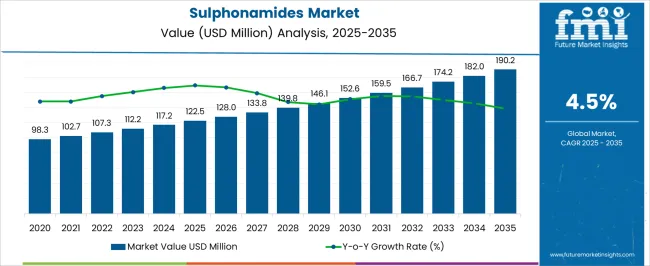

The Sulphonamides Market is estimated to be valued at USD 122.5 million in 2025 and is projected to reach USD 190.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Sulphonamides Market Estimated Value in (2025 E) | USD 122.5 million |

| Sulphonamides Market Forecast Value in (2035 F) | USD 190.2 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The sulphonamides market is witnessing consistent growth, supported by their critical role as antimicrobial agents across various therapeutic applications. Rising prevalence of infectious diseases, coupled with the continued demand for cost-effective treatments, is sustaining the relevance of sulphonamides despite competition from newer drug classes. The growing burden of urinary tract infections, respiratory tract infections, and certain gastrointestinal conditions is encouraging steady usage, particularly in regions where healthcare affordability remains a priority.

Expansion of generic drug manufacturing is increasing accessibility in both developed and developing economies, which further strengthens the market outlook. Advancements in formulation technologies and optimized dosing regimens are improving patient compliance and therapeutic effectiveness. Additionally, the integration of sulphonamides into combination therapies is providing added clinical value by enhancing efficacy and reducing resistance risks.

With rising awareness of antimicrobial stewardship and the continuing need for effective oral anti-infective agents, the market is expected to retain long-term importance As healthcare systems focus on broadening access to affordable antibiotics, sulphonamides are projected to remain a widely utilized therapeutic option in the global market.

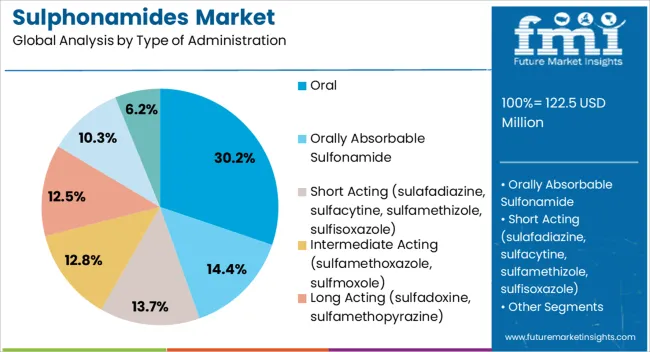

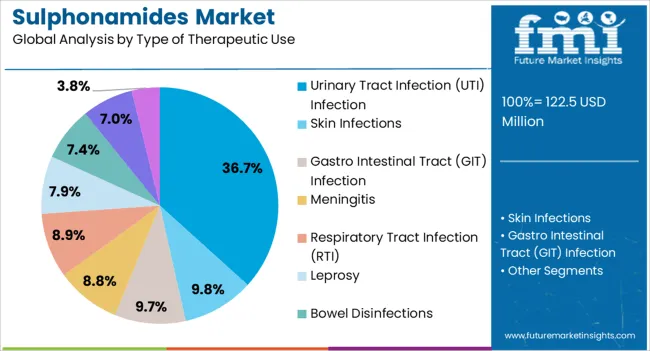

The sulphonamides market is segmented by type of administration, type of therapeutic use, and geographic regions. By type of administration, sulphonamides market is divided into Oral, Orally Absorbable Sulfonamide, Short Acting (sulafadiazine, sulfacytine, sulfamethizole, sulfisoxazole), Intermediate Acting (sulfamethoxazole, sulfmoxole), Long Acting (sulfadoxine, sulfamethopyrazine), Orally Non Absorbable Sulfonamide (sulfasalzine, osalazine), and Topical Agents (Silver sulfadiazine, sulfacetamide, mafenide). In terms of type of therapeutic use, sulphonamides market is classified into Urinary Tract Infection (UTI) Infection, Skin Infections, Gastro Intestinal Tract (GIT) Infection, Meningitis, Respiratory Tract Infection (RTI), Leprosy, Bowel Disinfections, Malaria, and Nocardiosis. Regionally, the sulphonamides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oral type of administration segment is projected to account for 30.2% of the sulphonamides market revenue share in 2025, making it the leading route of administration. This leadership is being driven by the convenience and accessibility offered by oral formulations, which improve patient compliance and support widespread prescribing practices. Oral sulphonamides provide consistent dosing, ease of storage, and suitability for outpatient treatment, which collectively contribute to their preference among healthcare providers and patients.

Cost-effectiveness is another significant factor enhancing the uptake of oral forms, especially in regions where affordability and availability of antibiotics are major determinants of prescribing trends. The growing prevalence of common infections, particularly in community settings, further supports reliance on oral sulphonamides as frontline therapies.

Additionally, the robust distribution network for oral formulations ensures their availability across pharmacies and healthcare centers, reinforcing their dominant position As global emphasis increases on expanding access to essential medicines, oral sulphonamides are expected to maintain their leading role in addressing infection management needs across diverse patient populations.

The urinary tract infection therapeutic use segment is anticipated to represent 36.7% of the sulphonamides market revenue share in 2025, establishing itself as the leading therapeutic application. This dominance is being supported by the high global incidence of UTIs, which affect a significant proportion of both male and female patients across all age groups. Sulphonamides remain an important therapeutic option due to their proven efficacy in treating uncomplicated and recurrent UTIs, offering a cost-effective solution in healthcare systems with limited resources.

The widespread prescribing of sulphonamides in primary care and outpatient settings further consolidates their use for urinary tract infections. Growing awareness regarding early diagnosis and treatment of UTIs, along with improved access to generic formulations, is contributing to market growth.

The segment also benefits from continued clinical preference for sulphonamides in cases where bacterial resistance patterns favor their effectiveness As the demand for affordable and reliable UTI treatments continues to rise, sulphonamides are expected to retain a significant share of therapeutic prescriptions in this indication, reinforcing their market leadership.

Further, the surging use of advanced technologies like bioinformatics, high throughput, and combinatorial chemistry to identify a better drug candidate is also helping the market witness a progressive growth trajectory. The growing demand for emerging technologies that help the drug discovery process to provide more accuracy, and become refined and less time-consuming, is escalating market development. The rising demand for high-throughput screening, an extensively utilized drug discovery technology due to its automation, imaging hardware and software, and multi-detector readers, is propelling the market growth.

The market is predicted to be positively affected by the increasing focus of prominent players on the formulation of diagnostics tools to check urinary tract infections (UTIs). For instance, Sysmex Corporation announced in January 2025 that it had agreed to invest in Astrego Diagnostics AB. With this investment, Sysmex intends to commercialize a rapid drug test that the latter has been developing for UTIs.

Additionally, a substantial amount of different sulfonamide drug formulations are available at a reasonable price, and the pervasiveness of complicated UTIs are predicted to fuel the market growth over the forecast period. Moreover, the rising drug-resistant bacteria and exponential use of antibiotics are propelling several physicians to prescribe sulfonamides to cure UTI cases.

Sulfonamides are organic sulfur compounds that contain the radical SO2NH2 (the amide of sulfonic acid), which are also known as sulfa drugs or sulpha drugs. These are first anti-microbial drugs developed to treat bacterial infections in humans and animals.

Sulfonamides interfere in folic acid synthesis process in bacterial cell by competitive inhibition of dihydropteroate synthetase (DHPS) enzyme competing with para amino benzoic acid (PABA). Folic acid is a precursor of ribonucleic acid (RNA) and deoxyribonucleic acid (DNA) formation in bacterial cell.

Sulfonamides limits the growth of bacteria and thus sulfonamides act as bacteriostatic agents. A few sulfonamides are highly water-soluble such as sulfisoxazole (sulfafurazole) and sulfasomidine, which are rapidly excreted through the urinary tract (more than 90% in 24 hr) mostly in an unchanged drug form; due to this pharmacokinetic property these sulfonamides are primarily used to treat urinary tract infections (UTI's).

In addition, some of the sulfonamide derivatives, such as sulfaguanidine, are insoluble in nature thus they are not absorbed from the gastro intestinal (GI) tract (less than 5%), therefore, these sulphonamides are used for treatment of ulcerative colitis.

Bayer AG was the first company who started experimenting with Prontosil in 1932. Many people are allergic to sulfa drugs and thus sulfonamides are prescribed with caution. Sulfonamides have potential to cause fatal side effects including urinary tract disorders, haemopoietic disorders, hyper sensitivity reactions and porphyria.

Most serious side effects include toxic epidermal necrosis, hemolytic anemia, agranulocytosis, fulminant hepatic necrosis, thrombocytopenia and Stevens Johnson syndrome.

Increasing prevalence of chronic diseases worldwide and the substantial availability of various sulfonamide drug formulations at reasonable price to meet the ever-growing demand are the major factors contributing to the growth of the global sulfonamides market.

In addition, increasing R&D activities in pharmaceutical companies is resulting in novel and improved classes of sulfonamides with improved therapeutic activity is another major driver, fueling the global sulfonamides market growth over the forecast period.

However, increasing side effects associated with the use of sulfa drugs such as urinary tract disorders, kernicterus and hypersensitivity and increasing use of broad spectrum antibiotics with lesser side effects such as quinolones, macrolides are expected to restrain the growth of global sulfonamides market.

Geographically global sulfonamides market has been segmented into North America, Latin America, Europe, Asia-Pacific & Japan, Middle East Africa regions. North America region has been estimated as most dominant region in the global sulfonamides market owing to presence of harmonized regulatory structure, high rates of awareness regarding sulpha drugs and its therapeutic uses, and highly developed healthcare infrastructure.

Asia-Pacific & Japan is a lucrative market for global sulfonamides. Countries in the Asia Pacific regions include, greater China and India together account for largest population pool in the world and thereby have large pool of geriatric population in addition to rapidly increasing medical tourism industry and increasing healthcare spending are some of the factors that are expected to fuel the growth of sulfonamides market in the region.

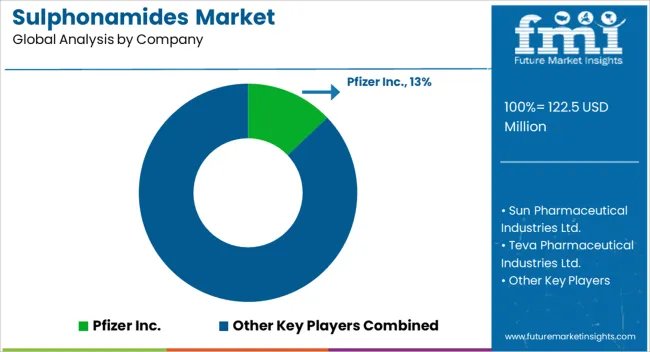

Some of the key companies contributing to global sulfonamides market are Abbott Laboratories, Boehringer Ingelheim Pharmaceuticals, Inc., Bayer AG, GlaxoSmithKline plc, King Pharmaceuticals, Inc., Mylan Pharmaceuticals, Novartis International AG, Pfizer, Inc., Par Pharmaceutical, Inc., Roche Holding AG, Sanofi Aventis, Stiefel Laboratories, Inc., and Teva Pharmaceuticals,.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology, material and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

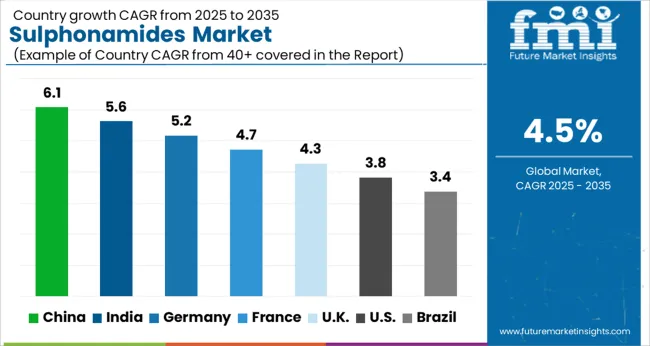

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The Sulphonamides Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UKcontinue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Sulphonamides Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Sulphonamides Market is estimated to be valued at USD 42.2 million in 2025 and is anticipated to reach a valuation of USD 61.4 million by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 6.3 million and USD 4.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 122.5 Million |

| Type of Administration | Oral, Orally Absorbable Sulfonamide, Short Acting (sulafadiazine, sulfacytine, sulfamethizole, sulfisoxazole), Intermediate Acting (sulfamethoxazole, sulfmoxole), Long Acting (sulfadoxine, sulfamethopyrazine), Orally Non Absorbable Sulfonamide (sulfasalzine, osalazine), and Topical Agents (Silver sulfadiazine, sulfacetamide, mafenide) |

| Type of Therapeutic Use | Urinary Tract Infection (UTI) Infection, Skin Infections, Gastro Intestinal Tract (GIT) Infection, Meningitis, Respiratory Tract Infection (RTI), Leprosy, Bowel Disinfections, Malaria, and Nocardiosis |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Pfizer Inc., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy’s Laboratories, GSK PLC, F. Hoffmann-La Roche Ltd., Amneal Pharmaceuticals LLC, Aurobindo Pharma, Cadila Pharmaceuticals Ltd., Glenmark Pharma Ltd., Bausch & Lomb Incorporated, Allergan, Lexine Technochem Pvt. Ltd., and Monarch Pharmaceuticals |

The global sulphonamides market is estimated to be valued at USD 122.5 million in 2025.

The market size for the sulphonamides market is projected to reach USD 190.2 million by 2035.

The sulphonamides market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in sulphonamides market are oral, orally absorbable sulfonamide, short acting (sulafadiazine, sulfacytine, sulfamethizole, sulfisoxazole), intermediate acting (sulfamethoxazole, sulfmoxole), long acting (sulfadoxine, sulfamethopyrazine), orally non absorbable sulfonamide (sulfasalzine, osalazine) and topical agents (silver sulfadiazine, sulfacetamide, mafenide).

In terms of type of therapeutic use, urinary tract infection (uti) infection segment to command 36.7% share in the sulphonamides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA