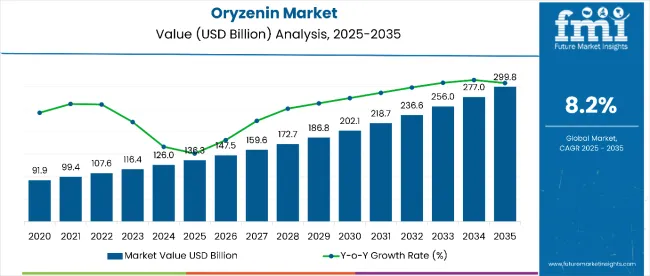

The market is estimated to be valued at USD 136.3 billion in 2025 and is projected to reach USD 299.8 billion by 2035, registering a CAGR of 8.2% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 163.6 billion over the forecast period, reflecting a 2.20 times growth.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 136.3 billion |

| Market Forecast Value in (2035F) | USD 299.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The market growth is anticipated to be driven by increasing demand for plant-based proteins, wider applications in sports nutrition, and rising incorporation into gluten-free food products.

By 2030, the market is likely to reach approximately USD 202.5 billion, accounting for USD 66.2 billion in incremental value over the first half of the decade. The market is projected to grow by an absolute dollar value of USD 163.6 billion between 2025 and 2035. The remaining USD 97.3 billion is expected during the second half, suggesting an accelerating growth trend. Product adoption is gaining traction due to oryzenin’s high digestibility, balanced amino acid profile, and allergen-free nature compared to conventional protein sources.

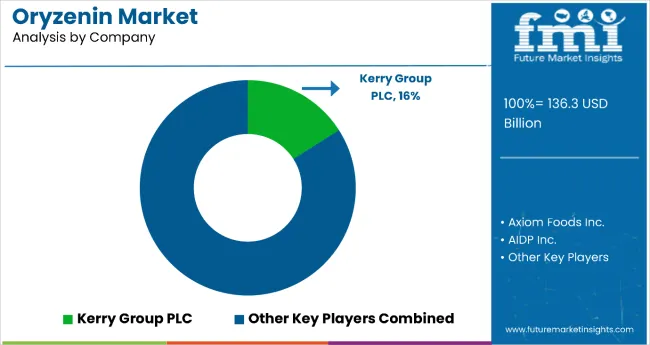

Companies including Kerry Group PLC, Axiom Foods Inc., AIDP Inc., Südzucker AG (BENEO GmbH), and Bioway Organic Group Ltd. are strengthening their competitive positions through investments in advanced protein extraction technologies and diversification into value-added formulations. Growing health-conscious consumer preferences are driving expansion into functional beverages, sports nutrition powders, and dietary supplements. Market growth is expected to remain supported by emphasis on organic certification, high protein purity, and sustainable rice farming practices, ensuring both quality and environmental responsibility.

The oryzenin market holds a significant share across its parent industries, reflecting its growing adoption as a plant-based, hypoallergenic protein source. In the plant-based rice protein sector, oryzenin accounts for approximately 37% of the market, driven by its clean-label appeal and digestibility, making it a preferred choice for health-conscious and vegan consumers. In the plant-based sports nutrition protein segment, it represents around 33%, supported by its increasing use in protein powders, meal replacement shakes, and energy bars. The market contributes nearly 28% to the gluten-free protein ingredient segment, particularly for bakery, confectionery, and ready-to-drink applications. It holds close to 25% of the allergen-free protein market, valued for being free from common allergens such as soy, dairy, and gluten. The share in the organic plant protein market reaches about 29%, reflecting rising adoption among consumers seeking natural and sustainably sourced protein alternatives.

The market indicate a strong rise in demand for clean-label, plant-based protein ingredients, driven by increasing consumer preference for hypoallergenic, sustainable, and functional nutrition. Manufacturers are innovating to improve protein purity, digestibility, and amino acid profile through advanced processing methods such as enzymatic extraction and sprouted rice protein production. Growing regulatory focus on food safety and labeling standards is prompting companies to develop organic-certified, flavored, and fortified oryzenin formulations. At the same time, expanding applications in vegan snacks, ready-to-drink beverages, and fortified bakery products are shaping market strategies, encouraging investment in research and development for high-performance, versatile, and sustainable protein solutions.

Oryzenin, a rice-derived protein, is gaining momentum as a sustainable, plant-based alternative to animal proteins due to its high digestibility, hypoallergenic nature, and balanced amino acid profile. Its clean-label positioning aligns with the surging demand for natural, allergen-free, and vegan-friendly ingredients across food, beverage, and nutraceutical sectors.

The growing popularity of plant-based diets and protein fortification in sports nutrition, weight management products, and functional foods is driving adoption. Technological advancements in protein extraction and processing are improving oryzenin’s solubility, taste, and texture, expanding its application in ready-to-drink beverages, protein powders, and gluten-free bakery products.

With health-conscious consumers increasingly favoring sustainable, allergen-free proteins, and manufacturers pursuing versatile, high-quality plant-based options, the outlook for the oryzenin market remains robust. Its application in clean-label, high-protein formulations positions it to secure an expanding share of the global plant-based protein landscape.

The market is segmented by product type, application, function, form, and region. By product type, the market is divided into isolates, concentrates, and others such as hydrolysates. Based on application, the market is segmented into sports & energy nutrition, beverages, bakery & confectionery, meat analogs & extenders, dairy alternatives, and other applications. By form, the market is bifurcated into dry and liquid. Based on function, the market is segmented into emulsifying, texturizing, gelling, and others such as foaming. Regionally, the market spans across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

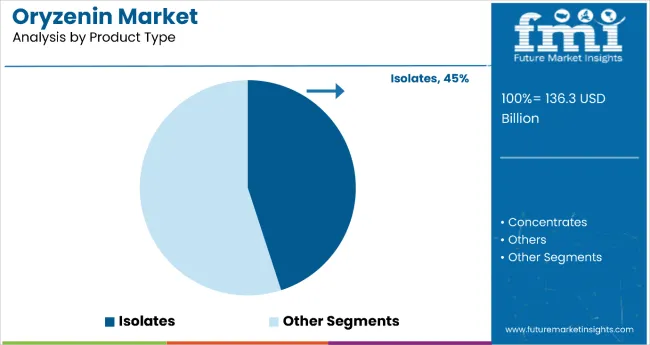

The isolates segment holds a dominant position with 45% of market share in 2025, driven by their exceptionally high protein concentration (often above 80% purity), superior solubility, and neutral taste profile, making them the preferred choice for premium sports nutrition, functional beverages, and plant-based protein formulations. Isolates also deliver a hypoallergenic, gluten-free, and non-GMO solution, aligning perfectly with clean-label and vegan trends.

The strong growth of the isolates segment is further fueled by the rising demand for high-performance plant proteins in both developed and emerging markets. Food and beverage manufacturers are increasingly reformulating products to meet consumer preferences for sustainable and allergen-friendly protein sources, with isolates offering the highest functional and nutritional advantages. Additionally, advancements in extraction technology have improved yield, purity, and cost efficiency, making isolates more accessible for large-scale production.

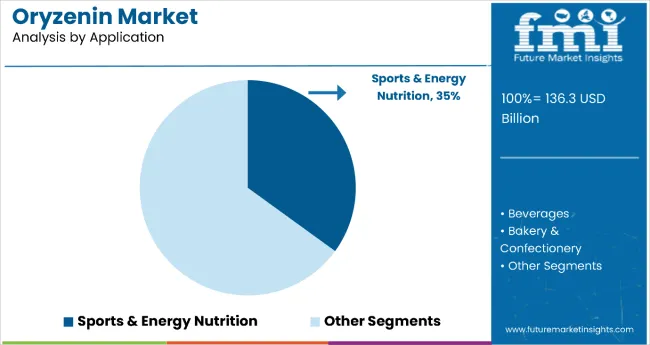

The sports & energy nutrition segment dominates with a 35% market share, making it the most lucrative application segment for oryzenin. Its dominance stems from the protein's clean-label appeal, high digestibility, and hypoallergenic profile, which align perfectly with the nutritional needs of athletes and fitness enthusiasts. Oryzenin isolates, in particular, are prized in this segment for their high protein purity, neutral flavor, and smooth texture, making them ideal for protein powders, recovery beverages, and performance bars.

Formulators increasingly favor oryzenin for its ability to deliver enhanced amino acid profiles while avoiding common allergens like soy and dairy a key differentiator amid rising gluten-free and vegan trends. Additionally, advances in protein extraction and processing techniques have boosted oryzenin's functional properties (solubility, mouthfeel, stability), enabling manufacturers to create next-gen sports nutrition products that meet both taste and performance demands.

Between 2025 and 2035, the global rise in sports nutrition and plant-based diets is set to be the main growth driver for the oryzenin market. Health- and fitness-conscious consumers are increasingly seeking clean-label, allergen-free, and high-protein solutions, making oryzenin, particularly isolates with over 80% protein purity, a preferred ingredient in premium sports nutrition, functional foods, and nutraceutical formulations.

Rising Demand for Plant-Based Proteins Drives Oryzenin Market Growth

The steady increase in demand for plant-based nutrition and functional protein ingredients has been identified as the primary catalyst for growth in the oryzenin market. In 2024, breakthrough applications in sports nutrition, dairy alternatives, and gluten-free bakery products prompted food & beverage companies globally to incorporate oryzenin into innovative formulations. These developments indicate that consistent innovation in plant-based food and beverage segments, rather than short-term dietary trends, are fueling procurement cycles.

Integration as a Functional Ingredient Drives Market Growth

In 2024, food and beverage manufacturers began incorporating oryzenin into multi-functional product formulations to boost texture, protein content, and overall nutritional value, while preserving allergen-free positioning. By 2025, oryzenin-based ingredients were increasingly embedded in product development strategies across sports nutrition, energy bars, dairy alternatives, and bakery applications. These implementations highlight that positioning oryzenin as a core functional ingredient enhances product performance, market appeal, and nutritional credentials, supporting broader adoption and market expansion.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| Germany | 10.1% |

| India | 9.5% |

| China | 8.1% |

| UK | 7.7% |

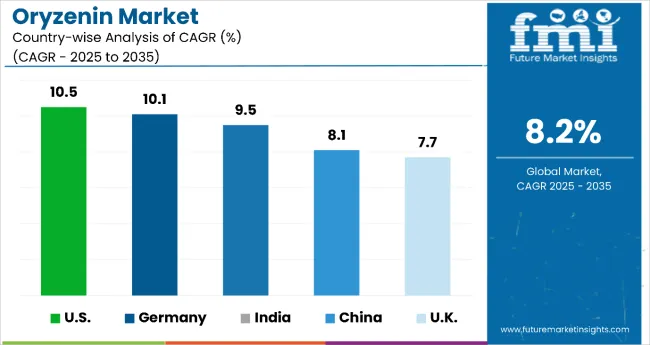

In the oryzenin market, the USA leads with a CAGR at 10.5%, reflecting its mature sports nutrition sector, advanced R&D, and strong export capabilities. Germany follows closely at 10.1%, driven by its leadership in clean-label food manufacturing, strict allergen regulations, and plant protein innovation. India, with a 9.5% CAGR, benefits from abundant rice production, a growing middle-class consumer base, and government-backed agricultural exports, positioning it as a cost-competitive manufacturing hub. China records 8.1% CAGR, leveraging its massive rice supply and expanding functional food market, with e-commerce accelerating product reach. The UK, though growing at a relatively moderate 7.7% CAGR, stands out as a premium market with high per-capita plant-based consumption and strong retail penetration.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA oryzenin market is projected to grow at a CAGR of 10.5% from 2025 to 2035, fueled by surging consumer demand for plant-based, allergen-free proteins in sports nutrition, beverages, and functional foods. The country benefits from advanced food processing infrastructure, strong R&D capabilities, and a robust nutraceutical industry that actively incorporates high-purity isolates.

Demand for oryzenin is expected to expand at a CAGR of 10.1% from 2025 to 2035, supported by its leadership in clean-label manufacturing and functional nutrition innovation. With a mature vegan and flexitarian population, demand is strong across bakery, dairy alternatives, and high-protein snacks. Strict allergen labeling laws and traceability standards drive adoption of gluten-free, non-GMO ingredients like oryzenin.

The oryzenin market in India is projected to grow at a CAGR of 9.5% between 2025 and 2035, driven by rising health consciousness, an expanding middle class, and a growing vegetarian and vegan consumer base. Rapid urbanization has led to increased adoption of protein supplements, particularly in sports nutrition and functional beverages.

Demand for oryzenin in China is expected to grow at a CAGR of 8.1% from 2025 to 2035, driven by rapid growth in the functional food and beverage sector, rising disposable incomes, and increased focus on healthy diets. The country’s vast rice production capacity ensures reliable raw material supply, supporting large-scale oryzenin processing. Chinese brands are integrating plant proteins into sports drinks, fortified snacks, and meal replacements to cater to a growing health-conscious urban population.

Sales of oryzenin in the UK are projected to grow at a CAGR of 7.7% between 2025 and 2035, driven by high consumer awareness of plant-based nutrition, especially in dairy alternatives and sports performance products. Veganism and flexitarianism trends continue to shape product innovation, with leading brands introducing allergen-free, gluten-free protein options. The UK benefits from strong retail penetration of functional foods and well-developed online distribution networks.

The oryzenin market is moderately consolidated, featuring established plant-protein manufacturers with varying degrees of extraction expertise, product purity, and application specialization. Key leaders such as Axiom Foods Inc. and RiceBran Technologies dominate the high-purity segment, supplying allergen-free rice protein for sports nutrition, infant formula, and functional food applications. Their competitive edge lies in advanced enzymatic extraction processes, consistent amino acid profiling, and strong regulatory compliance across global markets.

BENEO GmbH differentiates through clean-label solutions and innovative plant-protein blends, catering to health-conscious consumers and premium food brands in Europe and beyond. Kerry Group and Nutrition Resource Inc. focus on large-scale production, cost-effective sourcing, and integration into mainstream food, beverage, and nutraceutical categories, enabling them to capture both mass-market and mid-premium segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 136.3 Billion |

| Product Type | Isolates, Concentrates, and Others (Protein Blends, Hydrolysates, and Derivatives) |

| Application | Sports & Energy Nutrition, Beverages, Dairy Alternatives, Bakery & Confectionery, Meat Analogs & Extenders, and Others |

| Function | Emulsifying, Texturizing, Gelling, and Others (Stabilizing and Binding) |

| Form | Dry and Liquid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, Australia and 40+ countries |

| Key Companies Profiled | AIDP, Inc., BENEO GmbH, Kerry Group PLC, Shenzhen Beike Biotechnology Co. Ltd, Axiom Foods, Inc., Golden Grain Group Limited, Ribus, Inc., Ricebran Technologies, Inc., The Green Labs LLC, Bioway (Xi’An) Organic Ingredients Co., Ltd. |

| Additional Attributes | Dollar sales by source and application sector, rising demand for plant-based proteins in sports nutrition and functional foods, expansion in dairy alternatives and meat analogs, growing interest in allergen-free and gluten-free protein solutions, innovations in extraction processes improving purity, texture, and amino acid profile |

The global oryzenin market is estimated to be valued at USD 136.3 billion in 2025.

The market size for the oryzenin market is projected to reach USD 288.6 billion by 2035.

The oryzenin market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in oryzenin market are isolates, concentrates and other type.

In terms of application, sports & energy nutrition segment to command 37.4% share in the oryzenin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA