The Fluorite Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Fluorite Market Estimated Value in (2025 E) | USD 2.7 billion |

| Fluorite Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The fluorite market is experiencing steady growth due to its critical role in multiple industrial applications, including metallurgical, chemical, and manufacturing processes. Its adoption is being driven by the rising global demand for steel and aluminum products, as well as increasing production of hydrofluoric acid for chemical synthesis. Investments in industrial infrastructure and chemical manufacturing capacity are further supporting the expansion of the market.

Technological advancements in mining and processing methods are enabling higher yield and improved purity, which enhance product performance across applications. Growing focus on environmental compliance and efficiency in production processes has also influenced the preference for high-grade fluorite in industrial operations. The market is being shaped by rising demand in emerging economies, where industrialization and infrastructure development are accelerating.

Additionally, the versatility of fluorite across applications, including as a flux in metallurgical processes and as a feedstock for chemical production, is reinforcing its adoption With increasing attention to sustainability and operational efficiency, the market is positioned for continued growth, offering manufacturers opportunities to expand capacity and innovate in product offerings.

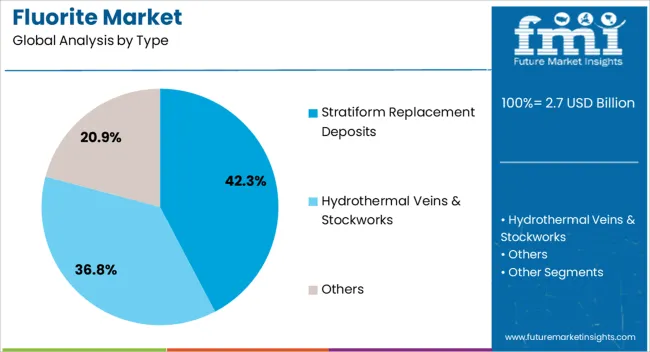

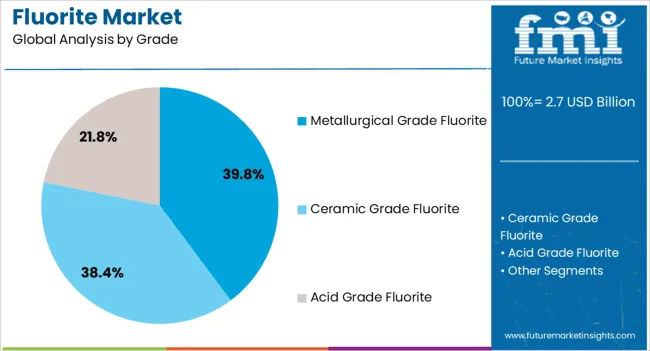

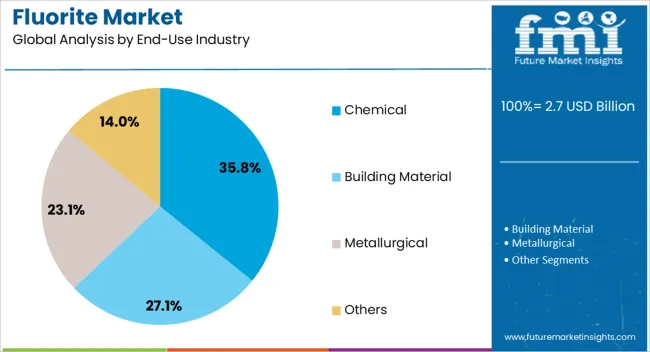

The fluorite market is segmented by type, grade, end-use industry, and geographic regions. By type, fluorite market is divided into Stratiform Replacement Deposits, Hydrothermal Veins & Stockworks, and Others. In terms of grade, fluorite market is classified into Metallurgical Grade Fluorite, Ceramic Grade Fluorite, and Acid Grade Fluorite. Based on end-use industry, fluorite market is segmented into Chemical, Building Material, Metallurgical, and Others. Regionally, the fluorite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stratiform replacement deposits type is projected to hold 42.3% of the fluorite market revenue share in 2025, making it the leading type segment. This dominance is being driven by the high quality and consistent purity of fluorite derived from stratiform formations, which meet stringent industrial requirements. The uniformity in mineral composition enables efficient processing for both metallurgical and chemical applications, reducing operational variability and cost.

The segment is benefiting from established mining practices and proven extraction techniques that support large-scale production, making it a reliable source for industrial supply chains. Growing demand from metallurgical and chemical industries, where consistent fluxing properties and high calcium fluoride content are critical, has reinforced adoption.

In addition, the adaptability of stratiform deposits for mechanized mining reduces operational risk and enhances cost-effectiveness, which further strengthens its position The segment is expected to maintain leadership as industries increasingly prioritize efficiency, quality, and reliability in their raw material sourcing strategies.

The metallurgical grade fluorite grade segment is expected to account for 39.8% of the market revenue share in 2025, making it the leading grade segment. This dominance is being supported by the high demand for fluorite as a flux in steelmaking and other metallurgical processes, where it reduces melting temperatures and enhances energy efficiency. The grade is preferred for its high calcium fluoride content, which ensures consistent performance in furnaces and minimizes impurities in final products.

Its adoption is being reinforced by increasing steel production globally, particularly in regions with expanding infrastructure and industrial activities. Technological improvements in material handling and processing are also enhancing yield and operational efficiency, further supporting the use of metallurgical grade fluorite.

The ability of this grade to meet industrial specifications and regulatory standards without compromising performance or safety contributes to its market leadership As energy efficiency and quality remain priorities in metallurgical processes, the demand for metallurgical grade fluorite is expected to sustain its dominant position in the market.

The chemical end-use industry segment is projected to hold 35.8% of the fluorite market revenue share in 2025, establishing it as the leading end-use sector. Its dominance is being driven by the growing requirement for hydrofluoric acid production, which serves as a critical feedstock for fluorochemicals, refrigerants, and specialty chemical applications. The segment is also benefiting from the rising adoption of fluorite in chemical synthesis processes where high purity is essential to achieve desired product performance and yield.

Expanding chemical manufacturing capacities in both developed and emerging regions are further supporting this growth, as manufacturers aim to meet rising global demand for industrial chemicals. Regulatory emphasis on energy efficiency and reduced emissions in chemical processing has reinforced the adoption of high-quality fluorite, which ensures reliable and cost-effective operations.

Additionally, the ability to process chemical-grade fluorite into multiple derivatives without quality loss is enhancing its versatility and industrial appeal As the chemical industry continues to expand and innovate, the demand for fluorite in chemical applications is expected to remain a major driver of market growth.

Fluorite is also known as fluorspar, and it is readily available naturally in all the colour spectrums. Being the mineral form of calcium fluorite, it also is a halide mineral and is visible not only in daylight but also in ultraviolet light.

Pure fluorite that is naturally found is colourless and various colours that it possess are usually because of impurities in the mineral. Fluorite is immensely popular for its cubic design and its various colours such as blue, yellow, purple, and green, and it is famous as a fluorescent mineral.

Fluorite is usually drilled to manufacture jewelleries, however, due to the softness of its nature, it is rarely used as a semiprecious stone. Yet, fluorite is high in demand across various industrial areas such as building & construction, metallurgy, chemicals, and glass industries.

The global fluorite market is predominantly driven by the growing demand for fluorite, being a precursor to almost all fluorite compounds, as an important raw material in the production of hydrofluoric acid.

As hydrofluoric acid is one the most commonly used commercial chemicals, the demand for fluorite is expected to remain significantly high. Apart from this, leading players in the global fluorite market are also capitalizing on the increasing applications of the mineral across a wide range of industries.

Fluorite is witnessing high demand in the manufacture of glass and ceramics, as it facilitates in surface treatments to produce opalescent and glossy surfaces. With a mounting number of manufacturers using fluorite to make attractive and durable consumer products that are made with glass, the consumption of fluorite is expected to increase in the coming years.

Furthermore, metallurgical-grade fluorite is also witnessing high demand in the manufacturing of steel, iron, aluminum, and other metals. Thereby, leading players in the global fluorite market are expected to expand their customer base into metal producers to boost the sales of metallurgical-grade fluorite.

While the industrial activities around the world are gaining momentum, production innovation is also becoming an indispensable part of the process in nearly all industrial applications.

However, typically in most developed countries, sustainability is becoming an important aspect for both industrialists as well as customers, which is encouraging all stakeholders to highlight the importance of reducing the carbon footprint of their business activities. This is likely to have a paramount impact on the demand and sales of fluorite in the coming years.

The awareness about the potential environmental hazards of using fluorite in triggering end users in various industries to shift to more sustainable alternatives to fluorite. End users are aiming to replace chemicals manufacturing using fluorite with hydrocarbon-based refrigerants in most common industrial applications.

Dolomitic limestone or olivine are among the most popular substitutes for fluorite used in the steel and iron industry. This way, increasing end-user awareness about the environmental hazards of fluorite may lead to the loss of market share for leading players in the global fluorite market in the coming years.

Based on the geographical factors, the fluorite market is broadly divided into seven regions - North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa. With a significant stronghold of global leaders' presence in Asia Pacific, the APAC market for fluorite is expected to witness incremental growth in the coming years.

The flourishing growth of the chemicals industry in the Asia Pacific region is mainly attributed to the natural resources and availability of commercially significant minerals including fluorite.

Growing demand for steel and aluminum in emerging Asian economies is one of the leading factors contributing to the growth of the fluorite market in the region, Furthermore, the construction industry accounts for a substantial share in the burgeoning consumption of fluorite in China and India.

China, being one of the largest producers of fluorspar, accounts for a huge share in the export of fluorite, and this is expected to drive a rise in downstream activities in the Chinese market for fluorite.

While the Asia Pacific region holds a strong position in the global market for fluorite, North America and Europe are also expected to create new growth opportunities for fluorite market players in the coming years. Global players are increasingly focused on expanding their hold over natural mines and resources of minerals in order to meet the increasing demand for commercial materials such as fluorite across the region.

In September 2025, Do-Fluoride Chemicals Co., Ltd. (Hereinafter called "DFD") - a global business involved in research, production, and sales of the high-performance fluoride products - announced that it has planned to purchase nearly 70% stakes of Luoyang Lanbao Fluoride Industry Co.,Ltd. - a leading fluorite mining and beneficiation enterprise in China.

The company announced that the deal was finalised at nearly US$ 11 million (RMB 77 million), and that it is aiming at gaining more access to raw materials to facilitate its own business operations.

Luoyang Lanbao owns 6 mines and 3 fluorite concentrators and in Luoyang, Chongqing and other areas, which account for nearly 3 million tonnes of fluorite, which can lead to producing over 60 thousand tonnes of flotation fluorite powders per year.

In April 2025, Ares Strategic Mining Inc. (formerly Lithium Energy Products Inc.) - a Canada-based natural resource mining company engaged in the business of acquiring and exploring lithium properties - announced that it has entered a definitive agreement to acquire the Liard Fluorspar Project - one of the most important fluorite prospects in British Columbia - to expand its geographical footprint. With this acquisition, the company also aims to reduce the impact of global uncertainties vis-a-vis the availability of fluorite by diversifying its portfolio as well as the countries where the company operates.

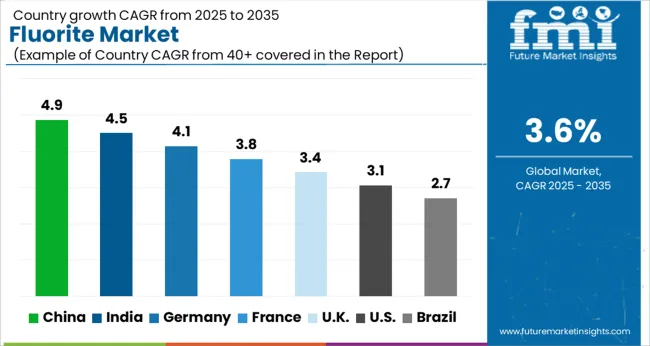

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| K | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The Fluorite Market is expected to register a CAGR of 3.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.9%, followed by India at 4.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.7%, yet still underscores a broadly positive trajectory for the global Fluorite Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.1%. The USA Fluorite Market is estimated to be valued at USD 992.6 million in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 3.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 139.9 million and USD 69.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Type | Stratiform Replacement Deposits, Hydrothermal Veins & Stockworks, and Others |

| Grade | Metallurgical Grade Fluorite, Ceramic Grade Fluorite, and Acid Grade Fluorite |

| End-Use Industry | Chemical, Building Material, Metallurgical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

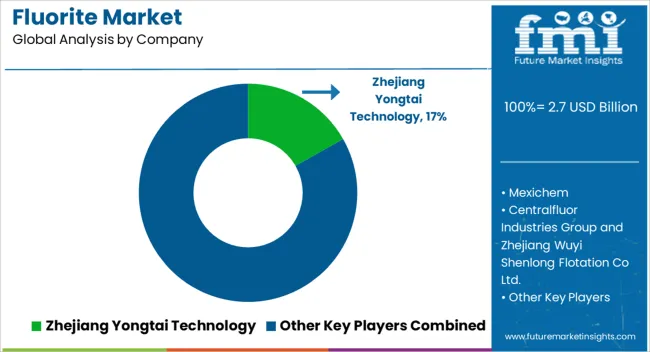

| Key Companies Profiled | Zhejiang Yongtai Technology, Mexichem, Centralfluor Industries Group and Zhejiang Wuyi Shenlong Flotation Co Ltd., Yaroslavsk Mining Company(RUSAL), Pars Gilsonite Reshad, Seaforth Mineral & Ore Co. Ltd., Sinochem Lantian Co., Ltd, SepFluor, China Kings Resources Group Co., Ltd., Inner Mongolia Xiang Zhen Mining Group Ltd., and Do-Fluoride Chemicals Co., Ltd. |

The global fluorite market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the fluorite market is projected to reach USD 3.8 billion by 2035.

The fluorite market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in fluorite market are stratiform replacement deposits, hydrothermal veins & stockworks and others.

In terms of grade, metallurgical grade fluorite segment to command 39.8% share in the fluorite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA