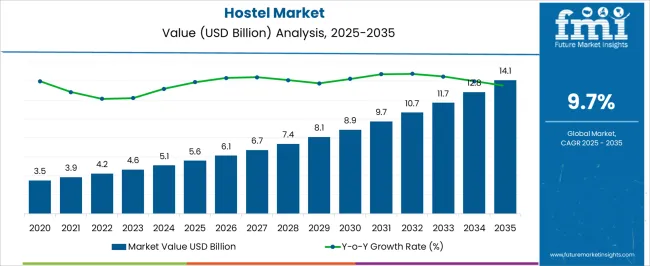

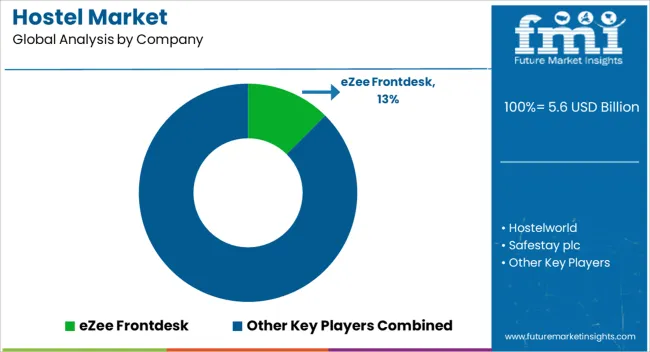

The Hostel Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 14.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Hostel Market Estimated Value in (2025 E) | USD 5.6 billion |

| Hostel Market Forecast Value in (2035 F) | USD 14.1 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The Hostel market is witnessing robust growth, driven by the increasing demand for affordable and flexible accommodation options among travelers worldwide. Rising tourism, both domestic and international, is creating a strong need for budget-friendly lodging that balances cost with comfort. The market is being further supported by the growing preference for communal living experiences, social interaction opportunities, and the flexibility offered by hostels compared to traditional hotels.

Digital transformation in the hospitality sector, including online booking platforms, mobile applications, and real-time availability management, has enhanced accessibility and convenience for travelers. Changing travel behaviors, such as short-term stays, solo travel, and youth travel, are shaping the demand for innovative hostel services and amenities. The market is also benefiting from increased investment in hospitality infrastructure and property development, particularly in urban centers and popular tourist destinations.

As traveler expectations evolve, hostels are adapting to provide enhanced customer experiences, making them an increasingly attractive option With the combination of affordability, convenience, and social engagement, the Hostel market is positioned for sustained expansion over the coming decade.

The private room accommodation type segment is projected to hold 33.1% of the Hostel market revenue in 2025, making it the leading accommodation type. Growth in this segment is being driven by the increasing preference for privacy and security among travelers, while still benefiting from the social and cost-effective aspects of hostels. Private rooms allow guests to enjoy a personal space with enhanced comfort, making hostels appealing not only to solo travelers but also to couples and small groups.

The integration of modern amenities, such as en-suite bathrooms, climate control, and personalized services, has further strengthened adoption. These accommodations also cater to travelers who seek a balance between affordability and convenience, often providing flexible booking options and shorter minimum stays.

The combination of privacy, safety, and value-for-money has reinforced the popularity of private rooms As hostels continue to diversify offerings to meet evolving guest expectations, the private room segment is expected to maintain its leading position, driven by demand for high-quality yet cost-effective accommodations in both urban and tourist-centric locations.

The online booking channel segment is anticipated to account for 55.4% of the Hostel market revenue in 2025, establishing it as the leading booking channel. This growth is driven by increasing digital penetration, the popularity of mobile applications, and travelers’ preference for convenience and instant access to real-time availability. Online booking platforms allow users to compare prices, read reviews, and make reservations instantly, significantly reducing planning time and enhancing the overall travel experience.

The adoption of online channels is also supported by hostel operators who leverage technology to optimize inventory management, dynamic pricing, and targeted promotions. Convenience, transparency, and flexibility provided by these platforms have encouraged widespread adoption among tech-savvy domestic and international travelers.

Additionally, online bookings facilitate contactless transactions, which have gained further importance in the post-pandemic era As digital engagement continues to increase and mobile-first booking behavior dominates travel decisions, online booking is expected to remain the primary channel driving revenue growth in the Hostel market.

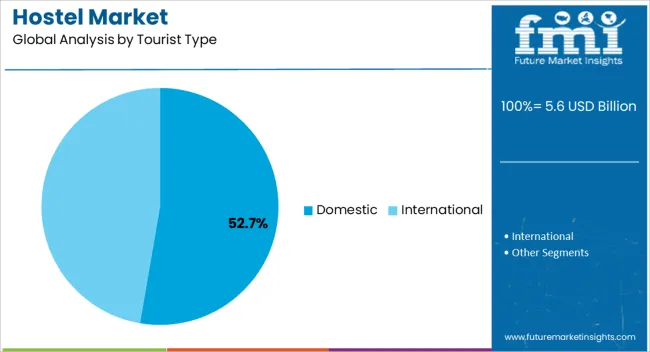

The domestic tourist segment is projected to hold 52.7% of the Hostel market revenue in 2025, making it the largest tourist type category. Growth in this segment is being driven by increasing domestic travel for leisure, business, and educational purposes, as well as by rising disposable income and flexible travel patterns within home countries. Domestic tourists often seek cost-effective accommodations with convenient locations, amenities, and flexible booking options, which hostels provide.

The segment is further supported by government initiatives promoting local tourism, improved transportation infrastructure, and awareness campaigns highlighting nearby travel destinations. Domestic travelers also benefit from online booking platforms that simplify planning and offer access to competitive pricing and user reviews.

The rising interest in experiential travel, cultural engagement, and short-term weekend getaways has reinforced hostel demand among domestic tourists As domestic tourism continues to expand, hostels offering private rooms, social spaces, and accessible locations are expected to remain a preferred choice, driving the segment’s sustained revenue growth in the market.

Hostels are considered one of the most inexpensive and convenient places to stay. Traditionally, hostels used to be dorm-style small and budget accommodations with basic amenities commonly known as dormitory hostels. But in the modern era, the new hostels are luxurious, with advanced amenities, and designed in an artistic way to attract youths.

The new age of hostels provides social space, safety features, and many other services. There are possibilities that travelers may find much cheaper stays as alternatives, but the hostel industry is undergoing many changes in the hospitality industry. Hostel developers are introducing many modern technologies to upgrade their infrastructure to suit the current environment and make their service process more convenient.

Rising trends of traveling to exotic places, trekking, hiking, and other outdoor activities have increased opportunities for accommodation providers in the tourism industry. Other than this, with more development in the education and service sectors, people travel to various places for conditional reasons.

As people travel from one place to another, the first and most important thing they search for is an inexpensive accommodation mode. Hence, it can be concluded that the temporary migration of people for conditional purposes or leisure has resulted in the growth of the hostel market. Hostels are comfortable for short-term as well as long-term stays.

Nowadays, hostels provide Wi-Fi, breakfast, transport facilities, privacy, a social area, spacious private rooms, sharing rooms, a lounge, kitchen facilities, and various other facilities along with a basic stay. Meanwhile, social media has its impact, especially on youth. This all results in the growth of the hostel industry.

Many hostel owners have realized that the visual appeal of the hostel is one of the key factors in attracting a huge number of travelers. Therefore, the hostel owners are renovating their traditional infrastructure with new, advanced ones.

The owners are improving the infrastructure and communication to target a massive audience. The hostel owners create attractive websites by using 3D tools or by creating a visual tour on the website displaying the view of the hostel rooms and the experiences of others.

Many hostel owners use multiple strategies, such as building a themed hostel or an eco-friendly hostel, combining both, and making eco-friendly themed hostels. Example. Urban Garden Hostel in Lisbon, Portugal, promotes an extensive recycling program and uses recycled material, energy-efficient light bulbs, other electrical appliances, reusable items, etc.

They promote garden events and conduct various activities related to environmental sustainability. Hence, such activities and initiatives from hostel owners may result in the growth of the hostel market.

There has been a significant rise in solo travelers in the last few years. The increasing growth of solo travelers has resulted in the growth of the hostel market. Solo travelers search for low-value, experienced-based accommodations that offer good value for money, a convenient place, and the opportunity to meet other travelers.

Therefore, travelers opt for hostels. The rise in video bloggers, the increasing trend of digital tourism, dark tourism, eco-tourism, and the increasing participation of people in recreational activities such as hiking, diving, cycling, skiing, etc., are all trends influencing travelers, especially solo travelers, to explore. Hence, the rise in solo travelers has resulted in the growth of the hostel market.

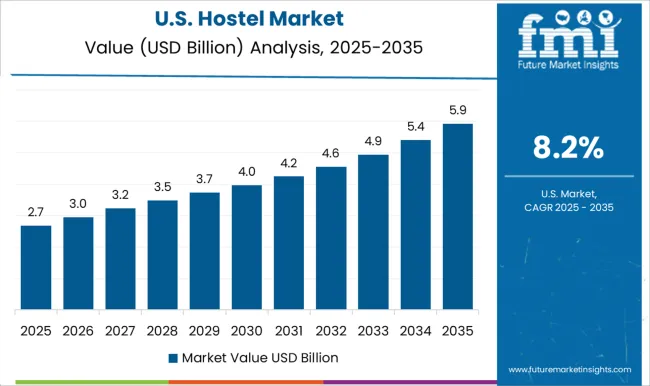

Rise in Admission for Educational Institutes Boosts the Hostel Market in the United States of America

Every year, millions of students travel to the United States from different parts of the world to qualify for educational institutions and to work in the United States. There are various top and well-known institutes in the United States, such as Princeton University, Harvard University, and Yale University.

They get many applications from international students every year due to their quality of education. Hence, students traveling to the United States mainly opt for hostels for their accommodation. Various institutions provide hostel services as part of their institutions. Hence, we can conclude that student hostels in the United States generate a higher demand for the hostel market.

The Rise in Growth of International Travelers Results in an Increase in Demand for the Hostels

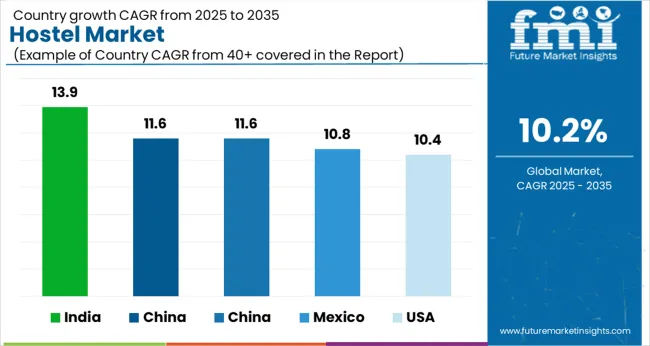

India is a country with a vast culture and diversity. People travel from various parts of the world to study the culture and religion of India. Over the past decade, there has been a continuous rise in international travelers traveling to India, especially from the United States of America and Other parts of Asia. Certain travelers travel to India for medical therapy, such as Ayurveda and other medical surgeries.

As international travelers travel from one place to another, they prefer staying in hostels because they find them affordable. Also, according to them, the hostel environment helps them connect with localities more efficiently. The hostile environment makes them feel connected and allows them to experience the taste of India. Thus, it generates market opportunities in the hostel market.

Group Trips, Student Trips, and Individual Travelers Prefer the Hostel

According to the analysis, in terms of tour type, the hostel is mostly preferred by group trips, student trips, and corporate travelers. The hostel offers sharing facilities called sharing rooms, and group travelers mainly like to accommodate all of them in one room. It is more likely because the hostel rooms are spacious and allot one bed to each member's group trip. Other than this, it is cheaper as compared to booking two different rooms in a hotel.

For corporate travelers and student trips, it is necessary to have a well-connected transport facility and possibly be close to the city to make it convenient for them to travel for work. Hence, most of the hostels are located near a connected public transport station or near the city, corporate hubs, or an educational institute. Other than this, some of the hostels provide complimentary travel services. Therefore, this set of tourists has a high demand for hostels.

Travelers from the Millennial and Young Age Groups Will Increase Significantly in the Hostel Market

In terms of age group, the number of tourists in the age groups of 15 to 25 years and 26 to 35 years is expected to rise significantly. A specific age group enjoys exploring new places and traveling. Other than this, the environment and amenities in the hostel attract millennials and youth. Therefore, the hostel owners try to load their hostels creatively with various other services.

For example, Los Patios, the stylish hostel in Colombia, has themed floors inspired by Colombia's environment, such as mountains, jungles, and the sea. The hostel offers amenities like a co-working space, a gym, rooftop bars, an organic garden, a community kitchen, etc. Each dorm has privacy curtains, and the private rooms are as good and comfortable as hotels. The hostel also offers parties, happy hours, various events, salsa classes, street art tours, and bike rentals.

All these amenities and services attract youths to participate, resulting in high demand for hostels from the above age group.

Online Booking is Generally More Preferred by The Tourist for its Feasibility and Wide Range of Availability of Hostel Rooms.

Online booking is more popular than in-person booking to make reservations. Travelers are drawn to explore the service offerings in depth on hostels modernized websites, such as the variety of facilities, ease of access to other verticals and categories of hostels, and additional services such as offers on tours, trips, and events.

Meanwhile, the other third-party travel and accommodation aggregator applications offer price details, comparisons of services, reviews, etc. Lastly, online bookings offer feasibility, an easy process of selection and transaction, a wide range of payment options, a wide range of selections in one place, and bank offers and discounts that result in more demand for online booking of hostels.

Leading players are operating globally in the market and focusing on expanding their businesses. They are also working on their service and infrastructure to attract new customers.

For instance:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.6 billion |

| Projected Market Size (2035) | USD 14.1 billion |

| Overall Market CAGR (2025 to 2035) | 9.7% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Analysis Parameter | Revenue in USD billion |

| By Accommodation Type | Private Room, Twin Sharing, Family Room, Suite, and Others |

| By Booking Channel | Online and in-person |

| By Tourist Type | Domestic and International |

| By Tour Type | Independent Traveller, Group Trip, Family Trip, Student Trip, and Corporate Traveller |

| By Consumer Orientation | Men, Women, and Children |

| By Age Group | 15-25 Years, 26-35 Years, 36-45 Years, and 46-55 Years |

| By Regions | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | eZee Frontdesk, Hostelworld, Safestay plc, Room Master, Hostelling International, Green Tortoise Hostel, London Backpackers, Newquay Backpackers, Canada Hostels, WOKSEN, A&O s and Hostels, Travellers House, Generator Hostels, Wombats City Hostel, Greg and Tom Hostel, La Banda Rooftop Hostel, Ecomama, Alter Hostel, and Urban Garden Hostel. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The global hostel market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the hostel market is projected to reach USD 14.1 billion by 2035.

The hostel market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in hostel market are private room, twin sharing, family room, suite and others.

In terms of booking channel, online booking segment to command 55.4% share in the hostel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Hostel Market Trends – Demand, Growth & Forecast 2025-2035

USA Hostel Market Growth – Demand, Trends & Forecast 2025-2035

China Hostel Market Analysis – Size, Share & Industry Forecast 2025-2035

France Hostel Market Analysis – Growth, Demand & Forecast 2025-2035

Australia Hostel Market Trends – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA