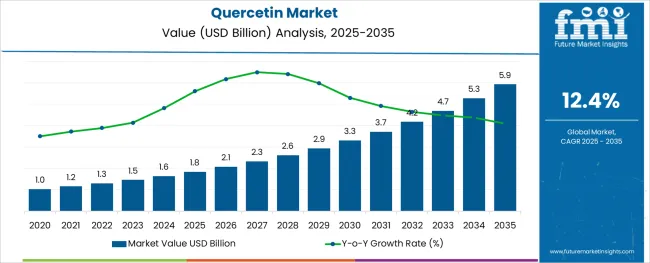

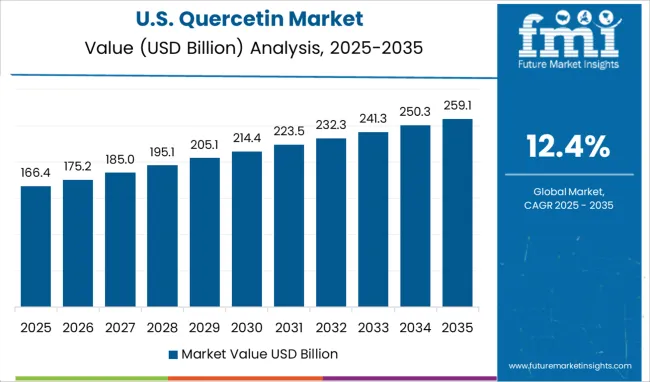

The Quercetin Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period.

The quercetin market is progressing steadily as health-conscious consumer trends, advancements in nutraceutical formulations, and expanding applications in functional foods continue to drive demand. Growing awareness of quercetin’s antioxidant, anti-inflammatory, and immunity-supporting properties has positioned it favorably among dietary ingredients.

Regulatory approvals in several regions and increasing research into its therapeutic potential have reinforced confidence among manufacturers and consumers alike. Future growth is expected to be supported by innovation in delivery systems, growing penetration into sports nutrition and pharmaceutical channels, and collaborations between ingredient producers and wellness brands.

The ability of quercetin to meet consumer expectations for natural, clean-label products while offering measurable health benefits is paving the way for broader adoption and sustained market expansion.

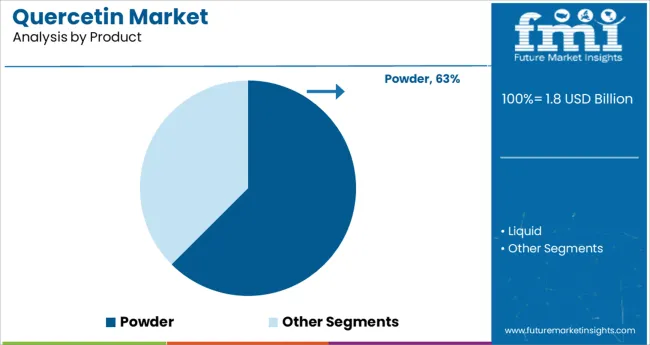

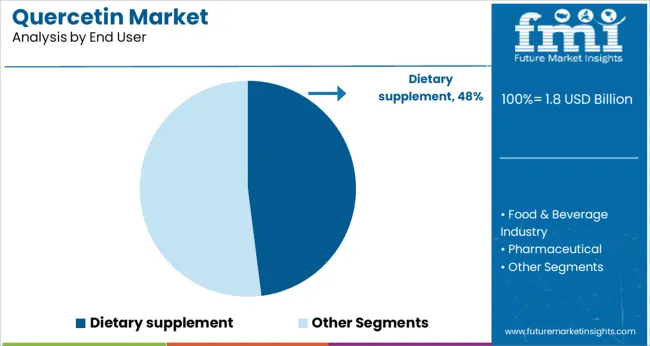

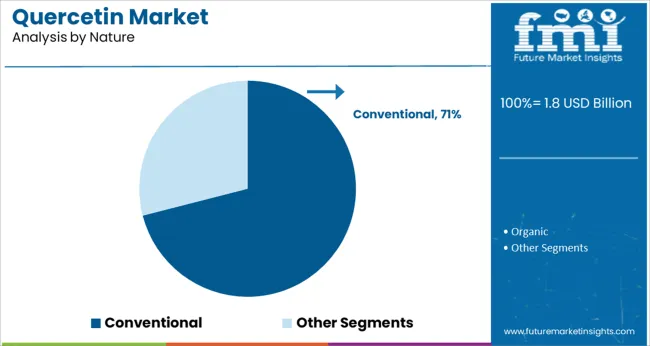

The market is segmented by Product, End User, Nature, and Sales Channel and region. By Product, the market is divided into Powder and Liquid. In terms of End User, the market is classified into Dietary supplement, Food & Beverage Industry, Pharmaceutical, and Nutraceutical. Based on Nature, the market is segmented into Conventional and Organic. By Sales Channel, the market is divided into Online Retailing / Delivery, Store-based Retailing, Modern Grocery Store, Traditional Retailers, and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product, End User, Nature, and Sales Channel and region. By Product, the market is divided into Powder and Liquid. In terms of End User, the market is classified into Dietary supplement, Food & Beverage Industry, Pharmaceutical, and Nutraceutical. Based on Nature, the market is segmented into Conventional and Organic. By Sales Channel, the market is divided into Online Retailing / Delivery, Store-based Retailing, Modern Grocery Store, Traditional Retailers, and Direct Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, the powder form is estimated to command 62.5 % of the total market revenue in 2025, securing its position as the leading product segment. This leadership has been reinforced by the versatility and ease of formulation that powder offers in a wide array of end products including capsules, tablets, beverages, and functional foods.

Manufacturers have favored the powder format due to its superior stability, cost-effectiveness, and longer shelf life compared to liquid alternatives. Additionally, powder facilitates higher concentration and flexible dosing, which has resonated with formulators aiming to deliver effective health benefits.

The ability to blend seamlessly into existing manufacturing processes and its compatibility with clean-label claims have further strengthened its dominance in the quercetin market.

Segmenting by end user shows that the dietary supplement category is projected to account for 48.0 % of the market revenue in 2025, establishing itself as the most prominent segment. This predominance has been driven by rising consumer interest in preventative health, immunity enhancement, and natural antioxidants, which has created sustained demand for dietary supplements containing quercetin.

The growing inclusion of quercetin in multivitamins, immune support complexes, and standalone supplements reflects its perceived efficacy and broad appeal among health-conscious consumers. Increased availability across retail, online, and specialty nutrition channels has further amplified its reach.

The segment’s leadership has also been reinforced by its alignment with lifestyle trends emphasizing wellness and self-care, coupled with an expanding base of consumers seeking scientifically backed, natural ingredients.

When segmented by nature, the conventional category is expected to hold 71.0 % of the market revenue in 2025, maintaining its position as the dominant segment. This leadership has been supported by the widespread cultivation and extraction practices of conventional quercetin, which ensure reliable supply and competitive pricing.

Manufacturers have favored conventional sources as they enable scalability, cost efficiency, and consistency in meeting large volume requirements. The relatively lower cost of production compared to organic alternatives and the ability to integrate into diverse product applications without premium pricing constraints have reinforced its appeal.

Moreover, the robust supply chain for conventional raw materials and its alignment with mainstream consumer demand have secured its leading share in the quercetin market.

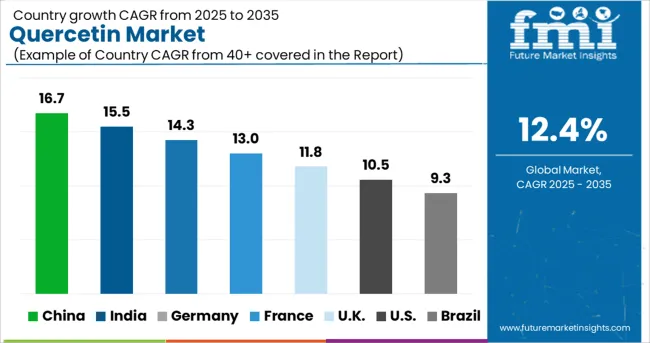

The global quercetin demand is expected to grow at an impressive CAGR of over 12.4% between 2025 to 2035, in comparison to the 9.5% CAGR registered during the historical period from 2020 to 2024. The growing popularity of quercetin across diverse industries due to its numerous health benefits is a key factor driving the global quercetin industry forward.

Over the years, growing health awareness has prompted consumers to opt for food products and supplements containing ingredients like quercetin. This has provided a strong impetus to the global market.

Quercetin is a flavonoid commonly found in various fruits and vegetables. The substance possesses anti-inflammatory and antioxidant properties and thus helps to improve blood circulation, reduce the risk of heart diseases, and protect cells from damage. Hence, it is being increasingly used in pharmaceuticals, functional foods, nutraceuticals, and dietary supplements.

Increasing production and consumption of functional foods, dietary supplements, and nutraceuticals coupled with growing awareness about the potential benefits of quercetin will help the market to thrive at a stupendous pace over the next ten years.

Rising Demand for Natural Healthy Food Ingredients Propelling Quercetin in the USA

In recent years, there has been a growing trend of consumers seeking out natural ingredients in their everyday lives. This has led to the growth of the USA global quercetin market.

According to Future Market Insights, quercetin demand in the USA is likely to surge at a robust pace during the next ten years owing to the rising inclination towards healthy food products and increasing awareness about health and wellbeing.

Similarly, the growing popularity of functional foods and supplements and the strong presence of leading players such as BASF SE, DSM Naturals Holding BV, and Wuxi App Tech Co., Ltd are positively influencing the USA quercetin industry.

Rising Application in Pharmaceutical Industry Boosting Sales in the United Kingdom

Europe is considered to become a leading global quercetin producer due to its favorable climate and favorable soil conditions. The continent has a long history of growing produce, making it well-suited to the cultivation of plants that produce quercetin. The region also has a high concentration of quercetin-rich plant species, making it possible for farmers to cultivate these crops profitably.

Further, European countries like the United Kingdom and Germany are witnessing high demand for food supplements and dietary supplements that contain quercetin. This will boost quercetin sales over the forecast period.

FMI, predicts the United Kingdom to emerge as one of the lucrative markets for quercetin across Europe during the forecast period, owing to the widening application of quercetin in pharmaceutical and dietary supplement sectors.

Food & Beverage Remains the Leading End User for Quercetin

Based on end users, the global market for quercetin is segmented into the food & beverage industry, pharmaceutical, dietary supplement, and nutraceutical. Among these, the food & beverage industry holds the largest share of the global market owing to the rising usage of quercetin as a natural food and beverage preservative globally.

There is a growing trend of people preferring natural foods and beverages, which is driving the market for preservatives made from natural ingredients. The key reasons for this are health concerns around the use of artificial additives in food and beverage products, as well as environmental concerns about the production of chemicals. This has led to a shift towards using more natural ingredients like quercetin.

Similarly, growing demand for functional food products from health-conscious consumers will boost quercetin sales during the forecast period. As quercetin possesses antioxidant and anti-inflammatory properties, it has become an essential ingredient used by manufacturers of functional foods.

Additionally, factors such as increasing awareness about the benefits of using natural ingredients, rising focus on holistic wellness therapies, and growing food safety concerns will continue to generate high demand for quercetin over the next ten years.

Key players in the market include King herbs Ltd, Natural Anhui Biotechnology Co. Ltd., Xi’an Tianuri Biotech Co. Ltd., Natrol Llc., and Hengyang Densen Biotechnology co. ltd., Xi,anFrankherb Biotech Co. Ltd., Nanjing Zelang Medical Technology Co. Ltd., NOW Health Group Inc., Bluebonnet Nutrition Corporation, Wuxi Gorunjie Natural Pharma Co. Ltd., Oregon’s Wild Harvest Ltd., and Source Naturals Inc.

New product launches, investments in research and development (R&D), facility expansions, mergers, acquisitions, partnerships, and collaborations are some of the key strategies adopted by companies to increase their customer base and solidify their position in the market. Some of the recent developments are given below:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 5.9 billion |

| Anticipated Growth Rate (2025 to 2035) | 12.4% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | The USA, Brazil, Mexico, Germany, United Kingdom, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Product, Nature, End User, Sales Channel, and Region |

| Key Companies Profiled | Kingherbs Ltd; Natural Anhui Biotechnology Co. Ltd.; Xi’an Tianuri Biotech Co. Ltd.; Natrol Llc.; Hengyang Densen Biotechnology Co. Ltd.; Xi’An Frankherb Biotech Co. Ltd.; Nanjing Zelang Medical Technology Co. Ltd.; NOW Health Group Inc.; Bluebonnet Nutrition Corporation; Wuxi Gorunjie Natural Pharma Co. Ltd.; Oregon’s Wild Harvest Ltd.; Source Naturals Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global quercetin market is estimated to be valued at USD 1.8 billion in 2025.

It is projected to reach USD 5.9 billion by 2035.

The market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types are powder and liquid.

dietary supplement segment is expected to dominate with a 48.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA