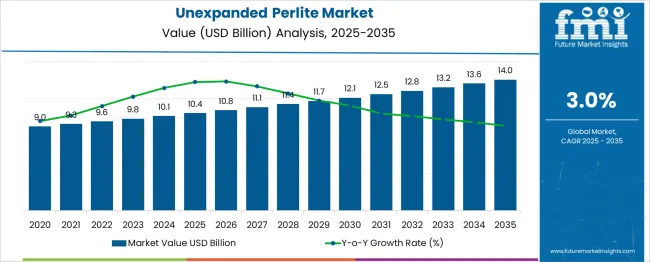

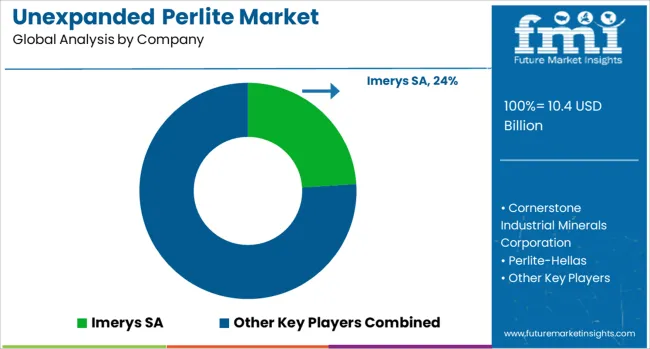

The Unexpanded Perlite Market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 14.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period. This growth trajectory suggests a maturing market with consistent but incremental adoption, largely driven by its application in construction, horticulture, filtration, and insulation.

From 2025 to around 2029, the market reflects characteristics of late early adoption, where demand is supported by a mix of cost-effectiveness, inert chemical properties, and growing interest in sustainable construction and agriculture practices. During this stage, awareness and trust in the material are solidifying, but adoption is still segmented by region and end-use. Entering the 2030–2035 window, the market enters the late majority phase, marked by broader acceptance across mid-tier markets and expansion into new geographic regions, especially in Asia-Pacific and Latin America. However, the absence of disruptive innovations or dramatic regulatory shifts suggests the market is unlikely to achieve exponential growth. Unexpanded perlite’s adoption curve is steady but linear, underpinned by functional performance and environmental advantages, but constrained by its commodity nature and limited technological evolution, signaling a market approaching full maturity.

| Metric | Value |

|---|---|

| Unexpanded Perlite Market Estimated Value in (2025 E) | USD 10.4 billion |

| Unexpanded Perlite Market Forecast Value in (2035 F) | USD 14.0 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The unexpanded perlite market is gaining traction due to its increased use in metallurgical, construction, and horticultural industries as a lightweight, non-toxic, and thermally stable material. The expansion of steel production, especially in emerging markets, has significantly contributed to demand for perlite in its raw form, particularly in slag removal and thermal insulation processes.

Regulatory emphasis on environmentally safe and recyclable additives in high-temperature operations has also increased the relevance of perlite. Advances in mining technologies and distribution networks have helped streamline perlite availability across regional markets.

Moreover, domestic manufacturing initiatives and rising demand for low-density, non-reactive materials in foundries and casting processes are expected to maintain the upward trajectory of the market. Looking forward, the unexpanded perlite segment is likely to benefit from its compatibility with green manufacturing practices and its substitution potential for synthetic insulators.

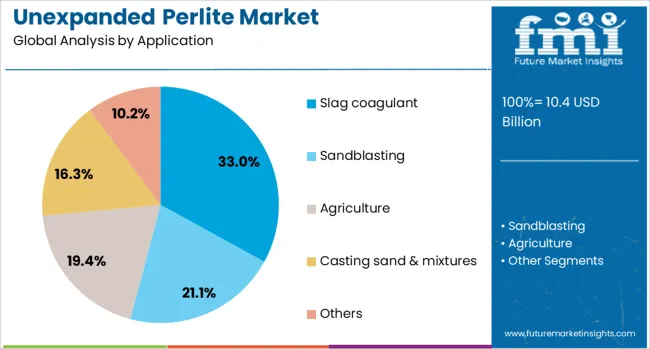

The unexpanded perlite market is segmented by application and geographic regions. The unexpanded perlite market is divided into Slag coagulant, Sandblasting, Agriculture, Casting sand & mixtures, and Others. Regionally, the unexpanded perlite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Slag coagulant is projected to account for 33.00% of the unexpanded perlite market revenue in 2025, making it the leading application segment. This dominance is being driven by the steel industry's requirement for effective slag removal agents that offer thermal insulation and structural consistency under high temperatures. Unexpanded perlite’s ability to expand rapidly when exposed to heat makes it a preferred slag coagulant in electric arc and induction furnaces.

Its low cost, ease of storage, and inert nature reduce contamination risks, improving the metallurgical yield and operational efficiency. Additionally, with increasing production of crude and alloy steel globally, the dependency on perlite as a coagulant has increased.

Manufacturers are focusing on sourcing high-purity perlite ores to ensure consistent performance in high-precision casting applications. As foundries prioritize clean and efficient processes, the use of unexpanded perlite as a slag coagulant continues to expand, reinforcing its leadership within application-based segmentation.

The unexpanded perlite market is growing steadily due to its rising demand in insulation, construction, and horticultural applications. Known for its lightweight and inert properties, unexpanded perlite is processed into expanded forms for thermal insulation, fireproofing, and soil conditioning. Growth in infrastructure and agriculture sectors, particularly in developing economies, supports demand. However, challenges such as energy-intensive processing and raw material dependency influence supply chains. Key market players are focusing on mining optimization, strategic sourcing, and application-specific grade customization to improve market reach.

The construction industry remains a key driver for unexpanded perlite demand, especially due to its thermal insulation and fire-resistant properties when expanded. The material is widely used in lightweight concrete, plasters, ceiling tiles, and pipe insulation. As infrastructure development projects increase globally, especially in Asia and the Middle East, demand for efficient and durable insulation materials is rising. Additionally, unexpanded perlite serves as a precursor for industrial applications, including refractory bricks, cryogenic insulation, and filter aids. The ability to expand perlite on-site based on specific volume and density requirements gives manufacturers flexibility and cost control. The growing preference for non-toxic and lightweight building materials aligns well with perlite's properties. Industrial manufacturers are also turning to unexpanded perlite due to its availability and compatibility with specialized processing systems. As building efficiency codes and fire safety standards tighten across several regions, demand for materials like perlite that support compliance is expected to grow.

One of the main restraints in the unexpanded perlite market is the high energy consumption required to process it into usable expanded forms. The expansion process involves heating the material to extremely high temperatures, which raises production costs and carbon emissions. This energy dependence limits adoption in regions with high electricity prices or limited access to industrial furnaces. Moreover, the mining of perlite is subject to environmental regulations that vary by region, affecting the availability of high-grade ore. Mining operations may face permitting challenges or restrictions related to land use and environmental conservation. Transporting unexpanded perlite also adds to logistical complexity because it is often processed near application sites to avoid shipping bulky expanded forms. These constraints can create bottlenecks in the supply chain and increase the overall cost to end users. Unless energy-efficient processing technologies are adopted and environmental compliance becomes more streamlined, these issues may restrict market scalability.

Unexpanded perlite is increasingly being used in agricultural and horticultural sectors as a precursor for expanded perlite that improves soil aeration, drainage, and water retention. It is particularly favored in soilless growing systems and hydroponics, where consistent root oxygenation is critical. Expanded perlite derived from unexpanded forms is chemically inert, sterile, and lightweight, making it an ideal substrate in greenhouses and vertical farming operations. The global shift toward controlled environment agriculture and water-efficient cultivation methods is boosting interest in materials like perlite. As growers seek alternatives to peat and synthetic soil additives, demand for naturally derived soil enhancers is on the rise. Producers supplying to the agricultural segment are exploring tailored particle sizes and grades to match specific crop and system requirements. This segment offers long-term growth potential, particularly in water-scarce regions and countries investing in food security. The continued expansion of commercial horticulture is expected to reinforce demand for unexpanded perlite.

The unexpanded perlite market faces supply challenges due to its geographic concentration and dependency on mining operations. Major deposits are located in regions like Turkey, Greece, and the United States, making the market vulnerable to regional instabilities or export regulations. Political disruptions, transportation bottlenecks, or environmental scrutiny near mining sites can delay shipments and reduce global availability. Additionally, logistics for unexpanded perlite require careful handling to preserve raw quality before processing. Regions without local sources face higher landed costs due to shipping and storage needs. Seasonal disruptions and labor shortages in mining regions further influence the continuity of supply. Market participants in perlite-dependent industries such as construction and agriculture may face sporadic shortages or price volatility during such disruptions. To mitigate these risks, several companies are investing in local sourcing strategies or backward integration to secure supply. However, without broader geographic diversification and supply chain resilience, market reliability remains a key concern.

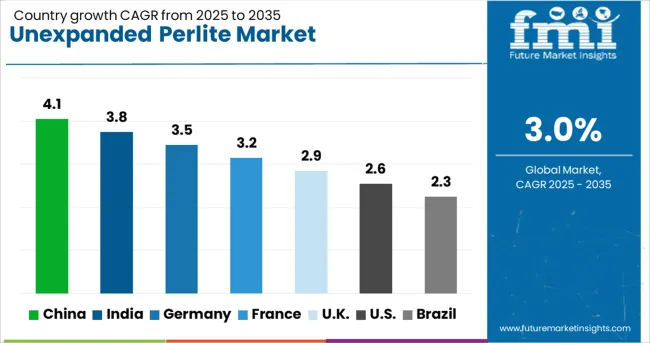

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

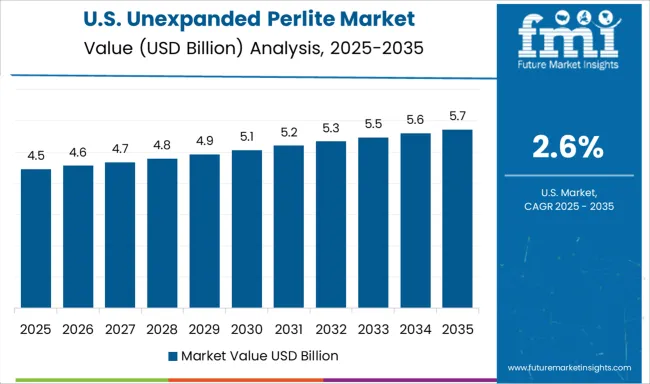

| USA | 2.6% |

| Brazil | 2.3% |

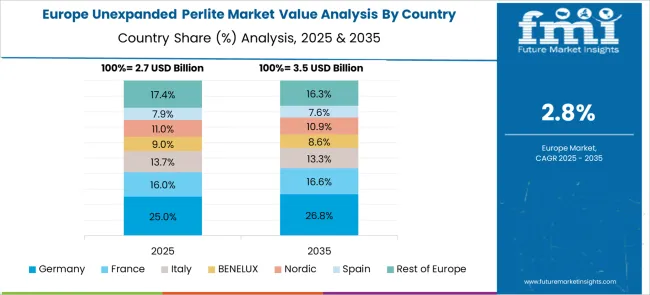

The global unexpanded perlite market is growing at a CAGR of 3.0%, driven by its use in construction materials, filtration, and horticulture. China leads with 4.1% growth, supported by abundant natural reserves and rising demand in building and insulation applications. India follows at 3.8%, fueled by infrastructure development and increased use of perlite in lightweight construction materials. Germany records 3.5% growth, reflecting demand in industrial filtration and energy-efficient construction systems. The United Kingdom shows steady growth at 2.9%, with applications expanding in soil conditioning and eco-friendly construction. The United States, at 2.6%, remains a mature market, influenced by sustainability trends and consistent demand in industrial sectors. Market dynamics are shaped by mining efficiency, purity of raw materials, and regional demand in construction and agriculture. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the unexpanded perlite market with a 4.1% CAGR, driven by strong construction sector demand and increased use in lightweight concrete and insulation materials. The availability of large perlite reserves and low-cost mining operations supports domestic supply chains. Growth is particularly high in prefabricated construction, where perlite is used for fire-resistant and thermally insulating building materials. Manufacturers are investing in cleaner extraction and screening technologies to meet environmental standards. Demand is also rising in industrial filtration and cryogenic insulation applications. The local agriculture sector is slowly adopting perlite as a soil amendment, offering additional market potential. Export activity is growing as Chinese producers serve neighboring countries with competitive pricing.

India is witnessing a 3.8% CAGR in the unexpanded perlite market, supported by growth in construction, horticulture, and foundry applications. The material is gaining popularity in cementitious compounds and lightweight plasters due to its thermal and acoustic insulation properties. Indian manufacturers are focusing on enhancing processing capacity and improving product quality for industrial-grade usage. Import dependency for high-purity ore remains moderate, but domestic exploration projects are underway. The agriculture sector is slowly integrating perlite into greenhouse and nursery practices, particularly in urban and peri-urban regions. Foundries are also using unexpanded perlite as a slag coagulant, increasing its industrial utility. Public infrastructure projects are contributing to overall market stability.

Germany is recording a 3.5% CAGR in the unexpanded perlite market, driven by eco-building regulations and demand for sustainable construction materials. The country is promoting green building certifications that prioritize natural, low-VOC, and energy-efficient materials. Unexpanded perlite is used in the production of fire-resistant boards, insulating mortars, and ceiling tiles. The horticulture segment is also contributing to market growth, particularly in indoor and hydroponic systems. German companies are optimizing supply chains through partnerships with European ore suppliers and focusing on minimal-waste processing. Innovation in energy-efficient expansion processes is emerging, although at a slower pace. Lightweight filler applications in polymers and coatings are being explored.

The United Kingdom is experiencing a 2.9% CAGR in the unexpanded perlite market, influenced by moderate construction activity and growing urban gardening practices. Lightweight building materials are in steady demand, particularly for insulation and soundproofing in residential renovations. Horticultural-grade perlite is increasingly used by amateur and commercial growers for improving drainage and aeration in container systems. Supply is primarily met through imports, leading to price fluctuations that impact end-user adoption. Local distributors are diversifying offerings to include customized blends and multi-purpose substrates. Awareness around sustainable construction is increasing, yet alternatives such as rock wool and vermiculite are also competing for market share.

The United States is seeing a 2.6% CAGR in the unexpanded perlite market, with usage anchored in industrial applications and niche construction solutions. Though growth is modest, steady demand exists in steel and foundry sectors where perlite is used for slag handling and insulation. In the construction industry, unexpanded perlite serves as a lightweight aggregate in plaster and refractory products. Agricultural usage remains stable, particularly in hydroponic systems and soil blends. Domestic production is concentrated in the western states, benefiting from established perlite reserves. Manufacturers are exploring product refinement to meet strict environmental and safety standards. Competitive materials and slow adoption in some regions are limiting broader market growth.

The Unexpanded Perlite Market is witnessing moderate yet steady growth, driven by its broadening application base across construction, agriculture, and industrial sectors. Unexpanded perlite, a naturally occurring volcanic glass, is valued for its low density and thermal insulation properties. Before expansion, it is used in high-temperature insulation, filtration processes, and as a lightweight aggregate in construction materials. Increasing demand for sustainable and energy-efficient materials, especially in developing regions, is creating new opportunities for manufacturers and suppliers. Key players in this market include Imerys SA, one of the largest producers with a global footprint and a diverse product portfolio.

Companies like Cornerstone Industrial Minerals Corporation, Dicalite Management Group, and Hess Perlite have established themselves as significant regional or niche players, offering specialized grades of unexpanded perlite for industrial filtration, foundries, and refractory applications. Perlite-Hellas, Gulf Perlite LLC, and The Schundler Company also maintain a strong presence, particularly in the Middle East, Europe, and North America, catering to both raw material and processed perlite markets. Smaller yet influential players such as Pratley Perlite Mining, PVP, and Midwest Perlite, Inc. contribute to localized supply and often provide customized solutions based on client-specific needs. As infrastructure development accelerates globally and the focus on environmentally friendly materials intensifies, the unexpanded perlite market is expected to grow steadily. However, factors like transportation costs, mining regulations, and limited high-quality perlite reserves may pose challenges to sustained expansion.

Dicalite officially launched Harvest Hero, a consumer-focused brand offering soil amendment products including the patent-pending Enhanced Perlite Mix, which blends perlite, diatomaceous earth, and essential nutrients designed to support early plant growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Application | Slag coagulant, Sandblasting, Agriculture, Casting sand & mixtures, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Imerys SA, Cornerstone Industrial Minerals Corporation, Perlite-Hellas, Gulf Perlite LLC, The Schundler Company, Hess Perlite, Dicalite Management Group, Pratley Perlite Mining, PVP, and Midwest Perlite, Inc |

| Additional Attributes | Dollar sales vary by form and application, with construction and horticulture leading usage, while insulation and filtration sectors grow fastest. Asia‑Pacific leads in volume, as Europe values regulatory‑compliant sustainable products. Pricing fluctuates with raw perlite ore and energy costs. Growth accelerates via eco‑friendly building trends, processing innovations, and expanding lightweight construction needs. |

The global unexpanded perlite market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the unexpanded perlite market is projected to reach USD 14.0 billion by 2035.

The unexpanded perlite market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in unexpanded perlite market are slag coagulant, sandblasting, agriculture, casting sand & mixtures and others.

In terms of , segment to command 0.0% share in the unexpanded perlite market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA