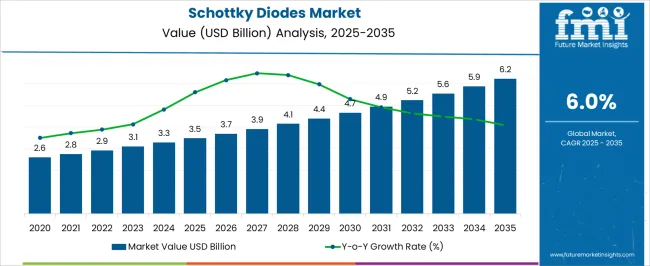

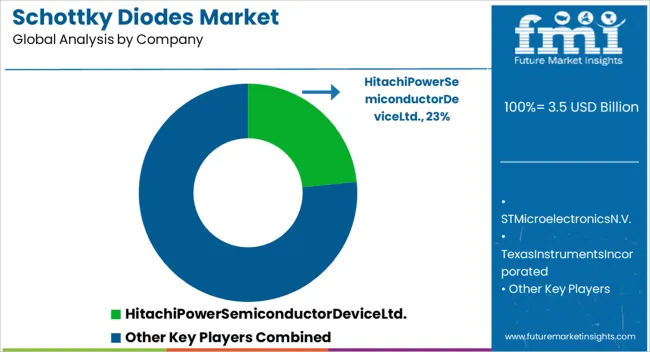

The Schottky Diodes Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

In the first stage between 2025 and 2030, the market grows from USD 2.6 billion to USD 3.5 billion, fueled by rising applications in consumer electronics, automotive electronics, and power supply units. The rapid shift toward energy-efficient devices and compact circuit designs drives greater adoption of schottky diodes due to their low forward voltage drop and high switching speed. Between 2031 and 2035, the market expands from USD 3.7 billion to USD 5.2 billion, supported by growing demand in telecommunications, industrial automation, and renewable energy systems. The increasing use of schottky diodes in solar inverters, battery charging systems, and electric vehicle powertrains further accelerates this phase. By 2040, the market value reaches USD 6.2 billion, as advancements in semiconductor materials and manufacturing processes enable diodes with improved efficiency, higher current handling, and better thermal performance. Expanding deployment in 5G infrastructure, aerospace, and medical electronics ensures continued relevance across industries. With their role in enhancing performance, reducing energy losses, and supporting miniaturized designs, schottky diodes are expected to remain a critical component in the evolution of next-generation electronics and power systems worldwide.

| Metric | Value |

|---|---|

| Schottky Diodes Market Estimated Value in (2025 E) | USD 3.5 billion |

| Schottky Diodes Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The Schottky diodes market is witnessing strong growth momentum, supported by the expanding demand for efficient power conversion, high-speed switching, and thermal stability in modern electronics. Advancements in semiconductor processing, combined with rising adoption in power supply circuits, automotive electronics, and renewable energy systems, are influencing market expansion.

The ability of Schottky diodes to reduce power losses and improve system efficiency has made them integral in next-generation electronic designs. Furthermore, the growing integration of these diodes into compact consumer devices, 5G infrastructure, and electric vehicle systems is reinforcing market opportunities.

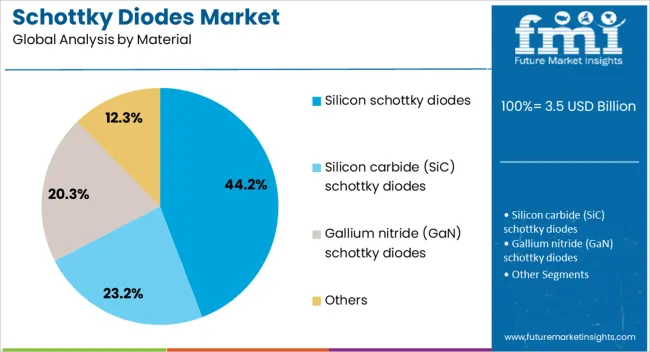

Material innovations, such as silicon carbide and gallium nitride variants, are enhancing performance metrics, catering to applications requiring higher voltage handling and thermal endurance As industries continue to demand miniaturized yet high-performance components, Schottky diodes are expected to play a critical role in enabling efficient, reliable, and scalable electronic systems globally.

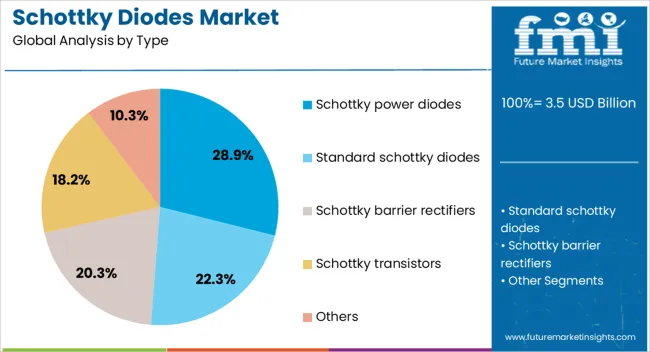

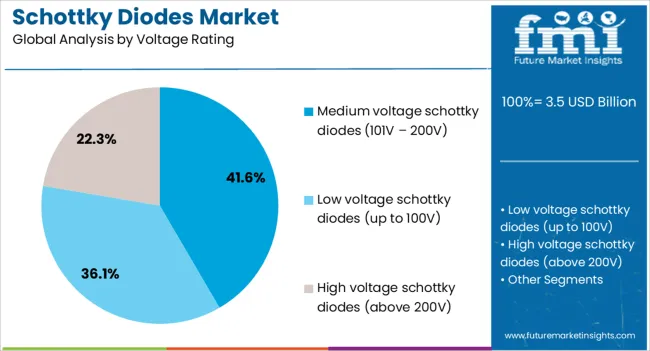

The schottky diodes market is segmented by type, voltage rating, material, application, and geographic regions. By type, schottky diodes market is divided into Schottky power diodes, Standard schottky diodes, Schottky barrier rectifiers, Schottky transistors, and Others. In terms of voltage rating, schottky diodes market is classified into Medium voltage schottky diodes (101V – 200V), Low voltage schottky diodes (up to 100V), and High voltage schottky diodes (above 200V). Based on material, schottky diodes market is segmented into Silicon schottky diodes, Silicon carbide (SiC) schottky diodes, Gallium nitride (GaN) schottky diodes, and Others. By application, schottky diodes market is segmented into Consumer electronics, Automotive, Industrial, Telecommunications, Computing, Power supply, and Others. Regionally, the schottky diodes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Schottky power diodes are expected to account for 28.9% of the total revenue share in the Schottky diodes market in 2025, establishing themselves as the leading type segment. This leadership is supported by their widespread use in high-current and high-frequency applications, where efficiency and fast recovery times are essential.

Their capability to deliver low forward voltage drop and minimal switching losses has been instrumental in power supply units, inverters, and high-performance converters. The segment has benefited from advancements in packaging technologies, which have improved heat dissipation and enabled deployment in space-constrained electronic assemblies.

Strong demand from automotive power management, consumer electronics, and industrial automation sectors has further reinforced the position of Schottky power diodes Additionally, their compatibility with emerging semiconductor materials and ability to meet stringent energy efficiency regulations have strengthened their adoption in both legacy and advanced circuit designs.

Medium voltage Schottky diodes, with a revenue share of 41.6% in 2025, are positioned as the dominant voltage rating category in the market. This dominance is attributed to their balance between voltage handling capability and minimal power loss, making them suitable for a broad range of power conversion applications.

They have been extensively utilized in automotive electronics, renewable energy inverters, and industrial motor drives where mid-range voltage levels are prevalent. The adoption of these diodes has been supported by their superior switching speed, reduced reverse leakage current, and thermal efficiency.

As power systems increasingly migrate toward energy-optimized architectures, medium voltage Schottky diodes have emerged as a preferred choice for ensuring operational stability and high efficiency The segment is also benefiting from technological developments in device fabrication, which are enabling greater current carrying capacity and improved durability in demanding operating conditions.

Silicon Schottky diodes are projected to represent 44.2% of the total revenue share in the Schottky diodes market in 2025, marking them as the leading material segment. This leadership is being driven by the maturity, cost-effectiveness, and manufacturing scalability of silicon-based solutions.

Their well-established performance characteristics, including low forward voltage drop, fast switching capability, and stable operation under a wide temperature range, have made them a standard in power rectification and signal detection circuits. The segment’s growth is further supported by high-volume demand from consumer electronics, telecommunications, and industrial power supply applications.

In addition, the extensive availability of silicon wafer fabrication infrastructure has ensured steady production capacity and competitive pricing The continued innovation in silicon-based designs to enhance reverse voltage ratings and reduce leakage currents is reinforcing their role as a cost-effective yet reliable solution in the evolving electronics landscape.

The schottky diodes market is being propelled by expanding roles in power conversion, automotive electronics, high-frequency circuits, and material advancements. Their efficiency and versatility position them as essential enablers across multiple industries.

Schottky diodes have been gaining strong acceptance in power conversion systems due to their efficiency in reducing forward voltage drop and switching losses. Their integration into AC–DC and DC–DC converters has improved overall circuit efficiency, making them indispensable in consumer electronics, communication systems, and renewable energy installations. Their fast recovery characteristics have enabled better thermal management, extending component life and reliability in compact devices. The preference for miniaturized and energy-efficient consumer goods has encouraged semiconductor companies to expand production capacity of Schottky diodes. Their role in lowering heat generation and supporting high-frequency operation places them at the center of modern power system design, ensuring stability and improved functionality for both industrial and consumer end users.

The automotive industry has been actively adopting Schottky diodes for battery management systems, infotainment devices, and ECU boards due to their high efficiency and compact form. Their application in electric and hybrid vehicles has expanded, as energy conservation in on-board electronics requires diodes with low leakage current and stable performance under varying temperatures. The transition toward advanced driver assistance systems has also raised demand for Schottky devices that enable reliable signal processing and fast switching. Their ability to withstand power surges while maintaining low forward voltage makes them suitable for vehicular environments. Tier suppliers and OEMs continue to collaborate with semiconductor manufacturers to introduce tailored Schottky diode solutions for automotive applications, cementing their growing relevance.

High-frequency circuits have seen increased reliance on Schottky diodes due to their ability to manage fast switching without compromising efficiency. They are now widely used in communication devices, RF mixers, satellite receivers, and detectors where speed and sensitivity are critical. Their integration into radar systems and IoT-enabled devices has expanded as demand grows for high-frequency efficiency in compact semiconductor packages. The enhanced response time of Schottky devices compared to traditional diodes gives them a competitive edge across multiple end-use industries. The market has been witnessing steady upgrades with silicon carbide variants offering higher breakdown voltage and improved performance in high-frequency domains, further supporting their role in next-generation electronic designs.

Material innovation has been reshaping the Schottky diode market, with silicon carbide (SiC) and gallium nitride (GaN) versions providing higher efficiency and superior thermal stability. These materials enable devices to operate at higher voltages and temperatures, enhancing reliability in power-intensive sectors. Manufacturers are actively investing in packaging designs that ensure minimal energy loss and improved integration with power modules. The emphasis on SiC-based Schottky diodes has grown significantly in renewable energy and industrial applications, where efficiency gains directly impact performance. Industry players are scaling R&D investments to accelerate the transition from conventional silicon to advanced materials, creating a shift that redefines cost structures, operational longevity, and product innovation within the Schottky diode ecosystem.

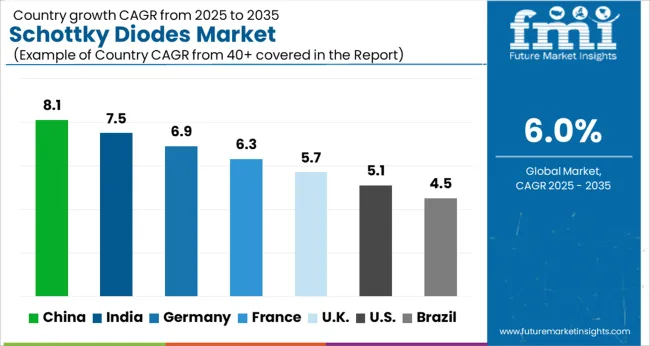

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

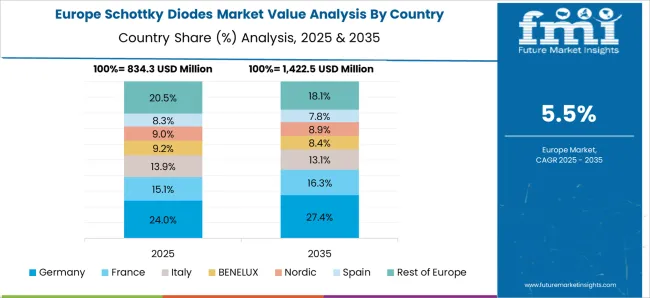

The schottky diodes market is expected to expand globally at a CAGR of 6.0% from 2025 to 2035, driven by their increasing role in power management, high-frequency circuits, and automotive electronics. China leads with a CAGR of 8.1%, fueled by large-scale semiconductor manufacturing, expanding consumer electronics production, and rapid integration of Schottky diodes in renewable energy systems. India follows at 7.5%, supported by strong growth in consumer devices, automotive electrification, and expansion of local semiconductor assembly capabilities. France records 6.3%, leveraging its high-value electronics sector and automotive applications that prioritize efficient power devices. The United Kingdom grows at 5.7%, where demand is supported by industrial automation, communication systems, and energy-efficient circuit designs. The United States posts 5.1%, reflecting steady adoption across consumer electronics and automotive, but with slower acceleration compared to Asia due to mature market conditions. The analysis underscores Asia’s dominance in Schottky diode adoption, while Europe and North America remain important for premium applications, industrial automation, and automotive integration.

China is projected to post a CAGR of 8.1% during 2025–2035, outpacing the global 6.0%. Capacity expansion in wafer fabrication, strong ODM and EMS activity, and rapid uptake of high-efficiency power stages in consumer devices have been prioritized by local champions. Photovoltaic inverters, fast chargers, and server power shelves use Schottky rectifiers to curb conduction losses and heat, which lifts unit intensity per system. Auto suppliers have integrated low-leakage Schottky parts in 12 V and 48 V rails, infotainment, and ADAS support electronics. Tier vendors are scaling SiC Schottky ramps for traction inverters and auxiliary DC links, which improves thermal headroom and boosts lifetime performance. China is expected to remain the anchor for cost discovery and volume scaling.

India is expected to record a CAGR of 7.5% for 2025–2035, staying above the global average. Smartphone and wearables assembly has broadened, which increases demand for compact, low drop rectifiers in charging and power management circuits. Two wheeler and compact EV programs use Schottky devices in DC-DC converters and on board chargers, improving efficiency at light loads. Telecom densification and data center builds create steady pull for high-frequency Schottky parts in SMPS and RF front ends. Government production incentives and OSAT expansions have shortened lead times and stabilized pricing. With consumer electronics, auto electronics, and telecom all scaling, India is positioned to deliver sustained mid-single digit volume gains with premium mix improvements.

France is projected to grow at a 6.3% CAGR during 2025–2035, slightly above the global mark. Aerospace and defense electronics require low noise, fast-switching rectifiers in radar modules and power conditioning units, which sustains high value demand. Automotive suppliers in northern and eastern corridors have stepped up sourcing of Schottky parts for infotainment, body control, and e-axle auxiliaries. Industrial automation and medical device clusters prefer Schottky solutions for compact SMPS and low thermal footprints. Design houses are qualifying SiC Schottky devices for traction auxiliaries and grid-tied converters, improving efficiency at elevated temperatures. France is expected to keep a premium skew due to stringent reliability criteria and design certification cycles.

The United Kingdom is anticipated to post a 5.7% CAGR during 2025–2035, just under the global 6.0% level. Industrial electronics, power supplies, and telecom networking sustain steady pull for fast-recovery rectifiers with low forward drop. EV and charging infrastructure programs are improving demand for SiC Schottky parts in DC fast chargers and auxiliary converters, while consumer appliance makers favor compact SMD packages for thermal efficiency. Design consultancies and fabless firms continue to specify Schottky devices for high-frequency converters used in instrumentation and test equipment. Procurement teams benefit from diversified European distribution, which reduces lead time volatility and supports stable production schedules.

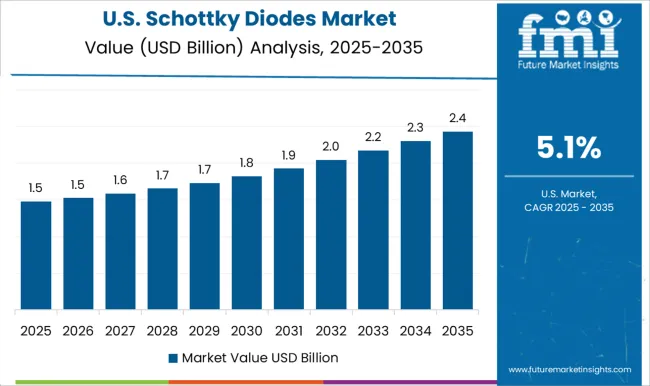

The United States is set to post a 5.1% CAGR during 2025–2035, modestly below the global rate. Server power, storage arrays, and networking equipment keep consistent demand for Schottky rectifiers in high-density SMPS, with emphasis on low losses and high reliability. Consumer device refresh cycles remain steady, but mature categories temper unit growth. Auto electronics demand remains healthy in body control and infotainment, while SiC Schottky adoption in fast chargers and traction auxiliaries gathers pace. Industrial OEMs are shifting designs toward higher switching frequencies, which favors Schottky devices for efficiency and thermal margins. Mix upgrades rather than large unit surges are expected to drive value contribution.

The Schottky diodes market is shaped by global semiconductor leaders such as Hitachi Power Semiconductor Device Ltd., STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., Renesas Electronics Corporation, and Microchip Technology Inc. These companies play a central role in advancing power management efficiency, supporting consumer electronics, automotive, and industrial applications.

Hitachi Power Semiconductor Device Ltd. focuses on discrete power components including Schottky diodes that enable efficient rectification for industrial power systems. STMicroelectronics N.V. has a strong footprint in Schottky diodes, offering silicon and silicon carbide variants optimized for automotive, consumer, and renewable energy solutions. Texas Instruments Incorporated emphasizes Schottky integration in power supply modules, highlighting low forward voltage and thermal efficiency for compact designs. NXP Semiconductors N.V. integrates Schottky devices into automotive and communication solutions, ensuring reliable high-frequency performance.

Renesas Electronics Corporation leverages Schottky diodes in automotive control units, consumer power supplies, and IoT-related hardware, supported by its broad semiconductor ecosystem. Microchip Technology Inc. provides Schottky diodes designed for high-speed switching and low-power applications, with a focus on industrial and embedded systems.

Competitive strategies include advancing silicon carbide Schottky diodes, expanding production capacity, and integrating devices into power modules for EV, telecom, and industrial markets. Partnerships with OEMs, emphasis on low-leakage designs, and regional manufacturing expansion strengthen their competitive edge. Future competitiveness will depend on scaling SiC-based Schottky diodes, reducing cost-per-device, and ensuring reliability across harsh environments.

Minebea Power Devices (Hitachi Power Devices)

STMicroelectronics N.V.

Texas Instruments Incorporated

NXP Semiconductors N.V.

Renesas Electronics Corporation

Microchip Technology Inc.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Schottky power diodes, Standard schottky diodes, Schottky barrier rectifiers, Schottky transistors, and Others |

| Voltage Rating | Medium voltage schottky diodes (101V – 200V), Low voltage schottky diodes (up to 100V), and High voltage schottky diodes (above 200V) |

| Material | Silicon schottky diodes, Silicon carbide (SiC) schottky diodes, Gallium nitride (GaN) schottky diodes, and Others |

| Application | Consumer electronics, Automotive, Industrial, Telecommunications, Computing, Power supply, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Power Semiconductor Device, Ltd.; STMicroelectronics N.V.; Texas Instruments Incorporated; NXP Semiconductors N.V.; Renesas Electronics Corporation; Microchip Technology Inc. |

| Additional Attributes | Dollar sales, share, CAGR, regional adoption trends, demand across automotive and consumer electronics, competitive landscape, SiC vs Si adoption, pricing benchmarks, and supply chain risks. |

The global schottky diodes market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the schottky diodes market is projected to reach USD 6.2 billion by 2035.

The schottky diodes market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in schottky diodes market are schottky power diodes, standard schottky diodes, schottky barrier rectifiers, schottky transistors and others.

In terms of voltage rating, medium voltage schottky diodes (101v – 200v) segment to command 41.6% share in the schottky diodes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Diodes Market

SMD TVS Diodes Market Size and Share Forecast Outlook 2025 to 2035

Limiter Diodes Market Size and Share Forecast Outlook 2025 to 2035

Field-effect Rectifier Diodes Market

High-Brightness Light-Emitting Diodes (LED) Headlamps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA