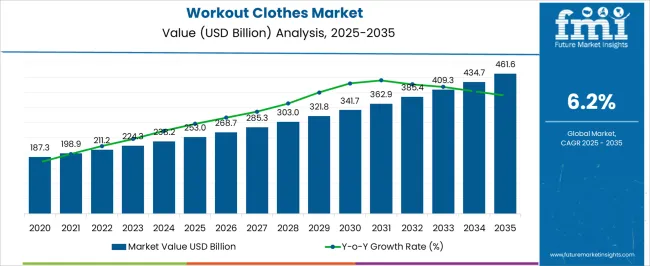

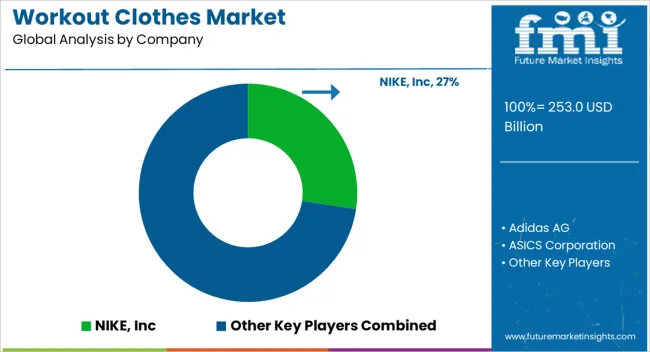

The Workout Clothes Market is estimated to be valued at USD 253.0 billion in 2025 and is projected to reach USD 461.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The Workout Clothes market is experiencing significant growth driven by rising consumer awareness of health and fitness and increasing participation in sports and physical activities. The future outlook of this market is shaped by evolving fashion trends, technological innovations in fabric performance, and the growing emphasis on comfort, durability, and moisture-wicking properties in athletic apparel. Investments in active lifestyle promotion, fitness infrastructure, and sports events have further fueled market expansion.

Increasing disposable incomes and urbanization have also contributed to the surge in demand for premium and performance-oriented workout clothing. The market benefits from the adoption of advanced textile technologies, including breathable fabrics, stretchable materials, and sustainable fibers, which enhance user experience and support the adoption of eco-friendly products.

Moreover, the rising influence of social media and digital fitness communities has reinforced consumer preference for stylish yet functional sportswear The integration of performance features with lifestyle fashion continues to open opportunities for product diversification and innovation, ensuring sustained growth across various regions.

| Metric | Value |

|---|---|

| Workout Clothes Market Estimated Value in (2025 E) | USD 253.0 billion |

| Workout Clothes Market Forecast Value in (2035 F) | USD 461.6 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

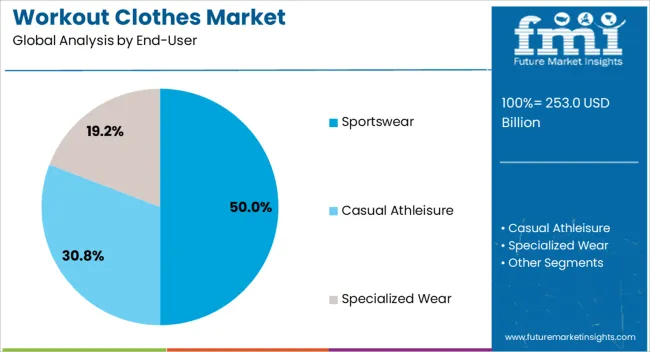

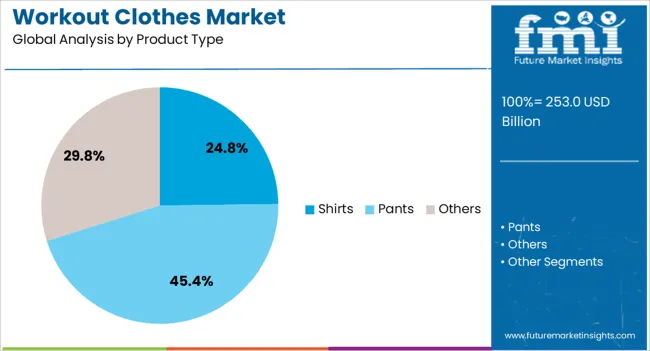

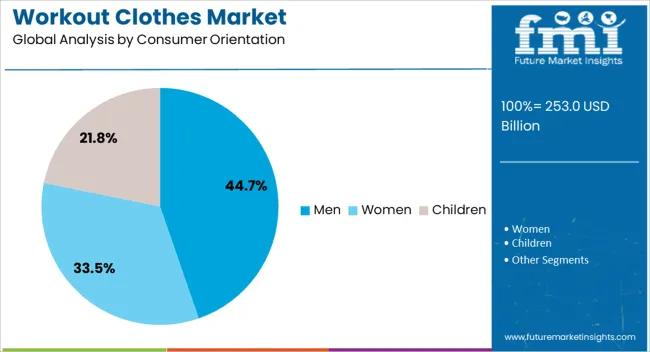

The market is segmented by End-User, Product Type, Consumer Orientation, Material Type, and Sales Channel and region. By End-User, the market is divided into Sportswear, Casual Athleisure, and Specialized Wear. In terms of Product Type, the market is classified into Shirts, Pants, and Others. Based on Consumer Orientation, the market is segmented into Men, Women, and Children. By Material Type, the market is divided into Nylon, Wool, and Polyester. By Sales Channel, the market is segmented into Online Retailers, Direct Sales, Franchised Stores, Specialty Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sportswear end-user segment is projected to hold 50.00% of the Workout Clothes market revenue share in 2025, making it the leading segment. The growth of this segment is driven by increasing engagement in fitness activities, gym culture, and organized sports across all age groups. Sportswear is preferred for its functional design, comfort, and adaptability to different physical activities.

The segment has benefited from innovations in performance fabrics that offer breathability, moisture management, and flexibility, enhancing consumer satisfaction and loyalty. Moreover, the rising popularity of athleisure has expanded its appeal beyond traditional sports contexts, making it a lifestyle choice.

Marketing campaigns by brands focusing on health, wellness, and active lifestyles have further accelerated demand The segment’s growth is reinforced by the convergence of performance, aesthetics, and durability, making sportswear the dominant end-user category in the market.

The shirts product type segment is expected to account for 24.80% of the Workout Clothes market revenue share in 2025. The dominance of this segment is driven by the versatility and widespread use of shirts across different sports and fitness activities. Shirts are preferred for their comfort, lightweight design, and ability to wick moisture, ensuring optimal performance during physical activity.

The segment has been further supported by technological enhancements in fabric, such as stretchability and ventilation features. Growing consumer demand for stylish and branded workout shirts has reinforced their market position, with options catering to both performance and casual wear.

Retail expansion, online sales channels, and targeted marketing campaigns have also contributed to segment growth As fitness participation continues to rise globally, shirts remain a highly sought-after product type, combining functionality, fashion, and performance in one segment.

The men consumer orientation segment is anticipated to hold 44.70% of the Workout Clothes market revenue share in 2025. The segment’s growth is influenced by the increasing focus on male fitness, gym memberships, and participation in sports and outdoor activities. Male consumers prioritize functionality, durability, and comfort in workout apparel, which has led brands to design performance-oriented clothing specifically for men.

Technological innovations in fabric and apparel design, such as moisture-wicking, anti-odor, and flexible materials, have strengthened the appeal of workout clothing in this segment. Additionally, growing brand awareness and the influence of fitness culture on male consumers have further supported adoption.

Marketing initiatives targeting men, along with the rise of athleisure as a fashion trend, have reinforced the prominence of this segment The convergence of fitness, style, and technology continues to drive revenue growth among male consumers in the workout clothes market.

Smart Fabrics Gain Popularity as Consumers Value Comfort and Functionality of Activewear

Technological advancements are a key driver. Activewear is now coming in moisture-wicking fabrics, temperature-regulating materials, and self-cleaning fabrics. These cutting-edge materials optimize comfort and performance. These innovations in performance fabrics facilitate individuals in going beyond their limits and reaching their fitness goals.

Advancements in activewear reflect the constantly changing consumer lifestyles and the desire to combine fashion, technology, and fitness.

Hot Trends in the Women’s Activewear

The women’s activewear section is replete with trendy options. Vibrant colors, bold prints, and eye-catching patterns are making a splash in the industry. Striking details like floral motifs and abstract designs empower women to make clothes choices that exude confidence and personality while breaking a sweat.

New Research Reveals Trendy Gym Apparel Might be a Catalyst of Lifestyle Disorders

New research reveals that trendy workout clothes, primarily synthetic activewear, may have chemicals that can leach out during intense workout sessions. Workout gear is often made of nylon, Spandex, and polyester, which are made of petrochemicals. This, along with harmful chemical additives like bisphenols and phthalates are added to the workout attire, which may cause health issues over time.

A study conducted by the University of Birmingham also pointed to the adverse effects of workout attire on human health. Compounds like brominated flame retardants (BFR), that is used to avoid burning in an extensive range of consumer products like fabrics cause hormonal disruption, thyroid disease, and neurological issues when they come in contact with sweat.

As more population becomes aware of the harmful impact of compounds found in synthetic clothes, opportunities to delve into the skin-friendly activewear section are expected to emerge.

Global workout clothes sales rose at a CAGR of 5.7% from 2020 to 2025. Over the forecast period, the industry is projected to expand at a 6.2% CAGR. Workout apparel brands are expected to have a bright future in urban cities. This is because people living in cities are increasingly undergoing lifestyle deterioration and seeking workout outlets and outfits to restore their health.

Consumers are demonstrating an inclination for sustainable clothing lines. These consumers are consciously choosing workout apparel made with sustainable production practices or made of recycled materials. Brands are thus utilizing recycled plastic fibers, organic cotton, and water-saving dyes to capture the expanding eco-conscious consumer segment.

Brands are also partnering with fitness communities to boost their sales. Apart from this, players are launching built-in features such as temperature regulation or gentle compression to enhance the workout experience. This sensory experience offers a unique selling point to the brand.

Consumers are gaining interest in customized options like adding initials, choosing colors, or even personalized motivational messages on workout clothes, which could be a prompter for workout attire sales. With more innovations underway, this industry is predicted to have a thriving future.

Data corresponding to the key markets in the following table demonstrates the growth potential of the industry in that particular country. Markets in the developed regions are showing signs of maturity. For instance, Germany and the United States are expected to moderately expand over the forecast period, at CAGRs of 4.4% and 3.9%, respectively.

Asia Pacific is now becoming a go-to market for developing and selling workout attire. Expanding pocket limits of people living in countries like India and China is a key driver for workout clothes market growth. Similarly, the surging population of millennials and Gen Zs in these countries beckons foreign investments. India and China are expected to observe growth at 9.4% and 8.7%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 3.9% |

| Germany | 4.4% |

| China | 8.7% |

| India | 9.4% |

| Australia | 6.4% |

The demand for workout clothes in the United States is expanding at a 3.9% CAGR through 2035. The country is also holding a prominent share globally. The market is driven by the impact of the athleisure trend, which was aggressively promoted during the coronavirus outbreak.

Consumers have become used to the idea of comfortable workout clothes like pajamas, sweatpants, and athleisure that can be worn inside and outside of the gym.

Consumers increasingly seek stylish sportswear to add a touch of glamour to their workout sessions. Responding to this demand, brands are introducing chic gym wear that is also comfortable, versatile, and durable. Brands are also catering to the increasing population of women in workout spaces with their new releases.

India is a promising market for workout clothes. The country is estimated to expand at a CAGR of 9.4% over the projected period. Foreign brands are also expected to increase their investments in the country, sensing robust growth in the fitness sector.

New homegrown brands compete for consumer attention by adding fun elements to their sustainable workout gear. Brands are presenting lightweight performance wear and yoga wear made of organic cotton to push the boundaries of fashion and design innovation.

Existing brands like No Nasties are also offering eco-conscious innovations in the Indian sector. The brand has been ahead of its time, offering fair trade, 100% organic, vegan clothing back in 2011. The latest innovation by No Nasties includes all-new yoga wear that includes 100% organic cotton.

China is expected to experience a growth rate of 8.7% over the forecast period. The increasing young population, who take fitness seriously, is pushing the sales of fitness apparel. With a rapidly increasing target sector in the country, foreign companies like Nike, Under Armour, and PUMA are strengthening their efforts in China.

Government involvement in promoting participation in sports is fueling demand for workout attire. Brands operating in China are further offering customization or ready-made fitness apparel to cater to the population residing in China.

This section is dedicated to the top performers in the workout clothes industry. Presently, shirts in the product category are gaining wider appeal, registering a share of 24.8% in 2025. Under the consumer orientation category, the men’s segment is expected to enjoy dominance over the forecast period. In 2025, this segment is predicted to obtain a 44.7% share.

| Segment | Men (Consumer Orientation) |

|---|---|

| Value Share (2025) | 44.7% |

Men’s activewear is expected to hold a share of 44.7% of the workout clothes market. Workout gear designed for men has come a long way from its humble beginnings. From plain and functional designs catering to sports and fitness activities, trends defining men’s fitness clothing have evolved.

Men’s fitness gear has shifted to looser, more relaxed fitted apparel. With the focus shifting toward movement and comfort, the demand for loose-fitting joggers, tees, tanks, and sweatpants has become the go-to option for men.

| Segment | Shirts (Product Type) |

|---|---|

| Value Share (2025) | 24.8% |

Demand for workout shirts is increasing to reach a value share of 24.8% in 2025. The versatility of workout shirts for many exercise styles and intensities is raising sales of shirts. Brands are also releasing functional shirts that are performance and comfort-driven, making functional workout shirts an attractive option for fitness enthusiasts.

Key players are employing various tactics to expand their presence in the market. Brands can be seen developing targeted clothing lines for women and children, who are demonstrating higher participation in sports and fitness activities than before. By targeting these demographics, players can expand their overall customer base.

Growing appeal of athleisure, which combines athletic and leisure wear, is inducing brands to invest more in this segment. Athleisure’s popularity has also accelerated due to celebrity endorsement of this product. Comfort and style associated with athleisure are fueling demand among consumers who value the utility factor as these clothes can also be worn outside of the gym.

The boom of eCommerce platforms, which allows wider product selection and convenient shopping, has also motivated players to increase their online presence. The availability of products on these sites allows customers to easily find workout clothes from their beloved companies or explore new ones that offer more comfort.

Industry Updates

Based on product type, the sector is divided into shirts, pants, and others.

By consumer orientation, the market is trifurcated into men, women, and children.

Different materials employed in workout clothes include nylon, wool, and polyester, among others.

Different sales channels for workout gear include direct sales, franchised stores, specialty stores, online retailers, and other sales channels (mono-brand stores, wholesalers/retailers)

The workout attire is sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global workout clothes market is estimated to be valued at USD 253.0 billion in 2025.

The market size for the workout clothes market is projected to reach USD 461.6 billion by 2035.

The workout clothes market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in workout clothes market are sportswear, casual athleisure and specialized wear.

In terms of product type, shirts segment to command 24.8% share in the workout clothes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Workout Clothes Providers

Pre-Workout Supplements Market Size and Share Forecast Outlook 2025 to 2035

Electric Clothes Drying Hanger Market Trends – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA