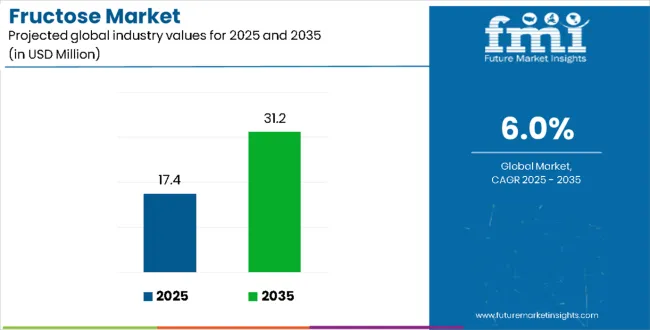

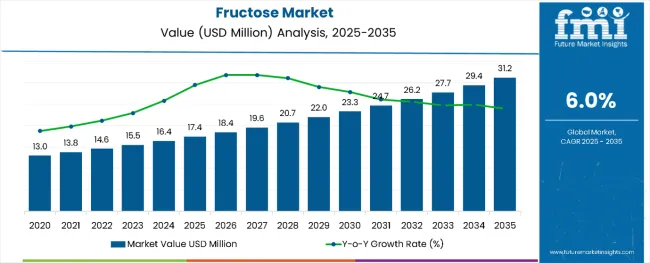

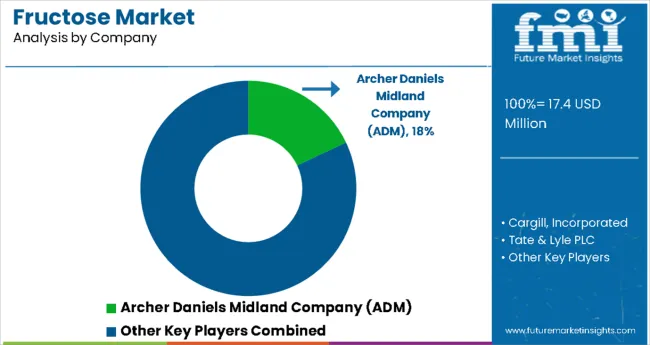

The global fructose market, valued at USD 17.4 billion in 2025, is expected to reach USD 31.2 billion by 2035, representing an absolute increase of USD 13.9 billion and a CAGR of about 6.0%.This translates into a total growth of 79.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing demand for natural sweeteners and growing applications in food and beverage industries.

Fructose Market Key Takeaways

| Metric | Value |

|---|---|

| Fructose Market (2025) | USD 17.4 Billion |

| Fructose Market (2035) | USD 31.2 Billion |

| CAGR (2025 to 2035) | 6.0% |

Between 2025 and 2030, the fructose market is projected to expand from USD 17.4 billion to USD 23.2 billion, resulting in a value increase of USD 5.8 billion, which represents 41.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for natural sweetening alternatives in processed foods, increasing consumer preference for low-glycemic index sweeteners, and growing applications in pharmaceutical and nutraceutical formulations. Manufacturers are expanding their production capabilities to address the growing demand for high-quality fructose products across various industrial applications.

From 2030 to 2035, the market is forecast to grow from USD 23.2 billion to USD 31.2 billion, adding another USD 8.1 billion, which constitutes 58.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of fructose applications in functional foods, integration of advanced processing technologies, and development of specialized fructose formulations for specific dietary requirements. The growing adoption of clean-label ingredients and natural sweetening solutions will drive demand for more sophisticated processing methods and specialized product variants.

Between 2020 and 2025, the fructose market experienced steady expansion, driven by increasing health consciousness among consumers and growing awareness of natural sweetening alternatives. The market developed as food and beverage manufacturers recognized the functional benefits of fructose in product formulations. Healthcare professionals and nutritionists began emphasizing the importance of alternative sweeteners for diabetic and health-conscious consumers seeking better sugar substitutes.

Market expansion is being supported by the increasing consumer demand for natural sweetening alternatives and the corresponding need for low-glycemic index sweeteners in food formulation and beverage applications. Modern food processing systems rely on fructose for maintaining product quality while providing enhanced sweetness levels without compromising taste profiles. Even minor formulation changes require comprehensive testing and validation to maintain optimal product performance and consumer acceptance.

The growing awareness of health implications associated with traditional sugar consumption and increasing regulatory focus on sugar reduction are driving demand for high-quality fructose products from certified suppliers with appropriate processing methods and expertise. Food manufacturers are increasingly incorporating fructose into product formulations following clinical evidence demonstrating metabolic advantages. Quality standards and food safety regulations are establishing standardized processing procedures that require specialized equipment and trained technicians.

The market segments include source, product type, application, and region. The source segment covers sugarcane, sugar beet, corn, and others such as (fruits, agave, tapioca & cassava, and sweet potatoes & Jerusalem artichoke). The product type segment includes high corn syrup, high corn syrup 42, high corn syrup 55, high corn syrup 65, high corn syrup 90, syrups, and solids. The application segment comprises sports applications, dairy-based products, ice cream, milkshake, frozen desserts, yoghurt, beverages, non-alcoholic drinks, alcoholic drinks, baked goods, biscuits & cookies, cake, muffins and pastries, bread, other baked goods, cosmetics & personal care, medicinal syrups and baby foods, and others such as (sauces & condiments, canned fruits & preserves, breakfast cereals & granola, nutritional supplements, and pet food & animal nutrition). The regional segment includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

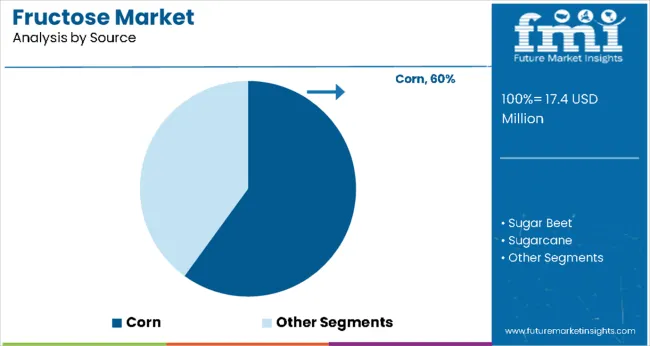

The corn segment is projected to account for 60% of the fructose market in 2025. This leading share is supported by the widespread availability of corn as a raw material and established processing infrastructure for corn-based fructose production across major agricultural regions. Corn-derived fructose provides consistent quality and cost-effectiveness, making it the preferred source for most commercial applications in food manufacturing and beverage production. The segment benefits from established supply chains and comprehensive processing capabilities from multiple suppliers, ensuring reliable raw material procurement and consistent product specifications.

Agricultural advantages including high corn yield potential, advanced farming techniques, and favorable growing conditions contribute to stable pricing and supply security for fructose manufacturers. Processing facilities equipped with specialized enzymatic conversion systems enable efficient transformation of corn starch into high-quality fructose products. The corn segment also benefits from government agricultural policies supporting corn production and trade frameworks facilitating international corn commodity markets. Environmental sustainability initiatives and crop rotation practices further enhance the long-term viability of corn-based fructose production across global markets.

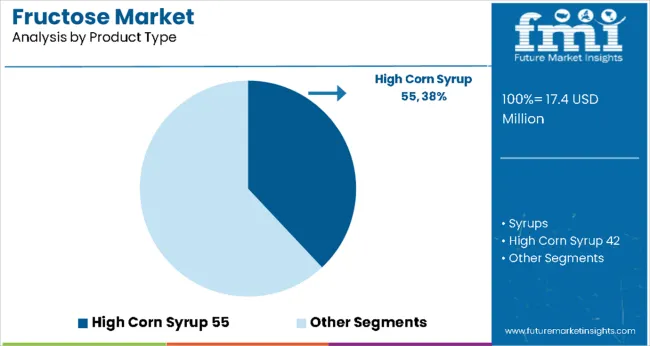

High corn syrup 55 is expected to represent 38% of fructose market demand in 2025. This dominant share reflects the optimal sweetness profile and functional characteristics of this product variant in food and beverage applications across diverse commercial formulations. High corn syrup 55 provides ideal sweetness levels and processing stability for various applications including soft drinks, baked goods, processed foods, and confectionery products. The segment benefits from established manufacturing processes and growing adoption across multiple industry verticals requiring consistent sweetening performance and functional reliability.

The 55% fructose content delivers superior taste characteristics compared to traditional sucrose while maintaining cost advantages over pure fructose alternatives. Food manufacturers prefer this formulation for its excellent solubility properties, extended shelf stability, and compatibility with existing production systems. Processing advantages include reduced crystallization risk, enhanced moisture retention in baked products, and improved fermentation characteristics in beverage applications. The segment also benefits from regulatory approvals across major markets and established quality standards that ensure consistent performance in large-scale commercial food production operations.

The fructose market is advancing steadily due to increasing health consciousness and growing recognition of natural sweetener importance. However, the market faces challenges including fluctuating raw material costs, regulatory concerns regarding high-fructose corn syrup consumption, and varying quality standards across different regions. Health awareness campaigns and nutritional labeling requirements continue to influence consumer preferences and market development patterns.

Expansion of Health-Conscious Food Formulations

The growing deployment of fructose in health-focused food formulations is enabling development of products targeting diabetic consumers, weight management applications, and functional food categories. Advanced formulations incorporating natural fructose provide controlled sweetness levels while reducing overall sugar content in processed foods. These applications are particularly valuable for food manufacturers seeking clean-label ingredients and consumers focusing on dietary restriction compliance.

Integration of Advanced Processing and Purification Technologies

Modern fructose producers are incorporating advanced processing technologies and automated purification systems that improve product purity and reduce processing costs. Integration of enzyme technology and continuous processing systems enables more efficient fructose extraction and comprehensive quality control. Advanced processing equipment also supports production of specialized fructose variants including crystalline fructose and high-purity liquid formulations for pharmaceutical applications.

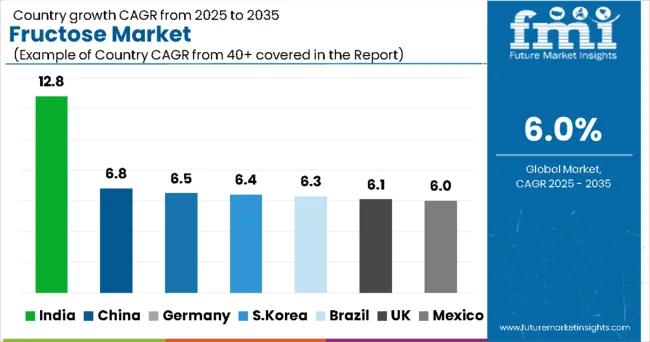

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 12.8% |

| China | 6.8% |

| Germany | 6.5% |

| South Korea | 6.4% |

| Brazil | 6.3% |

| United Kingdom | 6.1% |

| Mexico | 6.0% |

The fructose market is growing rapidly across key regions, with India leading at a 12.8% CAGR through 2035, driven by expanding food processing industry, growing consumer awareness of alternative sweeteners, and increasing demand for functional food ingredients. China follows at 6.8%, supported by massive food manufacturing sector and government initiatives promoting healthier food formulations. Germany records 6.5% growth, emphasizing quality standards, advanced processing technologies, and export market development. South Korea shows 6.4% expansion, focusing on innovative food applications and health-conscious consumer trends. Brazil demonstrates 6.3% growth through expanding beverage industry and increasing adoption of natural sweetening solutions, while the United Kingdom and Mexico both achieve 6.0% growth with emphasis on sugar reduction initiatives and processed food manufacturing expansion.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from fructose in India is projected to exhibit the highest growth rate with a CAGR of 12.8% through 2035, driven by rapid expansion of the food processing industry and increasing consumer awareness of alternative sweetening solutions. The country's growing middle-class population and rising disposable income are creating significant demand for processed foods and beverages containing natural sweeteners. Major food manufacturers and beverage companies are establishing comprehensive supply chains to support the growing population seeking healthier food alternatives across urban and rural markets.

Revenue from fructose in China is expanding at a CAGR of 6.8%, supported by the country's massive food manufacturing sector and increasing integration of health-focused ingredients in processed food formulations. The expanding beverage industry and growing consumer preference for natural sweetening alternatives are driving demand for high-quality fructose products. Domestic manufacturers and international companies are gradually establishing production capabilities to serve the growing population seeking functional food and beverage options.

Revenue from fructose in Germany is growing at a CAGR of 6.5%, driven by the country's advanced food processing infrastructure and growing emphasis on natural ingredient applications in food manufacturing. German food companies are gradually integrating fructose into various product formulations while maintaining strict quality control standards. Food manufacturers and ingredient suppliers are investing in fructose processing technologies and product development to address growing market demand for alternative sweetening solutions.

Demand for fructose in South Korea is projected to grow at a CAGR of 6.4%, supported by the country's emphasis on food innovation and growing consumer focus on health-conscious dietary choices. Korean food manufacturers and beverage companies are implementing comprehensive fructose applications that meet consumer preferences for functional ingredients and natural sweetening alternatives. The market is characterized by focus on product innovation, advanced formulation technologies, and compliance with comprehensive food safety regulations.

Demand for fructose in Brazil is expanding at a CAGR of 6.3%, driven by the country's expanding beverage industry and growing consumer preference for natural sweetening alternatives in processed foods. Brazilian food manufacturers and beverage companies are establishing comprehensive fructose applications to serve diverse consumer needs. The market benefits from agricultural raw material availability and increasing regulatory support for natural ingredient applications in food formulations.

Demand for fructose in the United Kingdom is projected to grow at a CAGR of 6.1%, driven by government sugar reduction initiatives and increasing consumer awareness of alternative sweetening solutions. British food manufacturers are implementing comprehensive fructose applications that support sugar reduction targets while maintaining product quality and consumer acceptance. The market benefits from regulatory clarity and consumer preference for natural ingredient alternatives following health awareness campaigns.

Revenue from fructose in Mexico is expanding at a CAGR of 6.0%, supported by the country's growing processed food manufacturing sector and increasing adoption of alternative sweetening solutions in beverage applications. Mexican food companies and beverage manufacturers are establishing comprehensive fructose processing capabilities to serve domestic and export markets. The market is characterized by focus on cost-effective formulations, quality consistency, and compliance with international food safety standards.

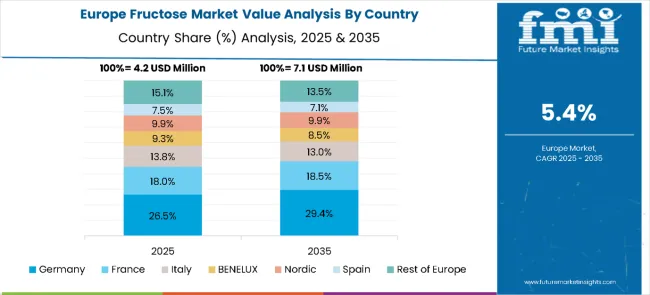

The fructose market in Europe is projected to grow from USD 4.2 million in 2025 to USD 7.1 million by 2035, registering a CAGR of 5.4% over the forecast period. Germany is expected to lead with a 26.5% share in 2025, followed by France at 18.0%, supported by strong demand in food and beverage applications. Italy accounts for 13.8% of the market, while BENELUX represents 9.3% and the Nordic countries hold 9.9%. Spain contributes 7.5%, and the Rest of Europe collectively makes up 15.1%. By 2035, Germany will further expand its leadership to 29.4%, France will reach 18.5%, and Italy will hold 13.0%. BENELUX and the Nordic region are projected at 8.5% and 9.9%, respectively, while Spain will decline slightly to 7.1%, and the Rest of Europe will adjust to 13.5%, signaling a stronger consolidation of demand in Europe’s largest food and beverage processing hubs.

The fructose market is defined by competition among major agricultural processing companies, specialized sweetener manufacturers, and integrated food ingredient suppliers. Companies are investing in advanced processing equipment, quality control systems, standardized procedures, and research capabilities to deliver pure, consistent, and cost-effective fructose solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Archer Daniels Midland Company (ADM), United States-based, holds an 18% market position and offers comprehensive fructose products with a focus on quality consistency and application versatility. Cargill Incorporated provides integrated fructose solutions across agricultural processing and food ingredient manufacturing operations. Tate & Lyle PLC, United Kingdom, delivers technologically advanced fructose products with standardized quality and global distribution capabilities. Ingredion Incorporated emphasizes specialized formulations and customer-specific applications for diverse food industry requirements.

DuPont de Nemours Inc. offers fructose solutions integrated into comprehensive food ingredient portfolios. These companies provide specialized processing expertise, standardized quality procedures, and reliable supply capabilities across global and regional networks, focusing on food and beverage applications, pharmaceutical formulations, and industrial processing requirements.

Fructose sits at the crossroads of sweetener formulation, calorie-management debates, and ingredient sourcing shifts. Its uses span high-fructose syrups for beverages and confectionery, crystalline fructose for specialty formulations, and niche roles in pharmaceuticals and fermentation feedstocks. The market’s trajectory will be shaped not only by demand-side trends (health, label claims, and reformulation) but by how policy, standards bodies, equipment makers, ingredient suppliers, and capital providers act together to balance cost, sustainability and consumer trust.

Key Players in the Fructose Market

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 17.4 Billion |

| Source | Corn, Sugar Beet, Sugarcane, Others (Fruits, Agave, Tapioca & Cassava, and Sweet Potatoes & Jerusalem Artichoke) |

| Product Type | High Corn Syrup (High Corn Syrup 55, High Corn Syrup 42, High Corn Syrup 65, High Corn Syrup 90), Syrups, Solids |

| Application | Sports Applications, Dairy-based Products, Ice Cream, Milkshake, Frozen Desserts, Yoghurt, Beverages, Non-Alcoholic Drinks, Alcoholic Drinks, Baked Goods, Biscuits & Cookies, Cake, Muffins and Pastries, Bread, Other Baked Goods, Cosmetics & Personal Care, Medicinal Syrups and Baby Foods, and Others (Sauces & Condiments, Canned Fruits & Preserves, Breakfast Cereals & Granola, Nutritional Supplements, and Pet Food & Animal Nutrition). |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countr ies Covered | India, China, Germany, South Korea, Brazil, United Kingdom, Mexico |

| Key Companies Profiled | Archer Daniels Midland Company (ADM); Cargill Incorporated; Tate & Lyle PLC; Ingredion Incorporated; DuPont de Nemours Inc. |

| Additional Attributes | Dollar sales by source and product type, regional demand trends across Asia Pacific, North America, and Europe, competitive landscape with established agricultural processing companies, buyer preferences for corn-based versus alternative source formulations, integration with food manufacturing and beverage applications, innovations in processing technologies and purification systems, and adoption of specialized fructose variants with enhanced functionality and quality consistency for pharmaceutical and food industry applications. |

The industry is expected to reach USD 31.3 million by 2035.

The industry is projected to grow at a CAGR of 6% during 2025–2035.

High-fructose corn syrup (HFCS), especially HFCS 42 and 55, remains the dominant form used in processed foods and drinks.

The United States, China, and India are among the top regions driving global fructose consumption and supply.

Functional beverages, infant nutrition, and clean-label bakery products are witnessing rising fructose integration.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glucose-Fructose Syrup Market – Growth, Demand & Food Industry Trends

Crystalline Fructose Market Growth - Trends & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA