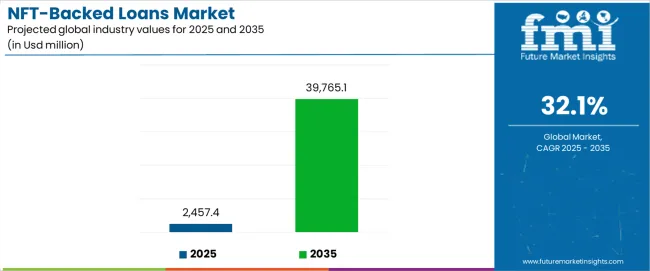

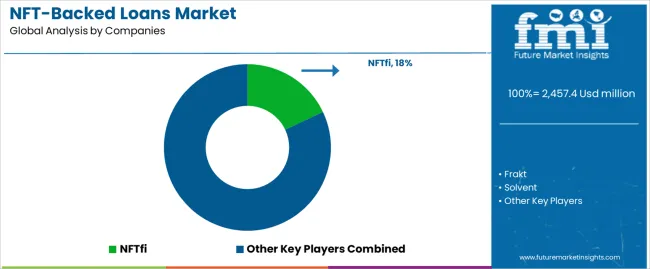

The global NFT-backed loans market, valued at USD 2,457.4 million in 2025 and projected to reach USD 39,765.1 million by 2035 at a CAGR of 32.1%, will expand almost 16.18X, but this growth will vary widely across regions depending on digital asset regulation, DeFi adoption, and institutional participation. North America is expected to retain the lead, underpinned by the United States’ dominant role in crypto markets, deep liquidity pools, and early institutional entry into digital asset lending. Regulatory developments around digital asset custody and collateralization, coupled with the presence of major DeFi platforms and NFT marketplaces, create a favorable foundation for NFT-backed loan growth. Demand is further strengthened by strong venture capital funding and the rapid integration of NFTs into mainstream fintech ecosystems. Europe will also see significant adoption, particularly in hubs such as the UK, Germany, and Switzerland, where crypto-friendly regulations and strong financial infrastructure support DeFi activities. The region’s emphasis on compliance with MiCA (Markets in Crypto-Assets Regulation) and experimentation with tokenized assets will drive trust in NFT-collateralized lending. Traditional banks exploring tokenized lending products may accelerate adoption, although fragmented regulation across EU member states could temper short-term scaling.

Asia Pacific is projected to emerge as the fastest-growing region, driven by high retail crypto participation and rapid institutional uptake in markets like Singapore, Hong Kong, South Korea, and Japan. China’s restrictive stance may slow domestic growth, but other Asian economies are positioning themselves as innovation hubs by supporting blockchain ventures and digital asset-backed financing. NFT integration into gaming and metaverse ecosystems in this region will create a unique catalyst for collateralization use cases beyond collectibles, reinforcing growth momentum.

The Middle East is gradually evolving into an influential niche market, supported by national visions to diversify economies and establish digital asset hubs. The UAE and Saudi Arabia, with their push into blockchain adoption and supportive frameworks, are expected to lead NFT-backed loan activities in the region, especially linked to real estate tokenization and institutional lending partnerships. Latin America is likely to represent a smaller but steadily growing share of the global market. Crypto adoption in Brazil, Argentina, and Mexico is driven by inflation hedging and financial inclusion, and NFT-backed loans could emerge as a natural extension of decentralized finance in underserved banking markets. However, a lack of regulatory clarity and infrastructure could slow widespread institutional engagement.

Between 2025 and 2030, the nft-backed loans market is projected to expand from USD 2,457.4 million to USD 13,058.4 million, resulting in a value increase of USD 10,601.0 million, which represents 28.4% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of NFT valuation protocols, rising demand for high-value digital asset collateral, and growing emphasis on automated lending systems with enhanced risk assessment capabilities. Financial service providers are expanding their digital asset capabilities to address the growing demand for nft-collateralized lending, cross-chain compatibility, and institutional-grade custody solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,457.4 million |

| Forecast Value in (2035F) | USD 39,765.1 million |

| Forecast CAGR (2025 to 2035) | 32.1% |

From 2030 to 2035, the market is forecast to grow from USD 13,058.4 million to USD 39,765.1 million, adding another USD 26,706.7 million, which constitutes 71.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of cross-chain lending protocols, the integration of ai-powered risk assessment systems, and the development of multi-asset collateral platforms with enhanced liquidity mechanisms. The growing adoption of institutional DeFi practices will drive demand for nft-backed loans with superior regulatory compliance and compatibility with traditional financial infrastructure across global markets.

Between 2020 and 2025, the nft-backed loans market experienced exponential growth, driven by increasing demand for digital asset monetization and growing recognition of NFT lending as essential infrastructure for the digital economy across gaming, art, and virtual real estate applications. The market developed as collectors and investors recognized the potential for nfts to unlock liquidity while maintaining ownership exposure and enabling capital-efficient portfolio management. Technological advancement in oracle systems and automated valuation mechanisms began emphasizing the critical importance of maintaining accurate pricing and risk assessment in volatile digital asset environments.

Market expansion is being supported by the increasing global demand for digital asset liquidity solutions and the corresponding need for automated systems that can provide superior collateral valuation and risk management while enabling reduced counterparty risk and enhanced capital efficiency across various DeFi and traditional finance applications. Modern financial institutions and digital asset specialists are increasingly focused on implementing lending technologies that can deliver instant liquidity access, prevent asset liquidation requirements, and provide consistent performance throughout volatile market conditions and diverse asset categories. nft-backed loans' proven ability to deliver exceptional liquidity against illiquid assets, enable time-efficient capital access, and support flexible repayment structures make them essential tools for contemporary digital asset management and portfolio optimization operations.

The growing emphasis on digital asset integration and financial innovation is driving demand for nft-backed loans that can support institutional requirements, improve capital efficiency outcomes, and enable automated lending systems. Investors' preference for technology that combines asset retention with immediate liquidity access and operational flexibility is creating opportunities for innovative lending implementations. The rising influence of decentralized finance and digital-first financial services is also contributing to increased demand for nft-backed loans that can provide cross-platform compatibility, real-time valuation capabilities, and reliable performance across extended market cycles.

The nft-backed loans market is poised for explosive growth and transformation. As industries across finance, gaming, art, and digital collectibles seek solutions that deliver exceptional liquidity access, portfolio optimization, and capital efficiency, nft-backed loans are gaining prominence not just as alternative lending products but as strategic enablers of modern digital asset management and DeFi ecosystem development.

Rising institutional adoption in North America and expanding DeFi initiatives globally amplify demand, while developers are leveraging innovations in oracle systems, automated valuation models, and cross-chain interoperability technologies.

Pathways like institutional-grade lending platforms, ai-powered risk assessment, and multi-asset collateral solutions promise strong margin uplift, especially in high-value NFT segments. Geographic expansion and protocol integration will capture volume, particularly where regulatory clarity and institutional adoption are critical. Regulatory development around digital asset lending, DeFi compliance requirements, and financial innovation standards give structural support.

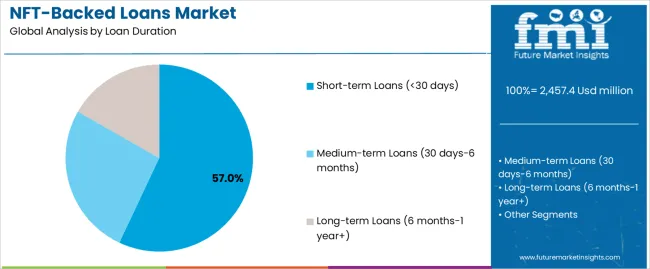

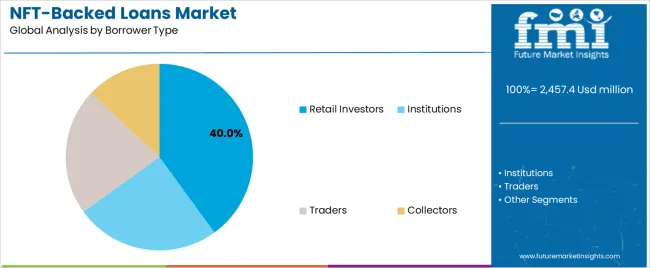

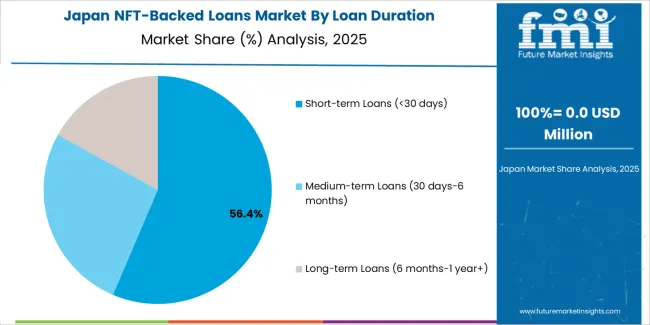

The market is segmented by loan duration, application, borrower type, lending platform, and region. By loan duration, the market is divided into short-term loans (<30 days), medium-term loans (30 days-6 months), and long-term loans (6 months-1 year+). By application, it covers digital art, gaming assets, virtual real estate, collectibles, and others. By borrower type, the market includes retail investors, institutions, traders, and collectors. By lending platform, it is categorized into decentralized protocols, centralized exchanges, hybrid platforms, and traditional financial institutions. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The short-term loans (<30 days) segment is projected to account for 57.0% of the nft-backed loans market in 2025, reaffirming its position as the leading duration category. Digital asset traders and short-term liquidity seekers increasingly utilize short-term nft-backed loans for their superior capital efficiency when operating across volatile market conditions, excellent flexibility characteristics, and cost-effectiveness in applications ranging from arbitrage opportunities to quick liquidity access for high-value transactions. Short-term NFT lending technology's rapid settlement capabilities and minimal interest exposure directly address the market requirements for agile capital management in fast-moving digital asset environments.

This duration segment forms the foundation of modern DeFi trading strategies, as it represents the loan type with the greatest liquidity efficiency and established market demand across multiple trading categories and investment approaches. Platform investments in instant liquidation mechanisms and automated repayment systems continue to strengthen adoption among active traders and institutional arbitrage operations. With borrowers prioritizing capital velocity and risk minimization, short-term nft-backed loans align with both performance requirements and cost optimization objectives, making them the central component of comprehensive digital asset trading strategies.

Retail investor applications are projected to account for 40% of nft-backed loan demand in 2025, reflecting their central role as the primary consumer base for accessible digital asset lending solutions. This segment is critical for portfolio management, liquidity access, and investment diversification. Retail investors prefer nft-backed loans for their user-friendly platforms, accessibility, and the ability to monetize digital collections while retaining ownership exposure during diverse market conditions. These loans are integral to modern digital asset portfolios, providing immediate liquidity advantages and portfolio optimization benefits. The segment’s growth is driven by continuous innovation in user experience design and the expanding availability of simplified lending interfaces. These innovations facilitate seamless borrowing, enhanced by improved security protocols and transparent pricing mechanisms. Additionally, retail platforms are investing heavily in educational resources to encourage widespread adoption and risk management awareness. As digital asset ownership becomes more widespread and individual investors become more sophisticated, retail investor applications will continue to dominate the end-user market, supporting advanced portfolio management and wealth optimization strategies.

The nft-backed loans market is advancing rapidly due to increasing demand for digital asset liquidity solutions and growing adoption of DeFi lending protocols that provide superior capital efficiency and automated risk management while enabling reduced counterparty exposure across diverse digital asset and traditional finance applications. However, the market faces challenges, including volatile collateral valuations, regulatory uncertainty, and the need for robust oracle systems and market-making infrastructure. Innovation in cross-chain interoperability and ai-powered risk assessment continues to influence product development and market expansion patterns.

The growing adoption of institutional custody solutions, regulatory-compliant lending protocols, and enterprise-grade risk management systems is enabling traditional financial institutions to integrate nft-backed lending with superior compliance capabilities, enhanced operational security, and automated regulatory reporting functionalities. Advanced institutional platforms provide improved risk assessment while allowing more sophisticated portfolio management and consistent performance across various asset classes and market conditions. Financial institutions are increasingly recognizing the competitive advantages of NFT lending capabilities for client service differentiation and alternative asset exposure.

Modern NFT lending platforms are incorporating machine learning algorithms, real-time market analysis, and predictive risk modeling systems to enhance collateral valuation accuracy, enable dynamic pricing mechanisms, and deliver intelligent lending solutions to digital asset borrowers. These technologies improve lending efficiency while enabling new operational capabilities, including automated liquidation protection, market volatility hedging, and reduced operational complexity. Advanced AI integration also allows platforms to support comprehensive risk management systems and lending optimization beyond traditional manual assessment approaches.

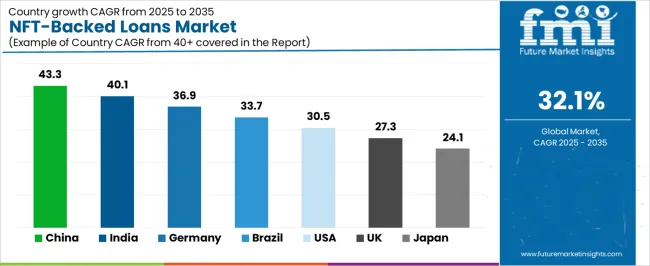

| Country | CAGR (2025-2035) |

|---|---|

| China | 43.3% |

| India | 40.1% |

| Germany | 36.9% |

| Brazil | 33.7% |

| USA | 30.5% |

| UK | 27.3% |

| Japan | 24.1% |

The nft-backed loans market is experiencing exceptional growth globally, with China leading at a 43.3% CAGR through 2035, driven by the expanding digital economy initiatives, growing blockchain technology adoption, and significant investment in NFT marketplace development. India follows at 40.1%, supported by government initiatives promoting digital financial inclusion, increasing crypto adoption rates, and growing digital art and gaming sectors. Germany shows growth at 36.9%, emphasizing fintech innovation and advanced regulatory frameworks for digital assets. Brazil records 33.7%, focusing on DeFi expansion and cryptocurrency market development. The USA demonstrates 30.5% growth, prioritizing regulatory clarity and institutional adoption excellence. The UK exhibits 27.3% growth, emphasizing fintech leadership and digital asset innovation development. Japan shows 24.1% growth, supported by advanced gaming culture and digital collectibles concentration.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Revenue from nft-backed loans in China is projected to exhibit exceptional growth with a CAGR of 43.3% through 2035, driven by expanding digital economy initiatives and rapidly growing blockchain adoption supported by government backing for technology innovation and digital asset development. The country's strong position in NFT marketplaces and increasing investment in DeFi infrastructure are creating substantial demand for advanced NFT lending solutions. Major technology companies and digital asset platforms are establishing comprehensive lending operation capabilities to serve both domestic digital asset demand and international expansion markets.

Revenue from nft-backed loans in India is expanding at a CAGR of 40.1%, supported by the country's massive tech-savvy population, expanding government support for digital financial services, and increasing adoption of cryptocurrency and blockchain solutions. The country's initiatives promoting fintech innovation and growing developer ecosystem are driving requirements for advanced digital asset lending capabilities. International platforms and domestic startups are establishing extensive development and service capabilities to address the growing demand for NFT lending products.

Revenue from nft-backed loans in Germany is expanding at a CAGR of 36.9%, supported by the country's advanced fintech capabilities, strong emphasis on regulatory compliance innovation, and robust demand for high-security digital asset solutions in institutional and retail applications. The nation's mature financial sector and technology-focused regulations are driving sophisticated NFT lending systems throughout the digital asset industry. Leading financial institutions and technology providers are investing extensively in compliance systems and institutional-grade platforms to serve both domestic and European Union markets.

Revenue from nft-backed loans in Brazil is growing at a CAGR of 33.7%, driven by the country's expanding cryptocurrency adoption, growing DeFi ecosystem, and increasing investment in blockchain technology development. Brazil's large digital asset community and commitment to financial technology innovation are supporting demand for efficient NFT lending solutions across multiple digital asset segments. Platforms are establishing comprehensive service capabilities to serve the growing domestic market and Latin American expansion opportunities.

Revenue from nft-backed loans in the USA is expanding at a CAGR of 30.5%, supported by the country's advanced financial technology sector, strategic focus on institutional digital asset adoption, and established regulatory development for blockchain applications. The USA's financial innovation leadership and institutional infrastructure are driving demand for nft-backed loans in traditional finance, institutional custody, and enterprise blockchain applications. Financial institutions are investing in comprehensive compliance development to serve both domestic institutional markets and international enterprise applications.

Revenue from nft-backed loans in the UK is growing at a CAGR of 27.3%, driven by the country's focus on fintech innovation, emphasis on digital asset regulation, and strong position in financial technology development. The UK's established financial innovation capabilities and commitment to blockchain-friendly regulation are supporting investment in advanced NFT lending technologies throughout major financial centers. Industry leaders are establishing comprehensive regulatory compliance systems to serve domestic financial operations and international fintech applications.

Revenue from nft-backed loans in Japan is expanding at a CAGR of 24.1%, supported by the country's advanced gaming culture, growing digital collectibles sector, and strategic emphasis on entertainment technology development. Japan's established gaming industry and integrated digital entertainment systems are driving demand for specialized nft-backed loans in gaming assets, digital collectibles, and entertainment applications. Leading gaming companies are investing in specialized capabilities to serve the unique requirements of gaming economies and digital entertainment industries.

The nft-backed loans market in Europe is projected to grow from USD 487.2 million in 2025 to USD 8,826.4 million by 2035, registering a CAGR of 33.8% over the forecast period. Germany is expected to maintain its leadership position with a 42.1% market share in 2025, growing to 43.8% by 2035, supported by its strong fintech sector, advanced regulatory framework capabilities, and comprehensive digital asset infrastructure serving diverse NFT lending applications across Europe.

France follows with a 21.3% share in 2025, projected to reach 22.7% by 2035, driven by robust demand for nft-backed loans in digital art markets, luxury goods tokenization, and cultural asset applications, combined with established financial technology infrastructure and creative industry expertise. The United Kingdom holds a 18.9% share in 2025, expected to reach 17.2% by 2035, supported by strong fintech leadership and growing institutional adoption activities. Italy commands a 8.7% share in 2025, projected to reach 9.1% by 2035, while Spain accounts for 5.2% in 2025, expected to reach 4.8% by 2035. The Netherlands maintains a 2.1% share in 2025, growing to 1.9% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Poland, and other nations, is anticipated to maintain momentum, with its collective share moving from 1.7% to 0.5% by 2035, attributed to increasing blockchain adoption in Eastern Europe and growing digital asset penetration in Nordic countries implementing advanced fintech programs.

The nft-backed loans market is characterized by competition among established DeFi protocols, specialized NFT lending platforms, and integrated digital asset solutions providers. Companies are investing in oracle technology research, cross-chain compatibility optimization, automated valuation system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific NFT lending solutions. Innovation in ai-powered risk assessment, institutional custody integration, and user experience enhancement is central to strengthening market position and competitive advantage.

nftfi leads the market with an 18% market share, offering comprehensive peer-to-peer NFT lending solutions including advanced collateral management systems with a focus on retail and institutional applications. Frakt provides specialized Solana-based lending capabilities with an emphasis on gaming assets and automated liquidation systems. Solvent delivers innovative fractionalized NFT lending products with a focus on high-value collections and institutional custody. Honey Finance specializes in automated lending protocols and multi-chain compatibility for diverse NFT ecosystems. Arcade focuses on institutional-grade lending infrastructure and traditional finance integration. BendDAO offers decentralized autonomous lending systems with emphasis on blue-chip NFT collections and community governance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,457.4 million |

| Loan Duration | Short-term Loans (<30 days), Medium-term Loans (30 days-6 months), Long-term Loans (6 months-1 year+) |

| Application | Digital Art, Gaming Assets, Virtual Real Estate, Collectibles, Others |

| Borrower Type | Retail Investors, Institutions, Traders, Collectors |

| Lending Platform | Decentralized Protocols, Centralized Exchanges, Hybrid Platforms, Traditional Financial Institutions |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | nftfi, Frakt, Solvent, Honey Finance, Arcade, and BendDAO |

| Additional Attributes | Dollar volume by loan duration and borrower category, regional demand trends, competitive landscape, technological advancements in oracle systems, cross-chain integration development, AI valuation innovation, and institutional adoption integration |

The global nft-backed loans market is estimated to be valued at USD 2,457.4 usd million in 2025.

The market size for the nft-backed loans market is projected to reach USD 39,765.1 usd million by 2035.

The nft-backed loans market is expected to grow at a 32.1% CAGR between 2025 and 2035.

The key product types in nft-backed loans market are short-term loans (<30 days), medium-term loans (30 days-6 months) and long-term loans (6 months-1 year+).

In terms of borrower type, retail investors segment to command 40.0% share in the nft-backed loans market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA