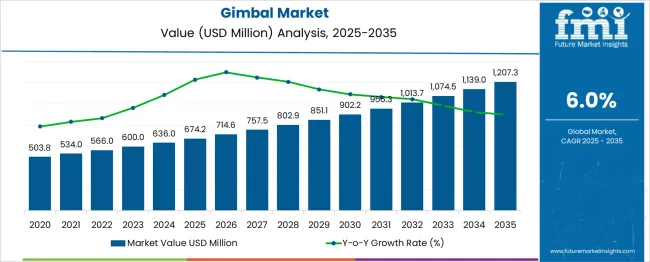

The Gimbal Market is estimated to be valued at USD 674.2 million in 2025 and is projected to reach USD 1207.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. This growth represents an absolute increase of USD 533.1 million over the forecast period. The steady rise in market value reflects expanding applications in sectors such as cinematography, drones, robotics, and augmented reality, where precise stabilization solutions are increasingly essential. The yearly progression highlights a consistent upward trend, with market values advancing gradually from USD 674.2 million in 2025 to USD 757.5 million by 2027, reaching USD 1,074.5 million in 2033, and culminating at USD 1,207.3 million in 2035.

This sustained increase demonstrates the market’s ability to capitalize on technological enhancements and growing consumer and industrial adoption. The absolute dollar opportunity underscores significant revenue potential for stakeholders, including manufacturers and suppliers, as demand for advanced gimbal systems intensifies globally. The cumulative growth of over half a billion USD reflects the market’s expanding footprint and the increasing preference for stabilization technology across various end-use industries. The Market’s absolute dollar opportunity points to steady financial gains fueled by innovation and diversified applications, positioning it for solid long-term expansion through 2035.

| Metric | Value |

|---|---|

| Gimbal Market Estimated Value in (2025 E) | USD 674.2 million |

| Gimbal Market Forecast Value in (2035 F) | USD 1207.3 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Gimbal market is progressing steadily as demand surges for stabilized imaging solutions across consumer electronics, content creation, and industrial applications. Growth has been reinforced by increasing adoption of smartphones and action cameras, along with the expansion of social media platforms that rely heavily on high-quality video content. Gimbals are being recognized not only for their stabilization features but also for their integration with intelligent tracking, gesture control, and wireless communication capabilities.

As manufacturers invest in improving motor efficiency, battery life, and multi-axis control, software enhancements are further refining user experience and performance outcomes. Technological advancements have allowed the market to transition from bulky, professional equipment to compact, consumer-friendly solutions without compromising functionality.

The future trajectory of the market is likely to benefit from growing enthusiasm for mobile filmmaking, influencer content, and virtual tourism. Strong adoption from consumer and commercial segments alike continues to ensure consistent demand for versatile gimbal systems across a wide range of uses..

The gimbal market is segmented by product type, application, end-user, distribution channel, and geographic regions. By product type, the gimbal market is divided into Axis-based and Mechanism-based. In terms of application, the gimbal market is classified into Smartphone cameras, DSLR/mirrorless cameras, Action cameras, Drone/UAV cameras, Professional camcorders, Virtual reality/3600 cameras, Industrial applications, Security/surveillance applications, and other applications. The end-user of the gimbal market is segmented into Consumer, Professional videographers/filmmakers, Commercial users, Government/military, and Research/educational institutions. The distribution channel of the gimbal market is segmented into Online channels and Offline channels. Regionally, the gimbal industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

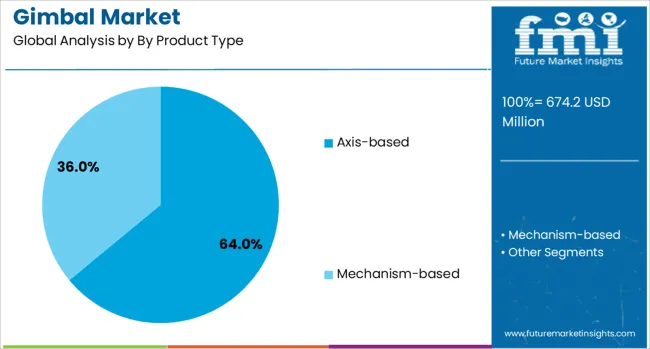

The axis-based segment is expected to account for 64% of the Gimbal market revenue share in 2025, establishing it as the leading product type. This dominance has been driven by the ability of axis-based gimbals to deliver precise stabilization across multiple planes of movement, ensuring smoother footage in dynamic and unpredictable conditions. These systems typically include two or three motorized axes, allowing for enhanced control of pitch, roll, and yaw motions.

Their popularity has grown due to adaptability across various camera platforms including smartphones, DSLRs, and action cameras. Manufacturers have focused on making these gimbals more lightweight, intuitive, and compatible with mobile apps, which has broadened their accessibility among hobbyists and professional users alike.

As content creators seek improved production value, the demand for axis-based systems has remained consistent. Their ability to integrate additional software features such as subject tracking and scene modes has further reinforced their strong market positioning and continued preference in stabilization equipment..

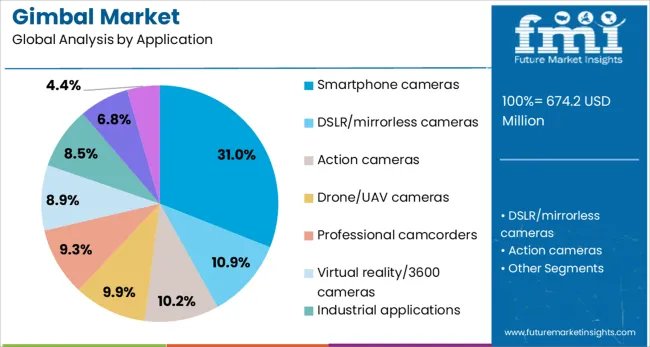

The smartphone cameras segment is projected to hold 31% of the Gimbal market revenue share in 2025, positioning it as the leading application. This leadership has been reinforced by the explosive growth of mobile content creation across social media, live streaming, and online entertainment platforms. With smartphone manufacturers continuously enhancing camera hardware and software, consumers are seeking external stabilization tools to complement these advancements.

Gimbals designed for smartphones have gained popularity for their compact size, user-friendly interfaces, and real-time connectivity with mobile apps. The demand has been further stimulated by increased usage of smartphones for vlogging, travel documentation, and virtual presentations.

Enhanced affordability and availability of smartphone-compatible gimbals have also played a crucial role in expanding their use beyond professionals to everyday users. As the need for cinematic mobile video continues to rise, smartphone camera stabilization systems are expected to maintain their leadership across both amateur and semi-professional domains..

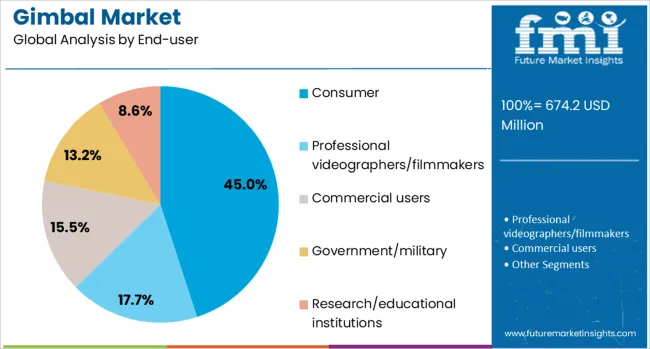

The consumer segment is anticipated to command 45% of the Gimbal market revenue share in 2025, marking it as the dominant end-user category. This leadership has been driven by the rising trend of personal content creation, travel videography, and recreational photography among hobbyists and casual users. With increasing ownership of high-performance smartphones and affordable action cameras, consumers are actively seeking ways to elevate video quality through stabilization.

Gimbals designed for the consumer market have evolved with simplified controls, ergonomic designs, and seamless integration with social media platforms, making them more approachable to non-technical users. Additionally, lifestyle trends centered on digital storytelling and self-expression have continued to encourage the use of gimbals in everyday scenarios.

The commercial availability of compact, app-connected models has further fueled adoption across diverse age groups and demographics. As consumers increasingly prioritize visual quality in their content, the gimbal's role in enhancing creative expression and video clarity remains central to market expansion.

The market has been expanding steadily as demand for stabilized imaging and motion control systems grows across multiple industries. Gimbals, which provide precise control and stabilization of cameras and sensors, have found widespread application in consumer electronics, filmmaking, drones, robotics, and surveillance. Market growth has been influenced by the proliferation of content creation, unmanned aerial vehicles, and automated systems requiring steady and smooth capture. Technological improvements in brushless motors, sensors, and control algorithms have enhanced gimbal performance and user experience.

Stabilization technologies have been significantly improved to enhance the accuracy and responsiveness of gimbal systems. The integration of advanced inertial measurement units (IMUs), gyroscopes, and accelerometers has enabled real-time compensation for vibrations and unwanted movements. Brushless motors with higher torque and precision control algorithms have contributed to smoother motion and extended operational life. The development of multi-axis gimbals capable of stabilizing across three or more axes has expanded application versatility. Software-based image stabilization and automated tracking features have been incorporated to provide superior user control. These technological advancements have made gimbals more effective for professional cinematography, aerial photography, and industrial automation, leading to increased demand and innovation within the market.

The drone and robotics sectors have been key drivers for the gimbal market expansion, as stable imaging and sensor positioning are critical in these fields. Drones equipped with gimbal-stabilized cameras enable high-resolution aerial photography, surveillance, mapping, and inspection tasks. In robotics, gimbals facilitate precise sensor orientation, enhancing navigation, obstacle avoidance, and task execution. The growth of commercial and defense drone usage has increased demand for compact, lightweight, and durable gimbal systems capable of withstanding harsh environments. Robotics applications in manufacturing, agriculture, and logistics also benefit from gimbal integration to improve operational efficiency. These sectors continue to push advancements in gimbal design, including ruggedization, payload capacity, and autonomous control capabilities.

The proliferation of consumer electronics incorporating gimbal technology has been a significant factor in market growth. Smartphones, action cameras, and wearable devices increasingly feature built-in or attachable gimbal stabilizers to enhance video and photography quality. The rise of social media platforms and video content creation has fueled demand for portable and user-friendly gimbal solutions among consumers. Affordable and compact handheld gimbals have become popular accessories, enabling smooth footage capture without professional equipment. Furthermore, gaming and virtual reality devices utilize gimbals for motion tracking and immersive experiences. Manufacturers have focused on miniaturization, wireless connectivity, and battery efficiency to cater to consumer preferences, broadening the market reach across demographics and geographies.

Miniaturization and seamless integration of gimbal systems present both challenges and opportunities within the market. Reducing size and weight while maintaining stabilization performance requires advancements in motor technology, sensor accuracy, and control algorithms. Power consumption and thermal management are critical considerations in compact designs, especially for battery-operated devices. Integration with diverse platforms such as smartphones, drones, and autonomous vehicles demands customization and interoperability. However, these challenges have spurred innovation in materials science, embedded systems, and artificial intelligence-based control. Opportunities exist in developing multifunctional gimbals combining stabilization with augmented reality, advanced tracking, and sensor fusion. Collaborations between hardware and software developers are expected to drive next-generation gimbal solutions, expanding applications and market potential.

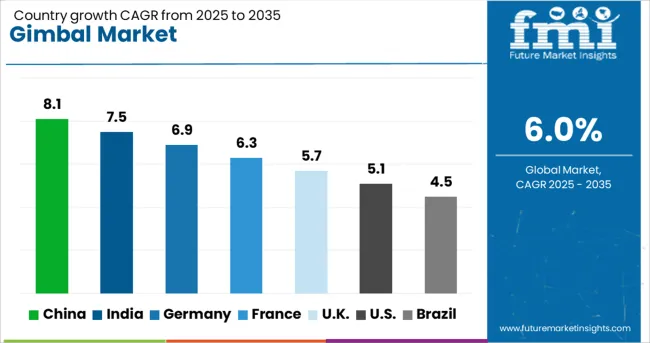

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The market is projected to grow at a CAGR of 6.0% between 2025 and 2035, driven by rising demand for stabilized imaging systems in consumer electronics, film production, and drone applications. China leads with an 8.1% CAGR, supported by large-scale manufacturing capabilities and growing domestic demand. India follows at 7.5%, fueled by increasing adoption in photography and videography sectors. Germany, at 6.9%, benefits from advanced engineering and innovation in precision stabilization technologies. The UK, growing at 5.7%, focuses on integrating gimbals in emerging media production techniques. The USA, with a 5.1% CAGR, experiences steady growth driven by innovation and expanding use in aerial and handheld devices. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 8.1% from 2025 to 2035, supported by increasing demand for stabilized camera systems in consumer electronics and commercial drones. Leading manufacturers such as Zhiyun and DJI are innovating with lightweight materials and advanced motor controls to enhance device stability and performance. The rise in content creation and live streaming has accelerated adoption across digital media sectors. Strategic investments in smart manufacturing and automation are optimizing production capabilities. Collaborations between camera manufacturers and technology firms further drive technological improvements, strengthening China’s position in the global gimbal supply chain.

India’s market is projected to grow at a CAGR of 7.5% over the next decade, driven by rising smartphone penetration and increasing use of handheld stabilizers for video content. Domestic players and startups focus on affordable designs tailored to regional consumer preferences. Demand from film production and social media influencers is accelerating product adoption. Government initiatives to support electronics manufacturing and innovation ecosystems have strengthened the industry landscape. Growing online retail platforms have expanded distribution channels, increasing accessibility in tier 2 and tier 3 cities.

Germany’s gimbal demand is expected to grow at a CAGR of 6.9%, supported by the country’s strong audiovisual production sector and advanced manufacturing capabilities. Industry leaders like FeiyuTech collaborate with German firms to produce precision gimbals for film and broadcast applications. Adoption in industrial inspection drones and robotics is accelerating. Focus on high reliability and integration with imaging technologies drives innovation. Government funding for Industry 4.0 initiatives further boosts market development.

The United Kingdom’s market is projected to grow at a CAGR of 5.7% through 2035, fueled by growth in creative industries including film, advertising, and live events. Domestic companies emphasize user-friendly designs and compact stabilizers for mobile devices. The rise of virtual events and digital content creation enhances demand. Collaboration between hardware manufacturers and software developers facilitates innovation in control algorithms. Investments in training and skills development improve market readiness.

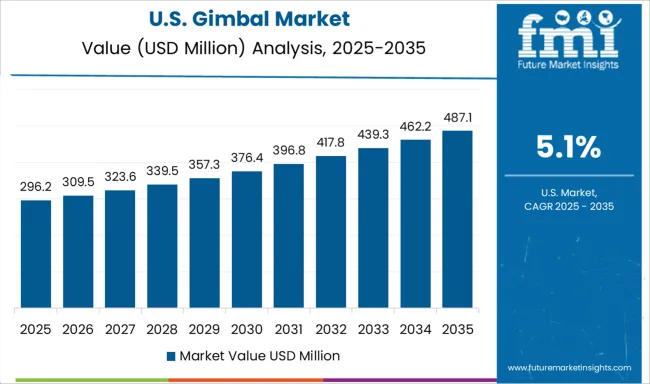

The market in the United States is forecast to grow at a CAGR of 5.1% from 2025 to 2035, primarily driven by demand in professional cinematography and drone applications. Leading companies such as Freefly Systems and Moza are developing high-end gimbals with enhanced motion control and wireless integration. Growth in e-commerce logistics and aerial photography are emerging as key drivers. Increasing investment in R&D for autonomous stabilization and AI-based control systems supports future expansion. The industry is influenced by collaborations between hardware developers and software innovators.

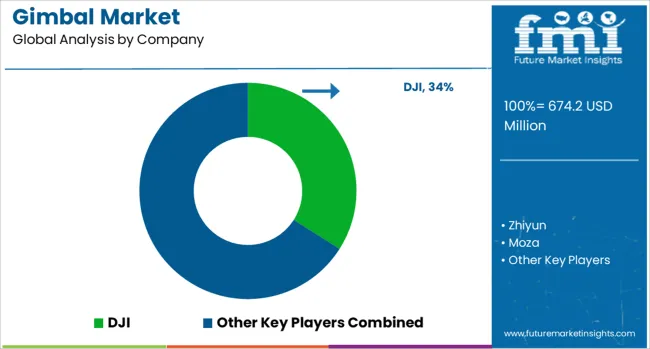

The market is primarily driven by key players focused on innovation and product diversification to meet growing demands in photography, videography, and drone stabilization. DJI stands out as a global leader, renowned for its advanced stabilization technology and integration of gimbals into its extensive drone portfolio. The company continuously invests in research and development to enhance precision and ease of use, maintaining a competitive edge. Zhiyun specializes in handheld gimbals, offering a range of products catering to both amateur and professional content creators. Its strategy includes frequent product launches targeting smartphone and mirrorless camera users, expanding its market share. Moza, under Gudsen Technology, emphasizes ergonomic designs and multi-functional features, appealing to filmmakers and vloggers.

FeiyuTech focuses on versatile gimbal solutions compatible with various devices, including action cameras and smartphones, leveraging innovation in motor control and battery life. Hohem targets budget-conscious consumers by providing affordable yet reliable stabilization equipment, expanding accessibility to broader market segments. These companies strengthen their positions through strategic partnerships, enhanced after-sales services, and expanding distribution channels globally. Entry barriers in the gimbal market include technical expertise in precision motor design and software stabilization algorithms. The evolving demand for high-quality, user-friendly stabilization tools ensures sustained competition and innovation among leading manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 674.2 Million |

| By Product Type | Axis-based and Mechanism-based |

| Application | Smartphone cameras, DSLR/mirrorless cameras, Action cameras, Drone/UAV cameras, Professional camcorders, Virtual reality/3600 cameras, Industrial applications, Security/surveillance application, and Other applications |

| End-user | Consumer, Professional videographers/filmmakers, Commercial users, Government/military, and Research/educational institutions |

| Distribution Channel | Online channels and Offline channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DJI, Zhiyun, Moza, FeiyuTech, Gudsen, and Hohem |

| Additional Attributes | Dollar sales by gimbal type and application sector, demand dynamics across consumer electronics, professional filmmaking, aerospace, and defense industries, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in brushless motor technology, AI-enabled stabilization algorithms, and lightweight composite materials, environmental impact of manufacturing processes, battery disposal, and device lifecycle, and emerging use cases in drone cinematography, virtual reality content creation, and precision targeting systems. |

The global gimbal market is estimated to be valued at USD 674.2 million in 2025.

The market size for the gimbal market is projected to reach USD 1,207.3 million by 2035.

The gimbal market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in gimbal market are axis-based, _2-axis gimbals, _3-axis gimbals, _4-axis and above gimbals, mechanism-based, _motorized gimbals and _manual gimbals.

In terms of application, smartphone cameras segment to command 31.0% share in the gimbal market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA