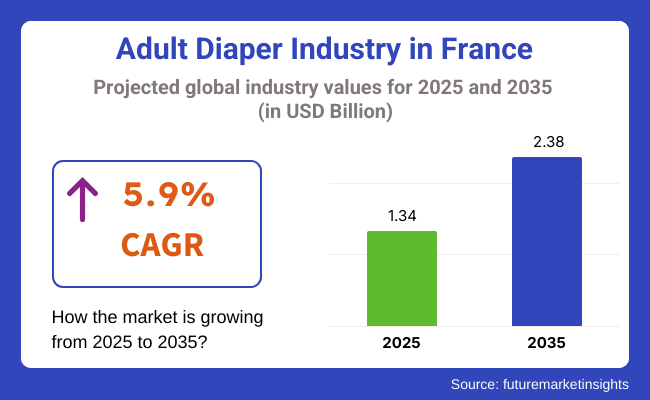

The adult diaper market in France was valued at USD 1.34 billion in 2025 and is expected to grow at a 5.9% CAGR over 2025 to 2035. The valuation is projected to be USD 2.38 billion in 2035. One of the major growth drivers is the French population aging, which is continuously increasing along with enhanced life expectancy and an increased prevalence of age-related health conditions such as urinary incontinence.

There is a mounting social acceptance and increased product availability. With incontinence as a controllable condition of good health rather than a stigma, public health education campaigns and public health programs are helping to generate a more positive consumer climate. This shift is driving adoption within both institutional and independent environments, such as hospitals, nursing homes and independent elderly populations.

Product innovations are enhancing user comfort, discretion, and skin health. French manufacturers and global brands spend on breathable fabrics, odor-eliminating technology and ergonomic designs suited for both men and women. These aspects are particularly significant in winning customer loyalty, where emphasis is put on quality.

Retailing is also changing, with an ever-larger share of adult diapers now being purchased over the internet. Online retailing is making it easy and discrete to buy a wider range of products, especially among the elderly and carers. Subscription models are also emerging, driving retention and frequency of purchase.

As France's health system continues to focus on elder care and chronic disease management, demand for adult diapers will continue to increase steadily. Government subsidies and reimbursement for medically necessary incontinence products under national health insurance will continue to contribute significantly to keeping costs affordable.

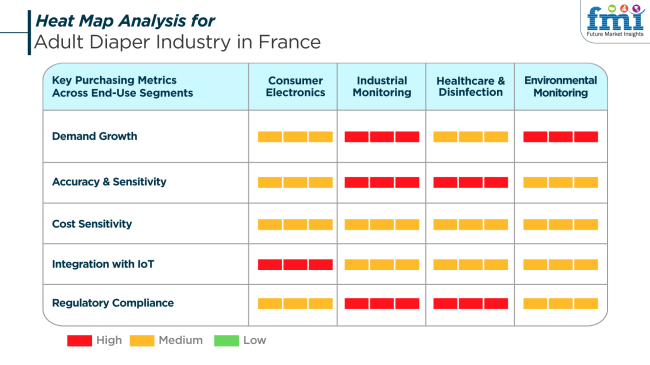

Within the disinfection and medical category, adult diapers have an important role in rehabilitative and geriatric care. Purchasing decisions revolve around ease of use, skin friendliness and absorption performance. Product reliability and medical-grade hygiene compliance levels are especially paramount in hospitals and care homes. Environmental concerns are also affecting purchasing behavior. Due to France's rigorous waste control policies on disposable items, brands are choosing biodegradable materials and recycling programs.

Consumer electronics now have a modest but increasing impact on the adult diaper industry with the introduction of sensor-detecting smart diapers for online wetness detection. While still an emerging stage technology, these gadgets can potentially revolutionize geriatric care as they reduce complications to the skin and the response time of caregivers.

Challenges in the industry include regulatory risk and environmental impact. With further pressure being exerted on landfill waste and single-use plastics, stricter regulation will potentially increase manufacturing costs for the traditional disposable diaper, compelling companies to accelerate the movement toward more eco-friendly options.

The second risk is demographic dependence. While an aging population underpins growth, it leaves the industry vulnerable to shifts in healthcare spending, long-term care policy, and pension reform. Any restriction on government support for incontinence-related healthcare items would dampen affordability and demand. Fragmentation is another challenge. With numerous domestic and international brands competing in retail and healthcare channels, differentiation increases increasingly through innovation, branding, and supply chain reliability. Companies that are not high-performance and price-competitive will find it difficult to retain a share in France.

Between to 2020 and to 2024, the French adult diaper market showed consistent growth, fueled by the aging population and growing concern over incontinence. There was a trend towards more inconspicuous, comfortable, and skin-friendly adult diapers, as manufacturers were pushing innovations tailored to the needs of active seniors. Moreover, the growth of online platforms for adult diapers made it easier for consumers to acquire products discreetly and conveniently.

During the forecast to 2025 to 2035,advances in technology will see the creation of smart diapers that contain sensors that track moisture and skin conditions, feeding real-time information to caregivers and healthcare professionals. Sustainability will be a priority, with producers taking steps toward the use of biodegradable materials and green manufacturing practices. Additionally, the inclusion of adult diapers as part of full-fledged eldercare solutions will improve the life quality of consumers, making such products integral to overall healthcare solutions.

Comparative Market Shift Analysis: Adult Diaper Industry in France 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Need for comfort, discretion, and skin-friendly products. | Technological Integration: Presence of smart diapers with real-time monitoring sensors. |

| Distribution Channels: Growth of e-commerce platforms with discreet buying facilities. | Integrated Care Solutions: Incorporation of adult diapers into integrated eldercare and healthcare packages. |

| Consumer Demographics: Targeted primarily at older people. | Expanded Demographics: A Wider user group encompassing people with temporary incontinence and mobility problems. |

| Sustainability Efforts: Early initiatives towards eco-friendly materials and packaging. | Sustainable Innovations: Introduction of biodegradable diapers and sustainable manufacturing processes. |

| Growth Drivers: Aging population and rising awareness of incontinence. | Integrated Advanced Healthcare: Partnership with healthcare professionals for individualized incontinence management solutions. |

The French consumer economy is experiencing steady growth in the adult diaper business with an aging population, enhanced healthcare systems, and changing social attitudes towards incontinence. Being one of the top aging care facilities countries in Europe, France offers a good business climate for high adult incontinence product consumption.

The growing age group of 65 and over is also accountable for the increasing demand for products across home care and institutional facilities. Along with the population movement, increased awareness and proactive management of incontinence conditions are also making consumers receptive to using such hygiene products. Product attribute innovation-i.e., breathability, odor control, and skin-sensitive construction-is also enabling brands to address user comfort and mobility requirements.

Public health programs and insurance reimbursement have also made the products more accessible, especially for low-income and elderly consumers. Rising environmental awareness is driving demand for sustainably sourced, biodegradable adult diapers that present the promise of brand differentiation through green offerings.

In addition, France's dense retail and pharmacy distribution networks provide broad coverage in urban and rural areas. With increasing demand being generated by both non-medical and medical uses, there seems to be good growth in the future since there is ongoing investment in localized production and customized marketing efforts by the producers.

Online outlets are expected to dominate the industry for adult diapers by to 2025, with a 37% share, followed by pharmacies and drugstores, with 30%.This trend results from the continuing expansion of online retail driven by consumer demand for discreet shopping, home delivery, and recurring purchases essential for adult incontinence products.

Online platforms such as Amazon.fr, Santédiscount, and the various store-specific TENA Direct or Hartmann Direct type establishments have their service package complete with size guides, user reviews, and subscription models. All these become much easier and more comforting for older people and their caregivers to access and rely on. Subscription purchases made online, such as from Ontex's iD Direct, also prevent users from running out of products.

Cocoon center and Shop-pharmacie.fr, among other niche health platforms, cater to special needs with such products as skin-sensitive or environmentally friendly types of diapers, e.g., Abena and Lille Healthcare, which appeal to the environmentally conscious or dermatologically sensitive consumer alike. This digitization is critical in accessing on-the-go services in rural and mobility-constrained populations.

Pharmacies and drugstores account for about 30% of the market. They are still essential for consumers who need professional advice, especially patients with conditions that require management, such as post-operative recovery and chronic incontinence.

The private networks of French pharmacies, which include Pharmacie Lafayette, Aprium, and Citypharma, provide such private consultations and trials with these items, ideal for the first buyers or users with specific health concerns. High-end lines of medical brands such as iD Expert and TENA ProSkin are stocked by the pharmacies, which doctors quite often recommend. Supermarkets, however limited in their range, are used for impulse or bulk purchases, with Carrefour and Leclerc offering store-brand options at competitive prices.

For to 2025, pant/pull-up style adult diapers are expected to dominate at 38% of the French adult diaper market, followed by flat style at 30%.Pant-style diapers offer consumers ease of use and discretion, thus garnering strong interest, especially among active adults or those suffering from mild to moderate levels of incontinence.

The elastic waists and underwear-like fit appeal to elderly users in need of independent dressing and doffing without assistance. The most selling brands found in pharmacies, online, and supermarkets are TENA pants, Moorey pants, Under, and Hartmann MoliCare Mobile. These different lines provide various levels of absorbency, skin-friendliness, and odor control attributes, thereby appealing to the ever-growing aging population in France that values dignity and independence.

The flat style holds a firm 30% of the revenue share, especially in intensive care, prolonged care, or long-term nursing care, due to absorbency rates suitable for bedridden or semi-mobile patients. This skill set also favors caregiver replacement, as they include tapes or velcro.

Institutional care has seen the widespread use of Ontex iD Expert Slip or Abena Slip for their excellent performance regarding long wear, leakage control, and other limitations. Partial reimbursement from the French healthcare system for incontinence products favors flat-style usage in clinical settings even more.

The flat style continues to be very useful and an essential type for professional care settings. Pant-style diapers, in contrast, have gained acceptance in institutional and retail sections due to ease of handling, comfort, and growing customer preference for discreet and mobility-friendly solutions. Adult hygiene preferences are consistently geared towards lifestyle-compatible innovations.

The adult diaper industry in France is undergoing a gradual evolution amid the slow maturity of the industry, with more influence from institutional demand, home care, and an aging population. Competition has heightened with the entry of global hygiene giants and regional companies investing in innovation-based superior absorbency, discretion, and eco-friendly design. The other investment avenue includes retailing with difficulty awareness programs to improve accessibility and remove stigma.

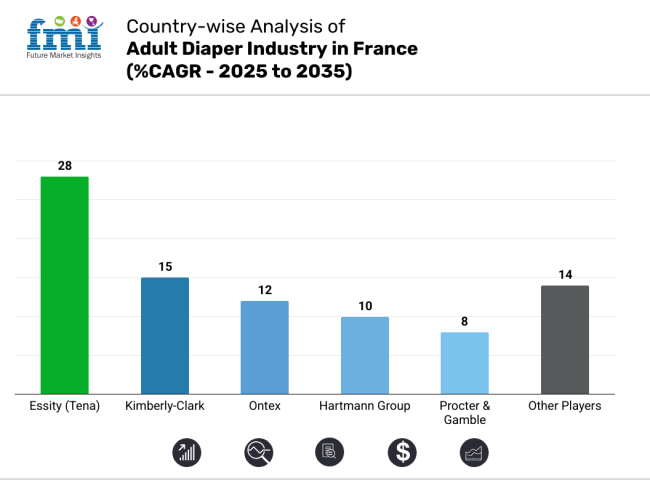

With Tena, Essity has been successfully penetrating the market through hospital affiliation and solid B2C channels, along with a very wide-ranging adult incontinence portfolio for varied mobility. Kimberly-Clark markets its Depend brand across Western Europe, touting skin-friendly, breathable, highly absorbent products. Procter & Gamble has re-entered adult care in selected European countries, including France, with Always Discreet, a brand focusing on women, discretion, and odor lock.

Ontex continues to drive a regional presence back with diversification into private labels in France, supported by relevant retailer partnerships and competitive production circumstances. Hartmann Group continues to lead the clinical segment with MoliCare, which provides a full range of pads and slips plus digital management tools for long-term care. At the same time, companies such as Abena and Domtar have seriously broadened the scope of their institutional presence by marketing biodegradable diapers and skin-friendly solutions that respect sustainability.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Essity (Tena) | 28-32% |

| Kimberly-Clark | 15-18% |

| Ontex | 12-15% |

| Hartmann Group | 10-13% |

| Procter & Gamble | 8-11% |

| Other Players | 14-18% |

Key Company Insights

Essity, through its flagship Tena brand, holds a leading 28-32% share of the French adult diaper market. Its success is rooted in broad product depth, from light incontinence pads to full protective underwear and strong relationships with healthcare providers and pharmacies. Tena’s expansion into digital monitoring solutions for care facilities also supports its dominance in institutional channels.

Kimberly-Clark holds about 15-18% of the market because of its ongoing innovation in absorbent core technology and skin wellness within the Depend product line. Ontex closely follows with a share of 12-15%, which is driven by its ability to provide tailored solutions for both branded and private-label products. Additionally, its localized production capabilities and agile supply chain give it significant advantages in cost-sensitive procurement environments.

Hartmann Group, with an estimated 10-13% share, continues to lead in medical-grade adult incontinence care. Its MoliCare brand is known for clinical reliability and comfort, appealing to France’s elder care institutions. Procter & Gamble captures 8-11% through its Always Discreet product line, which targets active, aging consumers via pharmacies and mass retail, emphasizing discretion and aesthetics. These leaders are continually differentiating through innovation, medical partnerships, and product segmentation that is aligned with demographic needs.

The segmentation is into Disposable Diapers and Reusable Diapers.

The segmentation is into Pant/Pull Ups Style, Pad Style, Flat Style, and Others.

The segmentation is into Small, Medium, Large, X-Large, and 2XL.

The segmentation is into Male, Female, and Unisex.

The segmentation is into Hospitals/Health Aid Centers, Hypermarkets/Supermarkets, Specialty Stores, Pharmacy/Drug Stores, Online Retailers, Direct to Consumers, Third Party Consumers, and Other Sales Channels.

The industry size is expected to reach USD 1.34 billion in 2025.

The market is expected to grow to USD 2.38 billion by 2035.

The market is expected to grow at a CAGR of 5.9% during the forecast period.

Online outlets are a significant distribution channel for adult diapers in France.

Major players in the market include eBay, SCA Hygiene Products, Essity, Kimberly-Clark, Procter & Gamble, Ontex, Domtar, Hartmann Group, and Medline Industries.

Table 1: Business Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 2: Business Volume (Million Units) Analysis By Product Type, 2019 to 2034

Table 3: Business Value (US$ Million) Analysis By Style, 2019 to 2034

Table 4: Business Volume (Million Units) Analysis By Style, 2019 to 2034

Table 5: Business Value (US$ Million) Analysis By Size, 2019 to 2034

Table 6: Business Volume (Million Units) Analysis By Size, 2019 to 2034

Table 7: Business Value (US$ Million) Analysis By Consumer Orientation, 2019 to 2034

Table 8: Business Volume (Million Units) Analysis By Consumer Orientation, 2019 to 2034

Table 9: Business Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 10: Business Volume (Million Units) Analysis By Sales Channel, 2019 to 2034

Table 11: Business Value (US$ Million) Analysis By Region, 2019 to 2034

Table 12: Business Volume (Million Units) Analysis By Region, 2019 to 2034

Table 1: Business Value (US$ Million) Analysis By Product Type, 2019 to 2034

Table 2: Business Volume (Million Units) Analysis By Product Type, 2019 to 2034

Table 3: Business Value (US$ Million) Analysis By Style, 2019 to 2034

Table 4: Business Volume (Million Units) Analysis By Style, 2019 to 2034

Table 5: Business Value (US$ Million) Analysis By Size, 2019 to 2034

Table 6: Business Volume (Million Units) Analysis By Size, 2019 to 2034

Table 7: Business Value (US$ Million) Analysis By Consumer Orientation, 2019 to 2034

Table 8: Business Volume (Million Units) Analysis By Consumer Orientation, 2019 to 2034

Table 9: Business Value (US$ Million) Analysis By Sales Channel, 2019 to 2034

Table 10: Business Volume (Million Units) Analysis By Sales Channel, 2019 to 2034

Table 11: Business Value (US$ Million) Analysis By Region, 2019 to 2034

Table 12: Business Volume (Million Units) Analysis By Region, 2019 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

France Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

France Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

France Centrifugal Pumps Market Trends – Size, Share & Growth 2025-2035

France Power Tool Market Growth – Demand, Trends & Innovations 2025-2035

France Sports Tourism Market Report – Demand, Trends & Innovations 2025-2035

France Outbound Travel Market Analysis – Trends, Growth & Forecast 2025-2035

France Wine Tourism Market Insights – Growth, Demand & Trends 2025-2035

France Space Tourism Market Insights – Growth, Demand & Trends 2025-2035

France Educational Tourism Market Analysis – Trends, Growth & Forecast 2025-2035

France Hostel Market Analysis – Growth, Demand & Forecast 2025-2035

France Extended Stay Hotel Market Outlook – Growth, Trends & Forecast 2025-2035

France Culinary Tourism Market Insights - Growth & Forecast 2025 to 2035

France Sleep Apnea Diagnostic Systems Market Insights – Size, Share & Demand 2025-2035

France Swab and Viral Transport Medium Market Report - Growth, Trends & Forecast 2025 to 2035

France Cell Culture Media Bags Market Trends – Size, Share & Growth 2025-2035

France Foley Catheter Market Trends – Demand, Growth & Forecast 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Women's Luxury Footwear Market Outlook – Size, Share & Innovations 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA