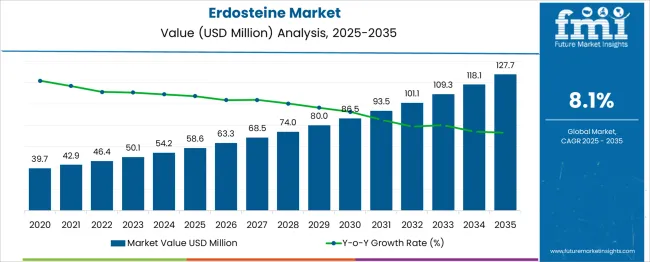

The Erdosteine Market is estimated to be valued at USD 58.6 million in 2025 and is projected to reach USD 127.7 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. A Breakpoint Analysis identifies phases within the growth trajectory where acceleration or deceleration patterns shift significantly, indicating potential changes in market drivers or adoption rates. From 2025 to 2028, the market grows steadily with annual increments ranging between USD 4.7 and USD 5.5 million, reflecting consistent but moderate uptake. Between 2029 and 2031, a noticeable acceleration emerges, with yearly gains surpassing USD 6 million. This shift likely marks the first breakpoint, suggesting that stronger demand triggers, such as expanded therapeutic applications, improved accessibility, or wider clinical adoption, may be at play.

From 2032 onward, growth continues at an elevated pace, with increments exceeding USD 8 million in the final years, peaking at USD 9.6 million between 2034 and 2035. This second breakpoint may be linked to significant market penetration in new geographies, potential regulatory approvals for additional indications, or competitive advantages enhancing product uptake. The data indicates two distinct breakpoints, an early-stage acceleration around 2029 and a late-stage boost after 2032. These shifts indicate a market transitioning from steady growth to stronger momentum, driven by the expansion of use cases and increased market awareness.

| Metric | Value |

|---|---|

| Erdosteine Market Estimated Value in (2025 E) | USD 58.6 million |

| Erdosteine Market Forecast Value in (2035 F) | USD 127.7 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Erdosteine market is demonstrating steady expansion as a result of the rising prevalence of chronic respiratory diseases and the growing use of mucolytic agents in supportive care. With increasing exposure to environmental pollutants, smoking habits, and seasonal infections, demand for respiratory therapies has accelerated across both developed and developing regions. Erdosteine, with its well-established antioxidant and mucoactive properties, is gaining wider adoption among prescribers for managing airway obstruction and promoting mucus clearance.

Enhanced inclusion in clinical guidelines and favorable safety profiles have further supported its use in outpatient and hospital settings. Regulatory approvals across multiple geographies and expanding generic drug manufacturing have improved access, while strategic collaborations among pharmaceutical firms have boosted production and regional penetration.

As public and private healthcare systems invest more in respiratory health infrastructure and drug availability, erdosteine is expected to sustain growth as a key therapeutic molecule in respiratory care. The market outlook remains positive with increasing demand from pulmonology segments and a consistent pipeline of generic formulations.

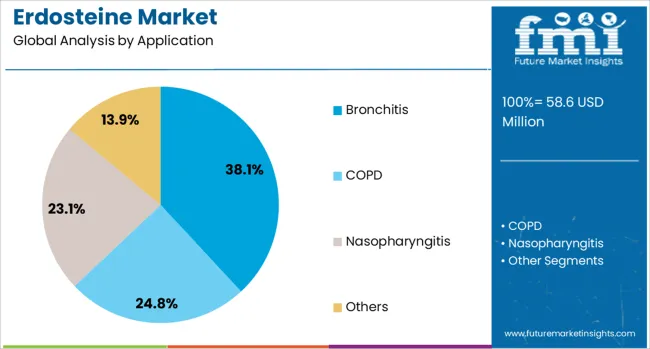

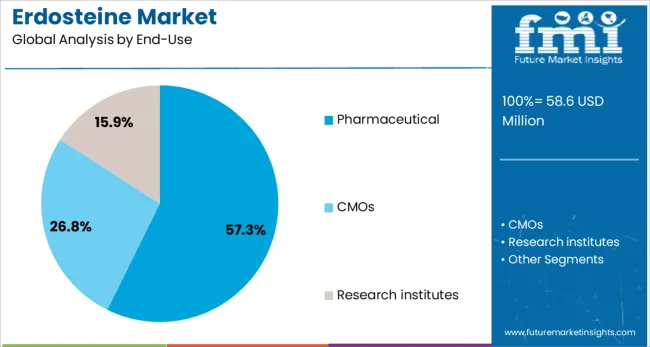

The erdosteine market is segmented by application, end-use, and geographic regions. By application, the erdosteine market is divided into Bronchitis, COPD, Nasopharyngitis, and others. In terms of end-use, the erdosteine market is classified into Pharmaceutical, CMOs, and research institutes. Regionally, the erdosteine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bronchitis application segment is expected to account for 38.1% of the total revenue share in the Erdosteine market by 2025, positioning it as the dominant therapeutic area. The growth of this segment has been influenced by the rising incidence of both acute and chronic bronchitis, especially in aging populations and high-risk groups with existing pulmonary conditions. Erdosteine’s mucolytic action has proven effective in reducing sputum viscosity and improving airflow, making it a preferred treatment option among healthcare providers.

The continued support from pulmonologists for prescribing erdosteine in bronchial inflammation cases has been driven by its ability to reduce exacerbations and hospital admissions in chronic bronchitis patients. Increasing environmental exposure to air pollutants and occupational hazards in industrial zones has contributed to sustained demand for bronchitis treatments.

The growing use of combination therapies and clinical preference for erdosteine over alternative agents with more side effects has also supported the segment. Expanded awareness campaigns and improved patient access to respiratory drugs are expected to further reinforce this segment’s dominance.

The pharmaceutical end-use segment is projected to capture 57.3% of the total revenue share in the Erdosteine market by 2025, reflecting its position as the leading consumer of the active ingredient. The dominance of this segment is being driven by the widespread integration of erdosteine in branded and generic formulations across global pharmaceutical pipelines. Manufacturers have increasingly adopted erdosteine in tablet and capsule forms due to its stability, safety profile, and broad market appeal.

Regulatory approvals for erdosteine across multiple jurisdictions have enabled pharmaceutical firms to commercialize respiratory products in high-demand regions. The scalability of production, alongside investments in formulation R&D, has allowed companies to meet the rising demand from hospitals, retail pharmacies, and export markets.

Additionally, the pharmaceutical sector’s focus on expanding mucolytic offerings for chronic respiratory conditions has solidified erdosteine’s inclusion in therapeutic portfolios. As demand rises for accessible, effective, and affordable respiratory medications, the pharmaceutical industry is expected to remain the central driver of erdosteine market growth.

The market has been experiencing steady expansion, supported by rising healthcare awareness, increasing diagnosis rates of respiratory illnesses, and the continuous demand for effective mucolytic agents. Erdosteine, a thiol derivative with antioxidant and mucus-reducing properties, has been widely used in the treatment of chronic obstructive pulmonary disease, bronchitis, and other airway-related disorders. Its capacity to enhance mucus clearance and improve respiratory function has secured its place in both prescription and over-the-counter medicine segments in various markets. Pharmaceutical research has focused on expanding its therapeutic profile, including potential applications in managing oxidative stress-related conditions.

The global burden of chronic respiratory diseases has been steadily increasing, influenced by environmental pollution, industrial emissions, tobacco use, and aging populations. These factors have contributed to a higher incidence of chronic obstructive pulmonary disease and chronic bronchitis, where mucolytic agents like Erdosteine are prescribed to reduce mucus viscosity and facilitate clearance. Increased patient compliance has been observed due to Erdosteine’s tolerability and minimal side effects compared to some older alternatives. Healthcare systems in emerging economies are integrating mucolytics into public health initiatives, expanding access to affordable treatment. Additionally, rising health literacy has been linked to increased patient demand for early intervention in respiratory care. This expanding therapeutic need is fostering sustained market growth, with pharmaceutical companies investing in manufacturing scale-up and geographic market penetration to address both acute and chronic respiratory conditions effectively.

The development of innovative Erdosteine formulations has been a significant driver in expanding its clinical application and improving patient adherence. Efforts have been made to enhance bioavailability, ensure stable shelf life, and introduce dosage forms such as dispersible tablets, oral suspensions, and sustained-release capsules. Advanced drug delivery systems have been adopted to optimize the pharmacokinetic profile of Erdosteine, enabling prolonged therapeutic effects and reduced dosing frequency. Research collaborations between pharmaceutical companies and formulation scientists have resulted in patient-friendly products that cater to pediatric, geriatric, and chronic care segments. The use of modern manufacturing processes has also reduced impurities and improved the consistency of active pharmaceutical ingredient quality. These advancements not only strengthen regulatory compliance but also improve market competitiveness, enabling companies to differentiate their products in regions with multiple generic alternatives and high competitive intensity.

Regulatory frameworks have played a pivotal role in shaping the Erdosteine market, with health authorities in various countries approving its use for a broader range of respiratory conditions. In several emerging markets, regulatory acceptance has led to inclusion in national drug lists, making the drug more accessible through public healthcare systems. Strategic licensing agreements and partnerships have enabled multinational companies to enter markets with high unmet respiratory care needs. This has been particularly relevant in regions with limited availability of advanced mucolytic therapies. Harmonization of quality standards across international markets has encouraged cross-border supply and accelerated global availability. As governments prioritize respiratory health in policy planning, pharmaceutical manufacturers are expected to leverage favorable regulatory pathways to strengthen their footprint in both urban and rural healthcare infrastructures, further reinforcing Erdosteine’s role in standard respiratory treatment protocols.

While Erdosteine’s primary application remains in mucolytic therapy for chronic respiratory illnesses, its role in preventive care and adjunct treatment strategies is expanding. Clinical research has suggested potential benefits in reducing exacerbation frequency in COPD patients, thereby lowering hospitalization rates and healthcare costs. Erdosteine has also been explored in combination therapy with antibiotics, where its antioxidant properties may contribute to improved treatment outcomes. Preventive applications are gaining attention in at-risk populations, such as smokers and individuals exposed to occupational dust or pollutants. Awareness campaigns by healthcare providers have highlighted the importance of early mucolytic intervention to maintain long-term lung function. As preventive medicine gains momentum globally, Erdosteine’s positioning within both treatment and prophylaxis frameworks is expected to solidify, ensuring its sustained relevance in comprehensive respiratory healthcare planning.

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

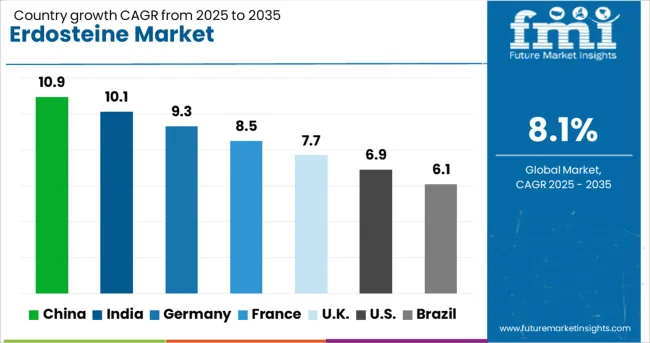

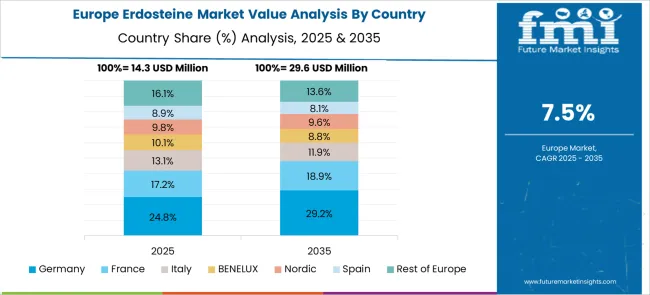

The market is forecast to expand at a CAGR of 8.1% between 2025 and 2035, driven by increasing prevalence of chronic respiratory diseases, rising healthcare expenditure, and advancements in pharmaceutical formulations. China is expected to lead with a 10.9% CAGR, supported by a large patient population and growing domestic pharmaceutical manufacturing. India follows at 10.1%, benefiting from its strong generic drug production capabilities and expanding healthcare infrastructure. Germany, at 9.3%, gains from high R&D investment and advanced formulation technologies. The UK, with a 7.7% CAGR, sees demand from its well-established healthcare system and growing prescriptions for respiratory therapies. The USA, at 6.9%, experiences steady adoption backed by awareness of respiratory health and increasing chronic disease management. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 10.9% from 2025 to 2035, supported by rising prevalence of chronic respiratory diseases and increasing adoption of advanced mucolytic therapies. Local pharmaceutical manufacturers are scaling up production to meet both domestic and export requirements, with emphasis on compliance with international quality standards. Research collaborations between hospitals and drug developers are contributing to more efficient formulations and delivery mechanisms. Government healthcare initiatives aimed at improving access to essential medicines are further bolstering market growth.

India’s market is projected to register a CAGR of 10.1%, driven by expanding respiratory care segments and rising demand for effective mucus-reducing drugs. Domestic companies are enhancing manufacturing capabilities with advanced formulation technologies to improve bioavailability. Partnerships with global pharma firms are helping Indian producers access new markets and regulatory approvals. Increasing awareness among healthcare professionals regarding the benefits of Erdosteine in managing chronic bronchitis and related conditions is accelerating uptake in both public and private healthcare sectors.

Germany is anticipated to expand at a CAGR of 9.3%, supported by robust research activities and strong integration between pharmaceutical companies and healthcare providers. The focus is on developing advanced formulations that offer sustained release and improved patient compliance. Regulatory emphasis on evidence-based prescriptions is ensuring steady demand in hospitals and specialty clinics. The country’s export-oriented pharmaceutical sector is also enhancing opportunities for locally developed Erdosteine products in global markets, particularly in regions with growing respiratory disease prevalence.

The United Kingdom Erdosteine market is forecast to grow at a CAGR of 7.7%, driven by the diversification of respiratory therapeutics and inclusion of Erdosteine in treatment protocols for chronic conditions. Pharmaceutical manufacturers are investing in both branded and generic variants to meet different pricing and patient segment needs. Clinical studies highlighting the efficacy of Erdosteine in combination therapies are expanding its adoption. Digital health platforms are also improving prescription management and patient adherence rates, thereby sustaining market growth.

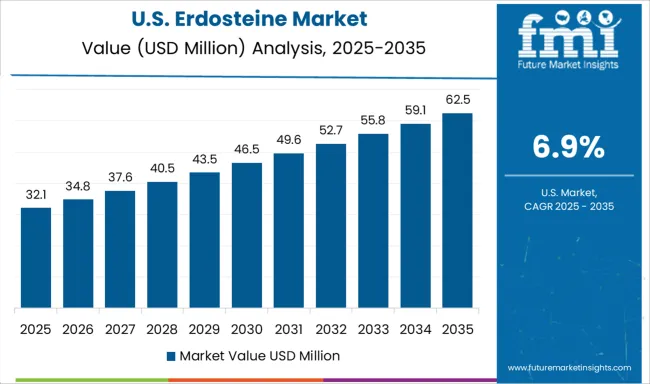

The United States market is set to register a CAGR of 6.9%, influenced by a rising focus on patient-centric drug delivery solutions. Adoption is being driven by the need for effective treatments for chronic obstructive pulmonary disease and related ailments. Pharmaceutical firms are integrating advanced manufacturing processes to enhance purity and efficacy. Increasing collaboration with healthcare providers is enabling better education on dosing benefits, while supportive insurance coverage for respiratory medications is ensuring broader patient access.

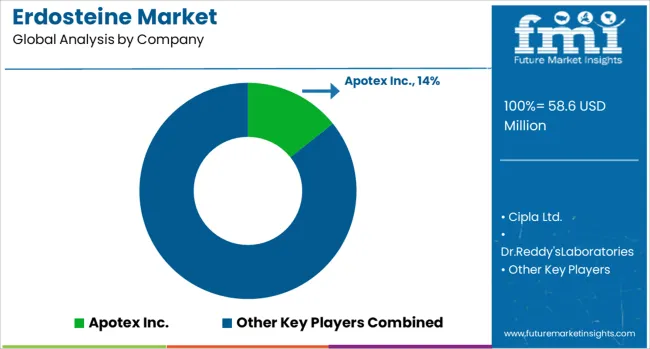

The Erdosteine market is shaped by a combination of multinational pharmaceutical leaders and regional manufacturers providing this mucolytic agent for respiratory disorders. Apotex Inc. maintains a notable presence in generics, leveraging global production and distribution channels to serve multiple markets efficiently. Cipla Ltd. and Dr. Reddy’s Laboratories have strategically expanded into both emerging and developed regions by offering competitively priced formulations and maintaining large-scale manufacturing capabilities, strengthening accessibility and market penetration. Hanmi Pharmaceutical and Hikma Pharmaceuticals sustain their participation through diversified portfolios that span multiple therapeutic areas, ensuring resilience against market fluctuations. Mylan N.V., now integrated into Viatris, leverages extensive regulatory approvals and well-established global networks to secure market share across continents.

Contract manufacturing plays a significant role in market dynamics. Reipharm AB provides tailored production support for both branded and generic Erdosteine, facilitating flexible supply for global clients. Sandoz, under Novartis, contributes high-quality generics backed by rigorous regulatory compliance, enhancing reliability for healthcare providers. Regional Chinese players such as Shandong Luoxin Pharmaceutical and Zhejiang Kangle Pharmaceutical Co., Ltd. complement the global supply, offering cost-effective solutions for domestic and export markets.

Market growth is influenced by increasing respiratory disease prevalence, rising healthcare expenditure, and patient preference for cost-efficient therapies. Leading players are emphasizing expansion into untapped geographies, optimizing supply chains, and developing enhanced dosage forms to improve adherence. Intellectual property management, regulatory alignment, and strategic partnerships are pivotal in maintaining competitive advantage, ensuring sustainable positioning in the global Erdosteine ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.6 Million |

| Application | Bronchitis, COPD, Nasopharyngitis, and Others |

| End-Use | Pharmaceutical, CMOs, and Research institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Apotex Inc., Cipla Ltd., Dr.Reddy'sLaboratories, HanmiPharmaceutical, HikmaPharmaceuticals, MylanN.V., ReipharmAB, Sandoz, ShandongLuoxinPharmaceutical, and ZhejiangKanglePharmaceuticalCo.,Ltd |

| Additional Attributes | Dollar sales by formulation type and dosage form, demand dynamics across chronic obstructive pulmonary disease, bronchitis, and respiratory infection treatments, regional trends in prescription rates across Europe, Asia-Pacific, and Latin America, innovation in extended-release formulations and combination therapies, environmental impact of pharmaceutical manufacturing and waste management, and emerging use cases in pediatric respiratory care and preventive lung health applications. |

The global erdosteine market is estimated to be valued at USD 58.6 million in 2025.

The market size for the erdosteine market is projected to reach USD 127.7 million by 2035.

The erdosteine market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in erdosteine market are bronchitis, copd, nasopharyngitis and others.

In terms of end-use, pharmaceutical segment to command 57.3% share in the erdosteine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA