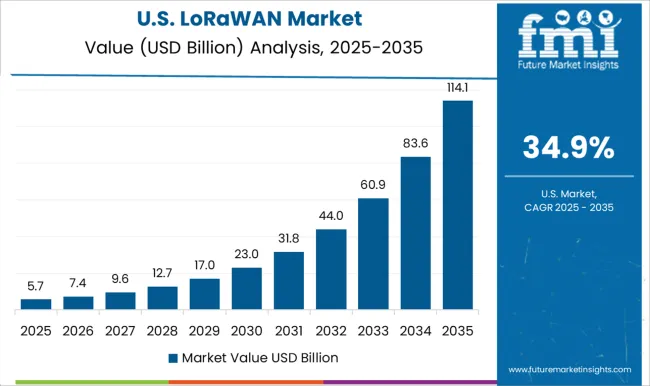

The LoRaWAN market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 163.3 billion by 2035, registering a compound annual growth rate (CAGR) of 41.1% over the forecast period. From 2020 to 2024, the market moved through its early adoption phase, expanding from USD 0.9 billion to USD 3.7 billion. Growth during this stage was marked by pilot deployments, proof-of-concept projects, and niche applications where organizations tested connectivity performance across different use cases. Stakeholders were cautious, focusing on validating coverage, scalability, and integration with existing infrastructures. Although adoption was still limited in scale, this stage created the groundwork by establishing trust and demonstrating practical outcomes that encouraged broader uptake.

Between 2025 and 2030, the LoRaWAN market will enter its scaling phase, rising sharply from USD 5.2 billion to nearly USD 41.2 billion. This acceleration reflects widespread adoption across sectors, with large-scale projects and broad rollouts becoming the norm. Ecosystems expand, supply chains adapt to higher volumes, and standardization supports interoperability. As adoption accelerates, competitive intensity grows, with leading vendors capturing greater market share through expanded service portfolios and partnerships. By 2030, the market is expected to shift toward consolidation, valued at around USD 41.2 billion. From 2030 to 2035, growth continues strongly, reaching USD 163.3 billion, where adoption is mainstream, competition stabilizes, and dominant players define market structure.

| Metric | Value |

|---|---|

| LoRaWAN Market Estimated Value in (2025 E) | USD 5.2 billion |

| LoRaWAN Market Forecast Value in (2035 F) | USD 163.3 billion |

| Forecast CAGR (2025 to 2035) | 41.1% |

Demand has been rising across sectors that require cost-efficient, long-range, and battery-friendly connectivity solutions, as highlighted in industry press statements and telecom company presentations. LoRaWAN has been favored for its ability to function in unlicensed spectrum and its flexibility in supporting both urban and remote deployments.

The market outlook remains positive as technology firms continue to invest in ecosystem development, interoperability frameworks, and satellite integration to boost coverage and performance. In recent news and investor briefings, growing emphasis on energy-efficient connectivity, predictive maintenance, and smart utility monitoring has been cited as a core driver.

Moreover, government-backed smart infrastructure projects and environmental monitoring initiatives are expected to widen adoption further. As verticals mature and use cases expand, LoRaWAN is positioned to serve as a foundational technology in the evolving IoT landscape.

The LoRaWAN market is segmented by component, deployment model, applicationend use, and geographic regions. By component, the LoRaWAN market is divided into Hardware, Software, and Services. In terms of the deployment model, the LoRaWAN market is classified into Private, Public, and Hybrid.

Based on application, the LoRaWAN market is segmented into Smart gas and water metering, Asset tracking, Smart buildings, Smart parking, Precision agriculture, Smart waste management, Livestock monitoring, and Others. By end use, the LoRaWAN market is segmented into Utilities, Healthcare, Agriculture, Logistics and transportation, Manufacturing, Consumer electronics, Government and public sector, and Others. Regionally, the LoRaWAN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware component segment is projected to hold 46.2% of the LoRaWAN market revenue share in 2025, making it the leading component category. This dominance is being supported by the essential role of gateways, sensors, and transceivers that form the physical backbone of LoRaWAN networks. Industry updates and product announcements have highlighted that ongoing advancements in chipsets and edge devices have improved both energy efficiency and range performance, encouraging broader deployment.

Hardware has been increasingly integrated with modular and upgradable features, enabling support for evolving network protocols and compliance standards. Its importance has also been reinforced by strategic partnerships between device manufacturers and solution integrators aiming to reduce deployment complexity. With smart cities and industrial automation projects scaling, demand for durable and interoperable hardware has remained high.

The private deployment model is expected to account for 39.5% of the LoRaWAN market revenue share in 2025, emerging as the leading deployment approach. This preference has been driven by the increasing need among enterprises and municipalities for secure, customizable, and cost-controlled network environments. Telecom technology blogs and corporate updates have emphasized that private networks allow users to maintain complete control over data ownership, latency, and network configuration.

Adoption has accelerated in sectors such as utilities, manufacturing, and agriculture, where consistent performance and local decision-making are mission-critical. Additionally, the ability to tailor infrastructure without dependency on public operators has resonated with organizations seeking long-term scalability and operational resilience.

Industry forums have also noted that private deployments are better positioned to integrate edge intelligence, further reinforcing their appeal. These drivers have collectively enabled private models to lead LoRaWAN adoption.

The smart gas and water metering segment is projected to contribute 21.7% of the LoRaWAN market revenue share in 2025, becoming the leading application area. This leadership is being shaped by increasing global efforts to modernize utility infrastructure and reduce resource wastage through real-time monitoring.

Press releases from utility companies and smart infrastructure providers have indicated that LoRaWAN’s long-range and ultra-low-power capabilities are ideally suited for metering deployments in both dense urban and remote rural settings. The segment’s growth has been supported by the cost-effectiveness of battery-operated sensors and the ability to transmit small packets of data reliably over long intervals.

Regulatory push for energy efficiency and accurate billing has also prompted large-scale rollouts of LoRaWAN-enabled meters across municipalities and private utility providers. With minimal maintenance requirements and strong data penetration in complex environments, this segment is expected to remain dominant as utilities transition toward smarter grids.

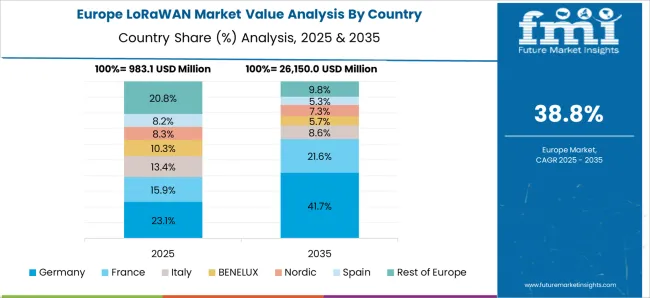

LoRaWAN technology provides long-range connectivity, low energy consumption, and cost-effective deployment, making it suitable for massive IoT ecosystems. Government-backed smart infrastructure projects, adoption in remote monitoring, and rising integration with cloud and edge platforms support growth. Europe and North America lead due to strong IoT frameworks, while Asia-Pacific shows emerging opportunities in smart agriculture and urban connectivity. Market differentiation increasingly focuses on scalability, interoperability, and data security in mission-critical applications.

One of the major challenges for the LoRaWAN market is ensuring device interoperability and network standardization. Different vendors often implement variations of LoRaWAN protocols, leading to compatibility issues in multi-vendor environments. Inconsistent adoption of global standards limits seamless integration across regions and industries. Network scalability and quality of service can also be affected by interference, device density, and spectrum regulations. To gain wider adoption, companies must ensure compliance with LoRa Alliance standards, develop interoperable devices, and align with global IoT ecosystems. Until greater standardization is achieved, interoperability and reliability concerns will continue to limit adoption in highly regulated and large-scale deployments.

Innovation is fueling new opportunities in the LoRaWAN market. Advances in edge computing, satellite-based LoRa connectivity, and hybrid network architectures are extending coverage into remote and underserved areas. Battery-optimized devices, adaptive data rates, and enhanced gateways increase scalability while reducing power consumption. Integration with AI-driven platforms enables predictive analytics for smart cities, logistics, and agriculture. Hybrid deployments combining LoRaWAN with cellular IoT or 5G offer flexibility and reliability. Companies collaborating with cloud providers and IoT platforms strengthen solution offerings for enterprise adoption. As technological innovation continues, LoRaWAN is expanding from niche applications into mainstream smart infrastructure and industrial IoT solutions.

The LoRaWAN market is influenced by region-specific spectrum regulations and IoT policy frameworks. LoRaWAN operates in unlicensed ISM bands, but spectrum allocation and usage rules differ across geographies, affecting deployment flexibility. In regions with stricter frequency management, interference and compliance challenges can slow adoption.

Additionally, data privacy and cybersecurity regulations in IoT networks add layers of complexity, requiring robust encryption and compliance with regional data laws. Governments supporting smart infrastructure projects accelerate adoption, while inconsistent or unclear IoT policies create barriers. Until harmonized regulatory frameworks and clearer spectrum guidelines are implemented globally, deployment speed and scalability will vary across markets.

The LoRaWAN market is highly competitive, with global network operators, IoT platform providers, and device manufacturers vying for market share. Established providers leverage large ecosystems and partnerships, while new entrants compete on niche applications and cost advantages. Competition is intensified by alternative LPWAN technologies such as NB-IoT, LTE-M, and Sigfox, which offer competing connectivity benefits. Deployment barriers include network infrastructure costs, gateway installation challenges, and integration with existing IT/OT systems. Companies focusing on ecosystem development, managed services, and vertical-specific solutions gain stronger positioning. Until deployment costs decline and ecosystem maturity improves, competitive rivalry and adoption barriers will remain significant market dynamics.

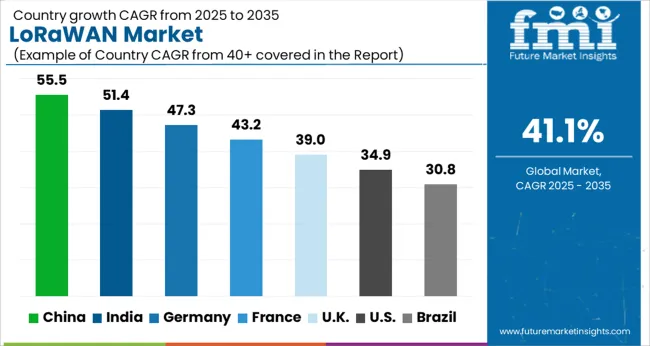

The global LoRaWAN Market is projected to grow at a CAGR of 41.1% through 2035, supported by expanding adoption across smart infrastructure, industrial monitoring, and connected device networks. Among BRICS nations, China has been recorded with 55.5% growth, driven by large-scale deployments in industrial zones and citywide connectivity projects, while India has been observed at 51.4%, supported by extensive applications in agriculture, logistics, and utility management. In the OECD region, Germany has been measured at 47.3%, where broad industrial automation and cross-sector deployments have been steadily reported. The United Kingdom has been noted at 39.0%, with adoption in logistics and energy monitoring being consistently expanded, while the USA has been recorded at 34.9%, where steady uptake in manufacturing, utilities, and enterprise systems has been maintained. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The LoRaWAN market in China is growing rapidly at 55.5%, fueled by strong adoption of Internet of Things (IoT) technologies across industries. The country’s push toward smart cities, industrial automation, and digital transformation is driving large-scale deployments of LoRaWAN networks. Government-backed initiatives encouraging IoT adoption in agriculture, manufacturing, energy management, and logistics are further strengthening the market. Chinese enterprises are integrating LoRaWAN solutions into applications such as smart metering, environmental monitoring, and asset tracking to improve efficiency and reduce operational costs. Local technology companies are also partnering with global players to enhance network infrastructure and expand connectivity. The rapid growth of 5G and cloud computing in the country is creating opportunities for hybrid solutions that combine LoRaWAN with advanced wireless technologies. With strong investment in IoT infrastructure and high demand for scalable connectivity solutions, China is expected to remain the global leader in LoRaWAN adoption.

LoRaWAN Market Insights in India

The LoRaWAN market in India is expanding at 51.4%, driven by increasing adoption of IoT solutions in utilities, agriculture, and industrial sectors. The growing emphasis on digital infrastructure development, supported by government initiatives like “Digital India” and smart city projects, is encouraging adoption of LoRaWAN networks. Utility companies are adopting LoRaWAN-based smart metering and monitoring systems to improve efficiency and reduce losses. In agriculture, LoRaWAN is being used for precision farming, soil monitoring, and irrigation management, enabling better crop yields and resource utilization. Startups and technology providers in India are collaborating to deploy low-cost and scalable IoT solutions that leverage LoRaWAN technology. As enterprises shift toward automation and digital transformation, the demand for long-range, low-power connectivity is expected to surge. With strong opportunities across multiple sectors, India is becoming one of the fastest-growing markets for LoRaWAN technologies in the Asia-Pacific region.

Germany’s LoRaWAN market is advancing at 47.3%, supported by the rapid adoption of IoT solutions in manufacturing, energy, and smart city initiatives. The country’s strong industrial base and focus on Industry 4.0 are driving demand for LoRaWAN-enabled systems in asset tracking, predictive maintenance, and logistics optimization. Municipalities are increasingly using LoRaWAN for smart lighting, parking management, and environmental monitoring, contributing to the expansion of urban digital infrastructure. German enterprises and telecom operators are investing in nationwide LoRaWAN networks to support growing demand for IoT connectivity. Integration with renewable energy systems and utility monitoring is also fueling adoption in the energy sector. Germany’s emphasis on data security, regulatory compliance, and high-quality infrastructure makes it a significant market for advanced LoRaWAN deployments. With strong collaboration between government, industry, and technology providers, Germany is well-positioned to lead LoRaWAN growth in Europe.

The LoRaWAN market in the United Kingdom is growing at 39.0%, supported by strong adoption of IoT solutions in utilities, healthcare, and smart infrastructure. Utility providers are increasingly implementing LoRaWAN-based smart meters and monitoring solutions to improve efficiency and meet regulatory standards. In healthcare, LoRaWAN applications are being deployed for patient monitoring, equipment tracking, and facility management. Municipalities are embracing smart city initiatives, where LoRaWAN networks support smart lighting, waste management, and environmental monitoring projects. Telecom operators and technology firms in the UK are collaborating to expand LoRaWAN coverage and offer scalable IoT solutions. The focus on sustainability and energy efficiency is also creating opportunities for adoption in building automation and renewable energy systems. With strong emphasis on digital innovation and policy support for IoT expansion, the UK LoRaWAN market is poised for steady long-term growth.

The LoRaWAN market in the United States is expanding at 34.9%, driven by widespread IoT adoption across industries such as logistics, agriculture, and utilities. Enterprises are deploying LoRaWAN-enabled systems for asset tracking, fleet management, and environmental monitoring to improve operational efficiency. The agricultural sector is embracing LoRaWAN for precision farming, livestock monitoring, and irrigation control, contributing to better productivity and cost savings. Utility providers are adopting smart metering and grid monitoring solutions that leverage LoRaWAN technology for real-time data insights. Telecom operators and technology companies in the USA are building nationwide LoRaWAN networks to support large-scale IoT deployments. The growing demand for sustainable and energy-efficient solutions is also boosting adoption in smart buildings and renewable energy management. With strong innovation capabilities and an expanding ecosystem of IoT solutions, the USA is becoming a major player in the global LoRaWAN market.

The LoRaWAN market is expanding rapidly as demand for low-power, wide-area networking (LPWAN) solutions grows across smart cities, industrial automation, utilities, and agriculture. LoRaWAN technology enables long-range communication with low energy consumption, making it ideal for connecting IoT devices that require extended battery life and cost-effective deployment.

With the increasing need for real-time monitoring, predictive maintenance, and smart infrastructure, LoRaWAN is becoming a cornerstone of the global IoT ecosystem. Actility is one of the leading players, offering a comprehensive IoT connectivity platform that supports large-scale LoRaWAN deployments worldwide. A2A Smart City focuses on integrating LoRaWAN technology into urban infrastructure to enable smart energy management, mobility, and public services.

Cisco Systems brings its expertise in networking and security to provide scalable LoRaWAN solutions for enterprise and industrial applications. Kerlink is recognized for its high-quality gateways and network infrastructure that enable reliable IoT connectivity. Telecom operators such as KPN, Orange, and Swisscom AG are driving LoRaWAN adoption by offering nationwide network coverage, supporting smart metering, logistics, and environmental monitoring applications. Microchip Technology plays a critical role by providing low-power semiconductor solutions that power LoRa-enabLED devices. SMtech and TEKTELIC Communications contribute with innovative gateways, sensors, and network management systems that strengthen the overall ecosystem. As IoT adoption accelerates across industries, the LoRaWAN market is poised for significant growth, enabling cost-efficient, scalable, and sustainable connectivity solutions for billions of devices worldwide..

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Component | Hardware, Software, and Services |

| Deployment Model | Private, Public, and Hybrid |

| Application | Smart gas and water metering, Asset tracking, Smart buildings, Smart parking, Precision agriculture, Smart waste management, Livestock monitoring, and Others |

| End Use | Utilities, Healthcare, Agriculture, Logistics and transportation, Manufacturing, Consumer electronics, Government and public sector, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Actility, A2A Smart City, Cisco System, Kerlink, KPN, Microchip Technology, Orange, SMtech, Swisscom AG, and TEKTELIC Communications |

| Additional Attributes | Dollar sales by component including gateways, network servers, and end devices, application across smart cities, industrial IoT, agriculture, and utilities, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising adoption of IoT solutions, demand for low-power wide-area networks, and increasing smart infrastructure development. |

The global LoRaWAN market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the LoRaWAN market is projected to reach USD 163.3 billion by 2035.

The LoRaWAN market is expected to grow at a 41.1% CAGR between 2025 and 2035.

The key product types in LoRaWAN market are hardware, software and services.

In terms of deployment model, private segment to command 39.5% share in the LoRaWAN market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LoRa & LoRaWAN IoT Market Growth – Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA