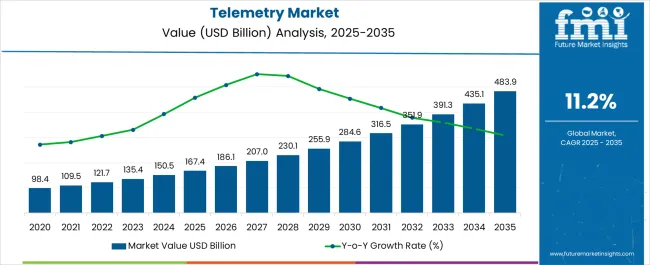

The Telemetry Market is estimated to be valued at USD 167.4 billion in 2025 and is projected to reach USD 483.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Telemetry Market Estimated Value in (2025 E) | USD 167.4 billion |

| Telemetry Market Forecast Value in (2035 F) | USD 483.9 billion |

| Forecast CAGR (2025 to 2035) | 11.2% |

The telemetry market is expanding steadily due to the rising adoption of remote monitoring solutions across industries such as automotive, aerospace, defense, and healthcare. Increasing reliance on real time data collection, transfer, and analysis is driving demand for advanced telemetry systems.

Growth is further supported by technological advancements in wireless communication, integration of IoT platforms, and miniaturization of sensors. Governments and enterprises are investing in telemetry solutions to enhance operational efficiency, safety, and predictive maintenance.

With industries moving toward connected infrastructure and smart technologies, the market outlook remains strong. Opportunities lie in innovations that improve data accuracy, energy efficiency, and system interoperability, ensuring that telemetry continues to be an essential component in high performance and safety critical applications.

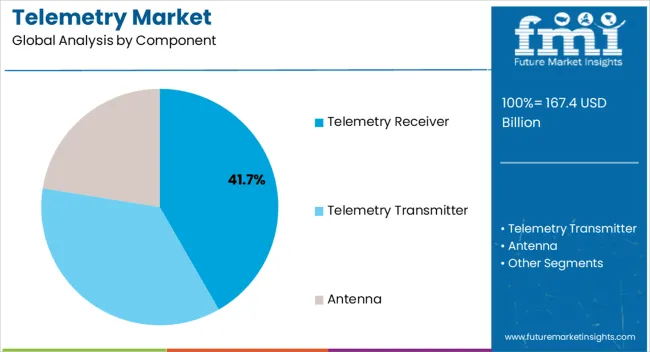

The telemetry receiver segment is expected to account for 41.70% of total revenue by 2025 within the component category, making it the leading segment. This is due to its critical role in accurately receiving and processing data signals from transmitters in real time.

High reliability and consistent performance in challenging environments have driven adoption across aerospace, automotive, and defense applications.

As systems become increasingly reliant on precise and uninterrupted communication, telemetry receivers remain indispensable, reinforcing their dominant market position.

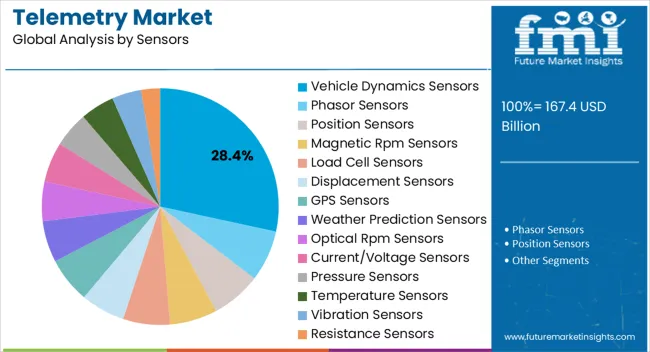

The vehicle dynamics sensors segment is estimated to capture 28.40% of the market revenue by 2025 within the sensors category. This growth is being driven by the automotive sector’s increasing reliance on advanced telemetry for monitoring parameters such as speed, braking, acceleration, and stability.

Rising demand for connected vehicles, electric mobility, and autonomous driving technologies has reinforced the need for precise vehicle dynamics monitoring.

The integration of these sensors supports enhanced safety features, improved performance, and compliance with stringent automotive safety regulations, solidifying their importance in the telemetry ecosystem.

Healthcare Industry Witnessing Growing Demand of Telemetry Devices

The increasing use of telemetry devices in the healthcare industry to monitor cardiac abnormalities is encouraging the growth of the telemetry market across the world. Further, the rising adoption of telemetry monitoring devices is due to the alarming rise in cardiovascular diseases (CVDs) around the globe. For example,

Every year, nearly 17 million individuals succumb to cardiovascular diseases, which is around 32% of overall deaths in the world. Telemetry monitoring devices are extremely useful for meeting patients who are susceptible to CVDs.

Telemetry monitoring finds a broad range of use in advanced and complex systems such as spacecraft, missiles, oil rigs, Remotely Piloted Vehicles (RPVs), and chemical plants. It enables and sends swift alerting, observation, and documents vitals for the effective and safe functioning of the systems. Further, to gather data from spacecraft and satellites, agencies like NASA, ISRO, etc., use telemetry solutions.

In the developing advanced levels of satellites and aircraft, telemetry devices portray a significant role. To enhance and analyze the system’s performance, engineers who construct these complex systems require crucial system parameters, which without telemetry services, is more often unobtainable.

| Category | By Component |

|---|---|

| Top Segment | Antenna |

| Market Share in Percentage | 48.6% |

| Category | By Sensors |

|---|---|

| Top Segment | Current or Voltage Sensors |

| Market Share in Percentage | 6.9% |

The rising use of the Internet of Things (IoT) enhances the battery life for the miniaturization of hardware systems and connected devices. Moreover, telemetry uses IoT devices like low bandwidth, remote sensors, reduced power, local IoT intelligent gateways, and low-code footprint. Additionally, the conjunction of the Internet of Things (IoT) and artificial intelligence will reshape the future of industrial automation.

Artificial Intelligence of Things affects several industries, such as automotive, aerospace and defense, supply chain, healthcare, and manufacturing.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 26.1% |

| Europe | 21.3% |

North America holds a 35.1% market share in the global telemetry market. Such dominance is owing to increased drug use in this region. Also, increased demand for the connected car, smart mobility, and smart energy metersin Canada and the United States is anticipated to experience significant growth in North America’s market. Moreover, this region has a high prevalence of cardiovascular disorders. For example,

Growing awareness amongs healthcare providers and patients about telemetry devices, as a result, is anticipated to assist in decreasing death because of heart attacks by rendering real-time monitoring. Consequently, this assists in boosting the growth of the telemetry market in this region.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| The United States | 18.4% |

| Germany | 9.3% |

| Japan | 4.8% |

| Australia | 3.5% |

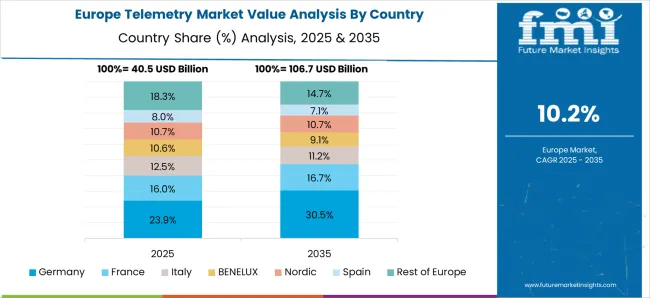

Europe is accountable for 23.2% market share in the global market owing to the constantly increasing demand for healthcare services in this region. Also, it has been predicted that Asia Pacific is estimated expand at a significant CAGR over the estimated timeframe.

Europe region has many wastewater treatment systems, increasing government funding for reservoir monitoring systems, and development of wireless telemetry in developing countries such as Japan, India, China, and others. These factors are likely to boost the growth of Asia Pacific’s telemetry market in the future. Moreover, the growth is also due to the big oil and gas industry and the developing automotive industry in the region.

| Regional Market | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 10.5% |

| China | 9.8% |

| India | 13.4% |

In May 2024, New Relic, Inc. announced a series of novel product inventions and community initiatives to assist engineers in making observability a data-driven approach. It is going help them plan, build, deploy and run the software.

The company launched its new Kubernetes experience, powered by Auto-Telemetry with Pixie, which incorporates New Relic One to render instant Kubernetes observability without requring users to update any sample data or code.

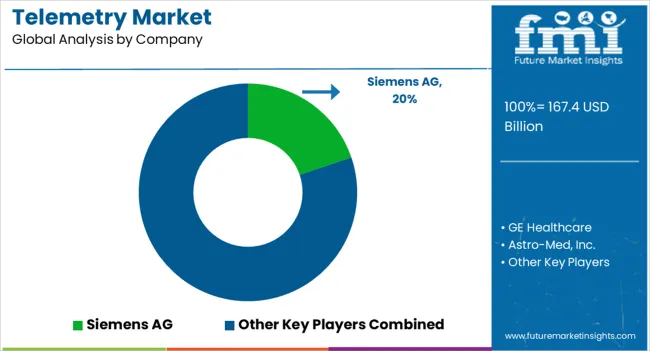

Some of the key players in the telemetry market are Siemens AG, GE Healthcare, Astro-Med, Inc., Rogers Communications, Inc., BayerischeMotorenWerke AG (BMW), Philips Healthcare, Lindsay Corporation, Schneider Electric, Verizon Communications, Inc., Kongsberg Gruppen, Honeywell International Inc., BioTelemetry, Inc., Schlumberger Ltd., L-3 Communications Holdings Inc., Sierra Wireless, Inc., Cobham Plc., IBM Corp, and Finmeccanica SPA.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 11.2% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million or USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Component, Technology, Sensor, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, Asia Pacific, GCC, South Africa |

| Key Companies Profiled | Siemens AG; GE Healthcare; Astro-Med, Inc.; Rogers Communications, Inc.; BayerischeMotorenWerke AG (BMW); Philips Healthcare; Lindsay Corporation; Schneider Electric; Honeywell International Inc; BioTelemetry, Inc.; Schlumberger Ltd.; L-3 Communications Holdings Inc.; Sierra Wireless, Inc.; Cobham Plc.; IBM Corp.; Finmeccanica SPA. |

| Customization & Pricing |

Available Upon Request |

The global telemetry market is estimated to be valued at USD 167.4 billion in 2025.

The market size for the telemetry market is projected to reach USD 483.9 billion by 2035.

The telemetry market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in telemetry market are telemetry receiver, telemetry transmitter and antenna.

In terms of technology, wire-link telemetry segment to command 36.9% share in the telemetry market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA