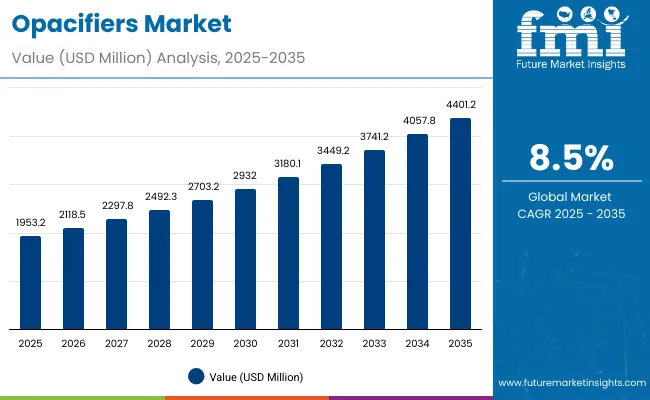

The Opacifiers Market is projected to be valued at USD 1,953.2 million in 2025, expanding to USD 4,401.2 million by 2035. This reflects a total addition of more than USD 2,448 million across the decade, signaling an 8.5% CAGR. The expansion is anticipated to deliver more than a 2X increase in market size, underpinned by consistent formulation requirements in personal care and industrial applications.

Opacifiers Market Key Takeaways

| Metric | Value |

|---|---|

| Opacifiers Market Estimated Value in (2025E) | USD 1,953.2 million |

| Opacifiers Market Forecast Value in (2035F) | USD 4,401.2 million |

| Forecast CAGR (2025 to 2035) | 8.50% |

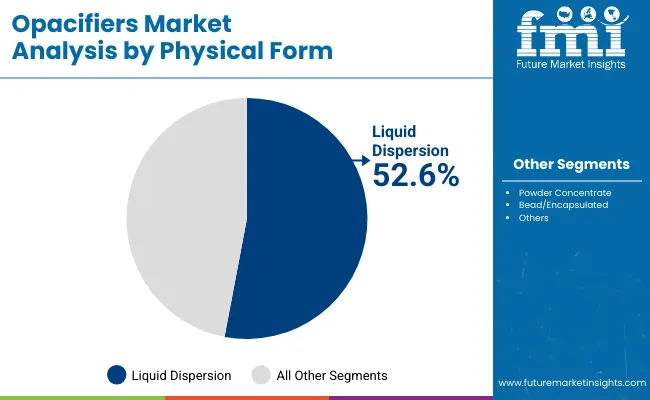

During the first half of the forecast window (2025-2030), revenues are expected to rise from USD 1,953.2 million to USD 2,932.0 million, adding nearly USD 979 million, which accounts for approximately 40% of the decade’s growth. This phase is likely to be characterized by stable adoption across mass personal care and premium product reformulations, driven by consumer demand for consistent texture, improved sensory performance, and more sustainable ingredients. Liquid dispersion formats, holding 52.6% share in 2025, are expected to anchor this phase due to ease of use in high-volume production environments.

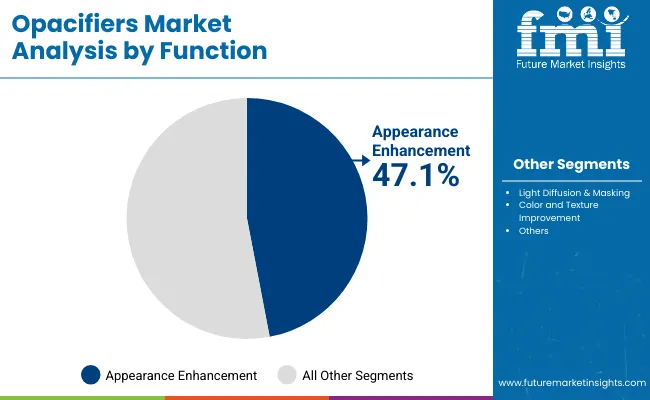

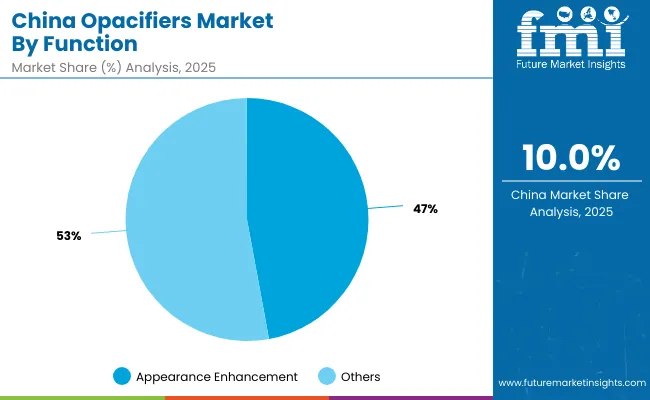

The second half (2030-2035) is projected to deliver a sharper gain, with the market advancing from USD 2,932.0 million to USD 4,401.2 million, equating to over USD 1,469 million in incremental value and nearly 60% of total decade expansion. This growth is expected to be supported by the widening role of opacifiers in premium categories, where appearance enhancement already accounting for 47.1% share in 2025 remains a central performance driver. Regional momentum is likely to be shaped by double-digit growth in China and India, while North America and Europe sustain stable demand through specification lock-ins and regulatory compliance.

Between 2020 and 2024, steady adoption of opacifiers in personal care formulations was observed, driven by consumer demand for enhanced appearance, texture uniformity, and visual density in both mass and premium categories. By 2025, market valuation is expected to reach USD 1,953.2 million, with demand anchored in shampoos, conditioners, and body washes where opacity remains critical for consumer perception.

Over the forecast horizon, revenues are anticipated to expand strongly, achieving USD 4,401.2million by 2035. Growth momentum is expected to be supported by premium personal care, where appearance enhancement already representing 47.1% share in 2025 remains a defining performance parameter. Emerging economies such as China and India are projected to outpace mature markets, driven by double-digit growth trajectories and expanding domestic personal care production.

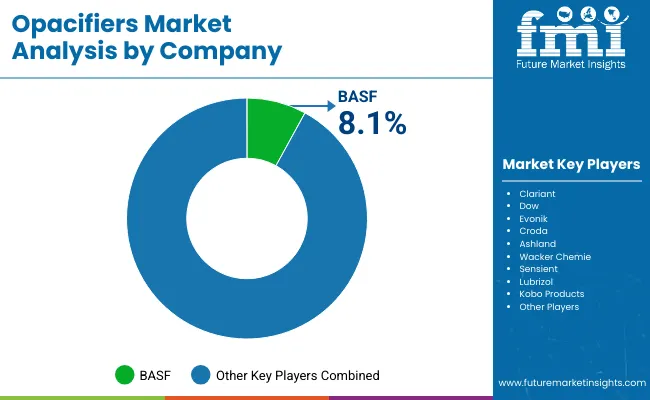

The competitive landscape is expected to remain fragmented, with BASF leading at 8.1% global share in 2025. Advantage is projected to accrue to suppliers able to provide sustainable, dispersion-stable systems that enable efficiency in large-scale production and compliance with evolving regulatory frameworks.

The Opacifiers Market is being driven by rising formulation complexity and the growing need for consistent visual performance in personal care and cosmetic products. Demand is being fueled by brand strategies that emphasize texture uniformity, opacity, and sensory appeal as critical differentiators in crowded consumer markets. Increasing adoption of liquid dispersion formats is being observed due to their efficiency in large-scale manufacturing and reduced handling risks.

Premium personal care and masstige categories are expected to accelerate uptake, as opacity becomes linked with luxury positioning and product quality perception. Emerging economies such as China and India are projected to contribute significantly, supported by double-digit growth in local production and consumer demand. Regulatory pressures and sustainability narratives are prompting reformulation cycles, where dosage efficiency and stable dispersion systems are being prioritized. Over the coming decade, innovation in sustainable alternatives and expansion of contract manufacturing networks are expected to reinforce long-term growth.

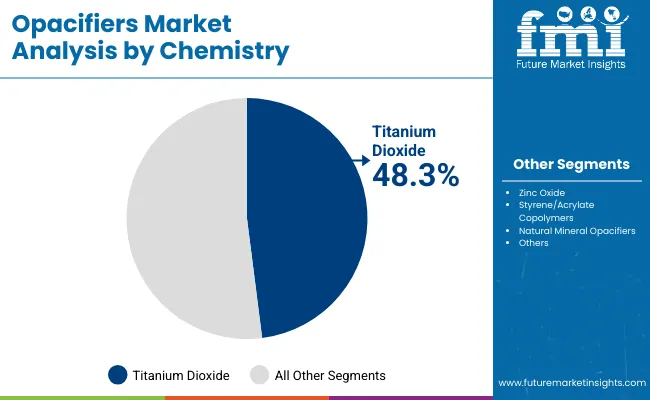

The opacifiers market has been segmented based on chemistry, function, and physical form, highlighting the key dimensions shaping demand across end-use formulations. Each segment reflects distinct performance drivers that influence product differentiation and adoption patterns. Within chemistry, titanium dioxide continues to anchor market value due to its proven opacity and compatibility, while functional benefits led by appearance enhancement highlight the importance of visual appeal in personal care products.

From a physical form perspective, liquid dispersion has emerged as the preferred option, offering efficiency and consistency in large-scale manufacturing environments. These leading segments underline the critical role of opacifiers in ensuring texture uniformity, opacity, and sensory performance, which remain decisive factors in premiumization and consumer acceptance.

| Chemistry | Market Value Share, 2025 |

|---|---|

| Titanium dioxide | 48.3% |

| Others | 51.7% |

Titanium dioxide leads the chemistry segment with 48.3% share in 2025, valued at USD 943.40 million. Its dominance is supported by proven performance in achieving opacity, stability, and consistent whiteness across multiple formulations. The material has been widely integrated into shampoos, lotions, and body washes due to its reliability and compatibility with diverse ingredients.

Despite increasing scrutiny in regulatory environments, titanium dioxide continues to remain indispensable in mass and premium personal care formulations. Its ability to provide high coverage at relatively low dosage strengthens its value proposition. Growth prospects are expected to be anchored in reformulation efforts where opacity cannot be compromised, ensuring its continued role as the backbone of opacifier chemistry through the forecast horizon.

| Function | Market Value Share, 2025 |

|---|---|

| Appearance enhancement | 47.1% |

| Others | 52.9% |

Appearance enhancement dominates the function segment, holding 47.1% share in 2025 with a market value of USD 919.96 million. This leadership is attributed to rising consumer expectations for uniform textures, improved visual density, and consistent opacity across personal care products. Formulators increasingly rely on opacifiers to deliver enhanced sensory cues, which directly influence perceptions of quality and product appeal.

The segment is expected to grow further as demand intensifies in premium skincare and haircare categories where appearance remains a critical purchase driver. Continuous innovation in dispersion quality and dosage efficiency will further strengthen this function’s position. Over the decade, appearance enhancement is projected to sustain leadership by aligning with evolving brand strategies focused on sensorial differentiation.

| Physical Form | Market Value Share, 2025 |

|---|---|

| Liquid dispersion | 52.6% |

| Others | 47.4% |

Liquid dispersion emerges as the leading physical form, representing 52.6% of the market in 2025, equivalent to USD 1,027.38 million. Its strong position is driven by advantages in manufacturing efficiency, offering ease of handling, reduced dust exposure, and faster batch processing.

These benefits make liquid dispersion the preferred choice for large-scale contract manufacturers and multinational brands seeking operational consistency. The segment’s appeal is further reinforced by its ability to reduce rework and improve color uniformity, lowering overall production costs. Growth prospects remain favorable as sustainability-linked reformulations highlight dispersion stability and dosage efficiency. Over the forecast period, liquid dispersion is expected to retain dominance, serving as the preferred form across both mass and premium personal care applications.

The Opacifiers Market faces regulatory scrutiny and cost optimization pressures, yet remains integral in personal care formulations where opacity and visual density are critical. Market momentum is being shaped by sustainability-driven reformulations, premium category expansion, and efficiency-focused manufacturing practices across regions.

Reformulation Cycles Driven by Regulatory and Sustainability Pressures

Formulation pipelines are increasingly being redesigned as regulatory oversight on certain chemistries intensifies, particularly in mature markets. Titanium dioxide alternatives and polymer-based systems are being integrated to secure compliance and align with corporate sustainability narratives. This driver is expected to accelerate growth by forcing routine product refreshes and creating recurring demand for opacifiers that demonstrate both regulatory clearance and enhanced dosage efficiency.

Competitive differentiation will be achieved by suppliers offering complete data packages, lifecycle assessments, and cross-market approvals, positioning them as indispensable partners to multinational formulators. As sustainability scorecards become central in procurement decisions, adoption of innovative, compliant opacifiers is expected to widen, reinforcing this driver as a long-term catalyst.

Supply Chain Concentration and Raw Material Volatility

Market expansion is being tempered by high dependency on limited sources for certain raw materials, leaving opacifier supply chains exposed to price swings and geopolitical disruptions. Volatility in feedstocks increases production costs and compresses margins, particularly for smaller producers without integrated sourcing strategies. Inconsistent supply reliability also complicates qualification processes for downstream manufacturers, as opacifiers typically undergo rigorous validation before being locked into formulations.

This restraint is anticipated to intensify unless supplier diversification and regional production bases are expanded. Strategic partnerships, dual-sourcing models, and localized production investments will be necessary to counter volatility, but until such measures are fully realized, this factor will act as a structural constraint on growth.

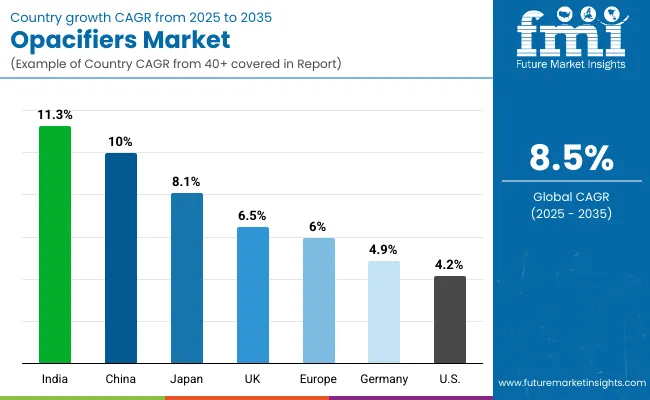

| Countries | CAGR |

|---|---|

| China | 10.0% |

| USA | 4.2% |

| India | 11.3% |

| UK | 6.5% |

| Germany | 4.9% |

| Japan | 8.1% |

The opacifiers market demonstrates distinct country-level growth trajectories, shaped by consumer preferences, regulatory frameworks, and industrial maturity. India emerges as the fastest-growing market with an 11.3% CAGR, driven by rapid expansion of domestic personal care production and increasing investments from multinational brands seeking scalable, cost-efficient manufacturing bases. China follows closely with a 10.0% CAGR, supported by strong demand for premium cosmetics, regulatory-driven reformulations, and the scale of its contract manufacturing ecosystem. Japan, with an 8.1% CAGR, reflects advanced adoption of liquid dispersions in high-value formulations where quality consistency and efficiency are prioritized.

Europe presents a more stable growth outlook, led by the UK (6.5%), Germany (4.9%), and the broader region at 6.0% CAGR, where sustainability mandates and strict compliance standards continue to drive reformulation cycles. These markets benefit from established R&D infrastructure and strong regulatory oversight that fosters innovation in clean-label opacifiers. The USA displays a moderate 4.2% CAGR, reflecting its maturity, where growth is largely service-driven with emphasis on sustainable ingredient sourcing and advanced technical support.

This distribution indicates that Asia will anchor global momentum through scale and rapid adoption, while Europe and North America sustain demand through compliance-driven reformulations and premium category resilience.

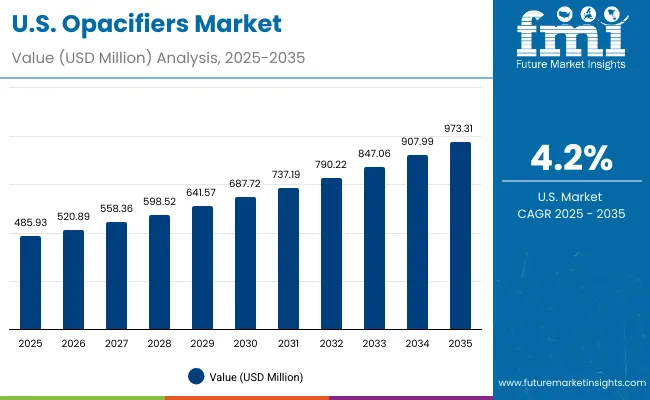

| Year | USA Opacifiers Market (USD Million) |

|---|---|

| 2025 | 485.93 |

| 2026 | 520.89 |

| 2027 | 558.36 |

| 2028 | 598.52 |

| 2029 | 641.57 |

| 2030 | 687.72 |

| 2031 | 737.19 |

| 2032 | 790.22 |

| 2033 | 847.06 |

| 2034 | 907.99 |

| 2035 | 973.31 |

The Opacifiers Market in the United States is projected to grow at a CAGR of 4.2% during 2025-2035, reflecting gradual but steady expansion driven by compliance-focused reformulations and premium personal care launches. The market value is expected to increase from USD 485.93 million in 2025 to USD 973.31 million by 2035. Intermediate years show consistent growth: 2026 (USD 520.89 million), 2027 (USD 558.36 million), 2028 (USD 598.52 million), 2029 (USD 641.57 million), 2030 (USD 687.72 million), 2031 (USD 737.19 million), 2032 (USD 790.22 million), 2033 (USD 847.06 million), and 2034 (USD 907.99 million).

The USA market outlook is characterized by stability, where liquid dispersion continues to dominate due to its efficiency in high-volume manufacturing and reduced rework needs. Sustained demand is expected from premium personal care, where opacity is positioned as a product quality indicator. Contract manufacturers are projected to emphasize stable dispersions for operational reliability, while sustainability-linked reformulations are anticipated to push demand for alternatives with validated safety and efficiency credentials.

The Opacifiers Market in the United Kingdom is projected to grow at a CAGR of 6.5% during 2025-2035, supported by compliance-led reformulations and premium personal care positioning. Demand is expected to be shaped by retailer sustainability scorecards, which are pushing suppliers toward efficient liquid dispersions and label-friendly chemistries. Private-label upgrades are anticipated to widen usage in mass channels, while indie brands are likely to emphasize opacity as a visible quality cue. Technical service and documentation depth are expected to influence vendor selection as regulatory scrutiny intensifies. Procurement strategies are projected to favor dual-qualification to manage supply risk without compromising texture and appearance goals.

The Opacifiers Market in India is projected to expand at a CAGR of 11.3% during 2025-2035, led by rapid scale-up in domestic personal care manufacturing and ongoing premiumization. Capacity additions by CMOs are expected to favor liquid dispersions for throughput and handling benefits. Portfolio refreshes are being guided by opacity consistency and dosage efficiency, aligning with cost-to-serve objectives in high-volume SKUs. Urban trade channels are anticipated to elevate texture expectations, pushing wider adoption beyond shampoos into lotions and color cosmetics. Supplier partnerships with local tech support are projected to differentiate through faster scale-up and tighter process control.

The Opacifiers Market in China is projected to grow at a CAGR of 10.0% during 2025-2035, underpinned by premium beauty, rapid product refresh cycles, and contract manufacturing breadth. Liquid dispersions are expected to dominate due to faster changeovers and reduced rework in large plants. Regulatory tightening and brand risk management are prompting diversified chemistry portfolios, while appearance enhancement remains central to consumer appeal. Cross-border e-commerce is anticipated to amplify shade uniformity requirements, raising barriers for unqualified suppliers. Domestic champions are projected to extend share via scale and responsive technical service, while multinationals prioritize compliance and global documentation parity.

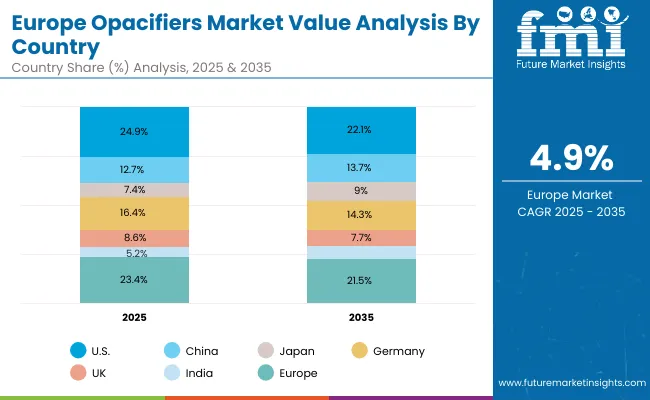

| Countries | 2025 |

|---|---|

| USA | 24.9% |

| China | 12.7% |

| Japan | 7.4% |

| Germany | 16.4% |

| UK | 8.6% |

| India | 5.2% |

| Countries | 2035 |

|---|---|

| USA | 22.1% |

| China | 13.7% |

| Japan | 9.0% |

| Germany | 14.3% |

| UK | 7.7% |

| India | 6.3% |

The Opacifiers Market in Germany is projected to rise at a CAGR of 4.9% during 2025-2035, reflecting steady, compliance-driven demand in a mature product landscape. Emphasis on documentation rigor, EHS conformity, and LCA transparency is expected to shape supplier selection. Incremental growth is anticipated from reformulations targeting microplastic narratives and recyclability claims, with liquid dispersions preferred for repeatability and reduced waste. Premium and dermocosmetic lines are likely to sustain value, while mass channels maintain baseline volumes through specification lock-ins. Local technical support and validated dosage efficiency are projected to be decisive in awards.

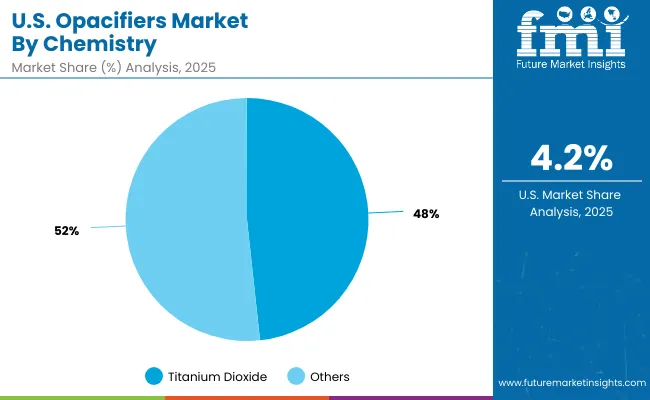

| USA By Chemistry | Market Value Share, 2025 |

|---|---|

| Titanium dioxide | 48.3% |

| Others | 51.7% |

The Opacifiers Market in the United States is projected at USD 485.93 million in 2025. Titanium dioxide contributes 48.3% (USD 234.71 million), while the category defined as others holds 51.7% (USD 251.23 million). This slight dominance of alternative chemistries reflects the influence of evolving regulatory frameworks and a shift toward sustainable, label-friendly formulations. The transition is being guided by procurement strategies that prioritize compliance, transparency, and risk diversification, particularly in high-volume categories where consumer scrutiny is most intense. While titanium dioxide retains critical relevance due to its unmatched opacity and cost efficiency, the broader basket of alternative systems is being integrated to balance regulatory resilience with performance stability.

Over the next decade, this chemistry mix is expected to remain balanced, with titanium dioxide sustaining its role in mass formulations while alternatives gain traction in premium and compliance-sensitive channels. Suppliers that combine dosage efficiency, dispersion stability, and lifecycle data are anticipated to capture strategic advantage in the USA market.

| China By Function | Market Value Share, 2025 |

|---|---|

| Appearance enhancement | 47.1% |

| Others | 52.9% |

The Opacifiers Market in China is projected at USD 248.37 million in 2025, with appearance enhancement leading the functional mix at 47.1%, valued at USD 116.98 million. This leadership reflects the importance of opacity as a visible performance indicator in Chinese personal care products, where texture consistency and whiteness are directly linked to consumer-perceived quality. Premium beauty categories are expected to reinforce this demand, with opacifiers increasingly integrated into shampoos, conditioners, lotions, and color cosmetics to ensure uniformity and enhance shelf appeal.

Although the category defined as others accounts for a slightly higher share at 52.9% (USD 131.39 million), its role is more dispersed across multi-functional applications such as light diffusion and masking. These functions provide incremental benefits, but appearance enhancement remains the decisive driver of consumer choice and brand differentiation. Over the decade, demand in China is anticipated to rise as opacity continues to anchor reformulation strategies and product upgrades.

The Opacifiers Market is moderately fragmented, with global leaders, established chemical innovators, and specialized formulation-focused suppliers competing across diverse application areas. BASF is identified as the leading player, holding a global value share of 8.1% in 2025, while the remaining 91.9% is distributed among other multinational and regional companies. BASF’s leadership reflects its broad formulation expertise, extensive distribution networks, and ability to align product portfolios with regulatory and sustainability requirements. Its scale in dispersions and technical service infrastructure provides additional competitive resilience.

Other key participants include Clariant, Dow, Evonik, Croda, Ashland, Wacker Chemie, Sensient, Lubrizol, and Kobo Products. These companies are expected to strengthen their positioning by focusing on liquid dispersion formats, compliant chemistries, and efficiency-driven opacifier solutions for both mass and premium personal care. Competitive strategies are being reshaped by sustainability-linked reformulations, regulatory scrutiny, and heightened demand for consistent sensory performance.

Differentiation is shifting away from commodity supply toward integrated value propositions, including lifecycle assessments, sustainability documentation, and technical service partnerships. As global regulations tighten and premiumization accelerates, suppliers with transparent sourcing, strong compliance credentials, and scalable production footprints are expected to capture higher-value opportunities.

Key Developments in Opacifiers Market

| Item | Value |

|---|---|

| Quantitative Value | USD 1,953.2 million (2025E); USD 4,401.2 million (2035F); 8.5% CAGR (2025-2035) |

| Component (Segment Labels) | Chemistry; Function; Physical form; Application; End use; Geography |

| Chemistry | Titanium dioxide; Others |

| Function | Appearance enhancement; Others (e.g., light diffusion, masking) |

| Physical Form | Liquid dispersion; Others (powder concentrate, bead/encapsulated) |

| Application | Shampoos & conditioners; Body washes & shower gels; Lotions & creams; Color cosmetics |

| End-use Industry | Mass personal care; Premium personal care; Industrial & contract manufacturing |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | BASF; Clariant; Dow; Evonik; Croda; Ashland; Wacker Chemie; Sensient; Lubrizol; Kobo Products |

| Additional Attributes | Dollar sales by chemistry, function, and physical form; dispersion stability and dosage-efficiency benchmarking; compliance and sustainability documentation (e.g., microplastics, LCA); qualification and technical service depth; premiumization-led reformulations; contract manufacturing scale effects; regional growth led by Asia (China, India); USA maturity with steady reformulations; competitive share led by BASF at 8.1% (2025) |

The global Opacifiers Market is estimated to be valued at USD 1,953.2 million in 2025.

The market size for the Opacifiers Market is projected to reach USD 4,401.2 million by 2035.

The Opacifiers Market is expected to grow at a CAGR of 8.5% between 2025 and 2035.

The key product types in the Opacifiers Market are titanium dioxide and other alternative chemistries, available in liquid dispersions, powder concentrates, and encapsulated forms.

In terms of function, the appearance enhancement segment is set to command a 47.1% share in the Opacifiers Market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA