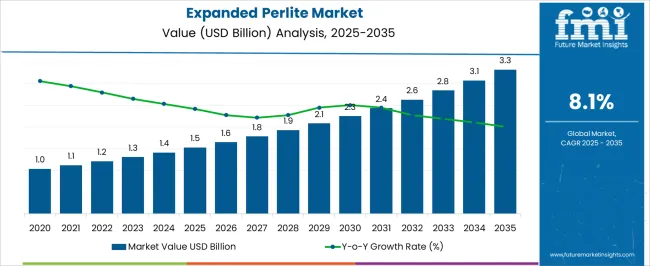

The expanded perlite market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. The growth trajectory highlights distinct regional imbalances shaped by industrial applications, construction trends, and agricultural demand. Asia-Pacific is expected to remain the leading contributor due to strong infrastructure development and rapid adoption of lightweight insulating materials.

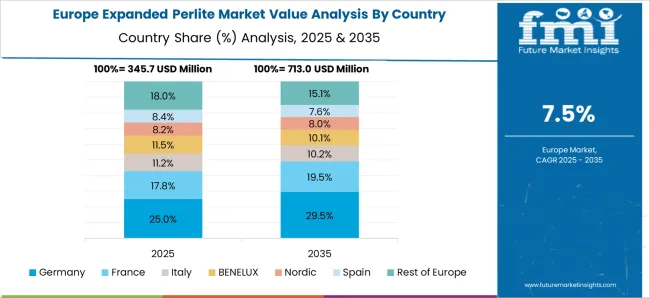

Expanding construction projects and the use of perlite in horticulture position this region as the fastest-growing, with its share rising steadily throughout the forecast horizon. Europe demonstrates stable but moderate growth compared to the Asia-Pacific. Regulatory emphasis on energy-efficient building materials and sustainable insulation drives perlite adoption, particularly in construction and industrial applications.

The market expansion pace is slower, reflecting saturation in some mature economies and reliance on imports for raw perlite. Growth in this region is sustained more by innovation and regulatory compliance rather than volume demand. North America shows a balanced trajectory with steady adoption in construction, filtration, and fireproofing applications.

The demand growth is supported by infrastructure renewal initiatives and advanced horticultural practices, but the pace lags behind Asia-Pacific. The imbalance highlights Asia-Pacific as the key driver of global expansion, while Europe and North America maintain consistent but comparatively restrained contributions.

| Metric | Value |

|---|---|

| Expanded Perlite Market Estimated Value in (2025 E) | USD 1.5 billion |

| Expanded Perlite Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The expanded perlite market represents a distinct segment within the industrial minerals and construction materials industry, emphasizing insulation, lightweight properties, and versatility. Within the broader construction materials market, it accounts for about 4.6%, driven by demand in lightweight concrete and plaster applications. In the horticulture and agriculture inputs sector, it holds nearly 5.1%, reflecting its role in soil aeration and water retention.

Across the filtration and separation media market, the segment captures 3.9%, supporting applications in beverages, chemicals, and pharmaceuticals. Within the industrial insulation materials category, it represents 4.3%, highlighting usage in cryogenic storage tanks and high-temperature insulation. In the consumer products and packaging fillers segment, it secures 2.7%, emphasizing its use in lightweight compounds and specialty packaging. Recent developments in this market have centered on processing innovation, application diversity, and environmental benefits. Advances include engineered perlite grades with enhanced porosity for improved insulation and filtration performance.

Key players are collaborating with construction and horticultural companies to expand usage in sustainable building materials and controlled environment agriculture. Automated expansion techniques have been introduced to achieve consistent particle size and energy efficiency. The use of expanded perlite in cryogenic and LNG applications is rising due to its superior thermal resistance. Research into blending perlite with polymers and composites is broadening its utility in lightweight industrial products. These advancements demonstrate how efficiency, multifunctionality, and sustainability are shaping the expanded perlite market.

The expanded perlite market is progressing steadily, supported by its increasing application in construction, horticulture, filtration, and industrial sectors. Industry updates and manufacturer announcements have emphasized its lightweight nature, thermal insulation properties, and fire resistance, which make it a preferred additive in building materials. The construction industry’s shift toward energy-efficient and sustainable materials has played a central role in driving perlite demand.

Infrastructure expansion in emerging economies, coupled with stringent building safety regulations in developed markets, has accelerated adoption. Furthermore, advancements in perlite processing technology have improved product quality and broadened its use in niche applications, including cryogenic insulation and lightweight concrete.

With governments and private developers prioritizing green building standards, demand for expanded perlite is expected to maintain an upward trajectory.

The expanded perlite market is segmented by application, and geographic regions. By application, expanded perlite market is divided into Construction products, Fillers, Horticultural aggregate, Filtration & process aid, and Others. Regionally, the expanded perlite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The construction products segment is projected to account for 38.6% of the expanded perlite market revenue in 2025, retaining its status as the leading application category. Growth in this segment has been driven by the material’s ability to provide excellent thermal and acoustic insulation while reducing overall structural weight.

Expanded perlite has been widely adopted in plaster, concrete, and mortar formulations due to its durability and cost-effectiveness. Its inherent fire-resistant properties have made it particularly valuable for meeting safety compliance in residential, commercial, and industrial buildings.

Additionally, the trend toward sustainable construction has encouraged the integration of perlite into eco-friendly building materials, aligning with global environmental goals. The segment’s expansion is further supported by infrastructure investments, urbanization trends, and the adoption of lightweight construction solutions that enhance structural performance and energy efficiency. As construction markets continue to evolve toward greener and more efficient materials, expanded perlite’s role in building products is expected to remain central to the industry’s growth.

The market has been expanding steadily, supported by its widespread use across construction, agriculture, filtration, and industrial applications. Perlite, when heated, expands into a lightweight, porous material with excellent insulation, absorbency, and filtration properties. The demand has been reinforced by rising construction activities, adoption of lightweight concrete, green roofing, and insulation systems. In agriculture, expanded perlite is increasingly used in soil conditioning, hydroponics, and water retention applications. Industries rely on its effectiveness as a filter aid in food, beverages, and pharmaceuticals.

The construction sector remains the largest consumer of expanded perlite, driven by its lightweight, thermal insulation, and fire-resistant properties. Perlite is widely incorporated in plaster, mortars, roof insulation, and lightweight concrete to reduce building loads while maintaining durability and safety. Green building projects and energy-efficient housing have created new opportunities for perlite-based insulation materials. Roofing systems and cavity wall fills are adopting perlite products to improve energy conservation in residential and commercial structures. Rising demand for fireproofing materials in high-rise buildings and infrastructure has further expanded its application scope. Construction companies are increasingly adopting expanded perlite due to its cost-effectiveness, availability, and ability to enhance building performance.

Agriculture has become another vital growth area for expanded perlite, particularly in soil conditioning, horticulture, and hydroponic systems. The porous structure of perlite enhances aeration, water retention, and root development, making it highly suitable for modern farming techniques. Hydroponic cultivation and greenhouse farming increasingly use perlite as a growing medium due to its sterile, lightweight, and reusable properties. Global concerns over soil degradation, limited arable land, and water scarcity have driven the adoption of perlite-based solutions. Its compatibility with fertilizers and ability to prevent soil compaction provide further advantages for sustainable crop production. Agricultural demand is expected to continue rising as food production systems modernize globally.

Expanded perlite has gained wide acceptance in industrial filtration, serving as a filter aid in beverages, pharmaceuticals, chemicals, and wastewater treatment. Its inert, non-toxic, and high-porosity structure allows it to trap impurities while maintaining flow rates in liquid processing effectively. In breweries, wineries, and food manufacturing, perlite filters are increasingly preferred due to their consistency and low contamination risk. Pharmaceutical industries use perlite for sterile filtration processes, ensuring high purity and compliance with quality standards. Environmental regulations on wastewater treatment have reinforced perlite adoption in filtration systems for municipal and industrial plants. This rising role in critical industries has strengthened the long-term demand for expanded perlite.

Sustainability trends and emerging economies present strong opportunities for expanded perlite. Eco-friendly construction practices and the need for energy-efficient insulation materials have created a favorable environment for adoption. In water-scarce regions, perlite’s ability to improve irrigation efficiency and soil productivity has positioned it as a valuable agricultural input. Emerging economies in Asia-Pacific, Latin America, and Africa are adopting expanded perlite in construction, farming, and municipal projects due to cost-effectiveness and availability. Companies are investing in sustainable mining practices, localized processing facilities, and advanced perlite products to cater to diverse industries. These developments are expected to ensure steady demand across multiple end-use segments globally.

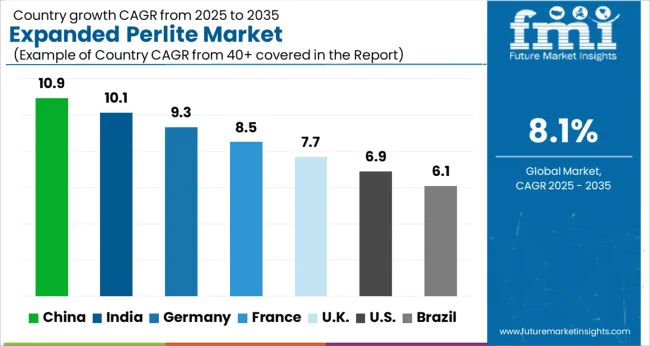

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| U.K. | 7.7% |

| U.S. | 6.9% |

| Brazil | 6.1% |

The market is set to grow steadily as demand rises from construction, filtration, and horticulture industries. China leads with a forecast growth rate of 10.9%, supported by strong construction activities and increased insulation applications. India follows at 10.1%, where agriculture and building material demand are boosting adoption. Germany records 9.3%, benefitting from energy-efficient building practices and advanced manufacturing processes. The United Kingdom secures 7.7%, with steady utilization in lightweight construction materials and industrial applications. The United States holds 6.9%, where growing demand for filtration media and insulation materials is sustaining momentum. These nations contribute significantly to the global adoption, production, and technological development of expanded perlite across multiple sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The expanded perlite market in China is projected to advance at a CAGR of 10.9%, supported by increasing applications in construction, agriculture, and industrial sectors. Residential and commercial construction projects are adopting expanded perlite for its insulation and lightweight properties. Agricultural applications, particularly soil conditioning and hydroponics, are gaining wider acceptance. Manufacturers are investing in improved processing technologies to enhance quality and consistency. Distribution channels include construction material suppliers, agricultural distributors, and e-commerce platforms. Marketing campaigns highlighting eco-friendly benefits and long-term performance are creating awareness. Partnerships with building contractors, greenhouse operators, and industrial users are expanding adoption. Government emphasis on sustainable building materials and agricultural productivity is further reinforcing growth.

India is anticipated to register a CAGR of 10.1%, driven by rising demand in construction insulation, horticulture, and industrial applications. Its lightweight nature and thermal insulation properties are particularly valued in the building sector. Agricultural use for soil aeration and water retention is expanding, supported by greenhouse and nursery adoption. Manufacturers are focusing on cost-efficient processing techniques to cater to diverse local requirements. Distribution networks, including construction supply chains and agricultural cooperatives, enhance availability in both urban and semi-urban areas. Marketing emphasizing durability, energy savings, and soil productivity is influencing adoption. Collaborations with construction developers, agricultural enterprises, and industrial operators are strengthening market presence. Regulatory support for sustainable materials is also aiding growth.

Germany’s market is forecasted to grow at a CAGR of 9.3%, supported by demand in energy-efficient construction, industrial insulation, and horticulture. The construction sector increasingly adopts expanded perlite for its insulation and fire resistance benefits. Agricultural demand is rising due to greenhouse cultivation and soil conditioning requirements. Manufacturers are focusing on high-quality production with eco-friendly standards, aligning with Germany’s emphasis on sustainability. Distribution through construction suppliers, horticultural networks, and specialized industrial distributors ensures wide availability. Marketing efforts highlight long-term energy savings, durability, and performance advantages. Strategic collaborations with building material firms, agricultural suppliers, and industrial manufacturers are enhancing product reach. Regulatory mandates for sustainable construction materials and agricultural efficiency continue to support steady market growth.

The market in the United Kingdom is expected to grow at a CAGR of 7.7%, supported by applications in construction, gardening, and industrial insulation. Its role in lightweight concrete and plaster products is gaining attention, especially in modern construction projects emphasizing energy efficiency. Gardeners and agricultural users are increasingly adopting expanded perlite for improved soil aeration and water retention. Manufacturers are introducing cost-effective and high-performance products suited for both domestic and industrial requirements. Distribution through construction suppliers, gardening centers, and online platforms ensures accessibility. Marketing emphasizing sustainability, cost savings, and long-term durability is driving awareness. Partnerships with contractors, garden centers, and industrial users are accelerating adoption. Regulatory initiatives supporting energy-efficient construction materials further strengthen market prospects.

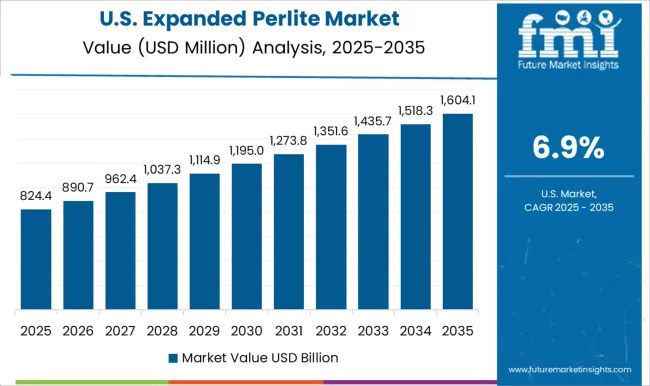

The market in the United States is projected to expand at a CAGR of 6.9%, driven by steady demand in construction, filtration, and horticulture. The construction industry relies on expanded perlite for insulation, fire resistance, and lightweight building materials. Agricultural applications, particularly greenhouse farming and soil conditioning, are steadily increasing. Industrial users adopt perlite for filtration processes in beverages and chemicals. Manufacturers are innovating to improve product performance while maintaining cost efficiency. Distribution networks, including building suppliers, agricultural distributors, and online platforms, are ensuring product reach. Marketing efforts highlight benefits such as durability, energy efficiency, and versatility. Collaborations with construction firms, greenhouse operators, and industrial companies are boosting adoption. Regulatory emphasis on sustainable construction and agricultural practices further supports market expansion.

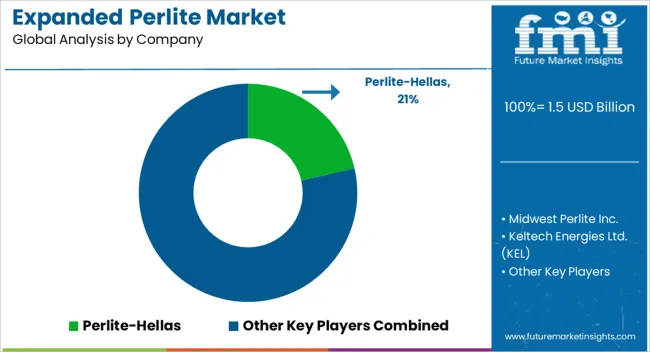

The market is defined by its versatile applications in construction, horticulture, industrial insulation, and filtration, supported by key players driving production and innovation. Imerys SA holds a dominant global presence with its extensive perlite mining and processing operations, supplying to diverse industries. Perlite-Hellas specializes in high-quality perlite sourced from rich deposits in Greece, strengthening Europe’s supply chain. Midwest Perlite Inc. plays a vital role in the North American market, catering to construction aggregates, horticultural soil amendments, and insulation-grade perlite. Keltech Energies Ltd. (KEL) is recognized in Asia for manufacturing perlite products suited for agriculture, cryogenic insulation, and refractory applications, positioning itself as a strong regional supplier.

Silbrico Corporation contributes to the market with a wide portfolio of expanded perlite used in lightweight construction materials, filtration media, and industrial applications. The availability of perlite reserves, production technologies, and distribution networks shapes the competitive landscape. Increasing demand for energy-efficient construction materials and sustainable agricultural inputs has been driving innovations in product performance and applications. As industrial sectors adopt expanded perlite for insulation and filtration, companies continue to invest in capacity expansions, logistics optimization, and collaborations. With construction growth, horticultural advancements, and industrial efficiency requirements, the expanded perlite market is expected to strengthen its footprint across both developed and emerging economies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Application | Construction products, Fillers, Horticultural aggregate, Filtration & process aid, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Perlite-Hellas, Midwest Perlite Inc., Keltech Energies Ltd. (KEL), Imerys SA, and Silbrico Corporation |

| Additional Attributes | Dollar sales by perlite grade and application, demand dynamics across construction, agriculture, and industrial sectors, regional trends in lightweight aggregate adoption, innovation in insulation efficiency, fire resistance, and filtration properties, environmental impact of mining and processing activities, and emerging use cases in green building materials, hydroponics, and specialty fillers. |

The global expanded perlite market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the expanded perlite market is projected to reach USD 3.3 billion by 2035.

The expanded perlite market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in expanded perlite market are construction products, fillers, horticultural aggregate, filtration & process aid and others.

In terms of , segment to command 0.0% share in the expanded perlite market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unexpanded Perlite Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polypropylene (EPP) Foam Market 2025 to 2035

Expanded Polystyrene for Packaging Market Insights – Growth & Forecast 2025 to 2035

Expanded PTFE (ePTFE) Market Growth – Trends & Forecast 2024-2034

Expanded Polystyrene Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA