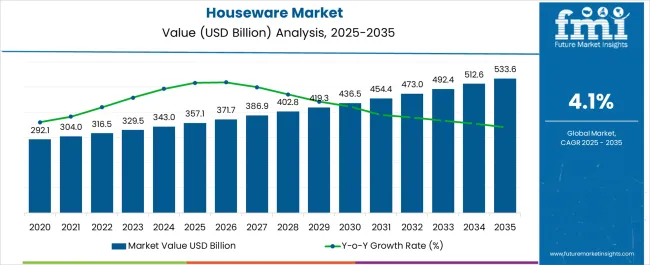

The Houseware Market is estimated to be valued at USD 357.1 billion in 2025 and is projected to reach USD 533.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Houseware Market Estimated Value in (2025 E) | USD 357.1 billion |

| Houseware Market Forecast Value in (2035 F) | USD 533.6 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The houseware market is expanding steadily, driven by lifestyle changes, rising disposable incomes, and the growing focus on home aesthetics and functionality. Increasing consumer interest in premium-quality and durable household products has contributed to the adoption of modern designs and multipurpose solutions.

Market growth is further supported by the urbanization trend and the expansion of organized retail channels, which have improved accessibility and variety for consumers. The integration of sustainable materials and eco-friendly designs is influencing product innovation, aligning with evolving consumer values.

Current demand patterns highlight a balance between essential kitchenware and aspirational home improvement items. With e-commerce complementing traditional distribution networks, the houseware market is expected to experience sustained growth, supported by global consumption trends and rising penetration of branded products.

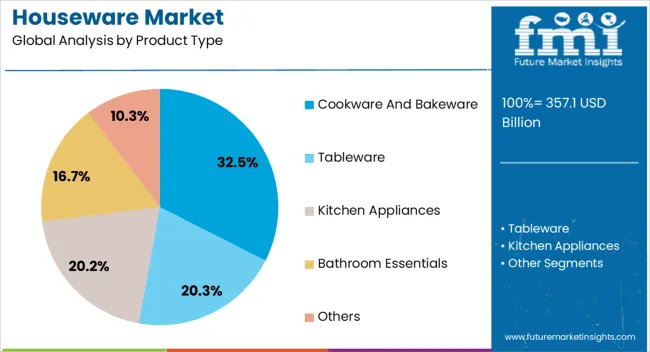

The cookware and bakeware segment dominates the product type category, holding approximately 32.5% share of the houseware market. This segment’s leadership is supported by its essential role in everyday food preparation, coupled with growing consumer interest in home cooking and baking activities.

Demand is further influenced by lifestyle shifts, including increased cooking at home and the popularity of specialty cuisines requiring specific tools. Manufacturers have responded with innovations in non-stick coatings, heat-resistant materials, and ergonomic designs, enhancing both functionality and consumer appeal.

Premiumization trends have also driven demand for durable, aesthetically pleasing products. With consistent utility and continuous product upgrades, the cookware and bakeware segment is expected to sustain its prominent position.

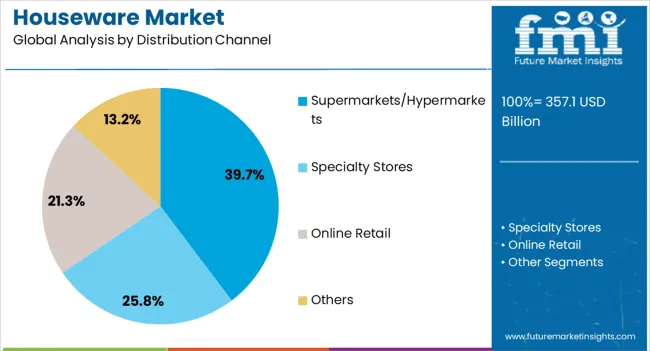

The supermarkets and hypermarkets segment leads the distribution channel category with approximately 39.7% share. This dominance stems from the segment’s ability to provide a wide variety of products under one roof, offering convenience and value-based purchasing. Large-scale retailers have expanded houseware assortments, enabling consumers to compare brands and price points directly.

Promotional campaigns, bundling offers, and seasonal discounts further attract shoppers to these outlets. The physical presence of products allows consumers to assess quality before purchase, reinforcing trust and brand recognition.

While online channels are growing, supermarkets and hypermarkets remain the primary sales avenue, supported by their accessibility and purchasing convenience. The segment’s leadership is expected to persist as modern retail formats expand globally.

The size of the houseware market was marked to be USD 292.1 billion in 2020. The market likely progressed at a consistent pace over the historical period from 2020 to 2025, with a CAGR of 2.7%.

Houseware’s demand continued to rise steadily over the historical period. Though the pandemic caused disruptions in supply and distribution, it also forced more people to stay at home. Thus, greater attention was paid to home appliances and consumers were more willing to have upgrades in houseware. By the end of the historical period in 2025, the market value had jumped to USD 332 billion.

| Market Value (2020) | USD 292.1 billion |

|---|---|

| Historical CAGR (2020 to 2025) | 2.7% |

| Historical Market Valuation (2025) | USD 332 billion |

Long-term Analysis of the Houseware Market

The houseware market is anticipated to have a value of USD 357.1 billion in 2025. For the forecast period, the market is expected to register a sturdy CAGR of 4.1%.

The market’s expansion is set to be faster in the historical period than in the forecast period. As more residences get constructed, the demand for houseware is getting propelled. In addition, the desire of consumers to live with high standards is contributing to the demand for high-end houseware. However, counterfeit and low-quality offshoot products are expected to hamper the progress of the market.

Trends of smart homes and modular homes are driving the demand for houseware. Modular and smart homes are incorporating houseware into their designs. Further, houseware is also becoming a part of interior design and benefitting from home renovations. By the end of the forecast period, it is projected that the value of the houseware market will be USD 513 billion.

The houseware market can be divided into the following segments: product type and distribution channel. As home sizes increase and there is more demand for an upgrade in homeware for all rooms, the type of products available in the market is widening. The boom in online platforms has impacted the distribution channel segment, but for the time being offline channels are still ruling.

Kitchen appliances are the common type of houseware in homes. For 2025, kitchen appliances are expected to account for 33.3% of the market share.

With home cooking on the rise, kitchens’ importance in homes is ever-increasing. Innovations in kitchen appliances, aided by people experimenting with different cuisines that require untraditional tools, are also helping the spread of the product.

| Attributes | Details |

|---|---|

| Top Product Type | Kitchen Appliances |

| Market Share in 2025 | 33.3% |

Supermarkets/hypermarkets are the preferred choice of consumers when buying houseware. For 2025, supermarkets/hypermarkets are anticipated to contribute to 47.1% of the market share.

The offline channels are still dominant in the houseware market. Among the offline channels, supermarkets are the destination that consumers often visit for houseware. Supermarkets afford consumers bulk-buying options and are also attractive due to the various offers and discounts provided.

| Attributes | Details |

|---|---|

| Top Distribution Channel | Supermarkets/Hypermarkets |

| Market Share in 2025 | 47.1% |

The rapidly expanding construction sector in the Asia Pacific and Oceania is helping the market go from strength to strength in the regions. The growth of middle-class families, as well as consumers desirous of luxurious living, are other factors propelling the markets in the region.

The market has high potential in Europe due to the willingness of the population in the region to spend on aesthetic household products. North America is also a prominent region, as home renovation and modular kitchens gain popularity.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| China | 4.1% |

| Germany | 3.8% |

| Australia | 4.7% |

| India | 5.5% |

India is set to be one of the lucrative countries in the market. For the 2025 to 2035 period, the CAGR for India is estimated to be a normal 5.5%.

Investment in houseware is rising in India, from both foreign and local players. For example, in February 2025, H&M Home entered the Indian market, and in November 2025, local player Cello World went public. Thus, the market is set to enjoy a sparkling rise in India over the forecast period.

Another country in Asia marked with promise for the market is China. For the forecast period, the CAGR for China is predicted to be a commendable 4.1%.

In China, comfort is the priority for a significant chunk of consumers when it comes to houseware. With the pandemic’s effects still felt in the country, consumers are seeking solace at home. Thus, producers in China are designing houseware that is pleasant and comfortable to be around.

Australian homeowners are seeking houseware that helps make their houses look sleek. Therefore, Australian consumers are buying houseware that is inspired by vintage, playful, and other funky styles. Australian market players, including a considerable number of local start-ups, are focused on creativity and differentiation. For the forecast period, the CAGR for Australia is anticipated to be a respectable 4.7%.

Germany is often at the forefront of technological innovations in household products. The country is also home to several trade fairs and shows that showcase houseware and technology, such as Ambiente and the Internationale Funkausstellung (IFA). Thus, German consumers are often among the first beneficiaries of innovations in the market. The market is expected to register a consistent CAGR of 3.8% in Germany.

Supermarket chains like Walmart, Costco, and Target are prominent destinations for United States consumers when it comes to shopping for houseware. Producers in the United States are stocking supermarket shelves with affordable products to appeal to consumers. The market is expected to register a steady CAGR of 2.9% in the United States.

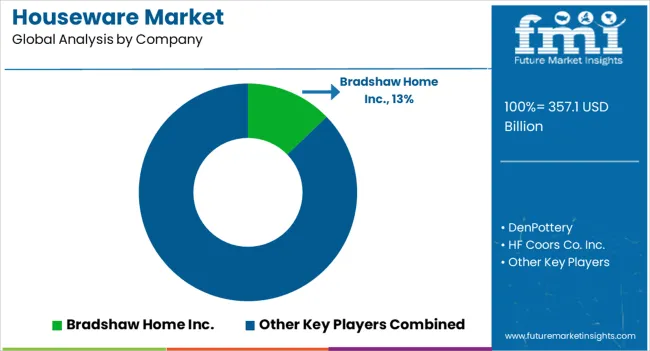

In line with the customization trends, start-up culture is strong in the market, offering a more intimate and personalized feel to home appliances. However, multinational giants have established a firm foothold in the market.

As designer trends emerge in houseware, celebrities and models are also becoming a part of the market, whether through branding or investment. Market players are also leveraging technology to come up with innovative home appliances.

Recent Developments in the Houseware Market

The global houseware market is estimated to be valued at USD 357.1 billion in 2025.

The market size for the houseware market is projected to reach USD 533.6 billion by 2035.

The houseware market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in houseware market are cookware and bakeware, tableware, kitchen appliances, bathroom essentials and others.

In terms of distribution channel, supermarkets/hypermarkets segment to command 39.7% share in the houseware market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA