The global vutrisiran industry is valued at USD 843 million in 2025. It is expected to grow at a CAGR of 12% and reach USD 2.62 billion by 2035. The global Vutrisiran industry report covers an overview of the industry, which comprises various sectors, key players, and factors driving segment growth. It is driven by increased awareness of hATTR, easier diagnosis, and the preference for treatments which are not severely harmful.

In 2024, the Vutrisiran landscape demonstrated significant growth, bolstered by rising patient uptake, additional regulatory approval, and refined treatment protocols in hereditary transthyretin-mediated amyloidosis (hATTR). Demand skyrocketed in several of the main regions such as North America and Europe as their awareness campaigns and better diagnostic tools grew.

Ongoing research and development efforts, heightened investment in the biopharmaceutical industry, and expanding healthcare infrastructure globally fuel it. Increasing diagnoses among patients and a growing elderly population more susceptible to transthyretin-related ailments also support the industry's growth.

Key Vutrisiran Market Metrics and Performance Indicators

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 843 million |

| Industry Size (2035F) | USD 2.62 billion |

| CAGR (2025 to 2035) | 12% |

Vutrisiran has a promising sector characterized by significant adoption for treatment of hereditary transthyretin-mediated amyloidosis (hATTR), a strong regulatory landscape, and improved patient access through the insurance coverage. Pharmaceutical companies in the RNA-based therapeutic space are poised to profit and older therapeutic modalities may find demand further diluted. The advances in healthcare infrastructure, especially in emerging economies and the Asia-pacific region contributes to the growth of the global sector.

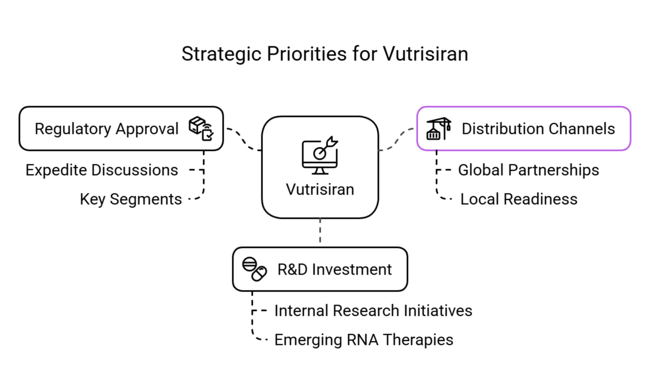

To strengthen Vutrisiran’s market position and drive global adoption, companies must prioritize strategic partnerships that expand market access. Collaborating with healthcare insurers in developed regions can secure better reimbursement terms, while engaging with local governments across Asia-Pacific and other emerging markets can facilitate coverage inclusion and faster regulatory approvals. These efforts will ensure more patients gain access to the therapy, increasing both equity and adoption rates.

Simultaneously, investment in next-generation RNA therapeutics is crucial to stay competitive in the evolving landscape of hATTR treatment. Developing complementary or combination RNA-based therapies can reinforce Vutrisiran’s clinical value proposition. Alongside this, expanding global distribution networks through scalable manufacturing and smart partnerships will ensure consistent supply and availability in underserved markets. Preventing distribution lags not only improves patient outcomes but also strengthens brand reliability and long-term market share.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays and Hurdles | Probability: High |

| Competition from Alternative Treatments | Probability: Medium |

| Supply Chain Disruptions | Probability: Medium |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Regulatory Approval in Key Segments | Expedite discussions with regulatory bodies to ensure smooth approval processes for Vutrisiran in emerging sectors. |

| Expansion of Distribution Channels | Initiate partnerships with global distributors and ensure local sector readiness to increase Vutrisiran’s availability. |

| Investment in R&D for RNA Therapeutics | Launch internal research initiatives to explore the potential of combining Vutrisiran with other emerging RNA therapies. |

| Country | Policies, Regulations, and Certifications Impacting the Industry |

|---|---|

| United States |

|

|

European Union |

|

| Japan |

|

| South Korea |

|

| China |

|

| Australia |

|

| Canada |

|

The market in the USA is sizeable, as the number of patients with hATTR is significant. Sales in the USA are expected to grow at a CAGR of12.5% due to the country’s developed healthcare system and significant total addressable sector. Demand for Vutrisiran in the USA is underpinned by a broader push to increase access to new therapies for rare disorders, including FDA approvals and backing from Medicare and Medicaid programs. Reimbursement policies and coverage with evidence development programs impact the accessibility of treatments for patients and their uptake.

The United Kingdom Vutrisiran market which is anticipated to grow at a CAGR of 11%, slightly lower than the global mean due to a growing focus on orphan drugs and rare diseases in the healthcare system. Notably, timely access to such treatments as Vutrisiran is dependent on the NHS's (National Health Service) access in the UK, with the reimbursement process and cost-effectiveness analysis serving as critical hurdles. Notwithstanding this, the UK is still an attractive sector, particularly as the importance of precision medicine and personalized healthcare continues to grow.

Vutrisiran market in France would grow at a CAGR of 10% owing to the country’s focus on advanced therapeutics for orphan conditions. Orphan drugs, for example, are usually incentivized under national healthcare schemes, so France, as one of Europe’s largest healthcare sectors, will benefit from an increased demand for these products.

Drugs that are eligible for reimbursement are looked at by the French National Authority for Health (HAS), and Vutrisiran is expected to meet the need for new treatments for hATTR. However, adoption rates may be slightly slower than in sectors such as the USA, where cost-effectiveness evaluations and reimbursement approval processes are in place.

Vutrisiran in Germany is anticipated to show strong growth with a CAGR of 12% from 2025 to 2035 in sales, in line with the global average. Germany’s robust healthcare system, with generous state -funded insurance coverage, makes it one of the most lucrative orphan drug sectors in Europe.

Germany has a healthcare system that puts a good deal of money into rare disease treatments, and treatments are also run through that country’s Institute for Quality and Efficiency in Health Care, or IQWiG, which empowers the country to check and balance on the approval of them against rigorous standards for safety, efficacy, and cost-effectiveness.

Italy’s Vutrisiran market will grow at a CAGR of 9% from 2025 to 2035, slightly below the global average. However, it is worth noting that Italy's NHS provides complete coverage for rare disease treatments, which is advantageous for patients who are looking for therapies such as Vutrisiran.

The country also benefits from the EU’s Orphan Medicinal Products Regulation, which promotes the development of drugs for rare diseases like hATTR. However, obstacles such as healthcare funding, regional variations in healthcare access, and cost-effectiveness evaluations could potentially impede the uptake.

The Vutrisiran sector of South Korea is estimated to flourish significantly at a notable CAGR of 13%, and the sector is expected to grow at a pace faster than the global average due to the advancing healthcare infrastructure of the country and government spending on rare disease treatment.

National Health Insurance Service (NHIS) coverage is significant, especially for rare disease therapies; the country is increasingly focusing on investing in precision medicine and biotechnology innovations. The Korea Food and Drug Administration (KFDA), South Korea's regulatory body, has been known for a favorable regulatory environment for the approval of innovative therapeutics such as Vutrisiran.

The relatively slower adoption of RNA-based therapies and biologics in Japan will lead to slower Vutrisiran growth in this region, giving its sector in Japan a CAGR of 8%. Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) follows a strict approval procedure that may delay the launch of Vutrisiran in the sector.

Japan’s health insurance system also has a cost-effectiveness evaluation, which can make reimbursement difficult for new, high-cost therapies. Despite these challenges, Japan’s aging population and rising rate of genetic diseases position the country as a growth engine for novel therapeutics.

The growing health care infrastructure and demand for innovative therapies, China is anticipated to record one of the highest CAGR for Vutrisiran (15%). The country’s National Medical Products Administration (NMPA) has also reorganized the approval process for new therapies, especially those targeting rare diseases. In addition, treatments for rare diseases such as hATTR are being included on China’s National Reimbursement Drug List (NRDL), further expanding access to breakthrough therapies in a cost-effective manner.

The Vutrisiran sector for the Australia-New Zealand region is expected to grow at a CAGR of 10% during 2025 to 2035 due to moderate yet sustainable growth owing to their developed healthcare systems and high demand for drugs for rare diseases.

The Therapeutic Goods Administration (TGA) in Australia regulates the approval of drugs, including RNA-based therapies like Vutrisiran. New Zealand is a nation with highly centralized medicine funding and reimbursement, specifically through PHARMAC, the public's uptake of Vutrisiran will largely depend on these authorities.

The Vutrisiran sector in India is expected to grow quickly, with a healthy CAGR of 18% from 2025 to 2035. This is much higher than the global average and is due to the fact that the country's healthcare system is changing quickly and more money is being spent on effective medical treatments.

India represents a timely opportunity for the adoption of therapies such as Vutrisiran. Although India’s healthcare system has still been maturing, and there is increasing attention to rare diseases and orphan drugs, government initiatives are trying to improve access to innovative therapies.

The market is segmented by drug class into antisense oligonucleotides, nucleic acids, nucleotides, and nucleosides, each representing a distinct molecular approach to therapeutic intervention. Based on route of administration, these therapies are primarily delivered through injectable, parenteral, and subcutaneous methods, catering to varied clinical settings and patient preferences.

Distribution channels encompass hospital pharmacies, retail pharmacies, and online pharmacies, reflecting the shift toward omni-channel healthcare delivery. Regionally, the market spans North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa, highlighting its global footprint and the rising demand for precision medicine across both mature and emerging healthcare ecosystems.

The CAGR for the antisense oligonucleotides segment in 2025 is projected to be approximately 16%. Vutrisiran is an antisense oligonucleotide that stops kino typically changed forms of transthyretin from working. Vutrisiran targets the production of transthyretin (TTR), the protein responsible for hereditary transthyretin-mediated amyloidosis (hATTR), a rare inherited disorder. This mechanism will reduce TTR levels and prevent deposits of amyloid from forming, leading to tissue damage.

The expected CAGR for the subcutaneous injectable route of administration in 2025 is projected to be around 15%.This approach also benefits patients by minimizing the frequency of hospital visits and enabling better convenience and flexibility for long-term management of hATTR. It is given through a needle and goes straight into the bloodstream without going through the digestive system. This makes it more effective for treating hATTR and other complex genetic disorders. Vutrisiran is injected under the skin at the administration site.

The CAGR for the distribution channels in 2025 is projected to be around 10-12%. Hospital pharmacies, online pharmacies, and retail pharmacies distribute Vutrisiran, which reaches a large patient pool in diverse geographical areas through multiple channels. Prevented from hospital settings, patients are prescribed medications on an inpatient basis. This process is especially important for patients who need to be monitored or receive help to administer the treatment, pharmacists in hospitals.

Alnylam Pharmaceuticals is projected to hold a leading share of the Vutrisiran market with a commanding 70-75% share in 2025, led by the commercial success of its FDA-approved RNAi therapeutic, Amvuttra® (vutrisiran), for hereditary transthyretin-mediated amyloidosis (hATTR).

Its leadership is being challenged by Ionis Pharmaceuticals and AstraZeneca, whose co-developed antisense oligonucleotide therapy, eplontersen, is expected to capture approximately 15-20% of market share as it gains clinical and commercial traction. Meanwhile, Pfizer’s tafamidis-based therapies, Vyndaqel and Vyndamax, retain a niche share of 5-10%, mostly among early-stage hATTR patients. However, the market is steadily shifting toward RNAi-based treatments due to their mechanism-driven advantages for advanced cases.

While current competition is dominated by established pharmaceutical players, emerging biotechnology firms like In tellia Therapeutics are entering the arena with next-generation CRISPR-based gene-editing therapies. Although they currently represent less than 5% of the market, their long-term disruptive potential-especially post to 2025-cannot be ignored. These entrants are likely to reshape the treatment paradigm by offering more durable, potentially curative options, pushing incumbents to innovate faster or expand into adjacent modalities.

The RNA and gene therapy landscape in rare diseases witnessed major regulatory momentum in 2024. The USA FDA granted accelerated approval to a new gene therapy for a rare disorder in January, signaling continued regulatory support for high-need innovation.

In March, Novartis launched the first oral RNA-targeting drug for a genetic disease, a move expected to expand access and push adoption beyond traditional hospital settings. On the clinical side, Roche reported a successful Phase III trial for a bispecific antibody in autoimmune diseases, setting the stage for a 2025 launch. Meanwhile, the EMA granted orphan designation to a novel AI-discovered drug for a rare pediatric condition, underscoring regulatory openness to algorithmically optimized drug candidates.

Pharma majors are strengthening their long-term pipelines via acquisitions and strategic partnerships. In February 2024, Bristol Myers Squibb acquired Karuna Therapeutics for USD 14 billion, consolidating its position in neuroscience and rare diseases.

AstraZeneca expanded its radiopharmaceutical footprint by acquiring Fusion Pharmaceuticals for USD 2.4 billion in April. Strategic collaborations also intensified-Moderna and Merck extended their cancer vaccine alliance in May, while Pfizer and BioNTech entered a new agreement in June to co-develop a next-gen mRNA vaccine targeting both influenza and COVID-19, signaling continued convergence in infectious disease and oncology therapeutics.

It is segmented intoAntisense Oligonucleotides, Nucleic Acids, Nucleotide, and Nucleosides

It is segmented into Injectable, Parenteral, and Subcutaneous

It is segmented into Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa

Vutrisiran is a treatment that reduces levels of transthyretin (TTR) protein and is used to treat hereditary transthyretin-mediated amyloidosis (hATTR), which is a rare genetic disease that leads to deposition of amyloid in the organs and tissues.

The Vutrisiran market is expected to reach USD 2.62 billion by 2035, growing at a CAGR of 12% from 2025.

Alnylam Pharmaceuticals leads the market, with Ionis–AstraZeneca and Pfizer following as major competitors.

Antisense oligonucleotides and subcutaneous delivery are the fastest-growing segments, projected at ~16% and ~15% CAGR respectively.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA