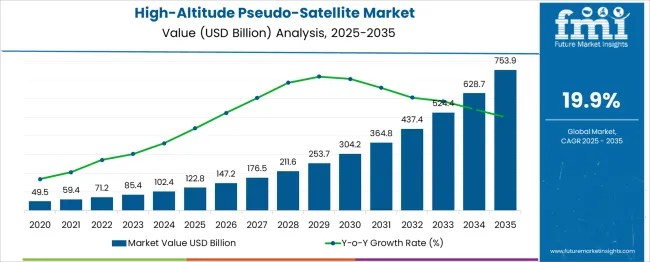

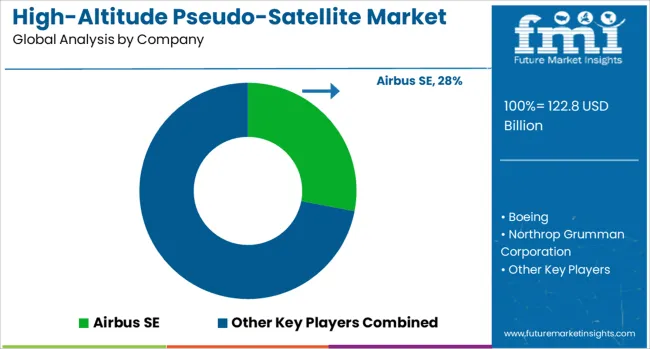

The High-Altitude Pseudo-Satellite Market is estimated to be valued at USD 122.8 billion in 2025 and is projected to reach USD 753.9 billion by 2035, registering a compound annual growth rate (CAGR) of 19.9% over the forecast period. A Peak-to-Trough Analysis highlights significant periods of acceleration and deceleration in the market’s growth. Between 2025 and 2030, the market grows from USD 122.8 billion to USD 304.2 billion, contributing USD 181.4 billion in growth, with a CAGR of 19.4%.

This early phase sees strong acceleration driven by advancements in aerospace technologies, increased demand for satellite communication systems, and growing applications in defense, surveillance, and broadband internet connectivity in remote areas.

The first peak occurs at USD 304.2 billion in 2030, followed by a deceleration between 2030 and 2032, where the market grows from USD 304.2 billion to USD 364.8 billion, adding USD 60.6 billion in growth, with a slightly lower CAGR of 9.6%. This slowdown reflects the market stabilizing as early investments and pilot programs mature.

From 2032 to 2035, the market experiences another acceleration, expanding from USD 364.8 billion to USD 753.9 billion, contributing USD 389.1 billion in growth, with a sharp CAGR of 27.9%. This rebound is driven by the widespread adoption of HAPS for global connectivity, with increasing demand for broadband solutions in underserved regions and improvements in the deployment of long-duration unmanned aerial vehicles. The Peak-to-Trough Analysis shows initial sharp growth, followed by a stabilization and a subsequent strong surge in demand.

| Metric | Value |

|---|---|

| High-Altitude Pseudo-Satellite Market Estimated Value in (2025 E) | USD 122.8 billion |

| High-Altitude Pseudo-Satellite Market Forecast Value in (2035 F) | USD 753.9 billion |

| Forecast CAGR (2025 to 2035) | 19.9% |

The High-Altitude Pseudo-Satellite (HAPS) market is experiencing notable growth fueled by the increasing demand for persistent aerial platforms capable of operating at stratospheric altitudes. The current market environment is being shaped by advancements in lightweight materials, solar power technologies, and autonomous flight systems which enable extended endurance and coverage. Industry announcements and technology-focused news highlight how governments and private enterprises are investing in these platforms to bridge the gap between satellites and traditional aircraft.

Future growth is expected to be influenced by the growing need for real-time surveillance, communication networks in remote areas, and disaster management capabilities. Investor presentations and company statements have also emphasized the role of regulatory support and international collaborations in accelerating deployments.

Sustainability initiatives and the ability to offer cost-effective alternatives to satellites have further reinforced the attractiveness of HAPS solutions in global markets. These combined factors are paving the way for continued market expansion across defense and commercial sectors alike.

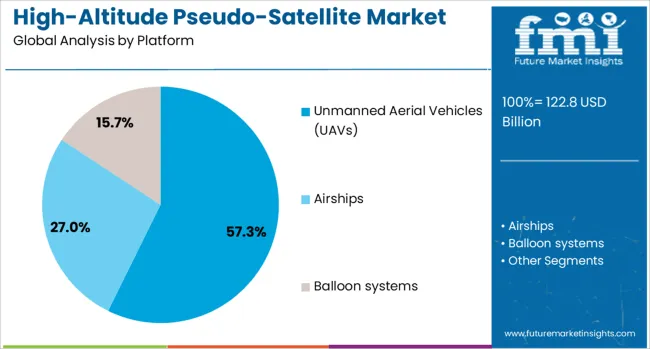

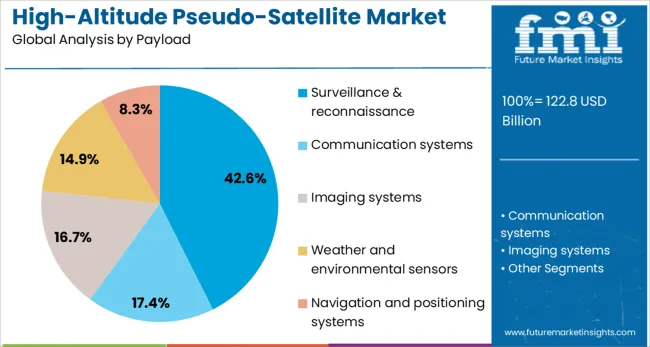

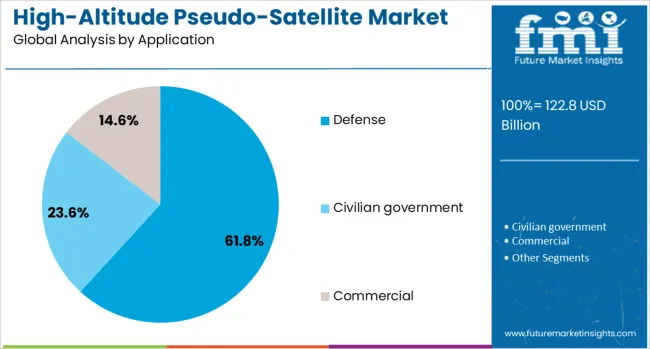

The high-altitude pseudo-satellite market is segmented by platform, payload, application deployment, and geographic regions. The high-altitude pseudo-satellite market is divided into Unmanned Aerial Vehicles (UAVs), Airships, and Balloon systems. In terms of payload, the high-altitude pseudo-satellite market is classified into Surveillance & reconnaissance, Communication systems, Imaging systems, Weather and environmental sensors, and Navigation and positioning systems.

The high-altitude pseudo-satellite market is segmented into Defense, Civilian government, and Commercial. The deployment of the high-altitude pseudo-satellite market is segmented into Land-based operations, Maritime operations, Polar regions, and Disaster-prone areas. Regionally, the high-altitude pseudo-satellite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The unmanned aerial vehicles (UAVs) platform is projected to account for 57.3% of the High-Altitude Pseudo-Satellite market revenue share in 2025, establishing it as the leading platform segment. This dominance is being attributed to the versatility, operational flexibility, and technological maturity of UAVs, as noted in aerospace industry publications and corporate product briefings. UAVs are being adopted widely due to their ability to sustain long-duration flights at high altitudes while carrying diverse payloads.

Company press releases have highlighted their capability to integrate advanced navigation, communication, and solar power systems which make them well suited for HAPS missions. Additionally, UAVs have been preferred for their lower development and operational costs compared to manned platforms while providing comparable effectiveness.

The scalability of UAV designs and their ability to be rapidly deployed in diverse operational scenarios have further strengthened their position. These advantages have collectively ensured the leadership of UAVs in the HAPS platform segment.

The surveillance and reconnaissance payload segment is expected to secure 42.6% of the High-Altitude Pseudo-Satellite market revenue share in 2025, maintaining its lead in the payload category. This leadership is being supported by increasing defense and security requirements for continuous monitoring of strategic regions, as highlighted in defense ministry statements and aerospace news articles. The integration of high-resolution sensors, real-time data transmission, and advanced analytics has improved the effectiveness of surveillance missions conducted from HAPS platforms.

Investor calls and product updates have pointed out the role of surveillance payloads in enabling intelligence gathering and situational awareness while minimizing the risk to personnel. Furthermore, rising geopolitical tensions and the need for persistent border surveillance have reinforced demand for these payloads.

Their adaptability to diverse mission profiles and ability to operate in contested or remote environments have sustained their dominance in the market. These drivers have ensured that surveillance and reconnaissance remains the most prominent payload segment.

The defense application segment is forecasted to hold 61.8% of the High-Altitude Pseudo-Satellite market revenue share in 2025, affirming its position as the largest application segment. This prominence has been driven by heightened military investments in persistent intelligence, surveillance, and reconnaissance capabilities, as evidenced by defense budgets and military procurement programs.

Defense agencies have increasingly favored HAPS platforms for their ability to operate undetected at high altitudes while providing continuous coverage over areas of interest. Corporate presentations and defense industry updates have noted that HAPS solutions enable enhanced command and control, early warning, and secure communication links in conflict zones and during peacekeeping operations.

The segment’s growth has also been reinforced by the platforms’ potential to support missile defense systems, electronic warfare, and border security missions. These strategic advantages combined with cost efficiency compared to satellite alternatives have cemented defense as the leading application area for HAPS platforms in the global market.

The high-altitude pseudo-satellite (HAPS) market is growing as industries seek advanced solutions for surveillance, communication, and data collection from the stratosphere. These systems, positioned at altitudes above commercial aircraft but below low Earth orbit, provide cost-effective, long-duration, high-resolution capabilities for various applications, including military surveillance, disaster management, and environmental monitoring. The growing demand for continuous connectivity and real-time data analytics drives the market. Despite challenges such as high operational costs and regulatory hurdles, the opportunities for market growth are significant, driven by advancements in solar-powered technology and miniaturized systems.

The demand for high-altitude pseudo-satellites is primarily driven by the growing need for real-time data and continuous connectivity in sectors like defense, disaster response, and environmental monitoring. These systems can provide persistent surveillance, communication, and monitoring capabilities over large areas without the high costs associated with traditional satellites. In military and defense applications, HAPS offer the ability to conduct surveillance missions with lower latency and at a fraction of the cost of low Earth orbit satellites. In addition, the increasing need for reliable communication in remote and underserved areas, especially in the face of natural disasters, further fuels the adoption of HAPS for providing broadband coverage and data collection services.

A key challenge facing the high-altitude pseudo-satellite market is the high operational costs, particularly related to launching, maintaining, and operating these systems. While HAPS are less expensive to deploy than traditional satellites, the cost of energy supply (such as solar power), maintenance, and ground infrastructure still represents a significant investment. Regulatory challenges, including airspace restrictions and the need to comply with aviation and satellite regulations, can complicate HAPS deployment. Governments and regulatory bodies need to establish clear policies for the use of HAPS in civilian and military operations, which can delay the development and implementation of these systems in some regions.

The HAPS market offers considerable opportunities driven by technological advancements, particularly in solar-powered systems. Solar-powered high-altitude pseudo-satellites offer a cost-effective, energy-efficient way to maintain long-duration operations in the stratosphere, reducing reliance on traditional power sources and extending mission durations. These systems can operate for weeks or even months, enabling continuous data collection without the need for frequent maintenance. As global industries look for more effective solutions in sectors such as telecommunications, environmental monitoring, and emergency response, HAPS present an opportunity to provide reliable services in areas where traditional satellites or terrestrial infrastructure may be lacking, opening new markets and applications.

A prominent trend in the high-altitude pseudo-satellite market is the ongoing miniaturization of technology and the integration of advanced payloads. As HAPS systems become smaller, lighter, and more efficient, their operational costs and energy consumption are reduced, making them more attractive for commercial and military applications. The development of advanced payloads, such as high-definition cameras, communications equipment, and environmental sensors, is enabling these systems to perform more specialized tasks, including real-time surveillance, climate monitoring, and communications in remote areas. Advancements in AI and data analytics are being integrated into HAPS operations, enhancing their ability to process large amounts of data in real time, improving their effectiveness in various applications.

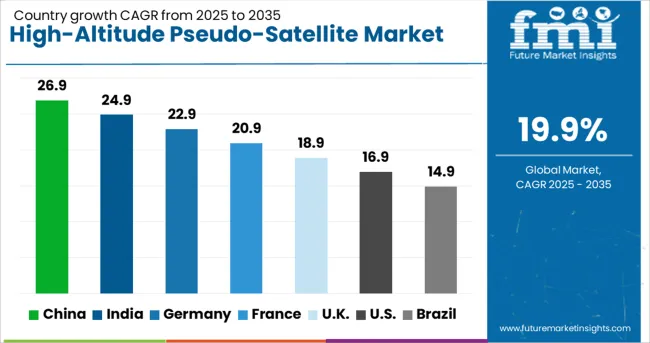

| Country | CAGR |

|---|---|

| China | 26.9% |

| India | 24.9% |

| Germany | 22.9% |

| France | 20.9% |

| UK | 18.9% |

| USA | 16.9% |

| Brazil | 14.9% |

The high-altitude pseudo-satellite (HAPS) market is projected to grow at an impressive CAGR of 19.9% from 2025 to 2035. China, part of the BRICS group, leads the market with a remarkable 26.9% growth rate, followed by India at 24.9%. Both countries are driving this growth through the rapid adoption of HAPS technologies for communication, surveillance, and environmental monitoring. In the OECD region, France is expected to grow at 20.9%, with the UK and USA showing more moderate growth rates of 18.9% and 16.9%, respectively. These developed markets experience steady demand, fueled by established infrastructure and ongoing investments in space, defense, and communication systems. The analysis spans 40+ countries, with the leading markets shown below.

The high-altitude pseudo-satellite market in China is expanding rapidly with a projected CAGR of 26.9%. The country’s strong focus on developing autonomous systems for communication, surveillance, and environmental monitoring is a major factor driving this growth. China’s government has prioritized the development of aerospace technologies, including HAPS, as part of its broader goals to enhance its space and defense capabilities. The increasing need for high-speed data transmission in remote areas and large-scale infrastructure projects further boosts the demand for high-altitude pseudo-satellites in China.

Sales of high-altitude pseudo-satellite in India is growing at a CAGR of 24.9%. The country’s expanding aerospace sector, along with its strategic focus on surveillance and communication technologies, fuels this growth. India’s remote regions, where traditional satellite coverage is limited, create strong demand for high-altitude pseudo-satellites to improve connectivity. The government’s push to enhance its defense and space capabilities supports investments in HAPS technology, further driving market expansion. The use of HAPS for environmental monitoring, disaster management, and agriculture also contributes to its growing popularity in India.

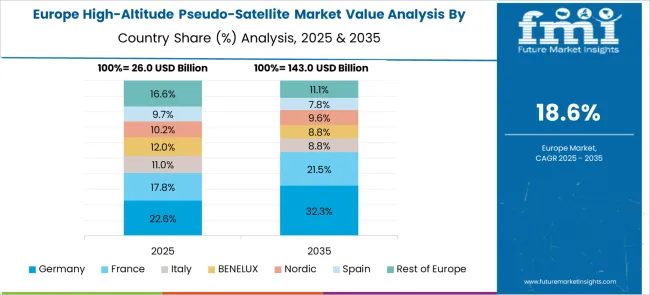

The high-altitude pseudo-satellite market in France is projected to grow at a CAGR of 20.9%. As a key player in the European aerospace sector, France is heavily investing in HAPS technology for both military and civilian purposes. The French government’s focus on enhancing surveillance capabilities and improving communication infrastructure in remote areas supports the demand for HAPS. France’s role in global space programs and its commitment to space-based innovations contribute to the growing adoption of high-altitude pseudo-satellites. The country is also leveraging HAPS for environmental monitoring and climate research.

The high-altitude pseudo-satellite market in the UK is expected to grow at a CAGR of 18.9%. The UK is increasingly focusing on HAPS for communication, surveillance, and scientific research. The government’s investments in space technologies and its ambitions to enhance defense capabilities are key drivers of the market. The UK also sees HAPS as a solution to improve connectivity in underserved regions, particularly in its rural and offshore territories. Moreover, the growing need for surveillance and monitoring of large-scale environmental projects in the UK continues to support demand for HAPS systems.

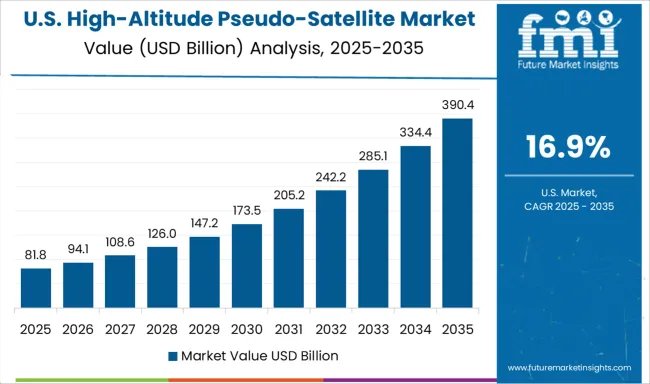

The USA high-altitude pseudo-satellite market is projected to grow at a CAGR of 16.9%. As a leader in space exploration and defense technologies, the USA continues to invest heavily in HAPS solutions for communication, surveillance, and reconnaissance. The country’s military applications for HAPS in defense and homeland security, combined with the commercial sector’s need for enhanced connectivity in remote regions, drive market growth. The USA is also leveraging HAPS for scientific purposes, such as climate research and disaster management, contributing to the technology’s expansion.

The high voltage commercial switchgear market is dominated by leading companies that provide advanced electrical solutions for the safe and efficient distribution of electricity in commercial, industrial, and infrastructure applications. ABB Ltd. is a market leader, offering a wide range of high-voltage switchgear solutions designed to meet global safety and efficiency standards, focusing on automation, smart grids, and sustainability. Siemens AG is another key player, providing innovative and reliable high voltage switchgear solutions, with a strong emphasis on energy management, grid integration, and digitalization.

Schneider Electric specializes in offering modular, smart, and eco-friendly switchgear solutions, integrating digital technologies and real-time monitoring for efficient power distribution and improved operational safety. Eaton Corporation delivers high-performance commercial switchgear designed for energy efficiency, fault protection, and load management, with a strong focus on sustainable energy solutions. Mitsubishi Electric Corporation provides robust and technologically advanced switchgear solutions that prioritize reliability, safety, and optimal power distribution in high-demand commercial environments.

Toshiba Corporation is also a prominent player, offering high-voltage switchgear that caters to various industries, focusing on innovative designs and advanced technologies to enhance system reliability and reduce energy loss.Competitive differentiation in this market is driven by product innovation, energy efficiency, compliance with international standards, and the ability to integrate with modern grid systems.

Barriers to entry include high capital investment, technology development costs, and the need for expertise in high-voltage electrical systems. Strategic priorities include developing smart switchgear solutions, improving energy management systems, and expanding into emerging markets with high infrastructure demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 122.8 Billion |

| Platform | Unmanned Aerial Vehicles (UAVs), Airships, and Balloon systems |

| Payload | Surveillance & reconnaissance, Communication systems, Imaging systems, Weather and environmental sensors, and Navigation and positioning systems |

| Application | Defense, Civilian government, and Commercial |

| Deployment | Land-based operations, Maritime operations, Polar regions, and Disaster-prone areas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus SE, Boeing, Northrop Grumman Corporation, BAE Systems, Thales Group, and Lockheed Martin Corporation |

| Additional Attributes | Dollar sales by switchgear type (circuit breakers, switch disconnectors, transformers) and end-use segments (commercial buildings, industrial facilities, infrastructure projects). Demand dynamics are influenced by the growing need for reliable power distribution, increasing demand for energy-efficient systems, and the adoption of smart grid technologies. Regional trends show strong growth in North America and Europe, driven by modernization of electrical grids and rising demand for sustainable energy solutions, while Asia-Pacific is expanding due to rapid industrialization and urbanization. |

The global high-altitude pseudo-satellite market is estimated to be valued at USD 122.8 billion in 2025.

The market size for the high-altitude pseudo-satellite market is projected to reach USD 753.9 billion by 2035.

The high-altitude pseudo-satellite market is expected to grow at a 19.9% CAGR between 2025 and 2035.

The key product types in high-altitude pseudo-satellite market are unmanned aerial vehicles (uavs), airships and balloon systems.

In terms of payload, surveillance & reconnaissance segment to command 42.6% share in the high-altitude pseudo-satellite market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA