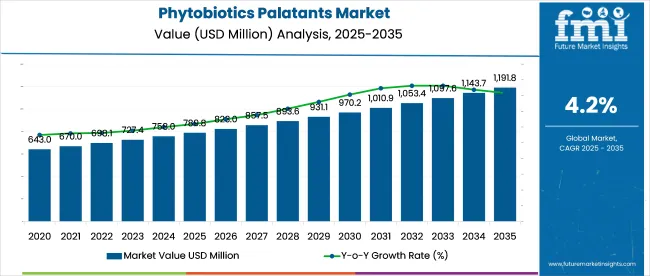

The phytobiotics palatants market, a vital segment of feed-additive solutions, is projected to grow from USD 789.8 million in 2025 to USD 1,192.9 million by 2035, at an 4.2% CAGR. Demand is being supported by rising livestock and pet nutrition needs, with plant-derived flavor enhancers particularly liquid, solid, and paste palatants being favored for improved feed intake in poultry, swine, and companion animals.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 789.8 million |

| Market Size (2035) | USD 1,192.9 million |

| CAGR (2025 to 2035) | 4.2% |

It is argued that suppliers investing in natural-extract palatants, functional blends, and clean-label credentials will outperform commodity-based counterparts. However, it is suggested that regulatory inconsistencies and cost pressures may limit broader adoption unless scale efficiencies are realized. Industry concentration is expected to increase as major agritech firms like ADM, Cargill, and DSM-Firmenich acquire niche palatant specialists to enhance their feed-additive portfolios.

In January 2024, Phytobiotics Futterzusatzstoffe GmbH expanded its presence in the industry by launching nine new “smart flavours” designed to improve feed palatability across livestock species, including ruminants, poultry, pigs, and aquaculture. These additions aim to optimize feed intake and animal performance, reflecting rising industry demand for taste-driven nutrition solutions.

The launch supports Phytobiotics’ strategic focus on sensory feed enhancements and positions the company competitively within the evolving feed palatant industry, which continues to see increased attention from producers prioritizing feed efficiency and species-specific intake behavior.

The industry holds a specialized share within its parent markets. In the animal feed market, it accounts for approximately 5-7%, as palatants are widely used to improve the acceptance of feed by animals. In the pet food market, the share is around 3-5%, driven by the demand for palatable, high-quality pet food.

Within the nutraceuticals market, its share is approximately 2-3%, as phytobiotics palatants are used to enhance flavor in functional foods and supplements. In the agricultural chemicals market, its share is about 1-2%, as palatants are used in some agricultural products. In the food and beverage market, the share is around 1-2%, used for flavor enhancement in specific functional products.

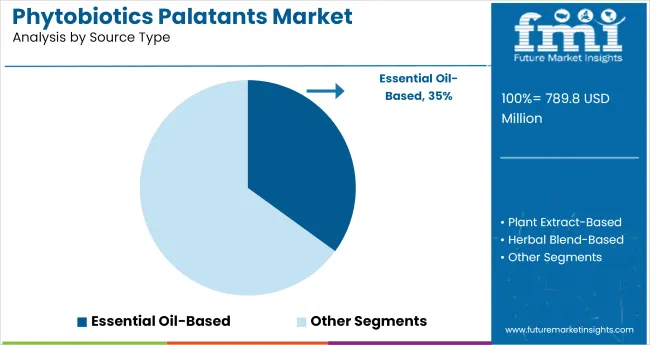

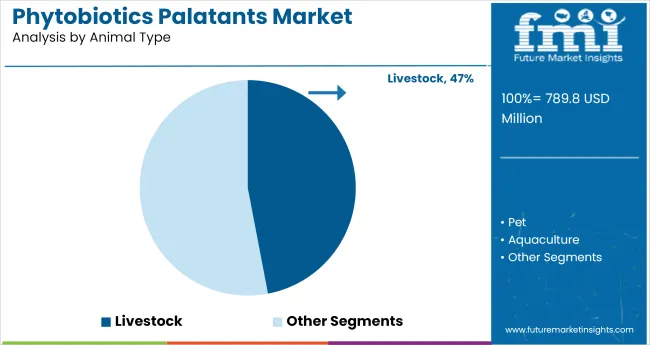

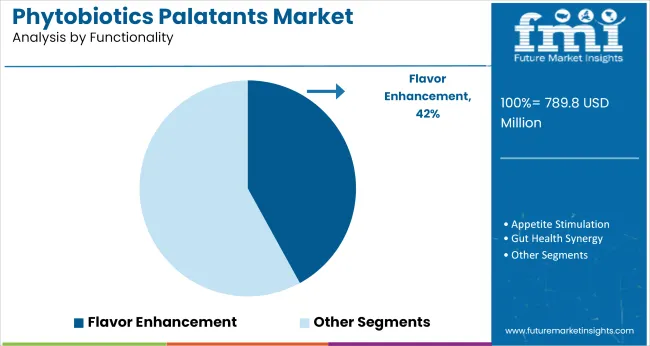

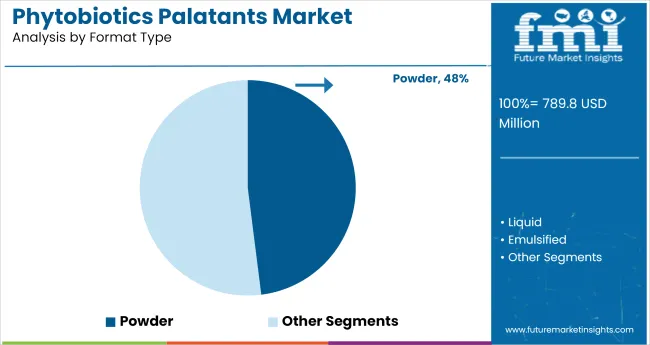

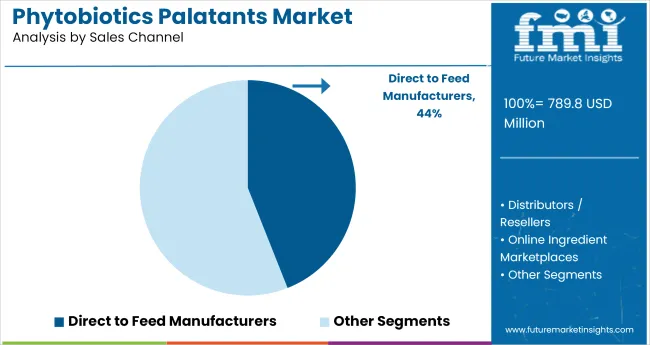

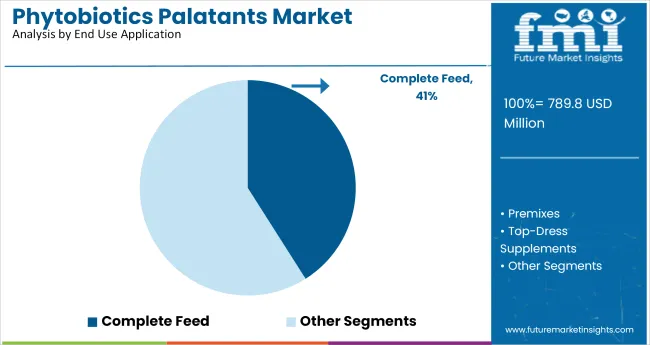

The industry is projected to see essential oil-based products leading the source type segment with 35%, livestock as the dominant animal type with 47%, flavor enhancement as the top functionality at 42%, powder as the leading format type with 48%, and direct-to-feed manufacturers accounting for 44% of the sales channel share. Complete feed will dominate the end-use application with 41% industry share.

Essential oil-based phytobiotics palatants are expected to capture 35% of the industry share in 2025. These palatants are popular due to their natural, safe, and effective properties in enhancing the flavor of animal feed. Essential oils such as oregano, thyme, and garlic offer antimicrobial benefits, while also improving the palatability of feed, ensuring better consumption by livestock. The increasing preference for natural ingredients and clean-label products in animal nutrition drives the growth of essential oil-based palatants in the industry.

Livestock, including swine, poultry, and ruminants, is expected to hold 47% of the industry share in 2025. The dominant presence of livestock in the industry is driven by the significant demand for animal feed additives to improve feed intake, digestion, and overall health. With the growing need for effective feed solutions that support optimal growth, immunity, and disease resistance in livestock, phytobiotics palatants remain a key tool in the agricultural sector, driving high industry demand for these segments.

Flavor enhancement is projected to dominate the functionality segment with 42% of the industry share in 2025. Phytobiotics palatants designed for flavor enhancement play a crucial role in improving the palatability of animal feed, ensuring better feed intake and nutritional uptake. By masking the bitter taste of certain feed ingredients and improving flavor profiles, these palatants encourage higher consumption, resulting in better growth rates, improved health, and optimized feed conversion.

The powder format is expected to capture 48% of the industry share in 2025. The powder form is preferred due to its ease of mixing with animal feed, versatility, and compatibility with various feed formulations. Powdered palatants offer convenient application, and they allow for precise dosing, ensuring that animals receive the optimal amount of active ingredients. This format is especially popular in large-scale feed production, where uniform mixing and ease of handling are essential.

The direct-to-feed manufacturers channel is expected to capture 44% of the industry share in 2025. This distribution model allows for efficient and large-scale supply of phytobiotics palatants to feed manufacturers who can incorporate these ingredients into their feed formulations.

By working directly with feed manufacturers, palatant producers can ensure the quality and consistency of the product while also meeting the specific needs of the feed industry. This channel’s dominance is further reinforced by the increasing demand for customized and effective feed solutions.

Complete feed is projected to hold 41% of the industry share in the end-use application segment by 2025. Phytobiotics palatants are crucial for inclusion in complete feed formulations, where they enhance the overall quality, taste, and nutritional value of the feed. As the demand for complete and balanced feed formulations grows, the need for palatants that can improve flavor and nutritional content in these products continues to rise.

The industry is expanding due to the increasing demand for natural and effective feed additives in animal nutrition. However, challenges such as limited awareness, regulatory complexities, and competition from synthetic alternatives are hindering broader adoption.

Growing Demand for Natural Feed Additives

The industry is experiencing growth driven by the increasing preference for natural feed additives in animal nutrition. Phytobiotics, derived from plant-based sources, offer benefits such as enhanced palatability, improved digestion, and better overall health in animals.

As consumers and producers seek alternatives to synthetic additives, the demand for phytobiotics palatants is rising. This trend is particularly evident in the poultry and swine sectors, where feed acceptance and performance are critical.

Challenges in Industry Penetration and Awareness

Despite the benefits, the industry faces challenges related to limited awareness and understanding among producers. Many are accustomed to synthetic additives and may be hesitant to switch to plant-based alternatives due to perceived efficacy concerns or unfamiliarity. Additionally, the higher cost of phytobiotics compared to traditional additives can be a deterrent, especially for small-scale producers operating on tight margins.

Global industry demand is projected to rise at a 4.2% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 3.6%, followed by China at 3.2%, and the United States and Australia, both at 3.4%, while the United Kingdom records 2.8%.

These rates translate to a growth premium of -14% for India, -24% for China, and -19% for the United States versus the baseline, while Australia and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing demand for natural additives and health-conscious feeding in India and China, while the United States and Australia experience more steady growth driven by stable agricultural sectors. The United Kingdom lags with slower adoption of phytobiotics palatants in animal feed.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.4% |

| United Kingdom | 2.8% |

| China | 3.2% |

| India | 3.6% |

| Australia | 3.4% |

Sales of phytobiotics palatants in the United States are projected to grow at a CAGR of 3.4% between 2025 and 2035. Rising scrutiny around antibiotic alternatives in livestock nutrition has encouraged broader use of botanical-based palatants.

Feed manufacturers are reformulating rations for poultry and swine with citrus extracts and saponin compounds to improve intake under stress. USA-based integrators are aligning formulations with voluntary antibiotic-free labeling programs, increasing reliance on phytobiotics.

The industry in the United Kingdom is expected to register a CAGR of 2.8% through 2035. Compliance with post-Brexit antimicrobial limits in livestock feed has fueled interest in phyto-additives.

Feed mills are incorporating plant-derived stimulants in ruminant premixes to enhance palatability during ration shifts. Distributors prefer EU-certified blends with documented sensory improvement in low-energy diets.

China’s industry is expected to expand at a CAGR of 3.2% from 2025 to 2035. Shifts toward feed safety and residue-free animal production continue to reshape formulation norms.

Imports of essential oil-based palatants have risen, especially for aquafeed and pet applications. Domestic players are developing blends combining ginger, licorice, and green tea extracts to address regional taste preferences.

India’s industry is projected to grow at a CAGR of 3.6% during the forecast period. Growth stems from the widespread transition away from growth-promoting antibiotics in poultry and aquaculture feed.

Domestic extractors are expanding supply of fenugreek, cinnamon, and holy basil-based ingredients tailored to species-specific needs. Feed consumption volatility during climatic stress has further raised interest in aroma-enhancing phytobiotics.

Australia’s industry is estimated to rise at a CAGR of 3.4% from 2025 to 2035. Antibiotic-free protocols in beef and sheep industries are propelling demand for natural taste enhancers.

Companies focus on leveraging native botanical extracts, such as lemon myrtle and eucalyptus, to create region-specific flavor profiles. Regulatory constraints on synthetic flavors have reinforced interest in clean-label palatants.

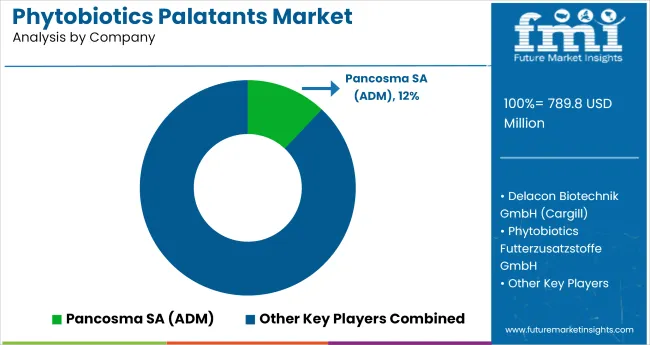

Leading Player - ADM (via Pancosma SA)Industry Share - 12%

In the industry, competitive advantage has been pursued through targeted botanical formulation, regional ingredient alignment, and vertical integration. Phytobiotics GmbH retains lead status by developing standardized actives with proven gut-health claims, distributed through livestock integrators and specialty feed mills across Europe and North America.

Cargill’s Delacon and ADM’s Pancosma focus on modular blends tailored for swine and poultry, leveraging captive sourcing of herbs and spices. Ayurvet’s India operations have enabled cost-efficient rollouts of functional palatants across ASEAN, aligned with native medicinal plant use.

Aromex, via Adisseo, supports flavor-masking systems in premium additives through co-development with local formulators. Regulatory frameworks differ sharply, with EU traceability rules shaping dose declarations and botanical origin labeling.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 789.8 million |

| Industry Value (2035) | USD 1,192.9 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and metric tons for volume |

| Source Type Segmentation | Plant Extract-Based, Essential Oil-Based, Herbal Blend-Based, Fermentation-Derived, Encapsulated Botanicals |

| Animal Type Segmentation | Pet (Dogs, Cats), Livestock (Swine, Poultry, Ruminants), Aquaculture |

| Functionality Segmentation | Flavor Enhancement, Appetite Stimulation, Gut Health Synergy, Stress Reduction/Calming, Antimicrobial Support |

| Format Type Segmentation | Powder, Liquid, Emulsified, Encapsulated |

| Sales Channel Segmentation | Direct to Feed Manufacturers, Distributors/Resellers, Online Ingredient Marketplaces, In-house Use by Feed Integrators |

| End Use Application Segmentation | Complete Feed, Premixes, Top-Dress Supplements, Treats & Chews (Pet), Starter Feeds (Livestock) |

| Regions Covered | North America, Latin America, Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players | Phytobiotics Futterzusatzstoffe GmbH, De lacon Biotechnik GmbH (Cargill), Pancosma SA (ADM), Ayurvet Limited, Aromex, Others |

| Additional Attributes | Dollar sales by source type, animal type, functionality, format type, and sales channel, increasing adoption of phytobiotics in animal feed, rising demand for natural and plant-based feed additives, expanding industry for specialty feed products, and regional variations in feed industry practices. |

Source-based segmentation includes Plant Extract-Based, Essential Oil-Based, Herbal Blend-Based, Fermentation-Derived, and Encapsulated Botanicals.

Animal categories include Pet (Dogs, Cats), Livestock (Swine, Poultry, Ruminants), and Aquaculture.

Functional applications span Flavor Enhancement, Appetite Stimulation, Gut Health Synergy, Stress Reduction/Calming, and Antimicrobial Support.

Format segmentation includes Powder, Liquid, Emulsified, and Encapsulated.

Sales channels comprise Direct to Feed Manufacturers, Distributors/Resellers, Online Ingredient Marketplaces, and In-house Use by Feed Integrators.

End use includes Complete Feed, Premixes, Top-Dress Supplements, Treats & Chews (Pet), and Starter Feeds (Livestock).

Regional segmentation includes North America, Latin America, Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The projected size of the industry in 2025 is USD 789.8 million.

The value of the industry in 2035 is USD 1,192.9 million, with a CAGR of 4.2%.

The powder format leads the industry with a 48% industry share.

India is projected to have the highest CAGR in the industry with a growth rate of 3.6% from 2025 to 2035.

The leading company in the industry is ADM, with a 12% industry share.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.