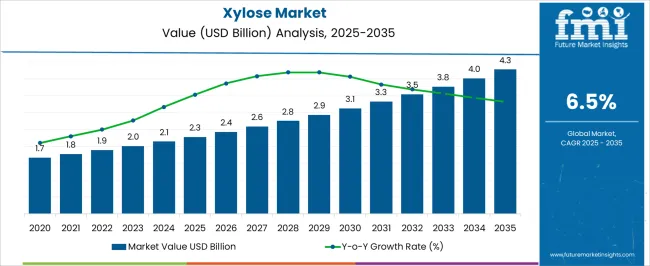

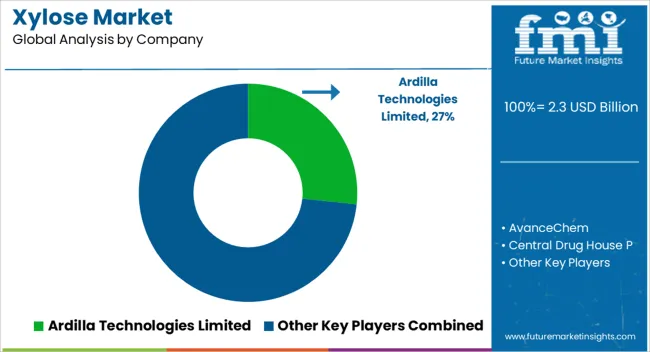

The global xylose market is projected to grow from USD 2.3 billion in 2025 to USD 4.3 billion by 2035, with a CAGR of 6.5%. Volume and price growth will be key drivers of this market's expansion. As demand for natural sweeteners and bioethanol production increases, volume growth is anticipated to be a significant factor, particularly as xylose gains popularity in sugar reduction applications across food and beverage industries. This trend is notably strong in regions like North America and Europe, where consumers are increasingly seeking healthier, low-calorie alternatives to sugar. In these markets, the use of xylose in functional foods and supplements is expected to rise, further fueling growth. Price growth is expected to remain steady, though less pronounced compared to volume growth.

Technological advancements in xylose extraction processes and rising efficiency in production are anticipated to reduce costs, making xylose more accessible for a wider range of applications. This trend is expected to open up new growth opportunities, particularly in emerging markets where demand for low-calorie and functional food products is on the rise. Over the long term, the combination of rising volume and steady price growth will support the xylose market's trajectory, ensuring its continued relevance as a key ingredient in various industries.

| Metric | Value |

|---|---|

| Xylose Market Estimated Value in (2025 E) | USD 2.3 billion |

| Xylose Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The xylose market is strongly influenced by five interconnected parent markets, each contributing to the overall demand and growth. The food and beverage market holds the largest share at 40%, driven by the increasing demand for natural sweeteners and sugar alternatives in products like beverages, snacks, and functional foods. Consumers’ growing health consciousness and preference for clean-label ingredients significantly boost xylose adoption, especially in sugar-free and low-calorie formulations. The bioethanol market accounts for 30%, with xylose being an important feedstock for biofuel production, as governments push for alternative energy sources. The pharmaceutical and nutraceutical sectors contribute 15%, where xylose is used in dietary supplements and other health-related products.

The animal feed market holds a 10% share, driven by the use of xylose as a fiber source in animal diets to promote gut health and digestion. Lastly, the cosmetics and personal care market represents 5%, where xylose is increasingly being incorporated into natural formulations, primarily in skin-care products. The food and beverage, bioethanol, and pharmaceutical sectors account for 85% of the xylose market, highlighting that demand for natural sweeteners, renewable energy sources, and health-related applications is the key driver. Other sectors, while growing, represent a smaller yet significant portion of the market, providing complementary opportunities for expansion.

The xylose market is experiencing steady expansion driven by its increasing application in the food and beverage sector, pharmaceutical formulations, and specialty chemical production. Growing consumer demand for low calorie sweeteners and functional food ingredients has elevated xylose usage, particularly due to its role as a precursor in xylitol production.

Technological advancements in biomass processing and sustainable extraction methods are improving production efficiency and cost competitiveness. Regulatory support for natural sweeteners in multiple regions is further strengthening market potential.

In addition, rising awareness regarding healthier sugar alternatives and their compatibility with diabetic and weight management diets is increasing demand. The market outlook remains favorable as innovation in application development and expansion of sustainable production capacities continue to align with both consumer health trends and environmental objectives.

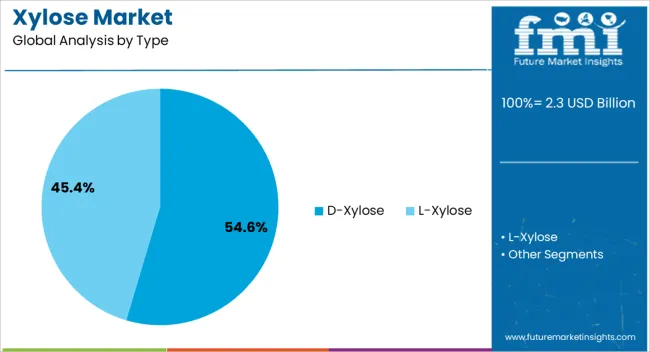

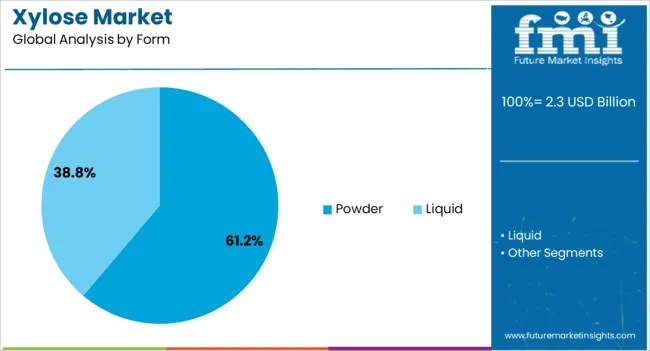

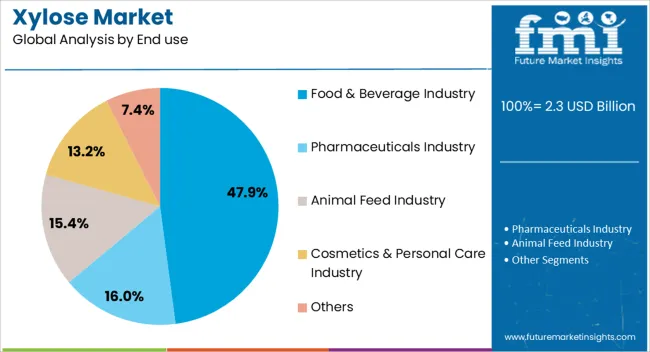

The xylose market is segmented by type, form, end use, and geographic regions. By type, xylose market is divided into D-Xylose and L-Xylose. In terms of form, xylose market is classified into Powder and Liquid. Based on end use, xylose market is segmented into Food & Beverage Industry, Pharmaceuticals Industry, Animal Feed Industry, Cosmetics & Personal Care Industry, and Others. Regionally, the xylose industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The D-Xylose segment is projected to hold 54.60% of total market revenue by 2025 within the type category, making it the leading variant. This growth is attributed to its extensive use in food formulations, pharmaceuticals, and chemical synthesis due to its functional versatility and natural origin.

D-Xylose serves as a key raw material for xylitol production and is valued for its sweetness profile without significantly impacting blood sugar levels. Its inclusion in a variety of food products, ranging from bakery to confectionery, has further strengthened its market share.

Additionally, technological improvements in extraction from lignocellulosic biomass have enhanced supply reliability, contributing to its continued dominance in the type segment.

The powder form segment is expected to account for 61.20% of total market revenue by 2025, emerging as the most significant form category. Its dominance is supported by ease of handling, long shelf life, and versatility in blending with other food and pharmaceutical ingredients.

Powdered xylose offers uniformity in formulation and is widely preferred for industrial applications due to its stable physical characteristics. It facilitates accurate dosing in production lines and is compatible with various processing conditions.

Its adaptability across multiple end uses and cost-effective storage and transport advantages have reinforced its leadership in the form segment.

The food and beverage industry is anticipated to represent 47.90% of market revenue by 2025 within the end use category, positioning it as the foremost segment. This growth is driven by increasing consumer preference for healthier sugar alternatives, product innovation in functional foods, and the rising demand for natural sweeteners in packaged goods.

Xylose’s ability to enhance flavor while maintaining a low glycemic impact has increased its integration into bakery, confectionery, and beverage products. Furthermore, the sector’s focus on clean-label ingredients and reduced-calorie formulations has accelerated adoption.

Regulatory approvals and expanding applications in both mainstream and niche health-oriented products have further consolidated the segment’s leading position.

Xylose demand is driven by natural sweetener trends, bioethanol growth, pharmaceutical applications, and clean-label consumer preferences. These factors collectively shape the market's expansion.

The growing demand for natural sweeteners is a primary driver in the xylose market. With health-conscious consumers increasingly avoiding artificial sweeteners, natural alternatives like xylose are gaining popularity, particularly in food and beverage products. Xylose’s ability to reduce calorie content while maintaining sweetening power makes it a sought-after ingredient in sugar-free, low-calorie, and clean-label products. Moreover, as obesity rates and lifestyle-related diseases rise, people are turning to healthier alternatives for daily consumption. This shift towards natural ingredients continues to fuel the market, especially in regions where sugar consumption is on the decline and the demand for functional, better-for-you products rises.

Xylose plays a critical role in bioethanol and biofuel production, contributing to the growth of renewable energy sources. As governments worldwide tighten regulations on fossil fuel emissions, the biofuel sector has become a significant area of focus. Xylose, extracted from biomass such as wood, corn, and agricultural residues, is increasingly utilized as an essential feedstock in bioethanol production. With the rising demand for cleaner energy sources and the need to reduce greenhouse gas emissions, bioethanol made from xylose has a growing role in supporting energy sustainability. This shift to bioethanol from renewable resources is expected to continue driving xylose demand in the coming years.

Xylose is increasingly being utilized in the pharmaceutical and nutraceutical industries. It is gaining popularity as a functional ingredient due to its prebiotic properties, which support digestive health. As the global consumer base focuses on preventive healthcare and dietary supplements, the use of xylose in formulations for gut health, metabolism support, and immune-boosting products has expanded. Xylose is also being incorporated into formulations of medicines and supplements targeting weight management, blood sugar regulation, and overall well-being. The rise in consumer awareness about health benefits and the growing preference for natural ingredients in medical and wellness products is further fueling xylose's demand in this sector.

Consumer preferences are shifting toward clean-label products, further boosting xylose adoption. Products with minimal ingredients, no artificial additives, and transparency in sourcing are in demand. Xylose, derived from natural sources like wood and corn, is highly regarded in the clean-label movement as it fits the criteria of being a simple, natural ingredient. As brands and manufacturers seek to meet these consumer demands for transparent, healthier ingredients, the market for xylose as a functional sweetener and ingredient is anticipated to grow.

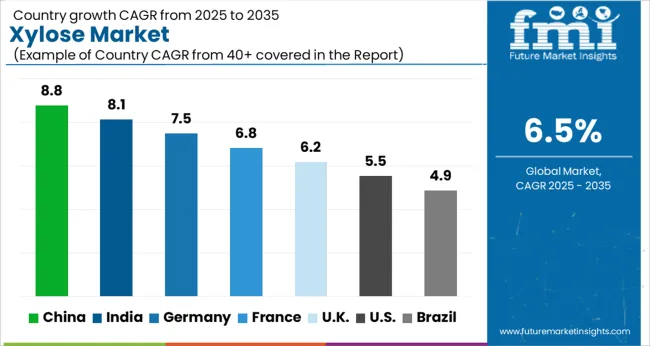

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global xylose market is projected to grow at a CAGR of 6.5% from 2025 to 2035, with China leading at 8.8%, followed by India at 8.1% and Germany at 7.5%. These countries are witnessing strong demand due to the rise in health-conscious trends, the adoption of natural sweeteners, and the growing use of xylose in bioethanol production. The UK and USA contribute 6.2% and 5.5%, respectively, driven by the clean-label movement, bioethanol expansion, and increased demand for xylose in nutraceuticals and sugar-reduced products. The analysis covers over 40 countries, with the key markets highlighted above.

The xylose market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, driven by the increasing demand for natural sweeteners and bioethanol production. China, as the world’s largest producer of agricultural commodities, is well-positioned to source raw materials like corn, wheat, and biomass for xylose extraction. The food and beverage industry in China is rapidly adopting xylose as a sugar alternative in sugar-free and low-calorie products, meeting the rising demand for healthier ingredients. Additionally, China’s bioethanol sector is experiencing substantial growth due to government support for renewable energy initiatives, boosting the demand for xylose as a biofuel. Domestic manufacturers are expanding production capacity to meet both food industry and bioethanol market needs, positioning China as a key player in xylose supply globally.

The xylose market in India is expected to grow at a CAGR of 8.1% from 2025 to 2035. Driven by increasing health awareness, India’s food and beverage industry is embracing xylose as a low-calorie, natural sweetener alternative. With a rising prevalence of diabetes and other lifestyle diseases, demand for sugar substitutes like xylose is gaining momentum, particularly in functional foods and sugar-free products. The Indian government’s initiatives to boost bioethanol production as part of its renewable energy strategy further support xylose adoption. As both the food sector and bioethanol industry continue to grow, India’s xylose market is poised for expansion, with manufacturers focusing on improving production efficiency and reducing costs to meet domestic and global demands.

Germany’s xylose market is projected to grow at a CAGR of 7.5% from 2025 to 2035, driven by a robust demand for natural ingredients and bioethanol. With an emphasis on clean-label products, the German food and beverage sector is increasingly adopting xylose as a sweetener in low-calorie and sugar-free formulations. Germany’s growing bioethanol industry, backed by government policies aimed at reducing carbon emissions, continues to drive demand for xylose as a renewable energy source. The pharmaceutical industry in Germany also sees a growing application for xylose due to its prebiotic properties, particularly in gut health supplements. German manufacturers are investing in cutting-edge production technologies to ensure high-quality xylose and meet the evolving market demands.

The xylose market in the UK is expected to grow at a CAGR of 6.2% from 2025 to 2035. The clean-label movement, which emphasizes natural ingredients in food products, is significantly boosting xylose adoption across the food and beverage sectors. The increasing demand for low-calorie, sugar-free, and functional foods is pushing companies to incorporate xylose into their formulations. Moreover, the UK's growing bioethanol sector, supported by renewable energy policies, continues to create a strong market for xylose as a biofuel feedstock. The UK government’s commitment to reducing carbon emissions and promoting energy efficiency further strengthens the market outlook for xylose. As a result, both domestic consumption and exports of xylose are expected to grow.

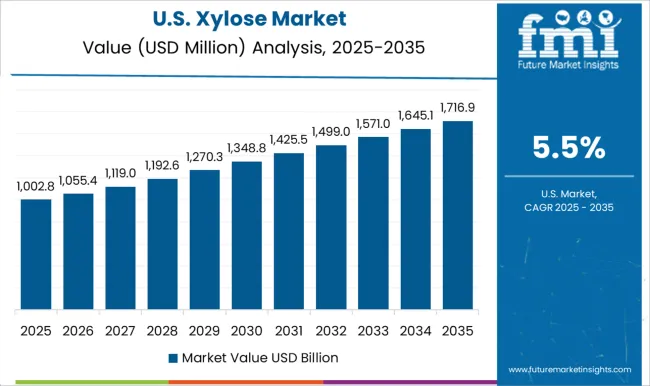

The xylose market in the USA is projected to grow at a CAGR of 5.5% from 2025 to 2035. The country’s food and beverage sector is increasingly adopting xylose due to rising consumer demand for healthier, natural sweeteners. With a focus on reducing sugar consumption, xylose is becoming a key ingredient in low-sugar and sugar-free product formulations, particularly in beverages and snacks. Additionally, the USA is enhancing its bioethanol production capabilities, creating new opportunities for xylose in renewable energy applications. The pharmaceutical and nutraceutical industries are also using xylose for its prebiotic benefits, particularly in products aimed at digestive health and weight management. As both the food and biofuel sectors expand, xylose demand is expected to grow steadily.

The xylose market is moderately consolidated, featuring a mix of global sugar derivative producers, regional specialty chemical companies, and niche ingredient suppliers. Leading players such as DuPont, Shandong Longlive Bio-Technology, Zhejiang Huakang Pharmaceutical, Hebei Huaxu Pharmaceutical, and Archer Daniels Midland dominate through high production capacities, advanced extraction technologies, and extensive distribution networks. These firms primarily compete on product purity, pricing efficiency, and the ability to ensure consistent bulk supply for food, pharmaceutical, and fermentation industries.

Regional manufacturers, especially in Asia-Pacific, strengthen their market presence by offering cost-effective xylose for use in low-calorie sweeteners like xylitol production. Competition is also driven by vertical integration strategies, where companies control raw material sourcing from hemicellulosic biomass to secure stable supply chains. Smaller players compete on specialized grades, faster delivery cycles, and customized packaging formats for niche applications in cosmetics and animal feed. Compliance with food safety regulations and certifications like ISO and HACCP plays a critical role in securing international contracts. Overall, companies that combine scalable production, strong quality control, and global reach are better positioned to capture market share in the competitive xylose market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | D-Xylose and L-Xylose |

| Form | Powder and Liquid |

| End use | Food & Beverage Industry, Pharmaceuticals Industry, Animal Feed Industry, Cosmetics & Personal Care Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ardilla Technologies Limited, AvanceChem, Central Drug House P, Healtang Biotech Co., International Flavour & Fragrance Limited, Penta Manufacturer, Sinofi Ingredients, Spectrum Chemicals, Sure Chemicals Co. Ltd., Shandong Xieli Bio-tech Co., Ltd., Stora Enso, Futaste Co., Ltd., Shandong LuJian Biological Technology Co., Ltd., Anyang City Yuxin Xylitol Technology Co., Ltd., and Jilin Yuxin Biotechnology Co., Ltd. |

| Additional Attributes | Dollar sales trends by product type, market share by region, demand dynamics across sectors (food, bioethanol, pharmaceuticals), growth rate projections, competitive landscape, pricing strategies, and emerging applications. |

The global xylose market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the xylose market is projected to reach USD 4.3 billion by 2035.

The xylose market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in xylose market are d-xylose and l-xylose.

In terms of form, powder segment to command 61.2% share in the xylose market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Xylose Absorption Tests Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA