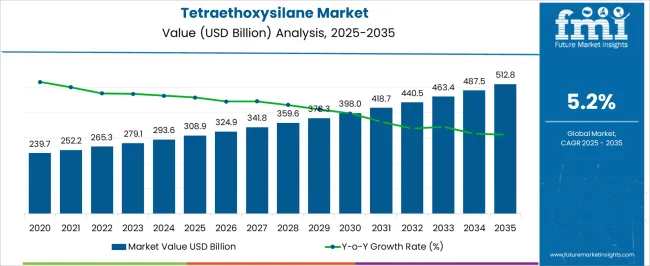

The tetraethoxysilane market is estimated to be valued at USD 308.9 billion in 2025 and is projected to reach USD 512.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. The tetraethoxysilane market is projected to generate an absolute gain of USD 203.9 billion and a growth multiplier of 1.66x over the decade. This growth is supported by a steady CAGR of 5.2%, driven by increasing demand for tetraethoxysilane in industries such as electronics, automotive, and construction.

During the first five years (2025–2030), the market will expand from USD 308.9 billion to USD 398.0 billion, adding USD 89.1 billion, which accounts for 43.7% of the total incremental growth. The demand for tetraethoxysilane in silicon-based coatings, sealants, and adhesives for electronics and solar panels will drive this growth. The second phase (2030–2035) contributes USD 114.8 billion, representing 56.3% of the total growth, reflecting stronger momentum as the demand for Tetraethoxysilane grows in high-tech applications like semiconductor manufacturing and renewable energy systems.

Annual increments rise from USD 9.7 billion in early years to USD 11.1 billion by 2035, signaling accelerated growth driven by technological advancements, infrastructure expansion, and the increasing use of silica-based materials in high-performance applications. Manufacturers focusing on optimizing production and exploring new applications will capture the largest share of this USD 203.9 billion opportunity.

| Metric | Value |

|---|---|

| Tetraethoxysilane Market Estimated Value in (2025 E) | USD 308.9 billion |

| Tetraethoxysilane Market Forecast Value in (2035 F) | USD 512.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The tetraethoxysilane market is showing consistent growth driven by its increasing use in advanced material development, surface treatment applications, and silica-based coatings. Growing demand for high-performance and durable coatings in automotive, electronics, and construction sectors is elevating the importance of tetraethoxysilane as a key precursor for silica and silicate materials.

Advancements in sol-gel technologies and a greater focus on nanostructured coatings have further enhanced its application scope. The compound’s role in enhancing adhesion, chemical resistance, and thermal stability is making it increasingly relevant in functional coatings and composites.

Regulatory compliance related to surface protection and environmental durability is also contributing to adoption. As innovation accelerates across multiple industries seeking customized solutions with superior surface properties, the market outlook remains optimistic with expanding end-use applications and material enhancements.

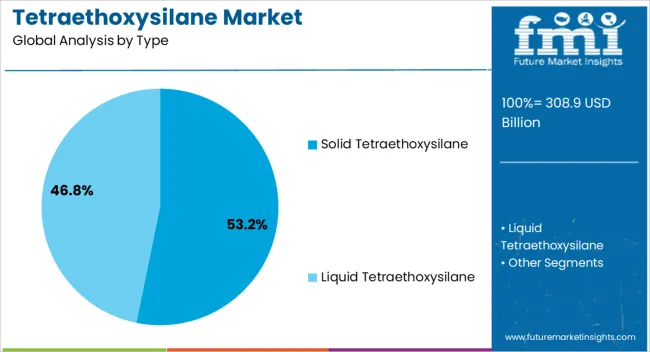

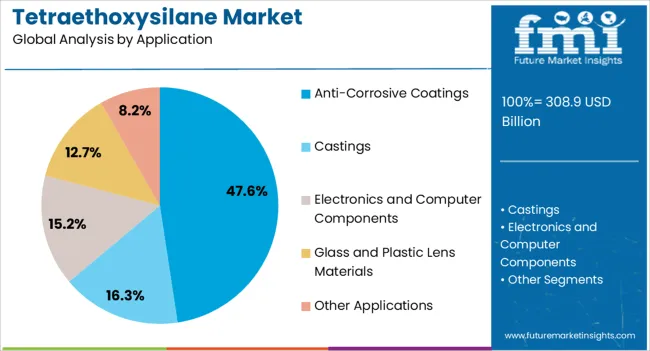

The tetraethoxysilane market is segmented by type, application, distribution channel, and geographic regions. By type, the tetraethoxysilane market is divided into Solid Tetraethoxysilane and Liquid Tetraethoxysilane. In terms of application, the tetraethoxysilane market is classified into Anti-Corrosive Coatings, Castings, Electronics and Computer Components, Glass and Plastic Lens Materials, and Other Applications.

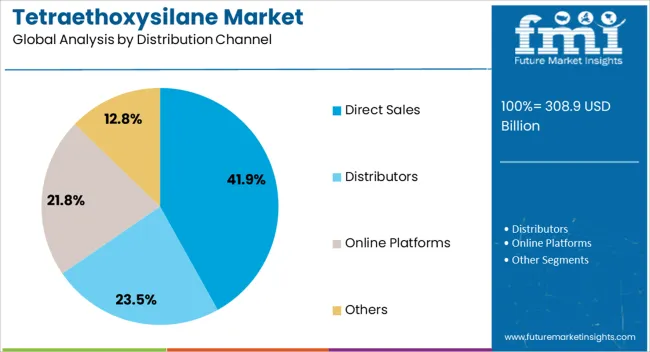

Based on distribution channel, the tetraethoxysilane market is segmented into Direct Sales, Distributors, Online Platforms, and Others. Regionally, the tetraethoxysilane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid tetraethoxysilane segment is expected to account for 53.20% of total revenue by 2025, making it the leading type in the market. This dominance is driven by its high purity, ease of handling, and suitability for precision applications in ceramics, semiconductors, and advanced coatings.

The solid form provides better stability and is preferred in processes where controlled hydrolysis and precise deposition are required. Its utility in sol-gel production, nanomaterial synthesis, and silicon dioxide film formation has led to wide-scale adoption in technologically advanced manufacturing environments.

As demand increases for functionalized surfaces and protective films, the role of solid tetraethoxysilane continues to grow, reinforcing its leadership within the type segment.

The anti corrosive coatings segment is projected to hold 47.60% of total market revenue by 2025, establishing it as the most significant application area. This is due to the increasing need for protective coatings in infrastructure, marine, and industrial equipment, where exposure to moisture, chemicals, and extreme temperatures is common.

Tetraethoxysilane enhances the protective properties of coatings by forming dense silica networks that act as barriers against corrosive agents. Its effectiveness in improving adhesion, durability, and environmental resistance makes it a preferred choice among formulators of high performance coatings.

The surge in refurbishment and asset protection projects across heavy industries is further supporting demand for such advanced coating solutions, ensuring continued growth in this application segment.

The direct sales segment is expected to represent 41.90% of total revenue by 2025 within the distribution channel category. This preference is driven by the need for customized supply agreements, technical support, and consistent product availability, especially for industrial-scale buyers.

Direct engagement with manufacturers allows end users to receive tailored material specifications, pricing advantages, and dependable logistics support. Large volume purchasers such as coating formulators and electronics manufacturers often require close collaboration on product development and process integration, which is best facilitated through direct channels.

As companies seek to streamline procurement and enhance supplier reliability, direct sales remain the dominant distribution strategy within the tetraethoxysilane market.

The tetraethoxysilane market is driven by rising demand in electronics, coatings, and construction, with opportunities in the expanding semiconductor and electronics sectors. Emerging trends in bio-based silanes are reshaping the market, while high production costs and raw material availability remain significant challenges. By 2025, addressing these obstacles with cost-effective production methods, sustainable sourcing, and efficient supply chain management will be crucial for supporting the growth and adoption of tetraethoxysilane across multiple industries.

The tetraethoxysilane market is experiencing significant growth due to increasing demand for silane-based compounds in industries such as coatings, construction, and electronics. Tetraethoxysilane, a crucial precursor in the production of silicon dioxide, plays an essential role in surface treatments, adhesives, and insulation products. The compound’s versatility and performance benefits make it ideal for use in a variety of high-performance applications, especially in industries focusing on enhancing product durability and functionality. By 2025, the demand for tetraethoxysilane is expected to continue increasing, especially with expanding applications in electronics, automotive, and construction sectors.

Opportunities in the tetraethoxysilane market are expanding significantly due to growth in the electronics and semiconductor markets. Tetraethoxysilane is used in the production of semiconductor devices and integrated circuits, which are integral to modern electronics. As the demand for smaller, more efficient electronic components increases, the requirement for high-quality silicon-based materials also grows. Tetraethoxysilane provides the necessary properties for producing thin-film materials in semiconductors, ensuring improved device performance and reliability. By 2025, continued advancements in the semiconductor industry, particularly in Asia-Pacific regions, will further fuel demand for tetraethoxysilane and similar silicon-based products.

Emerging trends in the tetraethoxysilane market include the increasing demand for bio-based silanes and environmentally friendly chemical alternatives. As industries seek to reduce their environmental impact, bio-based silanes derived from renewable resources are gaining traction. These sustainable alternatives are becoming a preferred choice in various applications, including coatings, adhesives, and construction, due to their reduced environmental footprint. By 2025, the trend towards green chemistry solutions will become more prominent, with businesses increasingly adopting bio-based tetraethoxysilane to meet regulatory standards and consumer preferences for eco-friendly products.

Despite growth, the tetraethoxysilane market faces challenges such as high production costs and fluctuations in raw material availability. The production of tetraethoxysilane requires specialized equipment and costly raw materials, which significantly impacts manufacturing expenses. Furthermore, supply chain disruptions and fluctuations in the cost of key raw materials such as ethyl silicate can affect the stability of production schedules and pricing. By 2025, overcoming these challenges through more efficient manufacturing processes, resource optimization, and securing stable raw material sources will be critical for ensuring continued market expansion and competitiveness.

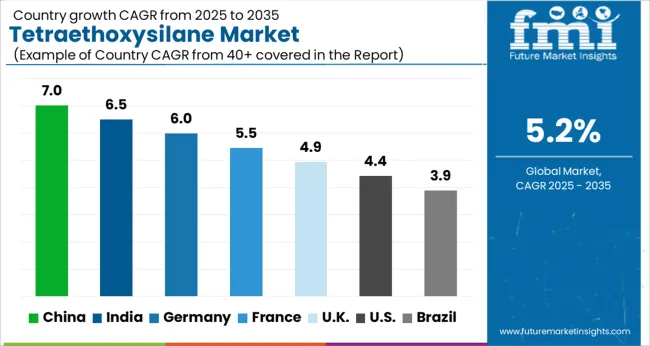

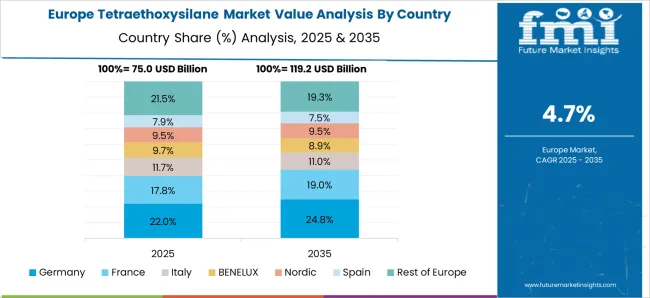

The global tetraethoxysilane market is projected to grow at a 5.2% CAGR from 2025 to 2035. China leads with a growth rate of 7%, followed by India at 6.5%, and France at 5.5%. The United Kingdom records a growth rate of 4.9%, while the United States shows the slowest growth at 4.4%. These varying growth rates are driven by factors such as increasing demand for tetraethoxysilane in applications like coatings, sealants, and adhesives, as well as its growing importance in the electronics and construction industries. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, expanding infrastructure, and increasing demand for high-performance materials. Meanwhile, more mature markets like the USA and the UK see steady growth, driven by technological innovations and rising demand for sustainable and efficient materials in various industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The tetraethoxysilane market in China is growing rapidly, with a projected CAGR of 7%. China’s expanding industrial sectors, particularly in electronics, automotive, and construction, are driving the demand for high-performance materials like tetraethoxysilane. The country’s growing focus on infrastructure development, manufacturing, and the increasing adoption of advanced materials in coatings and sealants is further contributing to market growth. Additionally, China’s investments in the electronics and semiconductor industries, coupled with the rising demand for energy-efficient and sustainable solutions, are fueling the market’s expansion. Government initiatives promoting industrial growth, combined with a strong manufacturing base, continue to drive the demand for tetraethoxysilane in various applications.

The tetraethoxysilane market in India is projected to grow at a CAGR of 6.5%. India’s rapidly expanding industrial and manufacturing sectors, along with increasing demand for high-performance materials in coatings, adhesives, and sealants, are key drivers for the market. The country’s growing infrastructure development, urbanization, and rising demand for electronics and automotive products further accelerate the demand for tetraethoxysilane. Additionally, India’s focus on sustainability and eco-friendly solutions is promoting the use of tetraethoxysilane in green building materials and energy-efficient products. The government’s focus on infrastructure growth, coupled with rising investments in industrial production, contributes to the market’s growth.

The tetraethoxysilane market in France is projected to grow at a CAGR of 5.5%. France’s demand for tetraethoxysilane is driven by the growing need for advanced materials in the automotive, electronics, and construction sectors. The country’s emphasis on sustainability, energy-efficient solutions, and the shift toward eco-friendly materials further accelerates the adoption of tetraethoxysilane. France’s regulatory environment promoting innovation and environmentally friendly production processes contributes to steady growth. Additionally, the rise in research and development efforts in electronics and coatings industries fuels the demand for high-performance materials like tetraethoxysilane, supporting market expansion.

The tetraethoxysilane market in the United Kingdom is projected to grow at a CAGR of 4.9%. The UK market is driven by increasing demand for advanced materials in coatings, adhesives, and sealants, along with the growing focus on sustainable construction practices and energy-efficient materials. The country’s established manufacturing sector and strong regulatory frameworks supporting innovation in high-performance materials contribute to steady market growth. Additionally, the UK’s push for green technologies and eco-friendly solutions in building and industrial applications further accelerates the adoption of tetraethoxysilane, particularly in energy-efficient products and green building materials.

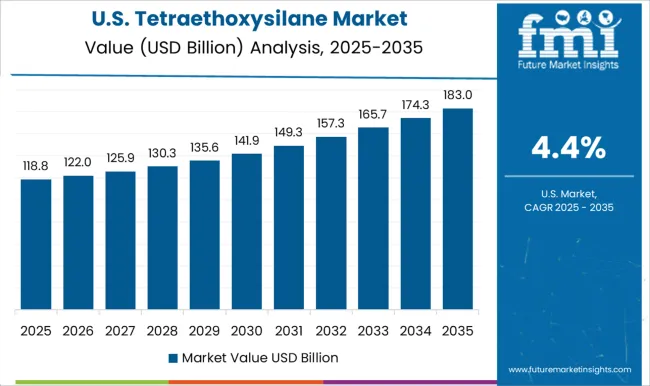

The tetraethoxysilane market in the United States is expected to grow at a CAGR of 4.4%. The USA market remains steady, driven by the increasing demand for high-performance materials in electronics, automotive, and construction sectors. The rise in consumer demand for energy-efficient products, coupled with the USA focus on sustainability and green technologies, is contributing to steady market growth. Advancements in manufacturing technologies and innovations in the use of tetraethoxysilane in coatings, sealants, and adhesives further support the market’s expansion. Additionally, the USA regulatory landscape, which emphasizes safety and performance standards, continues to drive the adoption of tetraethoxysilane in various industrial applications.

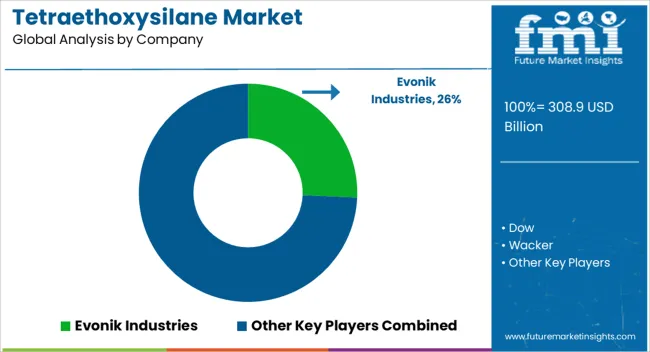

The tetraethoxysilane (TEOS) market is dominated by Evonik Industries, which leads with its high-quality TEOS solutions used in the production of silica, coatings, and semiconductor materials. Evonik’s dominance is supported by its strong R&D capabilities, innovative formulations, and robust global presence in various industries, including electronics, construction, and automotive. Key players such as Dow, Wacker, and Momentive maintain significant market shares by providing TEOS that offers exceptional performance in applications such as silicone production, surface treatment, and in the creation of high-purity coatings. These companies focus on enhancing the efficiency, durability, and functionality of their TEOS products, catering to industries that require advanced chemical solutions.

Emerging players like PCC Group (SiSiB Silicones), Shin-Etsu Chemical, and Jiangsu Chenguang Silane are expanding their market presence by offering specialized TEOS products designed for niche applications, such as organic silicon intermediates, polymer coatings, and semiconductor fabrication. Their strategies include enhancing product quality, increasing production efficiency, and offering customized solutions for specific industrial needs. Market growth is driven by the increasing demand for high-performance materials in electronics, construction, and automotive industries, coupled with the rising need for silica-based products in various end-use applications. Innovations in TEOS formulations, sustainability efforts, and advancements in silane technology are expected to continue shaping competitive dynamics and fuel further growth in the global tetraethoxysilane market.

| Item | Value |

|---|---|

| Quantitative Units | USD 308.9 Billion |

| Type | Solid Tetraethoxysilane and Liquid Tetraethoxysilane |

| Application | Anti-Corrosive Coatings, Castings, Electronics and Computer Components, Glass and Plastic Lens Materials, and Other Applications |

| Distribution Channel | Direct Sales, Distributors, Online Platforms, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Evonik Industries, Dow, Wacker, Momentive, PCC Group (SiSiB Silicones), Shin-Etsu Chemical, Jiangsu Chenguang Silane, PJSC Khimprom, Gelest, KMG Chemicals, Gelest Inc., ABCR GmbH, and Alfa Aesar |

| Additional Attributes | Dollar sales by application type and sector, demand dynamics across electronics, coatings, and construction industries, regional trends in tetraethoxysilane adoption, innovation in silicon-based materials and surface treatments, impact of regulatory standards on environmental safety and product quality, and emerging use cases in semiconductor manufacturing and advanced coatings. |

The global tetraethoxysilane market is estimated to be valued at USD 308.9 billion in 2025.

The market size for the tetraethoxysilane market is projected to reach USD 512.8 billion by 2035.

The tetraethoxysilane market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in tetraethoxysilane market are solid tetraethoxysilane and liquid tetraethoxysilane.

In terms of application, anti-corrosive coatings segment to command 47.6% share in the tetraethoxysilane market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA