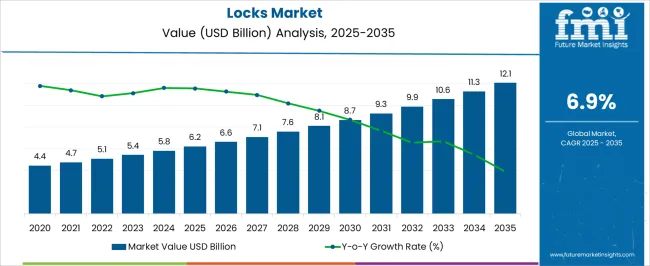

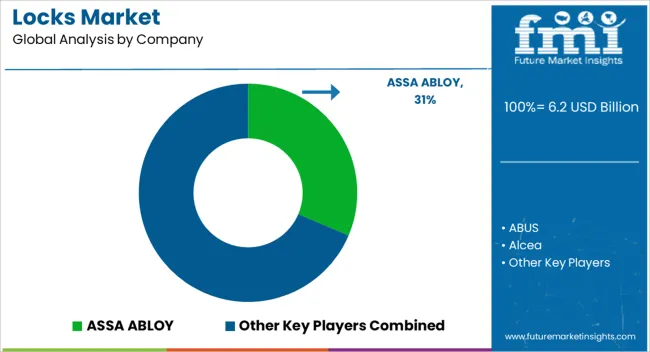

The locks market, with an estimated value of USD 6.2 billion in 2025 and projected to reach USD 12.1 billion by 2035 at a CAGR of 6.9%, is shaped significantly by regulatory frameworks that govern product safety, certification, and security standards. Compliance with national and international safety regulations, including fire resistance, anti-tamper mechanisms, and mechanical strength requirements, forms a foundational aspect of market operations.

Regulatory oversight ensures that manufacturers adhere to stringent quality benchmarks, which in turn affects production costs, material selection, and design innovation. Standards established by bodies such as ISO, ANSI, and regional electrical and mechanical safety authorities dictate the approval process for new lock types, especially smart and electronic locks. These regulations influence market entry dynamics, as manufacturers must invest in testing, certification, and compliance reporting to access major regional markets.

The regulatory mandates on electronic data security and encryption for connected locking solutions drive technological adoption and incremental R&D investments. Periodic updates to regulations create both challenges and opportunities, requiring agile adaptation of production lines and product portfolios. Stricter safety codes and smart lock data protection rules are anticipated to accelerate the adoption of advanced locking mechanisms, impacting market growth patterns across regions. The regulatory frameworks serve as a critical growth moderator, ensuring that market expansion is accompanied by safety, reliability, and legal compliance throughout the forecast period.

| Metric | Value |

|---|---|

| Locks Market Estimated Value in (2025 E) | USD 6.2 billion |

| Locks Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The locks market represents a specialized segment within the global security and hardware industry, emphasizing access control, safety, and durability. Within the broader door and hardware market, it accounts for about 5.5%, driven by demand from residential, commercial, and institutional facilities. In the commercial security systems sector, it holds nearly 4.8%, reflecting adoption for offices, retail, and industrial sites. Across the residential construction and home improvement segment, the market captures 4.2%, supporting traditional and smart lock installations. Within the electronic and digital security category, it represents 3.9%, highlighting integration with keyless entry systems, biometrics, and IoT connectivity.

In the locksmith and maintenance services sector, it secures 3.5%, emphasizing aftermarket replacement, upgrading, and repair services. Recent developments in this market have focused on smart technologies, digital integration, and enhanced physical security. Innovations include electronic locks, fingerprint and facial recognition access, keyless entry, and remote monitoring solutions. Key players are collaborating with IoT providers, building automation companies, and security service firms to expand smart access solutions.

Adoption of mobile-enabled locks, cloud-based access management, and encrypted communication protocols is gaining traction for enhanced convenience and safety. Additionally, materials innovation, tamper-resistant designs, and modular retrofit options are being implemented to improve longevity and performance. These trends demonstrate how technology, safety, and convenience are shaping the market.

The Locks market is experiencing steady expansion as demand for secure, durable, and technologically adaptable locking solutions grows across residential, commercial, and industrial environments. The current market landscape reflects strong adoption of both traditional mechanical systems and advanced security technologies, driven by rising urbanization, infrastructure development, and consumer focus on safety.

Manufacturers are increasingly investing in innovative designs and materials to enhance durability, functionality, and resistance to tampering, meeting diverse application needs. The integration of locks into broader security ecosystems is enabling greater flexibility for end users, while regulatory and insurance requirements are further encouraging upgrades to reliable locking mechanisms.

Future growth opportunities are expected from continued advancements in materials science, precision manufacturing, and integration with smart building systems, ensuring that locks remain a central component in safeguarding assets and properties in an increasingly security-conscious world.

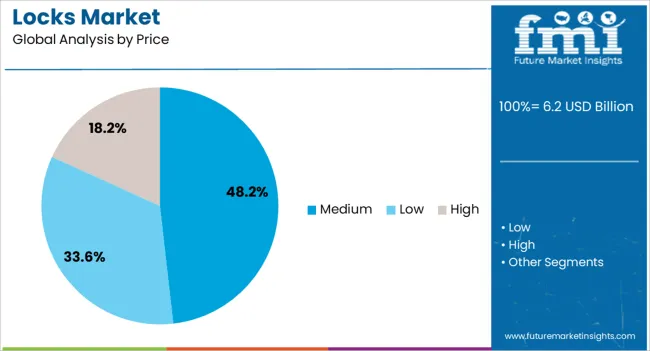

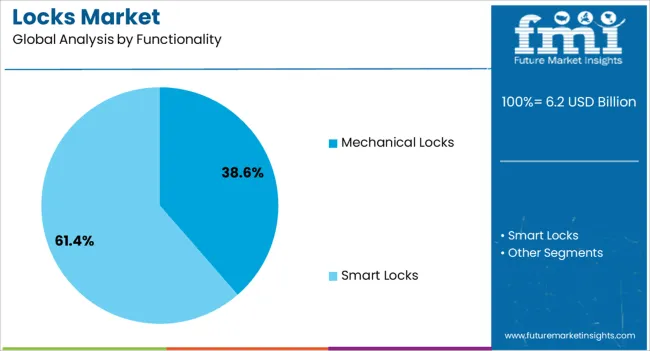

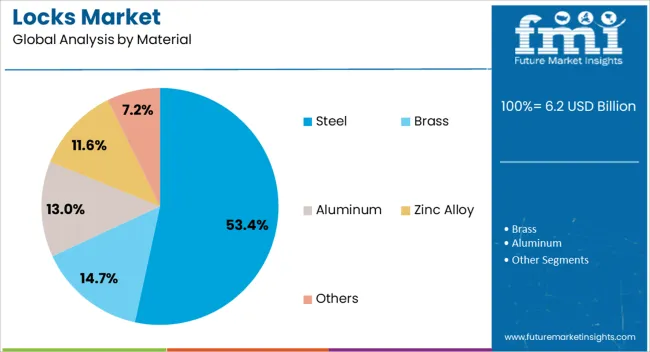

The locks market is segmented by lock type, functionality, material, price, end user, distribution channel, and geographic regions. By lock type, locks market is divided into deadbolts, padlocks, lever handles, knob locks, server locks & latches, and others (e.g., Mortise Locks). In terms of functionality, locks market is classified into mechanical locks and smart locks. Based on material, locks market is segmented into steel, brass, aluminum, zinc alloy, and others. By price, locks market is segmented into medium, low, and high. By end user, locks market is segmented into residential, commercial, and industrial. By distribution channel, locks market is segmented into online and offline. Regionally, the locks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Deadbolts segment is projected to hold 42.5% of the locks market revenue share in 2025, making it the leading lock type. This dominance is being supported by the segment’s reputation for high security and resistance to forced entry, which has made it a preferred choice for both residential and commercial applications.

Deadbolts provide a robust locking mechanism that is not easily compromised, aligning with heightened consumer and institutional emphasis on physical security. Their relatively simple construction, combined with compatibility with various door types and frames, has facilitated widespread adoption.

The ability to integrate deadbolts with both traditional keys and electronic access systems has further enhanced their appeal in a market where adaptability is valued. As concerns about property security remain high, and building codes in many regions favor stronger locking systems, deadbolts are expected to maintain their leadership through consistent demand and continued innovation in design and materials.

The mechanical locks segment is expected to account for 38.6% of the market revenue share in 2025, positioning it as the leading functionality category. This strong position is being attributed to the segment’s proven reliability, ease of maintenance, and cost-effectiveness compared to electronic alternatives.

Mechanical locks operate without reliance on power sources, ensuring dependable performance in all conditions, which is valued in both residential and industrial settings. The segment’s growth is being reinforced by its broad applicability across interior and exterior security needs, alongside its lower total cost of ownership.

Continued advancements in precision manufacturing have improved the durability and resistance of mechanical locks against tampering, further strengthening their role in the market. As segments of the population remain cautious about adopting fully electronic systems, mechanical locks are anticipated to sustain strong demand, benefiting from their established track record and familiarity among end users.

The steel material segment is anticipated to hold 53.4% of the locks market revenue share in 2025, emerging as the most dominant material choice. This leadership is being driven by the superior strength, durability, and corrosion resistance offered by steel, making it suitable for high-security applications across diverse environments.

Steel locks provide enhanced resistance against physical attacks and wear, ensuring long-term reliability in both indoor and outdoor settings. The material’s adaptability allows it to be used in various lock types, from residential deadbolts to industrial-grade padlocks, supporting widespread usage.

Additionally, advancements in alloy formulations and surface treatments have improved performance against environmental stress, further boosting adoption. As safety regulations and consumer expectations for robust security solutions rise, steel’s reputation as a dependable and long-lasting material is expected to keep it at the forefront of the market, ensuring sustained leadership in material selection.

The market has been evolving steadily due to increasing concerns over security, property protection, and controlled access across residential, commercial, and industrial sectors. Traditional mechanical locks continue to be widely used, while electronic, smart, and biometric locking systems have gained adoption due to convenience, enhanced monitoring, and integration with building automation systems.

The demand has been influenced by urban infrastructure development, rising awareness of safety standards, and technological advancements in access control solutions. Manufacturers are investing in durable materials, corrosion resistant designs, and tamper proof mechanisms. The market is shaped by a balance between traditional reliability and modern digital innovations, addressing diverse security requirements across the globe.

Residential security has remained a key driver for the locks market, with homeowners increasingly adopting smart and connected locking solutions. Mechanical locks continue to be preferred for their simplicity and cost effectiveness, while smart locks with mobile app control, keyless entry, and biometric authentication are being integrated into modern homes. These systems allow real time monitoring, remote access control, and automated locking schedules, enhancing convenience and safety. Urban residential developments, gated communities, and high rise apartments have amplified the demand for advanced locking solutions. The customizable designs and premium finishes are appealing to consumers seeking both aesthetic and functional security solutions. This combination of traditional and digital features ensures that locks remain integral to modern residential security strategies.

Commercial and industrial sectors have increasingly relied on advanced locks to protect assets, manage access, and maintain operational safety. Office complexes, retail outlets, warehouses, and factories utilize a mix of electronic key card systems, biometric locks, and high security mechanical locks. Industrial facilities often deploy tamper proof locks with corrosion resistant materials for equipment enclosures and restricted areas. The adoption of networked access control systems allows administrators to manage permissions, track entry logs, and respond promptly to security breaches. Growing regulatory compliance requirements and corporate security standards have further reinforced the adoption of robust locking solutions. The focus on minimizing unauthorized access, protecting high value assets, and integrating locks into broader security infrastructure continues to drive market expansion.

Technological advancements have transformed traditional locks into intelligent security devices capable of integration with IoT and building management systems. Smart locks now offer features such as remote unlocking, real time notifications, biometric verification, and cloud based access management. Materials innovation, including hardened alloys, reinforced steels, and corrosion resistant coatings, has enhanced durability and tamper resistance. Wireless communication protocols, including Bluetooth, Wi-Fi, and NFC, have enabled seamless connectivity with smartphones and home automation systems. In addition, modular designs allow easy upgrades and replacement of lock components without compromising security. These innovations have elevated the functionality, convenience, and reliability of locks, ensuring they meet the evolving demands of both consumer and industrial segments.

The market is influenced by stringent safety standards, certifications, and regulatory compliance requirements that govern mechanical and electronic locking devices. Fire safety codes, building regulations, and security guidelines necessitate the use of certified locks in residential, commercial, and public infrastructure projects. Manufacturers are investing in testing protocols, quality assurance, and compliance with international standards to ensure product reliability and consumer trust. Anti-tampering, pick-resistant, and high-security rating locks are increasingly preferred to meet these requirements. Awareness of cybersecurity risks for smart locks has also prompted compliance with data protection and encryption standards. Regulatory alignment, coupled with ongoing innovation, ensures that the locks market continues to provide secure, reliable, and compliant solutions across diverse applications globally.

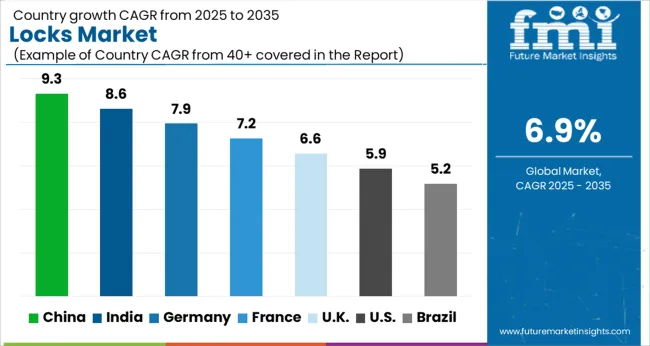

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The market demonstrates consistent growth due to rising security needs across residential, commercial, and industrial sectors. Germany records 7.9%, benefiting from integration of advanced locking technologies in smart buildings. India reaches 8.6%, driven by expanding construction and infrastructure activities requiring reliable security solutions. China leads with 9.3%, supported by large-scale urban developments and adoption of electronic locking systems. The United Kingdom achieves 6.6%, with growth fostered by residential security upgrades and commercial safety initiatives. The United States posts 5.9%, supported by technological adoption in access control and security systems. These countries collectively represent diverse market adoption, technological innovation, and production capabilities shaping the global locks industry. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 9.3%, driven by increasing residential, commercial, and industrial security requirements. Rising construction activity, expansion of smart buildings, and adoption of electronic and smart lock solutions have enhanced market demand. Domestic manufacturers have focused on high quality mechanical locks as well as digital access control systems, with several Chinese brands expanding internationally. It is considered that government initiatives promoting public safety and secure infrastructure have further reinforced adoption. Both household and commercial segments are expected to continue relying on innovative locking solutions. The competitive environment is shaped by domestic producers and global players collaborating for product development and distribution.

The market in India is expected to expand at a CAGR of 8.6%, supported by rising urban housing, commercial development, and infrastructure projects. The market has witnessed growth in electronic locks, keypad entry systems, and traditional mechanical designs. Indian manufacturers have focused on affordable yet secure lock solutions to cater to both household and commercial demand. Import of premium smart locks has also increased, particularly from European and Chinese suppliers. Adoption has been reinforced by regulatory frameworks encouraging safety and security in public and private facilities. India is considered a fast growing market for locking systems as demand continues across residential, commercial, and institutional segments.

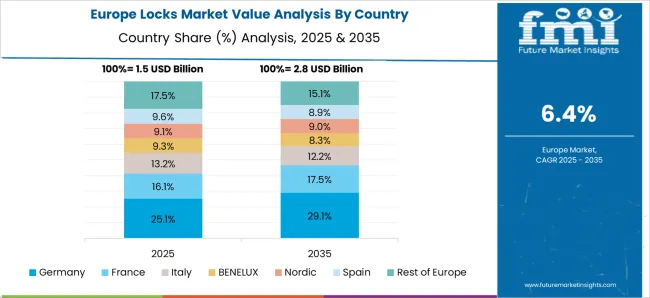

Germany is projected to register a CAGR of 7.9% in the market, driven by demand in residential, commercial, and industrial segments. Adoption of high security locks, electronic access control, and smart locking systems has increased due to stringent building codes and focus on safety standards. German manufacturers such as ABUS and Burg Wächter provide advanced mechanical and digital lock solutions, combining durability and technological integration. The hospitality and commercial property sectors have increasingly used electronic and biometric access solutions. Export of German locking systems has also contributed to market strength, reinforcing Germany as a technology and quality leader in the global locks industry.

The United Kingdom market is expected to grow at a CAGR of 6.6%, driven by adoption of electronic access systems and traditional lock upgrades in homes and offices. Demand has been reinforced by security requirements in residential complexes, commercial buildings, and heritage properties. British manufacturers and distributors provide a mix of mechanical, electronic, and smart locks tailored for both urban and rural applications. International brands have also expanded their presence through e-commerce and retail channels. The market outlook indicates steady growth as replacement cycles, renovation projects, and rising interest in keyless entry solutions drive adoption across households and institutions in the U K.

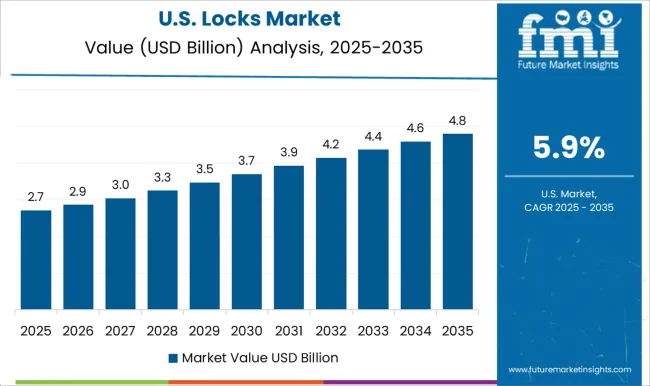

The market in the United States is projected to expand at a CAGR of 5.9%, supported by demand from residential, commercial, and institutional sectors. Adoption of digital locks, electronic access systems, and traditional mechanical locks has been fueled by safety regulations and rising focus on smart home technology. Leading manufacturers such as Kwikset, Schlage, and Allegion have strengthened the market through innovation in electronic locking, keyless entry, and durable mechanical solutions. Retail expansion and e-commerce have also contributed to market penetration. The market is expected to maintain steady growth, with replacement and renovation cycles and integration of smart security solutions supporting sustained demand across the United States.

The market is dominated by a mix of traditional mechanical lock manufacturers and advanced electronic access solution providers. ASSA ABLOY and Allegion lead globally with extensive portfolios ranging from mechanical locks to digital and smart locking systems, targeting commercial, residential, and institutional segments. DormaKaba and Hafele strengthen the market through high-security solutions, integrated access management systems, and innovative locking technologies tailored for enterprise and hospitality applications. ABUS, MIWA Lock, and Master Lock emphasize durable mechanical locks, padlocks, and combination solutions, maintaining strong brand recognition in residential and industrial security sectors. Salto Systems, Gantner Electronic, and Onity focus on electronic locks, RFID access, and IoT-enabled smart locking systems, catering to smart building trends and contactless security requirements.

Palladium, Cansec Systems, Sargent and Greenleaf, and Spectrum Brands expand market depth through niche products such as safes, high-security locks, and specialty locking solutions for governmental, military, and critical infrastructure applications. Competition is driven by technological advancement, product reliability, and integration with broader security ecosystems. Companies increasingly prioritize digital access, mobile-controlled locks, biometric authentication, and cloud-based management platforms. Regional customization, after-sales support, and collaborations with construction and real estate developers remain critical for market players to expand penetration, differentiate offerings, and maintain long-term growth in a security-conscious environment.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 bllion |

| Lock Type | Deadbolts, Padlocks, Lever Handles, Knob Locks, Server Locks & Latches, and Others (e.g., Mortise Locks) |

| Functionality | Mechanical Locks and Smart Locks |

| Material | Steel, Brass, Aluminum, Zinc Alloy, and Others |

| Price | Medium, Low, and High |

| End User | Residential, Commercial, and Industrial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASSA ABLOY, ABUS, Alcea, Allegion, Cansec Systems, DormaKaba, Gantner Electronic, Hafele, Master Lock, MIWA Lock, Onity, Palladium, Salto Systems, Sargent and Greenleaf, and Spectrum Brands |

| Additional Attributes | Dollar sales by lock type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in security technology adoption, innovation in smart locking mechanisms, biometrics, and durability, environmental impact of material production and disposal, and emerging use cases in IoT-enabled access control, home automation, and high-security infrastructure. |

The global locks market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the locks market is projected to reach USD 12.1 billion by 2035.

The locks market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in locks market are deadbolts, padlocks, lever handles, knob locks, server locks & latches and others (e.g., mortise locks).

In terms of functionality, mechanical locks segment to command 38.6% share in the locks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RFID Locks Market Analysis – Growth & Industry Trends 2023-2033

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Paver Blocks Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Locks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Mechanical Locks Industry

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Steering Column Locks Market Growth - Trends & Forecast 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Pre-Shaded Zirconia Blocks for All-Ceramic Restorations Market Size and Share Forecast Outlook 2025 to 2035

Wireless Synchronized Clocks Market Trends - Growth & Forecast 2025 to 2035

AAC (Autoclaved Aerated Concrete) Blocks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA