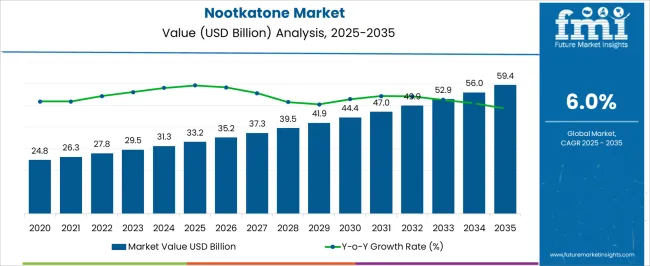

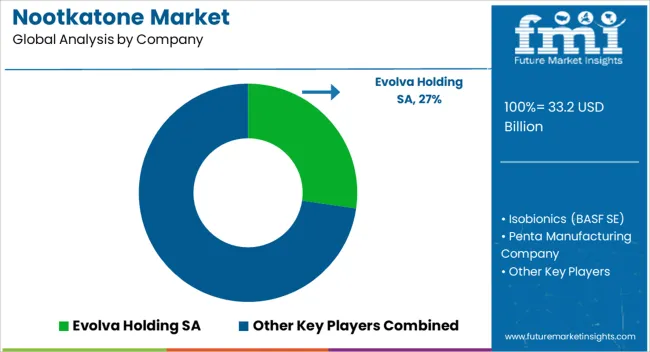

The Nootkatone Market is estimated to be valued at USD 33.2 billion in 2025 and is projected to reach USD 59.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Nootkatone Market Estimated Value in (2025 E) | USD 33.2 billion |

| Nootkatone Market Forecast Value in (2035 F) | USD 59.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The nootkatone market is witnessing robust growth driven by rising demand for natural flavor and fragrance ingredients across personal care, food, and pharmaceutical industries. Increasing consumer preference for clean label products and plant based active compounds is fostering the adoption of nootkatone as a natural alternative to synthetic additives.

Regulatory approvals for use in insect repellents and food applications have expanded its commercial viability in recent years. Technological advancements in extraction processes and biosynthesis methods are improving product yield and purity, making nootkatone more accessible and cost effective.

In addition, the growing focus on sustainable sourcing and environmentally friendly formulation practices is reinforcing its acceptance across diverse sectors. The market outlook remains positive as manufacturers align with evolving consumer expectations around ingredient transparency and functional natural ingredients.

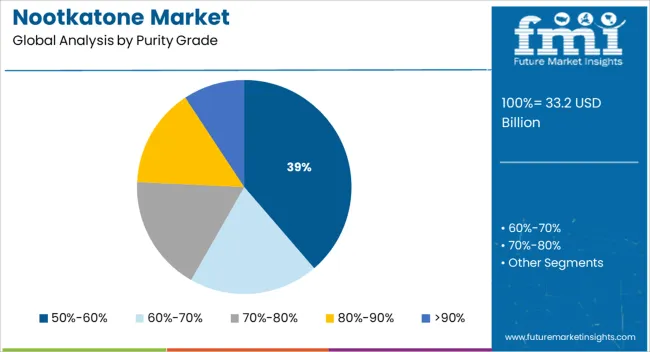

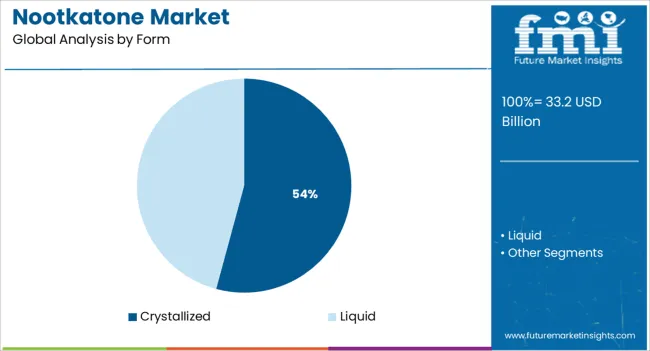

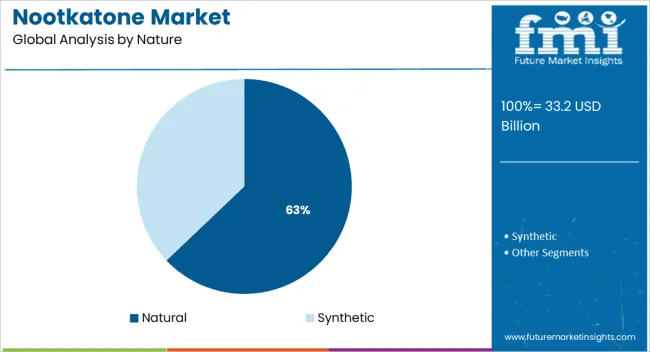

The market is segmented by Purity Grade, Form, Nature, and Application and region. By Purity Grade, the market is divided into 50%-60%, 60%-70%, 70%-80%, 80%-90%, and >90%. In terms of Form, the market is classified into Crystallized and Liquid. Based on Nature, the market is segmented into Natural and Synthetic. By Application, the market is divided into Food & Beverage, Personal Care, and Home Care. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 50% to 60% purity grade segment is projected to hold 38.70% of the total market revenue by 2025, positioning it as the leading purity category. This dominance is attributed to its optimal balance between efficacy and cost, making it suitable for large scale applications in fragrances, food flavoring, and insect repellents.

The grade offers sufficient concentration for commercial effectiveness while remaining economically viable for bulk procurement. Its adoption is further driven by its compatibility with regulatory standards in multiple end use industries.

As demand for mid range purity ingredients continues to rise in scalable formulations, the 50% to 60% category is expected to retain its leadership in the purity segment.

The crystallized form segment is expected to account for 54.20% of the overall market by 2025, emerging as the dominant form. Crystallized nootkatone offers higher stability, extended shelf life, and easier handling during formulation processes.

It is particularly favored in fragrance and flavor manufacturing where consistent quality and concentration are critical. This form also allows for more accurate dosing and integration into both solid and liquid end products.

Its enhanced compatibility with manufacturing standards and logistical efficiency have reinforced its adoption across global markets. As industries seek high performance and formulation ready compounds, crystallized nootkatone continues to lead the form segment.

The natural segment is forecasted to contribute 62.90% of total revenue by 2025 under the nature category, maintaining its position as the most preferred variant. This leadership is driven by escalating consumer demand for plant derived and sustainably sourced ingredients across all major end use sectors.

Natural nootkatone is favored for its origin from grapefruit or cedarwood and is increasingly used in clean label formulations that prioritize transparency and environmental responsibility. Regulatory support for natural ingredients in food, personal care, and wellness sectors has further elevated its market acceptance.

As sustainability becomes central to product innovation, the natural segment is expected to dominate due to its alignment with global trends in health conscious and eco aware consumption.

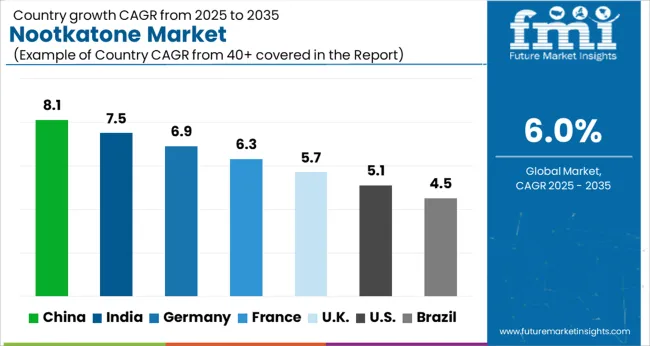

The global market for nootkatone is projected to grow at a healthy CAGR of 6.0% between 2025 and 2035 in comparison to the 4.0% CAGR registered during the historical period from 2020 to 2025.

The rising application of nootkatone across diverse industries including food & beverages, personal care & cosmetics, and homecare is a key factor expected to boost sales of nootkatone during the forecast period.

The health-benefiting nutritional properties of nootkatone and increasing awareness among consumers about healthy eating habits are prompting food manufacturers to add this nutritional food additive to their products. Manufacturers in the citrus fiber industry are coming up with healthier energy drinks with citrus food additives and protein powders with improved gelling properties. Such wide applications will lead to a surge in demand for nootkatone products.

Citrus fruits are a rich source of minerals, essential vitamins, and other nutrients. Therefore, citrus fruits like grapefruit, orange, and lemon that are used to make nootkatone are significantly utilized in pharmaceutical and nutraceutical applications. This is expected to enhance the growth of the nootkatone market over the forecast period. Nootkatone functions as an oil stabilizer and emulsifier and enhances the shelf life of beverages as well as enhances their taste.

Technological innovations in the production of citrus ingredients, their properties such as solubility and thermal stability, and their functions as binding agents and emulsifiers have opened many opportunities for citrus fiber products’ use in bakery products, plant-based food and beverages, ready-to-eat food and beverages, personal care, cosmetic products, pharmaceutical products, and many more. The increased usage of citrus fiber products in new areas has boosted the citrus fiber market globally, which is driven by the use of ingredients and food additives like nootkatone.

Consumers’ Inclination Toward Flavored Products Boosting Nootkatone Market

Consumers are increasingly interested in flavored products. This has increased in the production of food color remedies such as nootkatone, which are stable and offer a two-color blend. Thus, growing demand for flavored food products and beverages across the HoReCa sector due to changing consumer preferences will continue to fuel sales of nootkatone.

Furthermore, manufacturers' development of various emerging innovations for the formation of water-miscible solutions for foods and beverages is expected to aid the expansion of the nootkatone market.

Rising Trend of Using Organic and Natural Products to Help Market Thrive

Purchasers continue to express health-related concerns and limit their consumption of foods that contain synthetic chemicals, chemicals, or synthetic additives. To maintain a healthy lifestyle, consumers prefer natural and natural food products. Consequently, food manufacturers are also showing a keen inclination towards using natural ingredients like nootkatone in their products. This will help the global nootkatone industry to thrive over the next ten years.

Growing Preference for Clean-labeled Products Likely to Boost Nootkatone Sales

Consumers today pay close attention to product ingredient lists and labels and want a higher level of control in their diet. For food manufacturers, clean-label means providing simplified, easy-to-understand lists of ingredients that do not include ingredients that are obscure or unpopular.

According to an International Ingredients Solutions company, around 80% of consumers in the world want to help create a healthier society by identifying all-natural ingredients on their food packages. Around 17 countries both physically and electronically surveyed consumers from 2007 to 2020 and they found that around 80% of consumers from these locations feel that a brief and simple list of ingredients on their food packages is important.

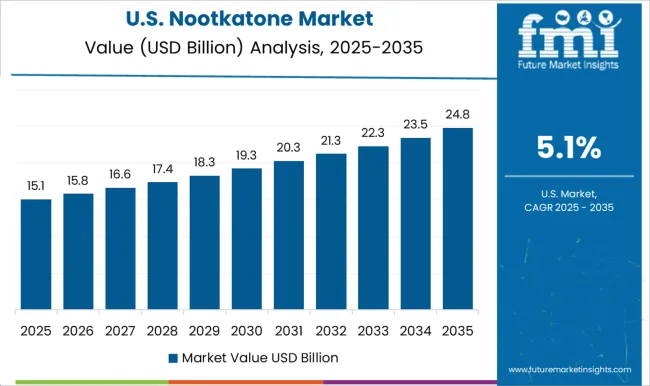

Rising Usage of Nootkatone in Perfumes to Boost Sales in the USA

As per FMI, the USA nootkatone market is poised to exhibit strong growth on the back of increasing usage of nootkatone in the perfume industry. Nootkatone has a wide range of uses, from repelling insects to being used as a fragrant ingredient in perfumes. While its use is not yet widespread, nootkatone has great potential to become a common household item in the USA

Nootkatone is a naturally-occurring substance found in Alaska and Canada. It has a strong scent that repels insects, making it ideal for use in bug sprays and other insect-repelling products. It is being increasingly used by companies as a fragrant ingredient in perfumes and other personal care products.

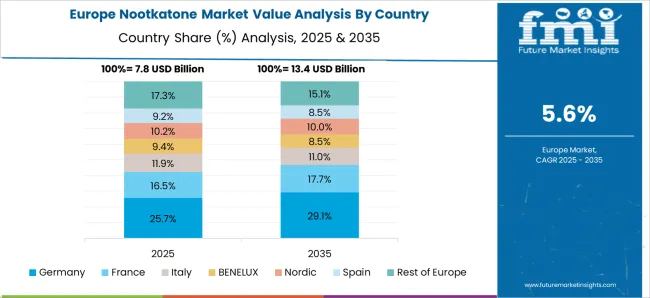

Growing Demand for Natural Insect Repellents Boosting Market in Germany

With consumers constantly looking for natural and safer insect repellents, demand for nootkatone across Germany is projected to grow at a healthy pace during the next ten years.

Nootkatone is a natural product found in the essential oils of grapefruit and other citrus fruits. It has a wide range of uses, including food flavoring, fragrance, and insect repellent. In recent years, nootkatone has become increasingly popular across Germany as an alternative to DEET, the synthetic chemical compound that is currently the gold standard for mosquito repellents.

Nootkatone is more effective than DEET at repelling mosquitoes and other insects, and it is also safer for humans and the environment. The majority of the world's nootkatone supply comes from China. However, German company Eckart GmbH has been working to increase its production of nootkatone in order to corner the European market.

Increasing Application in Cosmetics and Personal Care Industry Propelling Demand in the United Kingdom

In recent years, the United Kingdom has become the fastest-growing market for nootkatone, a naturally occurring compound that gives grapefruits their characteristic flavor. This can be attributed to the rising usage of nootkatone in personal care and cosmetics products and increasing consumer spending on these products.

Nootkatone is used in a variety of products, including cosmetics, food flavorings, and fragrances. Nootkatone was first isolated from grapefruit peel in the 1930s, but it was not until the early 2000s that its potential as a commercial product was realized. In 2004, a Japanese company began selling a Nootkatone-based fragrance, and since then, sales of Nootkatone products have steadily increased. The United Kingdom is now the largest market for nootkatone products outside of Japan, and demand is growing rapidly.

Growing Trend of Veganism Propelling Demand for Natural Nootkatone

Based on nature, the global market for nootkatone is segmented into natural and synthetic. Among these, the natural segment is likely to grow at a higher CAGR during the forecast period. This can be attributed to the rising consumer preference for natural products.

Veganism is a growing global dietary trend. People choose plant-based diets for a variety of reasons, the three most important of which are animal suffering, environmental protection, and personal health. People are becoming strict vegan, vegetarian, and flexitarian as their concerns about some of these factors grow. As a result, they are choosing natural plant-based nootkatone over a synthetic ones.

Similarly, rising health concerns are playing a key role in prompting consumers to opt for natural products. Consumers continue to express health-related concerns and limit their consumption of foods that contain synthetic chemicals, chemicals, or synthetic additives. They prefer natural and natural food products. Consequently, food manufacturers are also increasing their usage of natural ingredients

Key players operating the market for nootkatone include Evolva Holding SA, Isobionics (BASF SE), Penta Manufacturing Company, Vigon International, Inc, Moellhausen S.p.A., Fine Fragrances Pvt. Ltd. Florida Worldwide Citrus Products Group, Inc., The Flavored Herb.

Most of the players are focused on introducing high-quality products with high nutritional content and sustainable features in the market. New players on the other hand are concentrating on incorporating more advanced processing technologies, which are not just economical but also environmentally friendly as well. Some of the recent developments in this market space are given below:

In June 20240 Givaudan, a global leader in taste and wellbeing, and Manus Bio, a leading biomanufacturer of natural products, launched BioNootkatone, a sustainable, clean-label citrus ingredient with a natural taste that can be used in a variety of food and beverages.

In 2020, BASF entered into natural flavors and fragrances with the acquisition of Isobionics, an innovative leader in biotechnology that serves the global market for natural flavors and fragrances.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 33.2 billion |

| Projected Market Size (2025 to 2035) | USD 59.4 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.0% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Thousand for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa(MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, United Arab Emirates(UAE) |

| Key Segments Covered | Purity Grade, Form, Nature, Application, Region |

| Key Companies Profiled | Evolva Holding SA; Isobionics (BASF SE); Penta Manufacturing Company; Vigon International, Inc.; Moellhausen S.p.A.; Fine Fragrances Pvt. Ltd.; Florida Worldwide Citrus Products Group, Inc.; The Flavored Herb |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global nootkatone market is estimated to be valued at USD 33.2 billion in 2025.

The market size for the nootkatone market is projected to reach USD 59.4 billion by 2035.

The nootkatone market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in nootkatone market are 50%-60%, 60%-70%, 70%-80%, 80%-90% and >90%.

In terms of form, crystallized segment to command 54.2% share in the nootkatone market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA