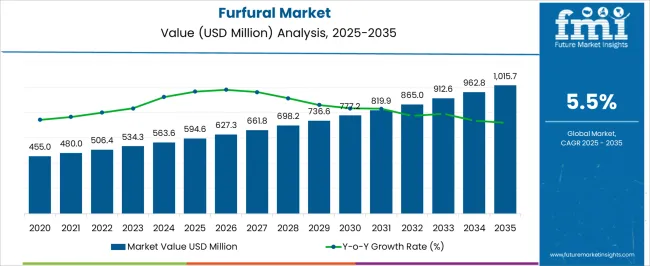

The Furfural Market is estimated to be valued at USD 594.6 million in 2025 and is projected to reach USD 1015.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Furfural Market Estimated Value in (2025 E) | USD 594.6 million |

| Furfural Market Forecast Value in (2035 F) | USD 1015.7 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The furfural market is experiencing steady expansion, supported by its increasing role as a key bio-based chemical used in diverse industrial applications. Derived primarily from agricultural residues such as corn cobs, sugarcane bagasse, and rice husks, furfural has gained traction as a sustainable alternative to petroleum-based chemicals. Its demand is being influenced by the global shift toward renewable feedstocks, growing regulatory emphasis on reducing carbon emissions, and rising awareness of circular economy practices.

Advances in biomass conversion technologies are improving production efficiency and lowering costs, making furfural more competitive in the global chemicals sector. Expanding applications in resins, solvents, and intermediate chemicals are reinforcing its adoption across multiple industries, including construction, automotive, and agriculture.

Moreover, the push for eco-friendly binders and bio-based polymers is opening new opportunities for furfural derivatives As industrial demand for sustainable solutions continues to grow and governments tighten environmental compliance standards, the furfural market is well positioned to achieve sustained growth, supported by both technological innovation and strong end-user adoption trends.

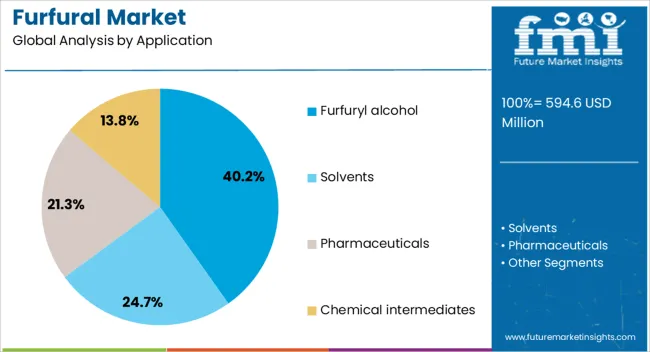

The furfural market is segmented by application, and geographic regions. By application, furfural market is divided into Furfuryl alcohol, Solvents, Pharmaceuticals, and Chemical intermediates. Regionally, the furfural industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The furfuryl alcohol segment is projected to account for 40.2% of the furfural market revenue share in 2025, establishing itself as the leading application. This dominance is being supported by the widespread use of furfuryl alcohol in the production of resins, which are extensively employed in foundry sand binders, coatings, and composite materials. Its excellent wetting and binding properties, combined with high thermal resistance, make it an indispensable component in industrial manufacturing processes.

Increasing demand for eco-friendly resins in the construction and automotive industries is further driving growth, as furfuryl alcohol offers a bio-based solution with lower environmental impact compared to synthetic alternatives. The segment is also benefiting from expanding use in the production of corrosion-resistant materials, adhesives, and specialty chemicals, which support diverse industrial applications.

Rising focus on sustainable and high-performance materials is reinforcing the position of furfuryl alcohol as the preferred derivative of furfural As industries increasingly prioritize bio-based feedstocks and energy efficiency, the furfuryl alcohol segment is expected to maintain its leadership in the global market.

APAC region is forecast to maintain its dominant position over the stipulated time-frame of 2025-2035. The prime element catering to market development in the region is the increasing production facilities being established in the region, particularly in China. Additionally, expanding numerous end-use industries, such as food and beverage, pharmaceutical, agriculture, and refinery. Furthermore, rising demand for furfural from the foundry and chemical industries is also predicted to add to the momentum of regional market growth.

Globally, demand for furfural is anticipated to grow significantly owing to increasing demand for green chemical. Other factors driving the demand for furfural includes environmental awareness to renewable alternatives in order to replace fossil resources and increasing production in developing countries.

Raw materials such as agro products and wastes are widely available in developing countries such as India, China, Indonesia and Malaysia with a low production cost. This is in turn expected to lead towards efficient raw material procurement from these countries leading to increasing availability of furfural across the globe.

Demand for furfural in pharmaceutical industry is expected to witness significant increase in the near future. However, inefficient technological advancement and lack of production process framework, restrain the furfural market globally.

Furfural being renewable in nature is anticipated to witness increased adoption among various end use industries. Also, development of efficient and new technologies is a key factor leading to create furfural product possibilities in chemical industry.

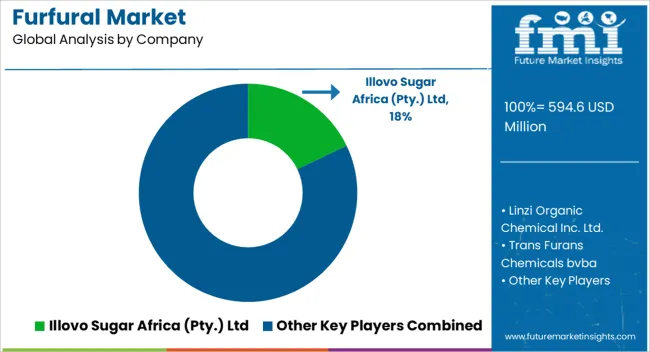

Some of the key players in the furfural market are Hongye Holding Group Corporation Ltd., Arcoy Biorefinery Pvt. Ltd., Corporation, Ltd., Central Romana, KRBL Ltd., Illovo Sugar Ltd., Lenzing AG, Penn A Kem LLC, Tanin Sevnica d.d., Linzi Organic Chemicals Inc. Ltd., Tieling North Furfural (Group) Co., Ltd., Silvateam S.p.A., and Xingtai Chunlei Furfuryl Alcohol Co., Ltd.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

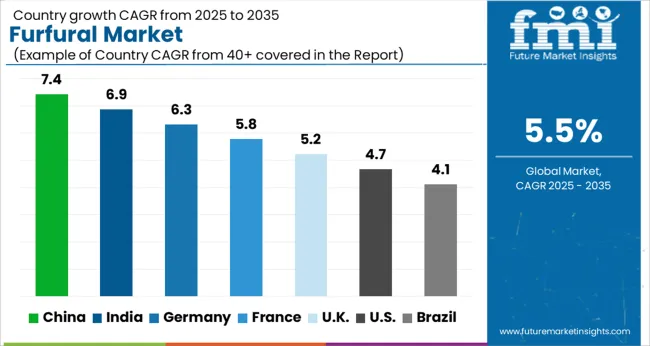

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Furfural Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Furfural Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Furfural Market is estimated to be valued at USD 212.6 million in 2025 and is anticipated to reach a valuation of USD 335.8 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 29.0 million and USD 18.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 594.6 Million |

| Application | Furfuryl alcohol, Solvents, Pharmaceuticals, and Chemical intermediates |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Illovo Sugar Africa (Pty.) Ltd, Linzi Organic Chemical Inc. Ltd., Trans Furans Chemicals bvba, Central Romana Corporation, DalinYebo, Hebeichem, KRBL Ltd., Silva team S.p.a., and LENZING AG |

The global furfural market is estimated to be valued at USD 594.6 million in 2025.

The market size for the furfural market is projected to reach USD 1,015.7 million by 2035.

The furfural market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in furfural market are furfuryl alcohol, solvents, pharmaceuticals and chemical intermediates.

In terms of , segment to command 0.0% share in the furfural market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA