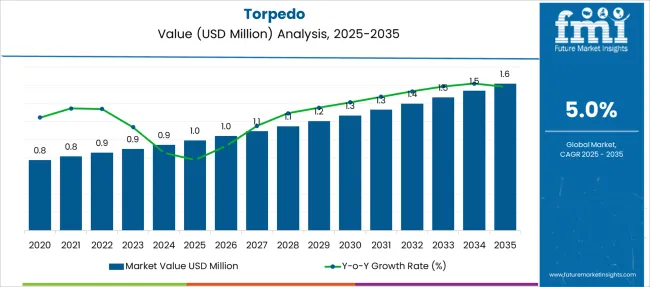

The Torpedo Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Torpedo Market Estimated Value in (2025 E) | USD 1.0 billion |

| Torpedo Market Forecast Value in (2035 F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The torpedo market is undergoing a significant transformation, fueled by evolving naval warfare strategies and growing investments in undersea defense technologies. Modernization programs by maritime forces are actively supporting the replacement of legacy munitions with advanced, software-programmable torpedoes that offer greater range, precision, and autonomy.

The increasing importance of littoral and deep-sea threat detection has reinforced the need for diverse torpedo types capable of adapting to both defensive and offensive missions. Rising geopolitical tensions and increased undersea activities have accelerated procurement across multiple nations, particularly within the Asia-Pacific and NATO-aligned countries.

Strategic focus has been placed on improving stealth, propulsion efficiency, and target acquisition capabilities, aligning torpedo development with evolving submarine and surface fleet operations. As the global emphasis on naval deterrence strengthens, the torpedo market is expected to experience continued demand growth across all major defense procurement channels, supported by collaborative R&D initiatives and strategic defense alliances aimed at underwater dominance..

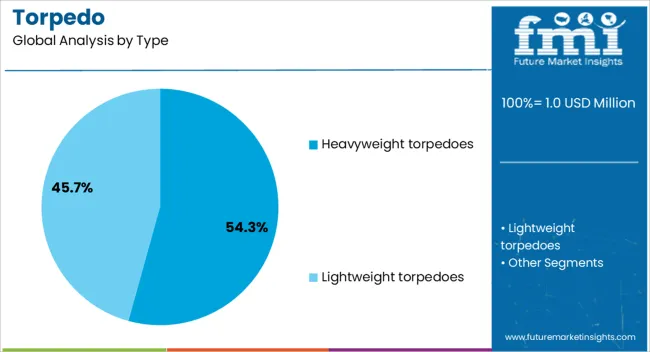

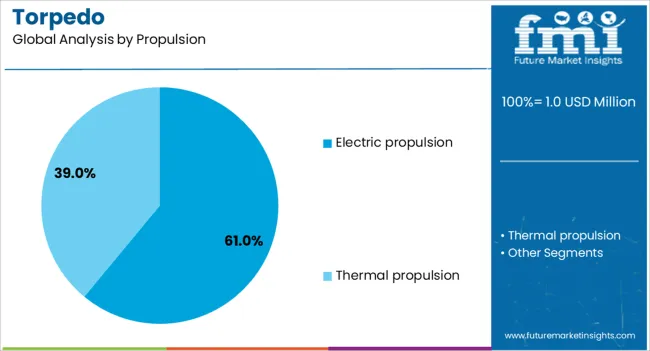

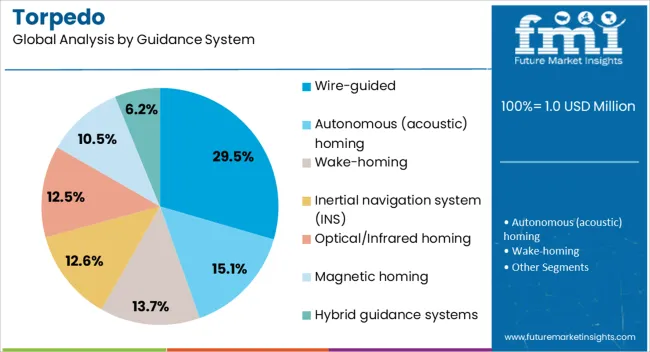

The market is segmented by Type, Propulsion, Guidance System, Launch Platform, Applications, and region. By Type, the market is divided into Heavyweight torpedoes and Lightweight torpedoes. In terms of Propulsion, the market is classified into Electric propulsion and Thermal propulsion. Based on the Guidance System, the market is segmented into Wire-guided, Autonomous (acoustic) homing, Wake-homing, Inertial navigation system (INS), Optical/Infrared homing, Magnetic homing, and Hybrid guidance systems.

By Launch Platform, the market is divided into Submarines, Attack submarines, Ballistic missile submarines, Surface ships, Aircraft, Maritime patrol aircraft, Helicopters, Unmanned underwater vehicles (UUVs), Autonomous UUVs, and Remotely operated UUVs. By Applications, the market is segmented into Anti-submarine warfare, Submarine warfare, Anti-surface warfare, Stealth operations, Tactical scenarios, and Versatile engagements. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The heavyweight torpedoes type segment is projected to hold 54.30% of the torpedo market revenue share in 2025, making it the most dominant among all torpedo types. The growth of this segment has been supported by the increasing use of heavyweight torpedoes in both submarine and anti-submarine warfare, where deep-sea engagement, high payload capacity, and extended range are operational necessities.

These torpedoes have been favored for their ability to engage large and fast-moving naval assets, including aircraft carriers and nuclear submarines, with advanced guidance and propulsion capabilities. Their deployment has also been aligned with the strategic needs of modern navies that require torpedoes capable of being launched from multiple platforms, both submerged and surface-based.

The increasing complexity of naval battle scenarios and the requirement for precise target neutralization have positioned heavyweight torpedoes as critical assets in modern naval arsenals. Enhanced warhead technologies, deep-sea maneuverability, and programmability have all contributed to this segment's sustained leadership in the global market..

The electric propulsion segment is expected to capture 61.00% of the torpedo market revenue share in 2025, establishing it as the leading propulsion type. This segment's expansion has been driven by the increasing demand for quieter, energy-efficient, and stealth-capable torpedoes that are less susceptible to acoustic detection in contested underwater environments.

Electric propulsion has been widely adopted due to its reduced thermal and acoustic signature, making it highly effective in covert operations and modern anti-submarine warfare scenarios. Its ability to deliver consistent thrust over long durations while minimizing operational noise has enhanced tactical advantages for submarines and naval surface fleets.

Additionally, advances in battery technology and onboard power systems have significantly improved range and endurance, making electric propulsion a more reliable and mission-adaptive alternative to traditional propulsion systems. As naval forces prioritize silent maneuvering and extended engagement capability, the reliance on electric propulsion systems is expected to solidify further, reinforcing the segment's leadership in the torpedo propulsion market..

The wire-guided guidance system segment is anticipated to hold 29.50% of the torpedo market revenue share in 2025, securing a prominent position among available guidance technologies. This segment has been propelled by the growing need for real-time communication and control between the launching platform and the torpedo during its trajectory. Wire-guided systems have enabled enhanced targeting accuracy, in-flight reprogramming, and obstacle avoidance, which are particularly critical in complex underwater environments.

Their reliability in scenarios requiring precise maneuvering around natural and artificial obstacles has made them essential in both offensive and defensive naval missions. The segment has also benefited from advancements in fiber-optic technology, which allow for faster data transmission and reduced signal interference.

These improvements have further enhanced the operational effectiveness of wire-guided torpedoes, making them a preferred choice for navies seeking control-intensive engagement strategies. The continuous need for responsive guidance under dynamic combat conditions is expected to uphold the demand for this technology across global naval inventories..

Rising naval modernization, undersea warfare threats, and demand for advanced anti-submarine capabilities drive torpedo market growth. Opportunities exist in autonomous torpedo systems, miniaturization, and strategic naval exports to allied nations.

The torpedo market is primarily driven by rising investments in naval defense and modernization programs across major maritime nations. As undersea threats grow due to expanding submarine fleets and territorial disputes, navies are prioritizing anti-submarine warfare (ASW) capabilities. Torpedoes—both lightweight and heavyweight—remain essential assets for surface ships, submarines, and maritime aircraft. Technological enhancements, such as improved guidance systems, wake-homing capabilities, and increased target discrimination, are increasing their operational value. Nations in Asia-Pacific, Europe, and the Middle East are rapidly upgrading their underwater weapons inventory to counter asymmetric maritime threats. Additionally, the dual use of torpedoes in offensive and defensive naval strategies ensures sustained procurement, particularly by nations with growing submarine fleets and blue-water naval ambitions.

Opportunities in the torpedo market are emerging through advancements in autonomous targeting, AI-based guidance, and networked warfare integration. Development of “smart” torpedoes capable of real-time threat assessment and adaptive mission execution is gaining traction. Export opportunities are increasing as Western nations collaborate with allies under strategic defense pacts, offering lightweight torpedoes and modular launch systems suited for smaller fleets. Growing interest in unmanned underwater vehicles (UUVs) is also fostering demand for miniaturized torpedoes optimized for compact platforms. Furthermore, retrofitting older torpedo models with modern propulsion and seeker technologies creates a cost-effective upgrade path. Defense firms focusing on scalable, interoperable designs that suit both legacy and modern naval systems are well-positioned to capture emerging market segments.

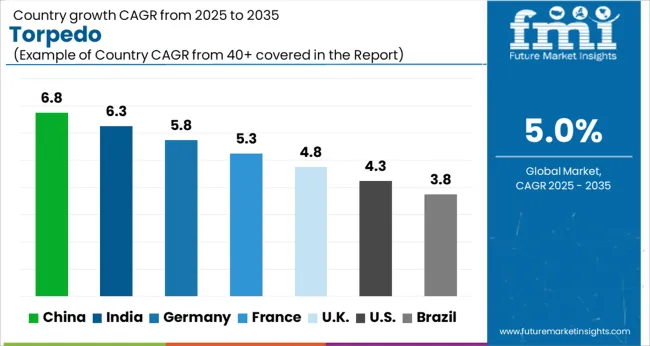

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global torpedo market is expected to grow at a CAGR of 5.0% from 2025 to 2035, driven by expanding naval modernization programs, undersea threat deterrence strategies, and investment in next-generation underwater weaponry. China leads with a 6.8% CAGR, supported by aggressive naval fleet expansion, indigenous torpedo development, and deep-sea warfare capabilities. India follows at 6.3%, reflecting increased defense procurement, domestic R&D under the Make in India initiative, and blue water navy ambitions. Germany, growing at 5.8%, focuses on integrating advanced guidance systems and dual-mode propulsion in torpedoes. The United Kingdom (4.8%) and the United States (4.3%) reflect mature defense markets with emphasis on system upgrades, autonomous delivery platforms, and interoperability within NATO frameworks.

Between 2025 and 2035, the torpedo market across China is expected to grow at a CAGR of 6.8%, with annual growth ranging from 6.4% to 7.2%. Rising geopolitical tensions in the Indo-Pacific and aggressive naval expansion are accelerating demand for advanced torpedo systems. Defense research programs are developing next-generation torpedoes featuring improved acoustic stealth, extended range, and AI-based homing capabilities. These technologies are being integrated into both conventional and nuclear-powered submarines. Strategic investments in domestic defense industries are also fueling production scalability, reducing dependency on foreign suppliers. With an emphasis on underwater supremacy, torpedo technology is increasingly linked to broader military modernization initiatives.

The torpedo market in India is projected to grow at a CAGR of 6.3% from 2025 to 2035, with annual growth expected between 5.9% and 6.7%. Modernization of naval assets and increased maritime security initiatives in the Indian Ocean are key market drivers. Lightweight and heavyweight torpedoes are being deployed across newly commissioned submarines and warships. Joint ventures between state-run and private defense firms are boosting indigenous capabilities, aligning with the nation's strategic focus on self-reliance. These developments are supported by sea trials and operational testing tailored for tropical and littoral environments, where complex acoustic conditions demand specialized solutions.

Germany’s torpedo market is forecast to grow at a CAGR of 5.8% between 2025 and 2035, with year-over-year growth rates between 5.4% and 6.1%. Investments in underwater defense, particularly within NATO joint operations, are encouraging the adoption of next-gen torpedo technologies. The focus is on developing modular systems that support quiet propulsion and real-time communication. German defense firms are aligning products with European interoperability standards, enabling seamless deployment across allied navies. Ongoing R&D in sensor fusion and guidance optimization is expected to raise performance levels in complex undersea terrain.

From 2025 to 2035, the torpedo market in the United Kingdom is expected to expand at a CAGR of 4.8%, with annual growth rates between 4.4% and 5.1%. The Royal Navy’s modernization efforts are focusing on enhancing underwater combat readiness through high-performance torpedoes. Emphasis is being placed on dual-mode guidance, advanced propulsion, and networked command integration. UK defense laboratories are trialing AI-enhanced threat detection and precision targeting systems. At the same time, export-oriented manufacturing is gaining traction, especially for lightweight torpedo systems suited for allied naval forces in Europe and Asia-Pacific.

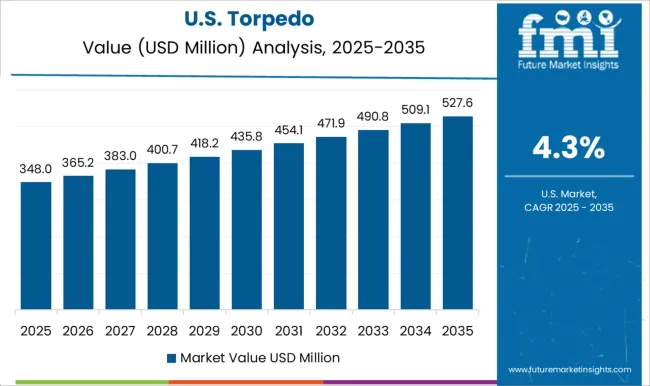

The torpedo market in the United States is forecast to grow at a CAGR of 4.3% through 2035, with yearly growth ranging from 4.0% to 4.6%. Continued focus on maintaining undersea warfare dominance is driving upgrades in torpedo range, speed, and smart control. USA naval programs are integrating next-gen torpedoes into attack submarines, surface vessels, and unmanned underwater vehicles (UUVs). AI-assisted navigation and network-centric warfare compatibility are defining future capabilities. Leading defense contractors are expanding R&D into ultra-fast propulsion systems and dynamic targeting algorithms designed to neutralize enemy submarines in contested waters.

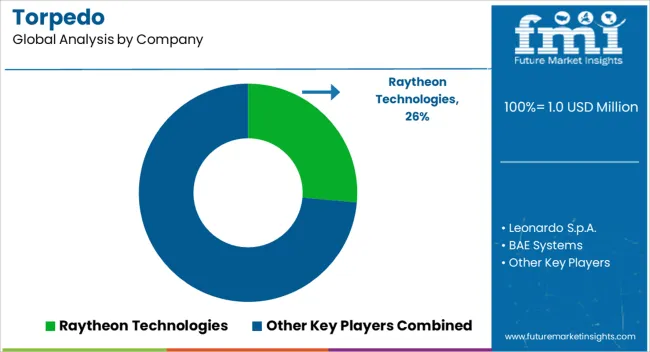

The torpedo market is moderately consolidated, dominated by a few defense giants with advanced underwater warfare capabilities. Tier 1 players such as Raytheon Technologies, BAE Systems, and Lockheed Martin lead the market with sophisticated torpedo systems like lightweight and heavyweight variants integrated with sonar guidance, propulsion control, and advanced targeting. These firms benefit from deep government contracts, naval modernization programs, and long-term R&D investments. Tier 2 companies including Leonardo S.p.A., Saab AB, and Thales Group offer regionally competitive solutions with strong export presence and tailored platforms for submarines, surface vessels, and aircraft. Tier 3 firms like LIG Nex1 and Atlas Elektronik serve niche markets with specialized offerings and focus on modularity and cost-efficiency. Market growth is driven by rising maritime security concerns, submarine fleet upgrades, and demand for multi-platform interoperability.

On April 8, 2025, Anduril unveiled the Copperhead-M, a torpedo-like autonomous underwater vehicle launched from Dive-XL UUVs, enabling scalable undersea strike capability, as mentioned in Breaking Defense.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Type | Heavyweight torpedoes and Lightweight torpedoes |

| Propulsion | Electric propulsion and Thermal propulsion |

| Guidance System | Wire-guided, Autonomous (acoustic) homing, Wake-homing, Inertial navigation system (INS), Optical/Infrared homing, Magnetic homing, and Hybrid guidance systems |

| Launch Platform | Submarines, Attack submarines, Ballistic missile submarines, Surface ships, Aircraft, Maritime patrol aircraft, Helicopters, Unmanned underwater vehicles (UUVs), Autonomous UUVs, and Remotely operated UUVs |

| Applications | Anti-submarine warfare, Submarine warfare, Anti-surface warfare, Stealth operations, Tactical scenarios, and Versatile engagements |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies, Leonardo S.p.A., BAE Systems, Saab AB, Lockheed Martin Corporation, Atlas Elektronik, LIG Nex1, and Thales Group |

| Additional Attributes | Dollar sales by torpedo type (heavyweight, lightweight, autonomous), end-user (naval forces, defense contractors), and launch platform (submarine, surface ship, aircraft); regional procurement trends and modernization programs; lifecycle cost dynamics including maintenance and upgrades; advancements in propulsion and guidance systems; impact of undersea warfare doctrines on demand; and emerging technologies such as AI-enabled targeting and stealth coatings. |

The global torpedo market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the torpedo market is projected to reach USD 1.6 billion by 2035.

The torpedo market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in torpedo market are heavyweight torpedoes and lightweight torpedoes.

In terms of propulsion, electric propulsion segment to command 61.0% share in the torpedo market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA