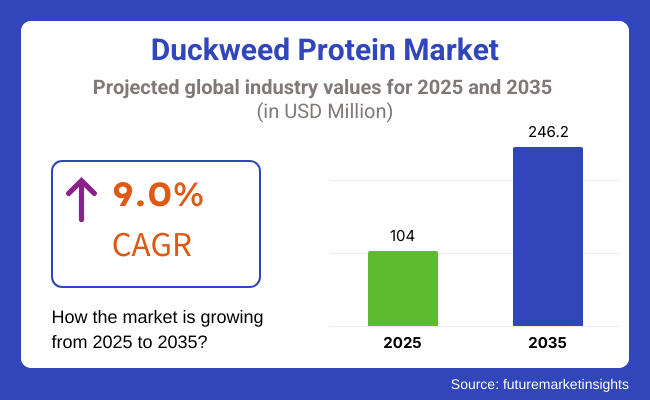

The global duckweed protein market, estimated at USD 104 million in 2025, is projected to expand to a valuation of USD 246.2 million by 2035 at a CAGR of 9% during the forecast period. Duckweed protein, derived from rapidly growing aquatic plants known as Lemnaceae, has emerged as a sustainable, high-quality plant-based protein alternative. This growth is driven by consumer preference for vegan, plant-based diets and environmentally friendly protein sources amid rising awareness of climate change and sustainability.

Europe and North America are anticipated to drive significant demand growth, propelled by heightened consumer willingness to integrate plant-based proteins into dietary habits. According to Rabobank's analysis, plant-based protein ingredients are rapidly transitioning from niche segments to mainstream diets, driven by health-conscious consumers and sustainability-minded millennials. Duckweed's superior nutritional profile, boasting up to 40% protein content, along with essential amino acids comparable to soy and pea proteins, positions it advantageously within the broader alternative protein category.

Innovation remains pivotal for market expansion. Companies such as Parabel USA and Hinoman Ltd. have introduced advanced processing techniques, significantly enhancing duckweed protein's sensory characteristics and taste profile. Strategic collaborations between food manufacturers and biotech firms are leading to enhanced duckweed cultivation methods, including vertical farming and controlled-environment agriculture, improving scalability and cost-efficiency.

Regulatory support and sustainability initiatives further strengthen market prospects. Government bodies, particularly within the European Union, emphasize eco-friendly agriculture through the Green Deal, encouraging plant-protein production and supporting the development of novel, sustainable ingredients like duckweed protein.

Moreover, industry participants like Plantible Foods have secured multimillion-dollar venture funding to scale commercial duckweed protein extraction processes, underlining investor confidence in market viability. In 2025, Asia Pacific markets, particularly China and India, are anticipated to witness significant growth, fueled by expanding middle-class populations, rising disposable incomes, and shifting dietary habits toward sustainable proteins. Collectively, robust product innovation, regulatory backing, and increasing global consumer interest position duckweed protein as a rapidly-growing player in the plant-based protein landscape through 2035.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global duckweed protein market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 7.3% (2024 to 2034) |

| H2 | 7.9% (2024 to 2034) |

| H1 | 8.4% (2025 to 2035) |

| H2 | 9.0% (2025 to 2035) |

The above table presents the expected CAGR for the global duckweed protein demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 7.3%, followed by a slightly higher growth rate of 7.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 8.4% in the first half and remain relatively moderate at 9.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

In 2025, the powdered form of duckweed protein is projected to dominate the market, accounting for approximately 66.3% of the total market share.This dominance is attributed to the powder's versatility and ease of integration into various food products, including protein bars, smoothies, soups, and baked goods.

The powdered form's extended shelf life and convenience in storage and transportation make it a preferred choice for both manufacturers and consumers. Additionally, the powder's adaptability allows for seamless incorporation into animal feed formulations, further expanding its application scope. The growing demand for sustainable and plant-based protein sources continues to drive the popularity of powdered duckweed protein in the global market.

In 2025, the Lemna genus is projected to dominate the duckweed protein market, accounting for approximately 57% of the global share. Lemna species are favored due to their rapid growth cycles and high protein yields, making them efficient for large-scale cultivation.Their adaptability to diverse aquatic environments further enhances their appeal for commercial applications.

The prominence of Lemna in the market is also attributed to its established use in various regions, particularly in Europe, where it serves as a primary source for duckweed protein production. This dominance is expected to continue as research and development efforts focus on optimizing Lemna cultivation techniques to meet the growing demand for sustainable plant-based proteins.

Government Support and Research Funding

Governments and organizations worldwide are recognizing the importance of alternative protein sources in addressing food security and sustainability challenges. As a result, they are investing in research and development initiatives focused on duckweed and other innovative crops. This funding supports scientific studies that explore the nutritional benefits, cultivation methods, and processing techniques of duckweed, leading to improved product quality and market viability.

Additionally, government-backed programs often provide resources and training for farmers, enhancing their ability to cultivate duckweed effectively. This collaborative effort between public and private sectors fosters innovation, strengthens market infrastructure, and ultimately drives sales by making duckweed protein more accessible and appealing to consumers and industries alike.

Increased Awareness of Plant-Based Diets

The growing trend towards plant-based diets and veganism is significantly influencing consumer preferences and purchasing decisions. As more individuals seek to reduce their meat consumption for health, ethical, or environmental reasons, the demand for alternative protein sources has surged. Duckweed, recognized for its high protein content and nutritional profile, is emerging as a popular choice among health-conscious consumers.

Its versatility allows it to be incorporated into various food products, from protein shakes to meat substitutes, catering to diverse dietary needs. This increased awareness not only boosts the demand for duckweed protein in the food market but also encourages manufacturers to innovate and expand their product offerings, further driving sales.

Shift Towards Sustainable Agriculture

As environmental concerns become more pressing, consumers are increasingly advocating for sustainable agricultural practices. Duckweed stands out as a sustainable protein source due to its rapid growth, minimal resource requirements, and ability to thrive in nutrient-rich environments, such as wastewater. This unique characteristic allows duckweed to contribute to waste management while providing a high-quality protein alternative.

As consumers prioritize eco-friendly products, the perception of duckweed as a sustainable option is gaining traction. This shift in consumer behavior is prompting food producers and farmers to adopt duckweed cultivation, leading to higher sales and greater market acceptance. Ultimately, the alignment of duckweed with sustainable agriculture trends positions it favorably in the global protein market.

Global Duckweed Protein sales increased at a CAGR of 7.9% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on duckweed protein will rise at 9.0% CAGR

Duckweed's ability to be processed into various forms-such as fresh, dried, or powdered-makes it an incredibly versatile ingredient for manufacturers. This adaptability allows it to be seamlessly incorporated into a wide array of food products, including protein bars, smoothies, and meat alternatives, as well as dietary supplements and animal feeds.

Manufacturers are drawn to duckweed for its potential to enhance product offerings and cater to diverse consumer preferences, driving innovation and expanding market opportunities.

The increasing shift towards plant-based diets and veganism is significantly boosting interest in alternative protein sources like duckweed. As consumers become more health-conscious and environmentally aware, they seek nutritious options that align with their dietary choices.

Duckweed, with its high protein content and essential amino acids, appeals to those looking to reduce meat consumption without sacrificing quality. This trend not only enhances duckweed's market presence but also encourages manufacturers to develop innovative plant-based products.

This tier comprises industry leaders with annual revenues exceeding USD 20 million, collectively holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacities and extensive product portfolios, which often include various forms of duckweed protein, such as fresh, dried, and powdered formats. Tier 1 players are distinguished by their advanced manufacturing capabilities, robust supply chains, and broad geographical reach, allowing them to cater to a diverse consumer base.

Their expertise in regulatory compliance and innovation positions them as frontrunners in the market. Prominent companies in this tier may include established names like Duckweed Farms, Greenwater Aquaculture, and Nutraceutical International Corporation, which are leveraging their resources to expand their market presence and drive growth.

This tier consists of mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and significantly influence local markets. They are characterized by their solid consumer base knowledge and the ability to adapt to regional preferences.

While they may not possess the extensive technological advancements or global reach of Tier 1 companies, they are known for their innovative approaches and compliance with industry regulations. Companies such as Water Lentils and Sustainable Aquatics fall into this category, focusing on niche markets and regional distribution channels to enhance their market share.

The majority of the market is composed of small-scale companies operating locally, with revenues below USD 5 million. These Tier 3 players primarily serve niche demands and are often characterized by limited geographical reach and a focus on fulfilling local marketplace needs.

This segment is recognized as an unorganized field, lacking the extensive structure and formalization seen in higher-tier competitors. Many of these companies are startups or small enterprises that are experimenting with duckweed cultivation and processing, contributing to the overall diversity of the market.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 36.9 million |

| Germany | USD 24.6 million |

| China | USD 19.7 million |

| India | USD 12.3 million |

| Japan | USD 4.9 million |

Regulatory support and research funding from USA government initiatives play a crucial role in advancing the duckweed protein sector. By allocating resources to sustainable agriculture and alternative protein research, the government encourages innovation in cultivation and processing techniques specific to duckweed.

This funding facilitates partnerships between academic institutions, research organizations, and industry players, leading to the development of more efficient farming practices and improved product formulations. As a result, duckweed protein becomes more accessible to manufacturers, who can produce it at scale, while consumers benefit from a wider range of high-quality, sustainable protein options that align with their dietary preferences.

Germany's aquaculture industry is increasingly adopting duckweed as a sustainable and cost-effective feed option for fish and livestock. Duckweed's high protein content and digestibility make it an ideal choice for enhancing growth rates and overall health in aquaculture species.

As consumers and regulatory bodies emphasize the importance of sustainable practices, duckweed's ability to thrive in nutrient-rich environments and its minimal resource requirements position it as an environmentally friendly alternative to traditional feed sources. This growing recognition of duckweed's benefits is driving its integration into aquaculture and livestock feed formulations, supporting the industry's shift towards more sustainable and efficient practices.

The rising interest in plant-based proteins in India is driven by a significant shift towards vegetarian and vegan diets, motivated by health, ethical, and environmental considerations. As consumers become more aware of the health benefits associated with plant-based eating, they seek nutritious alternatives to traditional animal proteins.

Duckweed, as a high-protein, plant-based source, aligns perfectly with this trend, offering essential amino acids and vitamins. Its sustainable cultivation methods further enhance its appeal, as environmentally conscious consumers prioritize foods that minimize ecological impact. This growing demand for nutritious, sustainable options positions duckweed protein as a compelling choice in the evolving Indian dietary landscape.

The competition in the global duckweed protein market is intensifying as companies focus on innovation, sustainability, and product diversification. Key players are investing in research and development to enhance cultivation techniques and improve processing methods, ensuring higher quality and nutritional value.

Additionally, firms are forming strategic partnerships with research institutions and food manufacturers to expand their product offerings and market reach. Emphasizing eco-friendly practices and promoting the health benefits of duckweed protein further strengthens their competitive positioning in the growing plant-based protein sector.

For instance

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 104.0 million |

| Projected Industry Size (2035) | USD 246.2 million |

| CAGR (2025 to 2035) | 9.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2019 to 2023 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Forms | Fresh, Dried |

| Species | Wolffiella, Spiro Dela, Lemna |

| End Uses | Food Processing, Animal and Fish Feed, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Key Players | Parabel USA Inc., Pontus Water Lentils, Barentz B.V., Hinoman, Ltd., Plantible Foods, Inc., Lempro Inc., Seta Organics, Other Market Players |

| Additional Attributes | Environmental impact of duckweed cultivation, scalability in water-based protein farming, species-specific protein content analysis, integration in alternative protein blends, emerging R&D in biotech applications. |

| Customization and pricing | Available upon Request |

This segment is further categorized into Fresh and Dried.

This segment is further categorized into Wolffiella, Spiro Dela, and Lemna.

This segment is further categorized into Food processing, Animal and Fish feed and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Duckweed Protein industry is estimated at a value of USD 104.0 million in 2025.

Sales of Duckweed Protein increased at 7.9% CAGR between 2020 and 2024.

Parabel USA Inc., Pontus Water Lentils, Barentz B.V., Hinoman, Ltd. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 27% over the forecast period.

North America holds 34% share of the global demand space for Duckweed Protein.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Species, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Species, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Species, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Species, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Species, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Species, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Species, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Species, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Species, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Species, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Species, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by Species, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Species, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Species, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Species, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Species, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ Million) by Species, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Species, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Korea Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Duckweed Market Insights – Trends, Demand & Growth 2025–2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA