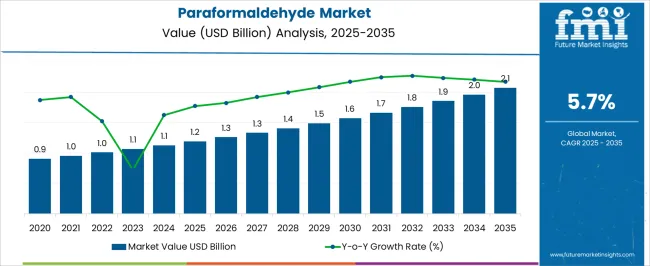

The paraformaldehyde market is projected to expand from USD 1.2 billion in 2025 to USD 2.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.7%. The decade-long growth trajectory indicates a steady increase in demand for paraformaldehyde as an essential chemical intermediate and formaldehyde donor, widely used in resins, adhesives, and chemical manufacturing.

From an industry perspective, the adoption of paraformaldehyde is being driven by its reliability, high purity, and consistent performance in industrial formulations. In this opinion, the growth pattern suggests that manufacturers focusing on high-quality production, global distribution networks, and application-specific solutions are positioned to capture substantial market share. The gradual upward trend highlights that paraformaldehyde is being increasingly recognized as a key material for chemical processes where precision, stability, and efficiency are prioritized. By 2035, with the market expected to reach USD 2.1 billion, the year-on-year expansion reflects steady industrial reliance on paraformaldehyde across sectors such as coatings, textiles, and agriculture.

The market values rising from USD 1.2 billion in 2025 to USD 1.7 billion by 2030 demonstrate that supply chains and production capacities are being optimized to meet growing demand. In this opinion, the CAGR of 5.7% indicates that paraformaldehyde is being positioned as a critical component in various chemical formulations, where consistent reactivity and quality control are essential. Stakeholders emphasizing operational reliability, regulatory compliance, and formulation flexibility are likely to strengthen their competitive advantage, making the paraformaldehyde market a stable yet strategically significant segment within the global chemicals industry.

| Metric | Value |

|---|---|

| Paraformaldehyde Market Estimated Value in (2025 E) | USD 1.2 billion |

| Paraformaldehyde Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The paraformaldehyde market holds a significant share within its parent markets, driven by its versatile applications across various industries. Within the formaldehyde market, paraformaldehyde constitutes approximately 25–30% of the total market share, reflecting its role as a key derivative in chemical processes. In the agrochemicals market, paraformaldehyde represents about 40–45%, as it is widely utilized in the production of herbicides and fungicides.

The resins market sees paraformaldehyde comprising around 15–20%, particularly in the manufacturing of phenolic resins used in adhesives and coatings. In the textile chemicals market, paraformaldehyde holds a share of approximately 5–10%, owing to its application in textile finishing processes. The pharmaceutical intermediates market has paraformaldehyde constituting about 5–10%, driven by its use in the synthesis of various pharmaceutical compounds. These figures highlight the dominance of paraformaldehyde in specialized applications, driven by its unique properties that meet the demanding requirements of various sectors.

Despite challenges such as environmental concerns and regulatory pressures, the market share distribution indicates a clear preference for paraformaldehyde in applications requiring precision, durability, and performance. The ongoing demand for efficient and cost-effective solutions continues to propel the growth of the paraformaldehyde market within its parent markets.

The paraformaldehyde market is witnessing stable growth, underpinned by its integral role in diverse industrial applications such as resin production, agrochemicals, and pharmaceuticals. Market expansion is being supported by strong demand from the construction, automotive, and packaging sectors, where paraformaldehyde-derived resins are extensively utilized for their durability and adhesive properties. The current scenario reflects a balanced supply-demand environment, aided by steady raw material availability and advancements in production technologies that enhance yield and product consistency.

Regulatory frameworks are driving manufacturers toward improved safety and environmental compliance, encouraging the adoption of cleaner production processes. In emerging economies, industrialization and infrastructure development are accelerating the consumption of paraformaldehyde-based products, while mature markets are experiencing moderate but stable demand.

Future growth is expected to be influenced by innovations in application-specific formulations, expansion of manufacturing capacities in high-growth regions, and sustained integration into downstream industries. This combination of structural demand drivers and technological progress is anticipated to keep the market on a steady upward trajectory.

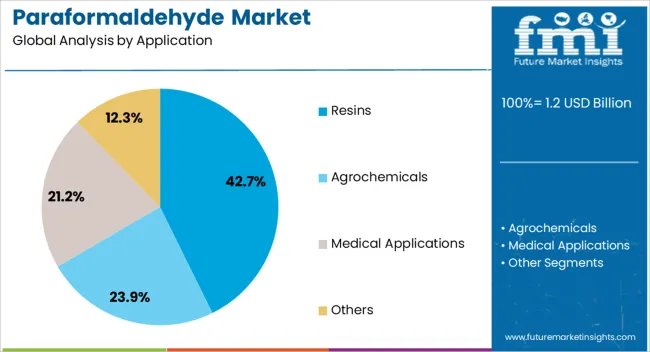

The paraformaldehyde market is segmented by application and geographic regions. By application, paraformaldehyde market is divided into Resins, Agrochemicals, Medical Applications, and Others. Regionally, the paraformaldehyde industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The resins segment, holding 42.70% of the application category, has been the dominant driver of paraformaldehyde consumption due to its essential role in producing urea-formaldehyde, melamine-formaldehyde, and phenol-formaldehyde resins. These resins are extensively used in adhesives, coatings, and molded products, making them a critical component of the construction, furniture, and automotive industries. Demand stability in this segment is supported by the resilience of downstream industries and their reliance on high-performance bonding and finishing materials.

Production efficiency has improved through enhanced polymerization control, resulting in superior product quality and reduced waste. Global supply chains for resin manufacturing remain robust, aided by strategic sourcing and vertical integration among key players.

While environmental regulations are prompting shifts toward low-emission resin formulations, the fundamental demand for paraformaldehyde in resin production remains strong. Continued infrastructure development, coupled with technological innovation in resin performance, is expected to reinforce this segment’s leadership in the market over the forecast period.

The paraformaldehyde market is growing due to rising demand in adhesives, resins, disinfectants, and agricultural applications. Opportunities exist in specialty resins, chemical intermediates, and pharmaceutical manufacturing. Trends are shifting toward safer handling, high-purity formulations, and compliance-driven packaging, while regulatory restrictions and health concerns pose challenges. Overall, the market is expected to expand steadily as manufacturers focus on performance, safety, and tailored solutions to meet industrial, agricultural, and pharmaceutical demands globally.

The paraformaldehyde market is witnessing strong demand due to its extensive use in adhesives, resins, disinfectants, and fumigants. Industrial sectors such as woodworking, construction, and chemical manufacturing rely on paraformaldehyde as a key intermediate for urea-formaldehyde and phenolic resins. In agriculture, it is utilized for pest control and soil treatment. Growing industrialization, expansion of construction activities, and increased demand for crop protection chemicals are driving steady adoption. Its versatility, ease of handling, and stability make it a preferred choice, reinforcing sustained market growth across North America, Asia-Pacific, and Europe.

Opportunities in the paraformaldehyde market are expanding due to its role in specialty resins, chemical intermediates, and pharmaceutical manufacturing. The rising production of high-performance adhesives, coatings, and molded products boosts market potential. In pharmaceuticals, paraformaldehyde is utilized in antiseptics, vaccines, and laboratory reagents, creating additional revenue streams. Growth in emerging economies, coupled with investments in industrial and healthcare infrastructure, provides further opportunities. Companies focusing on product customization, purity enhancement, and tailored formulations can capture premium market segments and strengthen global competitiveness.

A key trend in the market is the adoption of eco-friendly handling procedures, dust-free powders, and high-purity paraformaldehyde formulations. Manufacturers are introducing products with controlled polymerization and improved solubility to meet industrial and laboratory requirements. Packaging innovations, such as moisture-resistant bags, enhance shelf life and safety. Additionally, stricter regulatory compliance and workplace safety standards are encouraging suppliers to provide safer alternatives and guidance for industrial use. These trends underscore the market’s focus on performance optimization, regulatory alignment, and user safety while maintaining application versatility.

The paraformaldehyde market faces challenges due to strict regulatory frameworks, environmental concerns, and potential health risks. Exposure to formaldehyde-based compounds can pose toxicity issues, leading to stringent handling, storage, and emission controls in multiple regions. Compliance with chemical safety regulations, such as REACH in Europe and OSHA standards in the USA, increases operational costs. Furthermore, substitution pressures from alternative resins and disinfectants challenge market growth. Manufacturers must prioritize safe production, transparent labeling, and adherence to regulatory norms to ensure sustainability and trust in industrial and agricultural applications.

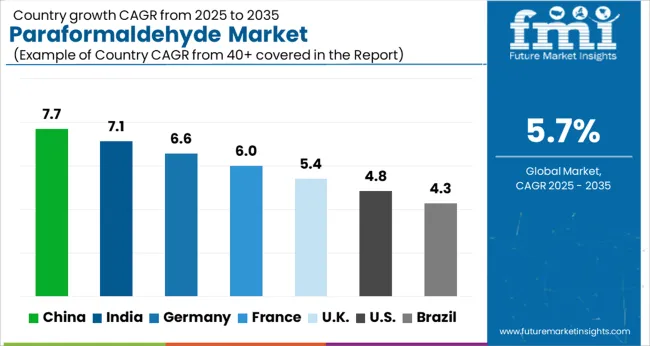

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

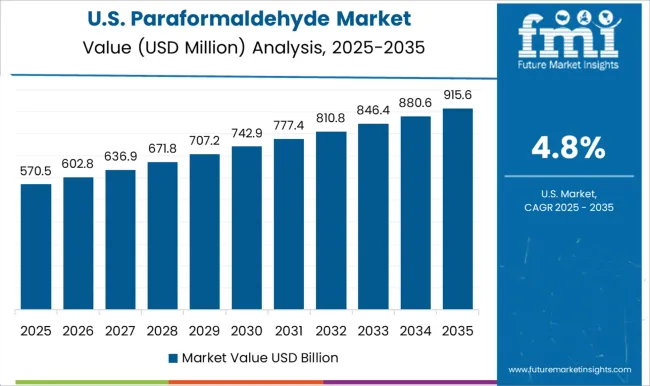

| USA | 4.8% |

| Brazil | 4.3% |

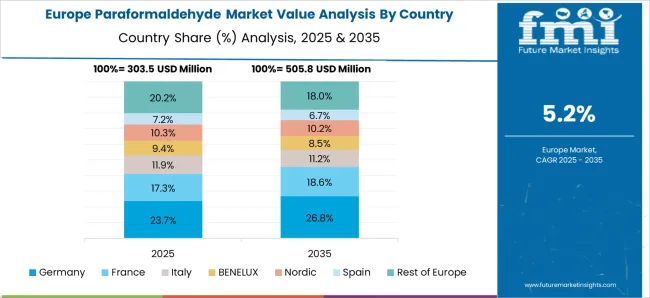

The global paraformaldehyde market is projected to grow at a CAGR of 5.7% from 2025 to 2035. China leads with a growth rate of 7.7%, followed by India at 7.1% and Germany at 6.6%. The United Kingdom is expected to expand at 5.4%, while the United States shows steady growth at 4.8%. Increasing demand for formaldehyde-based resins, adhesives, coatings, and disinfectants is driving market growth globally. Emerging markets like China and India are experiencing rapid industrialization, growing chemical manufacturing capacity, and rising end-user applications in construction and pharmaceuticals. Mature markets such as the USA, UK, and Germany focus on quality control, regulatory compliance, and sustainable production practices. Overall, global industrial expansion and increasing chemical processing requirements support the rising adoption of paraformaldehyde across multiple sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The paraformaldehyde market in China is projected to grow at a CAGR of 7.7%. The country is experiencing robust demand from adhesives, coatings, and chemical intermediates sectors. Industrial expansion and large-scale chemical manufacturing are driving consumption. Domestic manufacturers are investing in advanced production units to ensure consistent supply and meet quality standards. Rising demand from construction, automotive, and textile sectors supports adoption of paraformaldehyde-based products. Focus on operational efficiency, cost-effectiveness, and integration with downstream applications positions China as the leading growth market globally. Strategic initiatives to enhance production capacity and meet export demand further strengthen the market.

The paraformaldehyde market in India is expected to grow at a CAGR of 7.1%. Adoption is driven by construction, textile, and chemical manufacturing industries requiring formaldehyde-based resins and intermediates. Expansion of domestic chemical plants and modernization of production units support market growth. Collaborations with international technology providers enhance process efficiency and product quality. Increasing demand for adhesives, coatings, and disinfectants further encourages adoption. Rising industrialization and infrastructure development, along with government initiatives supporting chemical industry growth, position India as a key emerging market for paraformaldehyde.

The paraformaldehyde market in Germany is projected to grow at a CAGR of 6.6%. Adoption is primarily driven by chemical manufacturing, adhesives, coatings, and industrial resins applications. German manufacturers focus on high-quality production standards, regulatory compliance, and operational efficiency. Investments in advanced processing technologies ensure consistent product performance and reliability. Demand from automotive, construction, and electronics sectors supports market growth. The country’s mature industrial base, coupled with emphasis on precision applications, positions Germany as a steady growth market for paraformaldehyde in Europe.

The paraformaldehyde market in the United Kingdom is forecast to grow at a CAGR of 5.4%. Adoption is driven by chemical intermediates, adhesives, coatings, and disinfectants applications. Manufacturers focus on quality standards, regulatory compliance, and energy-efficient production methods. Domestic production and international partnerships support the introduction of advanced paraformaldehyde grades. Steady demand from construction, automotive, and consumer goods sectors ensures market continuity. While growth is moderate compared to emerging Asian markets, ongoing industrial investments and product upgrades maintain steady adoption of paraformaldehyde in the UK

The paraformaldehyde market in the United States is expected to expand at a CAGR of 4.8%. Adoption is driven by adhesives, coatings, disinfectants, and resin production for industrial and consumer applications. USA manufacturers focus on high-quality grades, operational efficiency, and compliance with regulatory standards. Technological integration and collaborations with global suppliers enhance product performance. Steady demand from construction, automotive, and chemical sectors ensures consistent market growth. While growth is slower than in China or India, the USA remains a key contributor to global paraformaldehyde demand due to established infrastructure and mature industrial base.

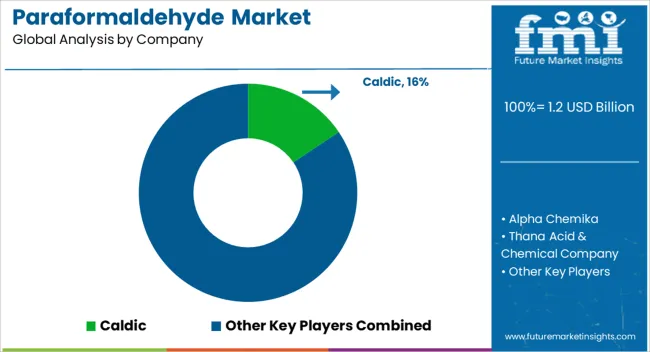

The paraformaldehyde market is being driven by chemical manufacturers focusing on high-purity, consistent, and versatile products for applications in resins, adhesives, textiles, and agriculture. Caldic and Alpha Chemika lead by offering paraformaldehyde with controlled particle size and formaldehyde content, showcased in brochures as suitable for industrial and laboratory uses. Thana Acid & Chemical Company and PURE Chemistry Scientific, Inc. emphasize specialty grades for chemical synthesis and research applications, highlighting reliability, solubility, and reactivity. Changzhou Koye Chemical Co., Ltd and Nantong Jiangtian Chemical Co., Ltd focus on large-scale production for bulk industrial applications, stressing consistency and cost efficiency, while maintaining compliance with global quality standards.

Other players, including Inter Atlas Chemical, GFS Chemical, Parchem, and Alfa Aesar, differentiate through niche product offerings such as micronized paraformaldehyde or high-purity laboratory grades tailored for research, pharmaceutical, and specialty chemical markets. Brochures consistently highlight stability, uniform particle distribution, and controlled formaldehyde release as key attributes. Competition in the paraformaldehyde market is influenced by product purity, manufacturing scale, and the ability to meet stringent industrial and laboratory specifications. Companies focus on providing reliable supply, technical support, and safe handling guidance, positioning paraformaldehyde as a critical raw material across diverse chemical and industrial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Application | Resins, Agrochemicals, Medical Applications, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caldic, Alpha Chemika, Thana Acid & Chemical Company, PURE Chemistry Scientific, Inc., Changzhou Koye Chemical Co., Ltd, Nantong Jiangtian Chemical Co., Ltd, Inter Atlas Chemical, GFS Chemical, Parchem, and Alfa Aesar |

| Additional Attributes | Dollar sales by product type (powder, granules, pellets) and application (resins, adhesives, disinfectants, textiles) are key metrics. Trends include rising demand in construction, automotive, and chemical industries, adoption in formaldehyde-based resins, and growth in industrial disinfectant applications. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global paraformaldehyde market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the paraformaldehyde market is projected to reach USD 2.1 billion by 2035.

The paraformaldehyde market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in paraformaldehyde market are resins, agrochemicals, medical applications and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA