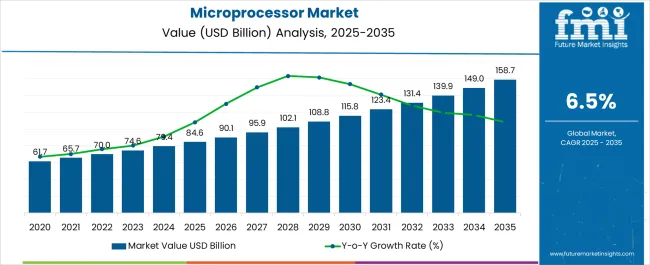

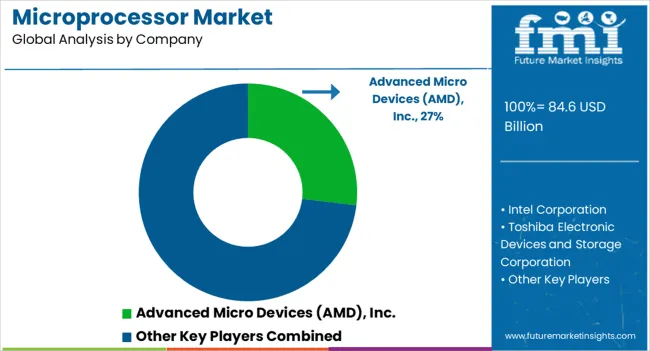

The microprocessor market is estimated to be valued at USD 84.6 billion in 2025 and is projected to reach USD 158.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

Market dynamics in this sector reveal complex operational challenges related to the extraordinary technical precision required for advanced processor manufacturing and the geopolitical tensions surrounding technology transfer restrictions that increasingly influence global supply chain strategies. Microprocessor development requires multi-year design cycles involving thousands of engineers and capital investments exceeding billions of dollars per generation, creating barriers to entry that limit meaningful competition to a small number of global participants. Manufacturing operations demand specialized fabrication facilities operating under extreme cleanliness standards and temperature controls that rival space exploration requirements, necessitating continuous facility upgrades and process refinements.

The technological landscape encompasses diverse architectural approaches ranging from general-purpose processors designed for broad computational flexibility to specialized chips optimized for specific applications like graphics processing, artificial intelligence acceleration, and signal processing functions. Design teams must balance performance optimization against power consumption constraints, manufacturing cost considerations, and compatibility requirements with existing software ecosystems while anticipating future application demands that may not emerge for several years after initial development begins. This technical complexity creates market segmentation where different processor categories serve distinct customer requirements with minimal overlap between target applications.

Investment patterns within the microprocessor sector reflect the capital-intensive nature of maintaining technological competitiveness while navigating increasingly fragmented global markets shaped by national security considerations. Companies must allocate substantial resources across research and development programs, manufacturing facility construction, and intellectual property protection initiatives while managing compliance costs associated with export control regulations and technology transfer restrictions. These investment requirements become complicated by the need to develop parallel development paths for different market segments subject to varying regulatory constraints.

Supply chain coordination presents extraordinary challenges due to the global distribution of specialized materials, manufacturing equipment, and technical expertise required for advanced processor production. Critical materials including rare earth elements, ultra-pure silicon, and specialized chemicals often originate from limited geographic sources, creating vulnerability to supply disruptions caused by natural disasters, trade disputes, or political tensions. Manufacturing equipment suppliers concentrate in specific countries, creating dependencies that can be affected by export control regulations or diplomatic relationships between nations.

Research and development collaboration increasingly encounters restrictions and limitations that affect the traditional model of global technology cooperation that historically accelerated innovation cycles. Academic partnerships, joint research programs, and technical exchange initiatives face scrutiny and limitations when involving participants from countries subject to technology transfer restrictions. These constraints force companies to develop redundant research capabilities and limit access to global talent pools that previously contributed to accelerated innovation cycles.

| Metric | Value |

|---|---|

| Microprocessor Market Estimated Value in (2025 E) | USD 84.6 billion |

| Microprocessor Market Forecast Value in (2035 F) | USD 158.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The microprocessor market is experiencing sustained momentum driven by advancements in computing performance, energy efficiency, and integration of artificial intelligence capabilities across multiple industries. Rising demand for connected devices, smart infrastructure, and data intensive applications is accelerating the use of advanced processors that deliver both high speed and low power consumption.

Continuous improvements in semiconductor manufacturing processes, such as smaller node technologies, are enhancing chip performance while reducing costs. The growing adoption of edge computing and autonomous systems is further propelling microprocessor innovation.

In addition, global investments in automotive electronics, industrial automation, and consumer devices are reinforcing steady demand. The outlook remains strong as companies prioritize innovation in processing power, efficiency, and adaptability to meet evolving digital transformation and mobility requirements.

The complex instruction set computer technology segment is projected to hold 41.70% of the total market revenue by 2025 within the technology category, making it the leading segment. This growth is being supported by its ability to execute complex commands efficiently and manage multiple tasks through a single instruction cycle.

The architecture enables compatibility with a wide range of applications, offering flexibility for both enterprise and consumer systems. Its strong presence in desktops, servers, and embedded systems is reinforced by mature development tools and software ecosystems.

The balance of performance, scalability, and backward compatibility has positioned complex instruction set computer technology as the most widely adopted segment in the microprocessor market.

The automotive and transportation segment is expected to represent 38.60% of the total market revenue by 2025, making it the most dominant application category. This growth is attributed to the increasing integration of microprocessors in advanced driver assistance systems, infotainment platforms, and vehicle to everything connectivity solutions.

Rising adoption of electric and autonomous vehicles has further intensified demand for processors capable of handling high computational workloads with real time responsiveness. Safety regulations and growing emphasis on in vehicle digitalization are accelerating the use of advanced chips in automotive electronics.

Continuous investments by automakers in next generation mobility solutions and the push for smarter, connected vehicles are consolidating the leadership of this application segment within the microprocessor market.

In contrast to the 4.13% CAGR observed between 2020 and 2025, the demand for microprocessor is anticipated to rise at a rate of 6.5% CAGR between 2025 and 2035. Global market expansion is being fueled by the electronics industry's rapid digitalization and automation, as well as the use of memory-based components in cutting-edge goods like smartphones, wearable technology, and electronic gadgets.

The smartphone market and industry have been growing and changing throughout time in terms of size and models. Emerging smartphone subscriptions are estimated to top six billion globally in 2024, and are likely to continue to grow by several hundred million over the following years, predicts Ericsson. China, India, and the United States are the three nations with high smartphone usage rates. According to predictions, there may be 7,516 million smartphone customers by 2029. The demand for cell phones is growing, thus the producers are creating more effective products.

An aging population, growing per capita disposable income, and improved quality of life are all closely correlated with healthcare spending. Long-life expectancies are a result of the world's old population, which is expanding at an unprecedented rate, but they come with a host of comorbidities. To enhance patient quality of life and lower medical expenses, microprocessors are used in a range of healthcare electronic systems, including real-time patient monitoring systems, wireless patient body monitoring systems, and remote health monitoring systems. For instance, electromyographic (EMG) impulses are translated into audible and visual signals by embedded microprocessors in nerve integrity monitors during several procedures

High Spending on the Gaming Industry is Providing Beneficial Prospects

Commonly found in contemporary consumer electronics, goods like smartphones and laptops are digital signal processor chips. Power speech recognition algorithms of these chips are used by programs like Google Assistant and Siri from Apple. DSPs have quickly migrated from modern smartphones and other consumer devices to military applications thanks to recent advances.

The integration of technologies like the In-Vehicle Infotainment (IVI) system, head-up displays, instrument clusters, AI-based voice assistants, and telematics into automobiles as a result of recent technological breakthroughs has significantly increased the demand for microprocessors in the sector. Additionally, as parking assistance and ADAS are used more frequently, the range of microprocessor applications is expanding.

The characteristics of the CISC-based processor, including its benefits over rival CPUs in terms of low cost, low power consumption, and low memory storage need, are attributed to driving the industry's growth. These capabilities boost the product's commercial acceptance in several sectors, including gaming hardware, automotive electronics, and IT & telecom infrastructure.

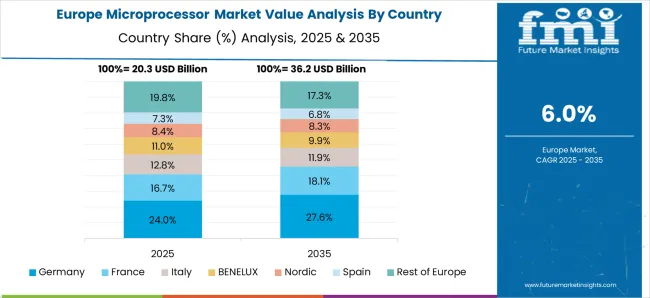

Several top automakers in the world, including Volvo Group, Audi, Volkswagen, Daimler, and BMW Group, are based in the area. In response to the region's stricter emission and traffic standards, nearly all key automakers are placing a growing emphasis on creating their electric vehicle models and self-driving automobiles. As a result, there may be a great uptake of automotive-grade microprocessors in the area, which is likely to significantly improve the prognosis for the industry given the high level of EV acceptance in nations like the United Kingdom, France, and Germany.

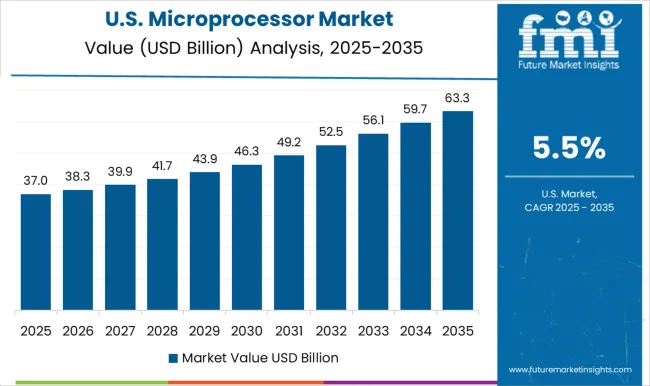

The growing need for intelligent and connected devices, such as IoT and smart devices, is the main driver of the possibility of microprocessor sales in the United States. The demand for strong and energy-efficient microprocessors to power these devices is rising as technology develops and more gadgets are linked to the internet.

This is generating a substantial opportunity for businesses in the America microprocessor market. The opportunity is also being driven in the United States by the expansion of sectors like autonomous vehicles, drones, and smart infrastructure that primarily rely on embedded microprocessors.

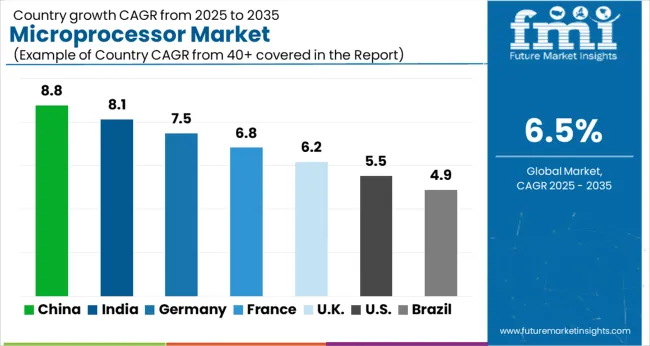

Asia Pacific region is expected to witness a 5% rate and hold a sizable market share. The rise is attributed to the region's growing usage of smartphones and other gadgets like laptops, mobile phones, desktop computers, and tablets.

Companies in the microprocessor sector should benefit significantly from government initiatives to encourage the creation of smart infrastructure and cities in India. It is anticipated that the need for microprocessors in sectors like automotive and industrial automation is likely to be driven by India's expanding manufacturing industry.

The need for embedded microprocessors in consumer electronics and other gadgets is also anticipated to be driven by India's vast and quickly expanding population, as well as its burgeoning middle class.

The Microprocessor Market is growing steadily as computing power becomes the backbone of digital transformation across industries such as consumer electronics, automotive, telecommunications, and data centers. Leading semiconductor companies like Advanced Micro Devices Inc. (AMD), Intel Corporation, and NVIDIA Corporation are at the forefront of innovation, developing advanced CPUs, GPUs, and AI accelerators that deliver high performance, energy efficiency, and scalability for next-generation computing applications. Their focus on heterogeneous architectures and chiplet-based designs is redefining system integration and processing capability.

Qualcomm Technologies Inc. and Texas Instruments Incorporated are driving the expansion of mobile and embedded processing markets with low-power, high-speed processors optimized for 5G connectivity, edge computing, and IoT devices. Samsung Electronics Co. Ltd., SK Hynix Inc., and Micron Technology Inc. play pivotal roles in integrating advanced memory and storage technologies with microprocessors to enhance system responsiveness and support complex AI workloads.

Taiwan Semiconductor Manufacturing Company Limited (TSMC) underpins the market as the leading foundry partner, enabling mass production of cutting-edge processors at sub-5nm nodes and supporting custom chip development for major OEMs and fabless design houses. Toshiba Electronic Devices and Storage Corporation contributes specialized microprocessors for industrial automation, automotive control, and energy-efficient consumer systems.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | Technology, Application, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled |

Advanced Micro Devices Inc., Intel Corporation, Toshiba Electronic Devices and Storage Corporation, Texas Instruments Incorporated, Qualcomm Technologies Inc., Taiwan Semiconductor Manufacturing Company Limited, SK Hynix Inc., Micron Technology Inc., Samsung Electronics Co. Ltd., NVIDIA Corporation |

| Customization & Pricing | Available upon Request |

The global microprocessor market is estimated to be valued at USD 84.6 billion in 2025.

The market size for the microprocessor market is projected to reach USD 158.7 billion by 2035.

The microprocessor market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in microprocessor market are complex instruction set computer (cisc), reduced instruction set computer (risc), application-specific integrated circuit (asic), superscalar and digital signal processor (dsp).

In terms of application, automotive & transportation segment to command 38.6% share in the microprocessor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Server Microprocessor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA