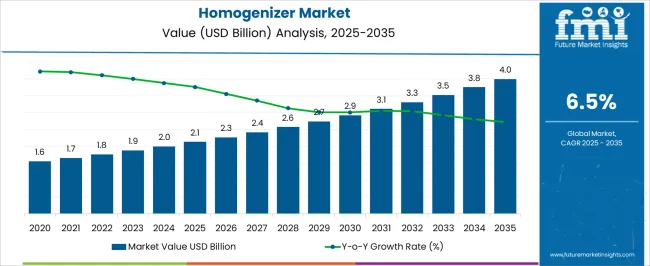

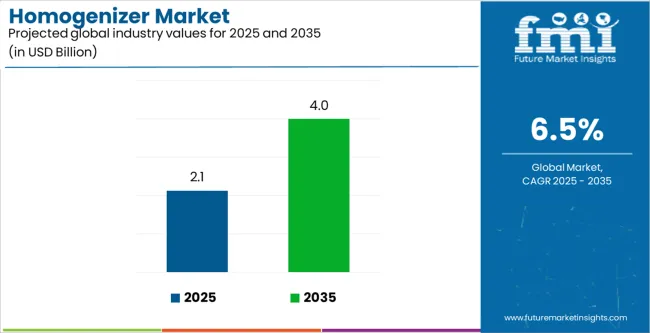

The Homogenizer Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The homogenizer market is experiencing steady growth driven by increasing demand from the food and beverage, pharmaceutical, and biotechnology industries. Current market dynamics are being shaped by technological advancements, process optimization, and the rising need for product consistency and enhanced texture in end-use applications. Manufacturers are focusing on improving energy efficiency, automation, and scalability of homogenization systems to cater to diverse industrial requirements.

The expansion of dairy processing, functional food production, and liquid formulation development is further stimulating adoption. The future outlook remains positive as investments in advanced manufacturing and high-pressure technologies continue to rise.

Stringent quality and safety regulations are encouraging the use of precision-engineered homogenizers to ensure uniform particle size distribution and extended product shelf life Growth rationale is reinforced by the increasing application of homogenization in emerging sectors such as nutraceuticals and cosmetics, alongside rising emphasis on efficiency, durability, and cost optimization across processing operations.

| Metric | Value |

|---|---|

| Homogenizer Market Estimated Value in (2025 E) | USD 2.1 billion |

| Homogenizer Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

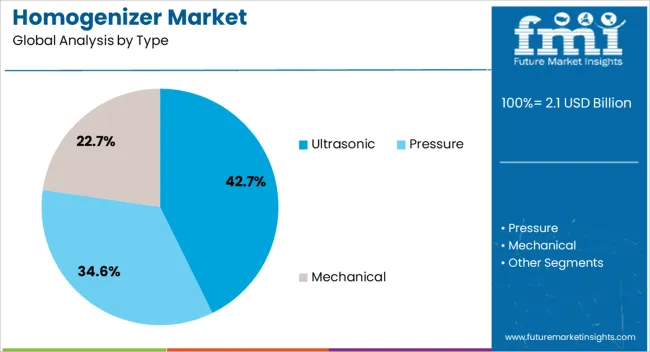

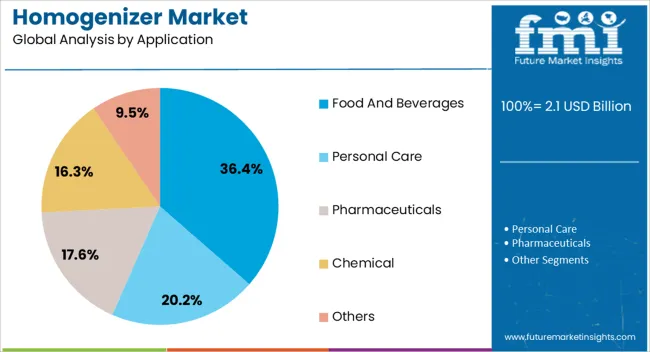

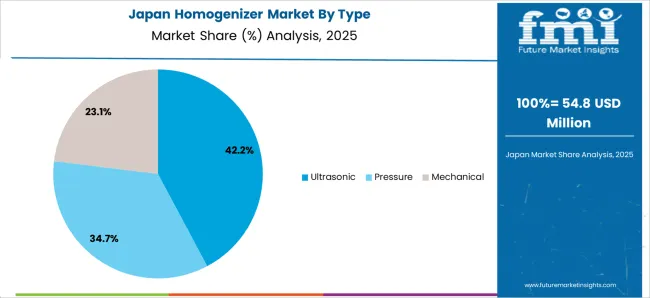

The market is segmented by Type, Technology, and Application and region. By Type, the market is divided into Ultrasonic, Pressure, and Mechanical. In terms of Technology, the market is classified into Two-Valve Assembly and Single-Valve Assembly. Based on Application, the market is segmented into Food And Beverages, Personal Care, Pharmaceuticals, Chemical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ultrasonic segment, accounting for 42.70% of the technology category, has emerged as the leading segment due to its superior efficiency in achieving uniform particle size reduction and improved emulsion stability. The segment’s growth has been supported by its capability to process heat-sensitive materials, making it ideal for pharmaceutical and biotechnology applications.

Enhanced control over processing parameters and reduced operational costs have driven its preference among manufacturers. The scalability of ultrasonic homogenizers for both laboratory and industrial production has strengthened their market penetration.

Ongoing developments in power transducer design and acoustic field optimization have improved process reliability and energy utilization As industries prioritize precision and repeatability, ultrasonic technology is expected to maintain its dominance, supported by continued research in nanomaterial dispersion and advanced fluid processing.

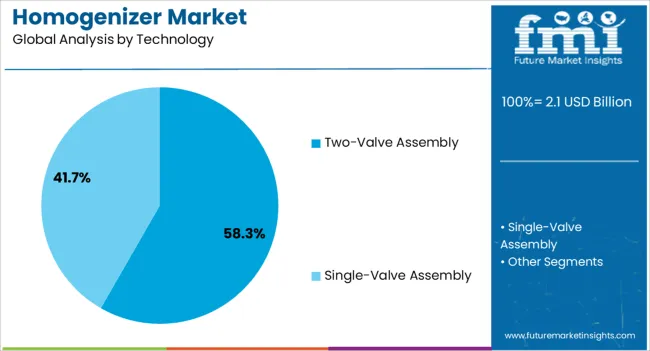

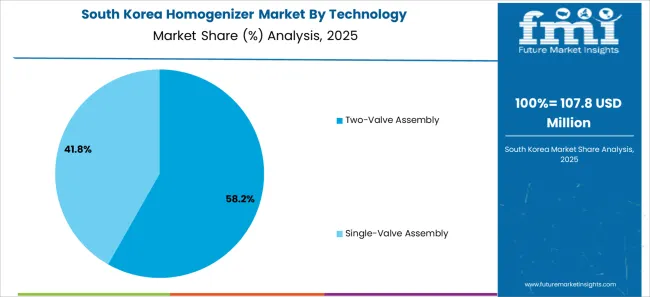

The two-valve assembly segment, holding 58.30% of the type category, has been leading the market owing to its ability to deliver consistent homogenization pressure and efficient mixing performance. Its operational robustness and suitability for large-scale industrial processing have reinforced its adoption in critical applications such as dairy and food emulsions.

The design’s adaptability to varying product viscosities and particle structures enhances versatility across diverse formulations. Reliability in continuous operation and ease of maintenance have further contributed to its widespread use.

Continuous improvements in valve geometry and material durability are optimizing energy efficiency and lifespan As industries demand higher throughput with reduced downtime, the two-valve assembly configuration is expected to retain its competitive advantage in industrial-scale homogenization processes.

The food and beverages segment, representing 36.40% of the application category, has remained the leading contributor due to the sector’s high demand for texture uniformity, product stability, and extended shelf life. Increasing consumption of processed foods, dairy products, and functional beverages has driven the adoption of homogenizers in both small and large-scale processing units.

Manufacturers are investing in advanced homogenization technologies to meet evolving consumer preferences for quality and consistency. The integration of high-pressure and ultrasonic systems has enhanced product smoothness and flavor retention.

Expanding production capacities in emerging economies and the rise of convenience food categories are expected to further support segment growth The combination of regulatory quality standards and industry innovation ensures the continued dominance of the food and beverage sector within the global homogenizer market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 1.4 billion |

| Market Value for 2025 | USD 1.9 billion |

| Market CAGR from 2020 to 2025 | 7.9% |

The segmented market analysis of homogenizer is included in the following subsection. Based on comprehensive studies, the ultrasonic sector is leading the type category, and the single-valve assembly segment is commanding the technology category.

| Attributes | Details |

|---|---|

| Top Type | Ultrasonic |

| CAGR % 2020 to 2025 | 7.6% |

| CAGR % 2025 to End of Forecast (2035) | 6.4% |

| Attributes | Details |

|---|---|

| Top Technology | Single-valve Assembly |

| CAGR % 2020 to 2025 | 7.5% |

| CAGR % 2025 to End of Forecast (2035) | 6.1% |

The homogenization equipment market can be observed in the subsequent tables, which focus on the leading economies in South Korea, the United Kingdom, Japan, China, and the United States. A comprehensive evaluation demonstrates that the United Kingdom has enormous opportunities.

| Country | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 12.3% |

| CAGR (2025 to 2035) | 7.7% |

| Nation | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 9.8% |

| CAGR (2025 to 2035) | 7.6% |

| Nation | Japan |

|---|---|

| HCAGR (2020 to 2025) | 11.1% |

| CAGR (2025 to 2035) | 7.2% |

| Nation | China |

|---|---|

| HCAGR (2020 to 2025) | 9.4% |

| CAGR (2025 to 2035) | 7.1% |

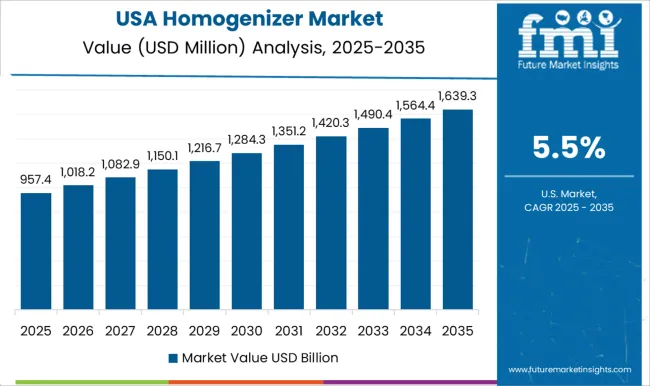

| Nation | United States |

|---|---|

| HCAGR (2020 to 2025) | 8.5% |

| CAGR (2025 to 2035) | 6.7% |

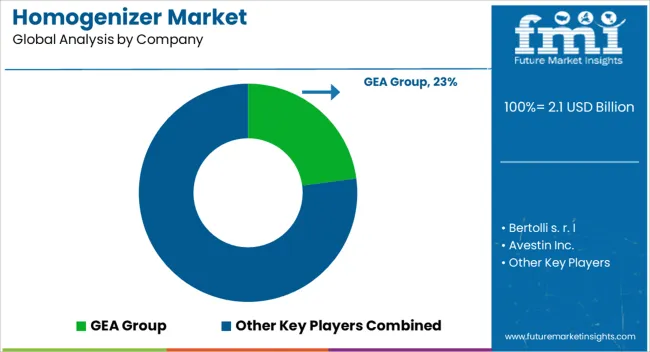

The market has a competitive environment, with leading homogenizer producers influencing its dynamics. Important homogenizer providers are essential for fostering innovation and establishing benchmarks for the sector.

Avestin Inc. and Bertolli s.r.l. contribute to the technological breakthroughs in the homogenizer market by bringing their expertise to the forefront. GEA Group and Ekato Holding GmbH demonstrate their expertise in developing and producing homogenization systems. Krones AG and Simes SA are key homogenizer manufacturers that add to the market's competitive edge. The unique viewpoints of Sonic Corporation and FBF Italia S.r.I. enhance the dynamism of the homogenization device market.

To address the demand for homogenization, major homogenizer vendors using their technological know-how are Microfluidics International Corporation and SPX Corporation. The homogenizer manufacturers' competition encourages ongoing development and pushes the limits of homogenizer technology.

Every participant in this dynamic environment has a distinct role that enhances the homogenizer market. The combination of top homogenizer producers' innovative ideas, manufacturing prowess, and market presence facilitates continuous progress in technology.

Notable Breakthroughs

| Company | Details |

|---|---|

| Oracle Corporation | In August 2025, Oracle Corporation automated the purchase-to-pay processes using Oracle Cloud ERP. With Oracle Cloud, the customer should be able to automate and streamline its procure-to-pay (P2P) process while maintaining agreed-upon terms, pricing, and policy compliance. |

| Accenture | The international consulting firm Accenture acquired the London-based digital company and procurement consultancy Xoomworks in October 2024. |

| SPX FLOW | The 77T and 57T homogenizer models, intended for effective performance and operations, were presented by SPX FLOW in 2024. These models emphasize improved performance and ease of maintenance, catering to a wide range of industries such as food and beverage, dairy, personal care, pharmaceuticals, and cosmetics. |

The global homogenizer market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the homogenizer market is projected to reach USD 4.0 billion by 2035.

The homogenizer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in homogenizer market are ultrasonic, pressure and mechanical.

In terms of technology, two-valve assembly segment to command 58.3% share in the homogenizer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milk Homogenizer Machine Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Homogenizer Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA