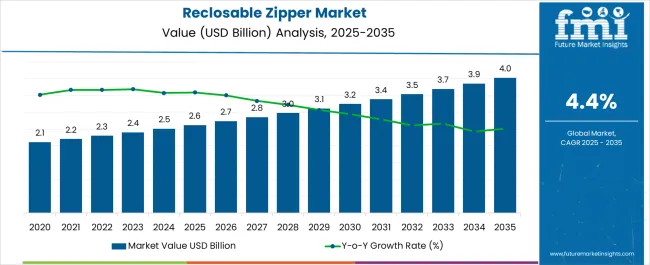

The Reclosable Zipper Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Reclosable Zipper Market Estimated Value in (2025 E) | USD 2.6 billion |

| Reclosable Zipper Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The reclosable zipper market is witnessing steady expansion. Growth is being driven by rising demand for convenient and sustainable packaging solutions, increased focus on food preservation, and the shift toward flexible packaging formats. Current dynamics are marked by heightened adoption across food, pharmaceutical, and personal care industries, where extended shelf life and reusability are prioritized.

Regulatory emphasis on reducing plastic waste is encouraging innovation in recyclable and biodegradable zipper solutions. Market players are investing in advanced manufacturing technologies to improve sealing performance and enhance production efficiency. The future outlook remains positive as consumer preference for portion-controlled and resealable packaging continues to strengthen across global markets.

Growth rationale is centered on the functional advantages of reclosable zippers in maintaining product integrity, ensuring safety, and improving consumer convenience With robust penetration in mature economies and increasing adoption in emerging regions, the market is positioned for sustained expansion supported by regulatory, technological, and consumer-driven forces.

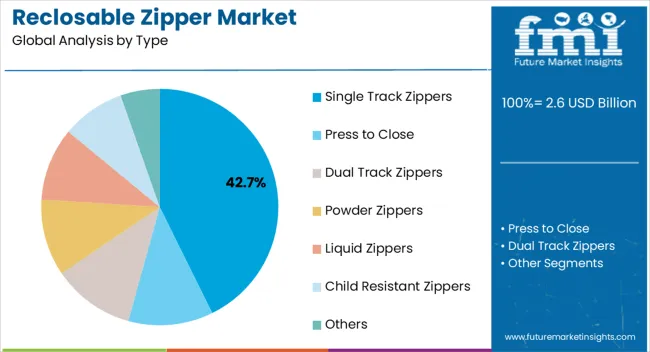

The single track zippers segment, holding 42.70% of the type category, has maintained dominance owing to its cost-effectiveness, design simplicity, and wide applicability across diverse packaging formats. Market preference has been reinforced by high production efficiency and compatibility with a variety of film substrates.

Demand growth has been supported by increased use in mass-market food packaging and household consumer goods. Reliability in sealing strength and ease of use have contributed to strong adoption across both retail and industrial packaging lines.

Manufacturers have been focusing on material optimization and recyclability to align with environmental regulations, further enhancing acceptance With scalability in production and broad adaptability across industries, single track zippers are expected to retain their market-leading position while capturing additional demand from evolving sustainable packaging initiatives.

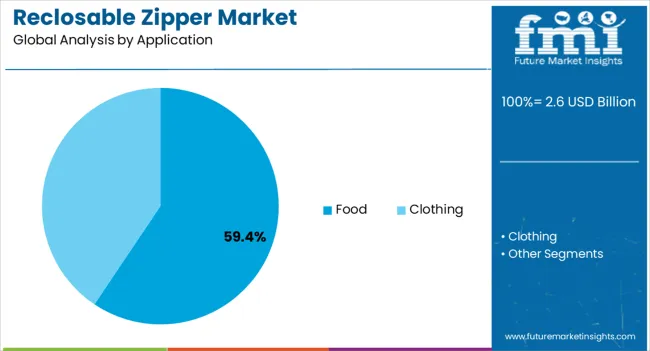

The food segment, accounting for 59.40% of the application category, has emerged as the leading application area due to rising global consumption of packaged food and the growing need for extended freshness and storage convenience. Its leadership has been supported by strong demand in bakery, snacks, frozen foods, and ready-to-eat products.

Functional advantages of reclosable zippers, such as preserving product quality and preventing contamination, have reinforced consumer preference and retailer acceptance. Market adoption has been further strengthened by regulatory compliance with food safety standards and the shift toward flexible packaging formats.

Expansion of e-commerce food delivery services has created additional opportunities, as secure and resealable packaging is essential for maintaining quality during transport Continued emphasis on convenience, sustainability, and waste reduction is expected to sustain the food segment’s dominance and drive incremental growth in the forecast period.

The reclosable zipper industry was tipped to have a value of USD 2.1 billion in 2020. The market likely progressed at a sluggish CAGR of 2.1% over the historical period from 2020 to 2025.

The market was heavily affected by the shutdown of various industrial operations during the pandemic. However, demand from the food & beverage and pharmaceutical industries for sustainable packaging started lifting the reclosable zipper market. By the end of the historical period in 2025, the market value had reached USD 2.4 billion.

| Market Valuation (2020) | USD 2.1 billion |

|---|---|

| Historical CAGR (2020 to 2025) | 2.1% |

| Market Valuation (2025) | USD 2.4 billion |

Long-term Analysis of Reclosable Zipper Market from 2025 to 2035

For 2025, the valuation for a reclosable zipper is estimated to be USD 2.5 billion. The growth of the market is predicted to elevate at a modest pace of 4.6% over the forecast period.

The expansion of industries like food & beverage and pharmaceuticals is conducive to the growth of the reclosable zipper market. Moreover, manufacturers are developing flexible packaging reclosable zippers with additional features to make them easy to use.

Consumers favor packaging that can be used again and again. Reusable packaging not only increases the convenience of consumers but also affords consumers savings on packaging material. Reusability is one of the key features of reclosable zippers. As such, the popularity of reclosable zippers is expected to soar over the forecast period. By the end of the forecast period, the value of the market is expected to reach USD 3.9 billion.

Press-to-close zippers are the standard type of closures in reclosable zipper packaging. For 2025, the market share by closure type of press-to-close zipper is pegged at a dominant 71.2%.

Press-to-close zippers provide a no-frills type of closing system for packaging. In addition, the optimal product production and its east-to-close design make them more affordable for consumers. For instance, LPS Industries launched Top-Loc Zipper with anti-static features for food & snacks, veterinary medicine, and OTC health & beauty.

| Attributes | Details |

|---|---|

| Top Closure Type | Press-to-close |

| Market Share in 2025 | 71.2% |

Food is the sector where reclosable zippers find numerous applications. For 2025, food is anticipated to hold 61.4% of the market share by end-use category.

The burgeoning food industry is in constant need of packaging that preserves them from contamination. In addition, the growing sale of food online is also creating an increased need for secure packaging. Reclosable zippers are increasingly used in candy and other sweets, beverages, and even pet food packaging.

| Attributes | Details |

|---|---|

| Top Application | Food |

| Market Share in 2025 | 61.4% |

The expanding food and packaging industry in the Asia Pacific, with the propensity to eat food at home, increasing urbanization, and growing population, is propelling the market in the region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

| Australia | 4.2% |

| Japan | 3.7% |

| India | 6.2% |

| China | 5.3% |

India is estimated to be one of the leading countries in the market over the forecast period, with a CAGR of 6.2%.

With the rising population, the food demand in India is significant. As a result, the food production in the country is rising, creating the need for large amounts of packaging.

For the forecast period, the CAGR in China is pegged to be an encouraging 5.3%. The online segment is helping the expansion of the packaging industry in China with its one-stop service. As a result, e-commerce is the key to market growth for easy access to a variety of reclosable zipper packaging.

Japan is another Asian country that holds opportunity for the market. For the forecast period, the CAGR for Japan is anticipated to be a steady 3.7%.

Manufacturers of reclosable zipper packaging products are getting creative with the design of the product. Various colors and tie-ins are used in the likes of bags and pouches. Thus, the market is being driven in Japan.

Sustainable practices are quickly becoming the norm in Australia. The recycled polyester trend is prevalent in packaging in the country to reduce greenhouse gas emissions. Moreover, paper over plastic packaging material for easy degradation is presenting key opportunities in the country. Thus, Australian consumers are leaning toward sustainable packaging closures. The CAGR for Australia over the forecast period is predicted to be a calm 4.2%.

The United Kingdom is one of the most promising countries in Europe for the market. For the 2025 to 2035 period, the CAGR for the United Kingdom is projected to be a respectable 4.7%.

Flexible packaging is a primary concern among suppliers in the United Kingdom. Consumers are also partial to the convenience provided by reclosable zippers. Thus, easy-to-handle reclosable zippers are gaining popularity in the United Kingdom.

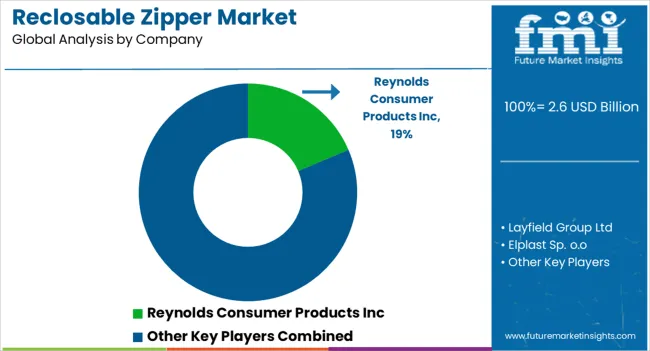

The reclosable zipper market needs to be more cohesive. Several multinational players exist, but small-scale local companies have plenty of room to grow.

Innovation is considered key by market players. In addition to innovative products, like ones made with recyclable material, innovative designs for ease of use are also given importance by market players.

Recent Developments in the Reclosable Zipper Market

The global reclosable zipper market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the reclosable zipper market is projected to reach USD 4.0 billion by 2035.

The reclosable zipper market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in reclosable zipper market are single track zippers, press to close, dual track zippers, powder zippers, liquid zippers, child resistant zippers and others.

In terms of application, food segment to command 59.4% share in the reclosable zipper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reclosable Zipper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Zipper Bag Market Trends & Growth Forecast 2024-2034

Zippered Bottle Suit Market

Pre-zippered Pouches Market

Foil Zipper Bags Market

Double Zipper Bags Market Outlook & Key Trends 2024-2034

Stand-up Zipper Pouches Market Analysis – Trends & Forecast 2025 to 2035

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Aluminum Foil Zipper Pouch Market Trends - Growth & Forecast 2024 to 2034

Press-to-Close Zippers Market

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA