calysta, Inc., who stated that duckweed is seen as an effective solution to meet the growing global protein demand. Similarly, Marc Delcourt, CEO of Kiverdi, Inc., noted that innovations in duckweed biomass conversion align with circular economy goals and sustainability initiatives.

In biofuel production, duckweed’s fast biomass accumulation and high starch content make it an efficient feedstock. Research efforts by the National Renewable Energy Laboratory (NREL) have focused on advancing scalable biofuel technologies using duckweed. Dr. Martin Keller, NREL director, emphasized that duckweed biofuels are recognized for their potential to reduce carbon emissions while utilizing non-arable land, a critical factor in renewable energy expansion.

Duckweed’s ability to absorb nutrients and pollutants efficiently is increasingly leveraged in wastewater treatment. Large-scale duckweed cultivation for this purpose is supported by government initiatives in Asia-Pacific countries such as China, India, and Indonesia. Environmental regulations like Europe’s Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) program influence market adoption and growth.

Challenges such as optimizing cultivation techniques, maintaining biomass quality, and navigating complex regulatory landscapes remain. However, advances in controlled farming systems and biotechnological enhancements are being implemented to address these barriers. Duckweed’s multifunctional applications in nutrition, energy, and environmental sectors are driving market expansion.

Per capita spending on duckweed-based products is gaining momentum globally as consumers and industries increasingly prioritize sustainability, nutrition, and alternative protein sources. Duckweed, a fast-growing aquatic plant rich in protein and essential nutrients, is being incorporated into a range of products spanning food, animal feed, and biofuels. Growing environmental concerns and the quest for eco-friendly, cost-effective ingredients have propelled the demand for duckweed, particularly in health-conscious and sustainability-driven markets.

Duckweed-based products are subject to evolving regulatory frameworks and certification standards that ensure safety, quality, and sustainability across food, feed, and industrial applications. Regulatory oversight varies by region, reflecting different priorities related to novel food approval, environmental impact, and agricultural practices.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) in the global duckweed market. This analysis provides insights into shifts in market performance, revenue realization patterns, and growth trajectory, offering stakeholders a comprehensive outlook on industry trends. The first half of the year (H1) spans from January to June, while the second half (H2) includes July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 10.8% |

| H2 (2024 to 2034) | 11.0% |

| H1 (2025 to 2035) | 11.1% |

| H2 (2025 to 2035) | 11.2% |

The above table presents the expected CAGR for the global duckweed demand space over a semi-annual period spanning from 2024 to 2035. In the first half (H1) of 2024, the business was projected to grow at a CAGR of 10.8%, followed by a slightly higher growth rate of 11.0% in the second half (H2) of the same year. Moving into 2025, the CAGR is projected to increase to 11.1% in H1 and further rise to 11.2% in H2, indicating a stable market expansion trend.

In the first half (H1 2025), the market witnessed an increase of 30 BPS, while in the second half (H2 2025), the market observed a similar increase of 10 BPS. These shifts indicate sustained growth, fueled by rising consumer demand for sustainable plant-based protein, increasing applications in wastewater treatment, and advancements in biofuel production.

Additionally, technological innovations in large-scale duckweed cultivation, sustainability-driven investments in alternative proteins, and optimized supply chain strategies are supporting the steady growth trajectory of the duckweed market.

The global paradigm shift towards alternate and sustainable protein sources is one of the key driving factors for the duckweed market. It is in tune with the growing interest among global consumers and their counterparts in the corporate and research spheres into issues of food security, environmental sustainability, and benefits in nutritional qualities of sustenance.

Duckweed is, in a broader scope, being recognized as a scalable and resource-efficient soy and pea replacement mainly because of up to 45%-protein content in dry weight, which is very rich amino acid meats and, unlike other plant-based proteins, can double up growth interceptions.

Foods and beverages nowadays are exploring duckweed protein isolates for a chance to come of all longings one might have for clean-label, minimally processed, highly nutritious foods, particularly in plant-based dairy and meat substitutes production.

But other than for human use, processing duckweed changes the usual day for animal husbandry in having protein-rich feed that is eco-friendly compared to conventional soy- and fishmeal-based feed. Duckweed meals are now getting into the fish and shrimp feeds of a fast-aquaculture sector.

This is primarily because duckweed is easy to digest, absolutely cost-effective, and has a very small carbon footprint, although the opportunities for earning financial gains have decreased. All of these are to promote various forms of such innovations, while also encouraging businesses to eliminate the need for deforestation as a practice and creating a low-carbon agriculture solution at local, regional, and global levels.

The adoption of the Duckweed plant for wastewater treatment, bioremediation, and even in agricultural techniques that are environment friendly is also common due to the fact that it can remove a host of excessive, undesirable or harmful substances in water including bioaccumulation of metals.

Due to the high levels of water pollution experienced due to industrialization, overpopulation and land use change, governments and nongovernmental organizations are currently channeling resources to the restoration of duckweed grown wetlands. This area of water treatment is both preventive and restorative hence the reason its focus is so critical.

Duckweed is submerged inside the municipal effluent for nutrient removal prior to discharge into the water body. Those that includes excess of phosphorus in the effluent or the introduction of nitrogen into the water system is referred to as nutrient pollution instead of water pollution.

Such waste waters is distributed as irrigation in many parts of the world as is the practice in many pulp and paper mills where effluents are used for irrigation. Nitrogen input can also be upgraded in which nitrogen is dissolved in the water and used as nitrogen input for other crops as well.

As companies and governments accelerate their net-zero carbon commitments, biofuel production from sustainable feedstocks has gained immense traction. Second-generation biofuels derived from non-food crops, algae, and aquatic plants like duckweed are expected to shape the future of clean energy. Duckweed’s high starch content (up to 40% dry weight), fast growth rate, and ability to thrive in wastewater environments make it an attractive feedstock for bioethanol and biodiesel production.

Several energy research institutions and biotechnology firms are investing in duckweed-based biofuel projects, leveraging genetic modification and metabolic engineering to enhance starch-to-ethanol conversion efficiency. Compared to corn- and sugarcane-based biofuels, which require significant agricultural land and freshwater resources, duckweed-based biofuels present a highly sustainable alternative, reducing the competition between food security and energy production.

The growing adoption of decarbonization policies, biofuel blending mandates, and government incentives for renewable energy will further drive the commercialization of duckweed-derived biofuels. Additionally, the use of duckweed in carbon sequestration and climate-resilient agriculture has gained attention, with corporations investing in nature-based solutions to offset carbon footprints.

Global Duckweed sales increased at a CAGR of 7.1% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on Duckweed will rise at 7.5% CAGR

Global duckweed market is estimated to grow annually with an outstanding 17.5% growth rate through 2024. Growth was largely attributed to its increased adoption as an alternative protein sources, in wastewater treatment, and biofuel production that was considered to be environmentally safe, thus offering attractive prospects.Wild duckweed, as such, has been very popular among those farming these alternative-meat birds.

Reasons will amount to the fact that the global food industry is quickly changing to plant-based, environmentally beneficial food alternatives. Duckweed has also captured global attention due to the high protein content (up to 45% dry weight) that competes against conventional crops like soy and wheat, apart from its very fast growth and less-essential resource needs. It is known to feature food-grade and industrial-scale applications that producers had begun building for using in the products above.

Duckweed has not only made its identification in animal feed sectors but has recently been evaluated in many other applications. Duckweed-derived protein powders have found promising emerging applications in the nutraceutical, animal feed, and food industries. Its use in turkey, ducks, and fish is well recognized by producers for prawns where its protein is easily digestible and yields almost the same performance as that produced by fishmeal.

2023 would find the market touching multi-billion-dollar margins and the most rapid growth going to be expected from North America, Europe, and Asia-Pacific regions. Such things as regulations, consumer awareness, and technological advancements are going to characterize the growth trajectory of an industry; all of it would make duckweed a stimulating technology deeply convicted into the mainstream of all other industries.

The advancement of duckweed will be driven across numerous categories of products, such as bioprocessing technologies, advanced cultivation systems, and novel product formulations, to seed powerful control/influence in emerging duckweed markets, thereby making it very promising within the broader context of sustainable agriculture and biotechnology.

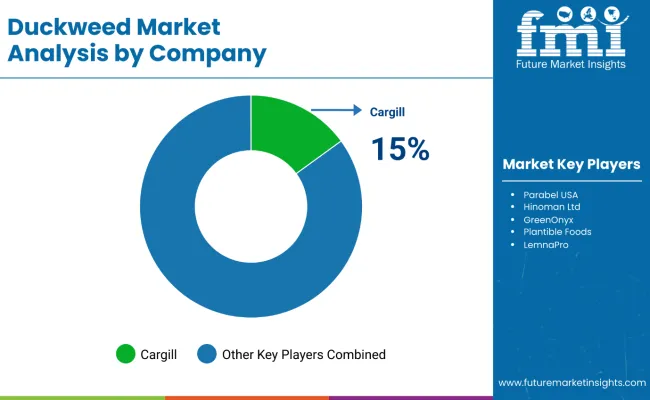

Tier 1 players in the global duckweed industry are multinational agribusiness, biotech, and alternative protein companies with over USD 1.5 billion in yearly revenues, holding 50% to 60% of the global market. These multinational players lead the commercialization of duckweed products through large-scale production, research-based innovations, and diversified revenue streams.

Their primary areas of focus are high-protein duckweed for human nutrition, environmentally friendly animal feed, biofuel production, and wastewater cleanup technologies. Top Tier 1 players like Cargill, ADM (Archer Daniels Midland), and DSM-Firmenich invest significantly in biotechnology breakthroughs, precision agriculture based on AI, and innovative extraction technologies to improve the nutritional and industrial uses of duckweed.

Tier 2 duckweed market participants have revenues of between USD 300 million and USD 900 million per year, with 30% to 35% market share. Tier 2 firms focus on domestic and regional distribution, developing scalable processing technologies for duckweed-based food, feed, and industrial products.

Leading Tier 2 firms such as Parabel USA, Hinoman Ltd., and GreenOnyx employ specialized cultivation techniques, local supply chain networks, and patented bioprocessing technologies to optimize duckweed protein extraction, bioactive compounds, and nutritional content. Tier 2 firms are increasingly entering plant-based protein markets, partnering with food producers, aquaculture feed firms, and clean energy firms to develop high-value duckweed-based substitutes for traditional protein sources.

Tier 3 duckweed companies are small-cap companies, R&D-oriented businesses, and specialty ingredient manufacturers that have annual top-line revenues below USD 300 million, a global market share of 10% to 15%. They specialize in targeted applications such as duckweed extracts suitable for use in pharmaceutical applications, high-priced nutraceuticals, bioactive ingredients, and high-margin animal feed compounds.

LemnaPro, Plantible Foods, and DryGro are some major Tier 3 companies, which use advanced biotechnology, hydroponics, and machine learning-based growing practices to optimize duckweed biomass yield, protein density, and bioavailability. They all operate mostly in pilot-scale production facilities and supply B2B premium marketplaces such as the sports nutrition market, premium animal feed, and medical nutrition segment.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 98.7 million |

| Germany | USD 72.4 million |

| China | USD 61.8 million |

| India | USD 49.3 million |

There is increasing investment in alternative protein production, renewable energy, and wastewater treatment solutions, resulting in the United States emerging as the next key supplier in the duckweed market worldwide. It is suggested that most operations are already based in California, Florida, and Texas, where agribusinesses activities take place.

This is clear that the increasing demand for plant-based proteins and sustainable aquafeed is behind this recent growth in duckweed farming. For such materials, businesses need to obtain options for alternative protein, incorporating good efficiency without high-input costs (drew or melted) into various agrihydroponic/bioaqua systems.

Biofuel The USA is powering up its demand for biowaste duckweed by installing new biofuel policies and incentives that come with tax rebates, notably for high-starch future feedstocks that would feed-based demand for duckweed. Reasons behind the ducks being useful: the rate of growth and the degree of carbon sequestration when judged against these other traditional bio-fuel crops.

On the other hand, USA companies are significantly driven towards supplementary proteins and new energy. Phytoremediation with duckweed is already used in water treatment projects in areas located in polluted waters, where mentions in the territories of cities are made by private corporations as well as municipal water management authorities, making the USA stand out in capital investment in the fields of alternative protein and clean energy.

Duckweed shall witness the supply scaling up further to an industrial level because investment is heavy behind the ever growing green agriculture supported by biotechnological innovations.

The United Kingdom is becoming a key supplier of high-quality duckweed-based functional ingredients and aquafeed, fueled by rising consumer demand for plant-based nutrition, sustainable seafood, and eco-friendly agricultural practices. British agribusiness companies and alternative protein startups are focusing on scaling duckweed cultivation through controlled-environment farming to ensure consistent supply and nutrient retention.

The country’s strong regulatory framework supporting sustainable food production has led to increased funding for duckweed-derived protein isolates, which are being developed for use in nutraceuticals, functional foods, and high-protein meat alternatives.

The UK aquaculture sector, particularly salmon and trout farming, is also driving demand for duckweed as an alternative to soy-based aquafeed. As the industry faces sustainability challenges related to fishmeal supply and environmental concerns, the use of nutrient-dense duckweed protein in fish feed is gaining acceptance among commercial fish farms.

On the supply side, companies are investing in precision fermentation and enzymatic processing to optimize duckweed’s digestibility and amino acid profile, ensuring high-value feed formulations. With plant-based nutrition and aquaculture sustainability gaining traction, the UK’s duckweed supply chain is expected to expand through advanced farming technologies and strategic partnerships with food and feed manufacturers.

Germany leads in the cultivation of duckweed for organic agriculture, industrial bioprocessing, and clean-label food production, fueled by increasing consumer demand for sustainable, non-GMO ingredients and environmentally friendly farming practices. German agricultural cooperatives and biotech companies are increasing duckweed cultivation through automated hydroponic and closed-loop farming systems, allowing for year-round production with minimal environmental effects.

Due to the EU's robust regulatory drive for sustainable agriculture, German suppliers are promoting duckweed as an eco-friendly substitute for conventional crops, especially for organic fertilizers and soil enhancers.

Apart from agriculture, Germany's food processing and biotechnology sectors are incorporating bioactive compounds from duckweed into functional drinks, protein supplements, and plant-based dairy substitutes. The demand in the market for low-impact protein sources is providing chances for suppliers to create fermented duckweed proteins and extracts rich in antioxidants for application in sports nutrition and dietary supplements.

Moreover, Germany's emphasis on industrial bioprocessing for sustainable materials and compostable packaging is fostering research into bioplastics and bioadhesives derived from duckweed, broadening its impact on innovative sustainable materials. Germany's robust proficiency in supply chains for alternative proteins and green technology is anticipated to drive faster commercialization of the duckweed market, backed by investments in sustainable food and industrial uses.

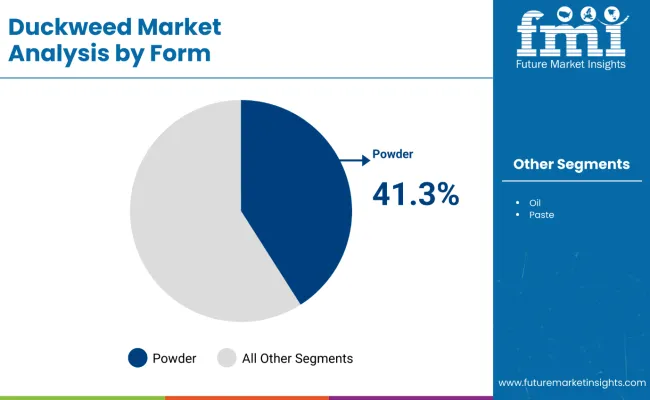

| Segment | Value Share (2025) |

|---|---|

| Powder (Form Type) | 41.3% |

The worldwide appetite for duckweed powder is increasing, fueled by its rich protein levels, bioactive substances, and diverse uses in functional foods and alternative protein sources. Food producers and nutraceutical companies are looking for sustainable, plant-derived protein options, and duckweed powder is becoming a viable and environmentally friendly substitute for soy and pea protein isolates.

The clean-label trend and growing appetite for minimally processed, nutrient-rich food components are increasing interest in duckweed powder as a valuable ingredient in protein shakes, dietary supplements, and plant-based meat alternatives.

On the supply side, agribusiness and biotech companies are investing in cutting-edge drying and processing technologies to improve the stability, digestibility, and amino acid bioavailability of duckweed powder. As controlled-environment agriculture and hydroponic farming expand, suppliers guarantee a continuous year-round production cycle, enabling worldwide distribution to food producers, supplement companies, and alternative protein firms.

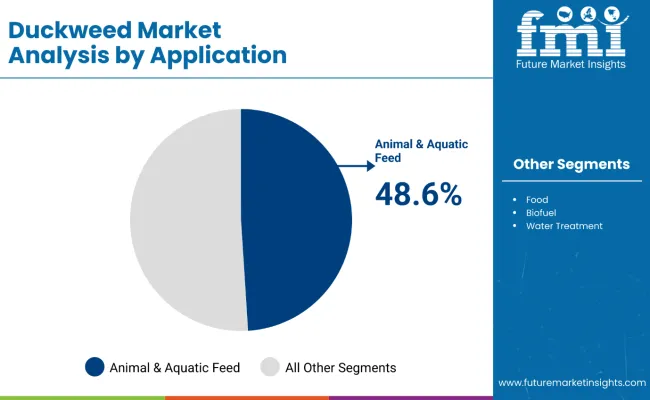

| Segment | Value Share (2025) |

|---|---|

| Animal & Aquatic Feed (Application) | 48.6% |

The global demand for duckweed in animal and aquatic feed is increasing as livestock and aquaculture industries seek nutrient-rich, cost-effective, and environmentally sustainable alternatives to traditional feed ingredients. Duckweed’s high protein content (up to 45% dry weight), essential amino acid profile, and rapid growth cycle make it an ideal replacement for soy and fishmeal in poultry, cattle, and aquaculture feed formulations.

With supply chain disruptions affecting conventional feed ingredients, agribusiness firms and feed manufacturers are integrating duckweed-based formulations to ensure consistent and locally sourced feed solutions.

On the supply side, companies specializing in alternative proteins and sustainable feed solutions are expanding large-scale duckweed cultivation and bioprocessing technologies to optimize nutrient retention and digestibility. The aquaculture sector, particularly in salmon, tilapia, and shrimp farming, is increasingly adopting duckweed meal as a functional feed ingredient, promoting better fish growth rates, enhanced immunity, and reduced environmental impact.

With regulatory bodies supporting sustainable aquafeed solutions and livestock nutrition, the duckweed-based feed industry is poised for strong growth, driven by rising investments in alternative protein sources and climate-resilient farming practices.

The global duckweed market is becoming increasingly competitive, with leading agribusiness, biotechnology, and alternative protein companies investing in large-scale production, advanced processing technologies, and sustainability-driven applications. Market leaders are expanding R&D efforts in high-protein duckweed extracts, biofuel production, and phytoremediation solutions to meet rising global demand.

Companies are also forming strategic partnerships with food, feed, and energy industries to accelerate commercialization. With governments promoting alternative proteins and sustainable agriculture, industry players are leveraging precision farming, AI-driven cultivation, and bioengineering techniques to optimize duckweed yield and nutrient composition, reinforcing their market position through technological and regulatory advancements.

For instance:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 89.4 million |

| Projected Market Size (2035) | USD 256.7 million |

| CAGR (2025 to 2035) | 11.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Forms Analyzed (Segment 1) | Fresh Duckweed, Dried Duckweed |

| Applications Analyzed (Segment 2) | Food and Beverages, Animal Feed, Biofuel Production, Wastewater Treatment, Pharmaceuticals, Cosmetics |

| End Users Analyzed (Segment 3) | Food Processing Companies, Livestock Farmers, Biofuel Producers, Wastewater Treatment Facilities, Pharmaceutical Companies, Cosmetic Manufacturers |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; and Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, GCC Countries, South Africa |

| Key Players influencing the Duckweed Market | Cargill; ADM (Archer Daniels Midland); Parabel USA; Hinoman Ltd.; GreenOnyx; Plantible Foods; LemnaPro; DryGro; Aqua BioTech Group; Baruch Future Ventures |

| Additional Attributes | Market share by form and application; Demand trends in sustainable and plant-based proteins; Impact of environmental regulations; Technological advancements in cultivation and processing; Sustainability initiatives in sourcing and production |

| Customization and Pricing | Available upon Request |

This segment is further categorized into Powder, Oil, Paste.

This segment is further categorized into Household, HoReCa, Food & Beverages, Aquaculture Industry, Pharmaceutical Industry, Others.

This segment is further categorized into Food, Animal & Aquatic Feed, Dietary/Health Supplements, Biofertilizers, Biofuels, Water Treatment.

This segment is further categorized into Little Duckweed (Lemna Minor), Thick Duckweed (Lemna Gibbs), Cross Duckweed (Lemna Priscila), Great Duckweed (Lemna Polyuria).

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global duckweed market is projected to reach approximately USD 256.7 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 11.2% from 2025 to 2035.

Between 2020 and 2024, the duckweed market experienced a growth rate of 8.7% CAGR.

Prominent players in the global duckweed industry include Plantible Foods, Parabel USA, GreenOnyx, LemnaPro, and DryGro.

North America is projected to hold a significant revenue share of the duckweed market by 2033, driven by increased consumption of plant-based protein and sustainable food sources.

In 2025, North America is projected to account for 15.1% of the global duckweed demand.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Form, 2023 to 2033

Figure 27: Global Market Attractiveness by End Use, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Form, 2023 to 2033

Figure 57: North America Market Attractiveness by End Use, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Form, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Form, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Form, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 207: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Duckweed Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Korea Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA