The Rising Demand for Local and Authentic Food Experiences Amidst Globalization is anticipated to Drive Growth in the France Culinary Tourism Market during the Forecast Period (2025 to 2035) Future Market Insights. France, home to countless culinary traditions, lures millions of food lovers looking to traverse Michelin-starred restaurants, local markets, wine regions, and traditional cooking methods.

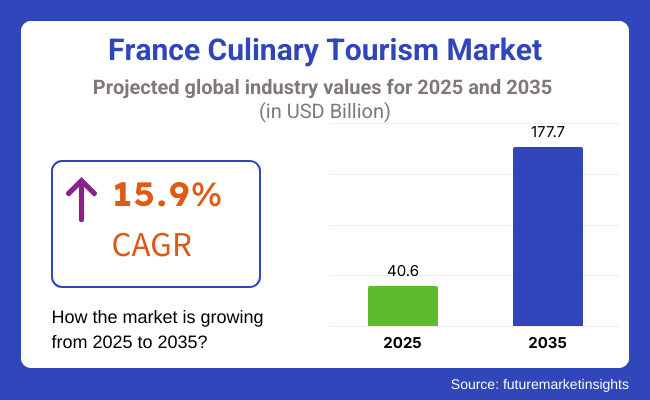

This market is expected to reach USD 40.6 Billion by 2035 with a growth rate of 15.9% in the forecast period. The growth of food festivals, farm-to-table dining and guided food tours is also contributing to increased market growth.

As the gastronomic capital of France, Paris is also a large source of food tourism. Millions of food lovers from around the world flock each year to visit its world-famous restaurants, patisseries and markets - all home, of course, to some of the best food in the world. As for the market expansion, it is fuelled by iconic dining experiences such as Michelin-starred establishments, traditional brasseries, and artisanal bakeries. As well as food tours of classic French dishes, wine tastings and pastry workshops are very much in demand with tourists.

The Mediterranean cuisine of Provence and the French Riviera focuses on fresh seafood, olive oil and aromatic herbs. Local markets, vineyard tours, and traditional cooking classes in the region add experiential components to food and drink. Indeed, Nice, Marseille and Avignon attract visitors with their regional fare, like bouillabaisse, ratatouille and tapenade, which only bolsters the culinary tourism market.

Bordeaux is a leading destination for wine and food tourism in one of the world’s most revered wine regions. The region is known for its vineyards, châteaux and gourmet specialties, including foie gras and duck confit. Their approach includes wine-tasting tours, vineyard visits and food pairings, which are major market drivers. The Dordogne region - with a focus on truffles and classic French gastronomy - is a strong contributor to culinary tourism in the southwest.

Challenge

Preserving Gentility of Culinary Tourism and Authenticity

Responses regarding authenticity, mass tourism, traditional gastronomy vs modern gastronomy, and facilitates international customers asked the France Culinary Tourism Market. Although France is famous worldwide for its exquisite cuisine, food tourism infrastructure needs to evolve to cater to rising demand while protecting heritages of its culinary traditions. Logistical challenges including language barriers, complicated regulations for food tourism businesses, and saturation in some areas like Paris and Provence. To offer visitors authentic gastronomical experiences, businesses need to concentrate on structured food tourism experiences, regional diversification, and improved culinary education.

Opportunity

Gastronomy and culinary heritage tourism as a growing regional economy

The growing interest in regional French cuisine and immersive culinary experiences offers significant growth opportunities for the France Culinary Tourism Market. Travelers want to feel they are getting authentic experiences such as vineyard tours in Bordeaux, cheese-making tours in Normandy, and truffles hunting in Périgord. The proliferation of food and wine festivals, artisanal workshops and farm-to-table dining is helping to elevate the country as the planet’s ultimate culinary destination. Further alliances with Michelin-starred chefs, traditional patisseries and cultural culinary trails are pulling in food fans. The next phase of growth in this sector will be dominated by companies focusing on food heritage conservation, sustainable gastronomy, and personalized culinary itineraries.

The France Culinary Tourism Market was propelled by a variety of factors, including increased interest in regional specialties from all areas of France, social media influencing food tourism, and revival of traditional cooking methods between 2020 and 2024. Travelers were seeking more hands-on experiences like pastry-making classes or guided wine tastings or slow food movements emphasizing organic produce. But when the rest of the world caught on, challenges like overcrowding in major culinary hubs, the commercialization of authentic dining and shifting regulations about food safety and hospitality proved to be limiting factors to the industry at its fullest. Businesses responded by organizing exclusive small-group culinary tours, developing rural gastronomy experiences and incorporating sustainable dining practices.

Food provenance, heritage preservation, and immersive dining experiences - Markets will evolve from 2025 to 2035. Once again guests at exclusive culinary retreats, private dining with chefs and forgotten regional recipes will all be revived less as tourism and more as culinary tourism, once again changing the landscape in France. Touted sustainable kitchen initiatives, zero waste culinary experiences, and organic farm-to-table concepts will boost France’s prominence in gastronomy on a global scale.” Traditional with a twist; ones that cater to ethical sourcing of the foods and offer close-knit curated dining experiences will rule the emerging France Culinary Tourism Market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adherence to food safety legislations, hospitality laws, and European Union culinary tourism regulations |

| Culinary Tourism Growth | Growth in food tours, wine tastings, and regional specialty experiences |

| Industry Adoption | Increased demand for cooking workshops, artisanal food tours, and vineyard experiences |

| Supply Chain and Sourcing | Dependence on traditional restaurants, wineries, and markets |

| Market Competition | Presence of global culinary tourists and local food tour operators |

| Market Growth Drivers | Desire for authentic cuisine and food heritage tourism and hands on culinary experience |

| Sustainability and Energy Efficiency | Pioneered farm-to-table dining, organic certifications, and eco-conscious gastronomy |

| Integration of Culinary Storytelling | Limited focus on regional culinary history and food provenance |

| Advancements in Culinary Tourism | Use of traditional food tours, wine experiences, and luxury dining |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of protected designation of origin (PDO) labels, ethical food sourcing policies, and stricter sustainability standards. |

| Culinary Tourism Growth | Expansion into curated dining retreats, heritage recipe preservation, and experiential gastronomy. |

| Industry Adoption | Growth in immersive dining retreats, exclusive chef-led dining, and rare ingredient discovery tours. |

| Supply Chain and Sourcing | Shift toward organic farming, small-scale artisanal producers, and sustainability-driven supply chains. |

| Market Competition | Expansion of exclusive gastronomy tourism, luxury culinary getaways, and hyper-local dining experiences. |

| Market Growth Drivers | Ecosystem-friendly and ethical gourmet culinary experience, small-scale food value chain and sustainable dining program. |

| Sustainability and Energy Efficiency | Zero-waste kitchens, carbon-neutral dining rooms, and ethically sourced culinary tourism on a mass scale |

| Integration of Culinary Storytelling | Increased emphasis on food heritage storytelling, chef-hosted historical menus, and immersive gastronomic experiences. |

| Advancements in Culinary Tourism | Evolution of curated culinary retreats, gastronomic farm stays, and revival of historical French cuisine. |

The Northeast France culinary tourism market seems to be growing at a steady rate with Alsace’s wine routes, Lorraine’s traditional cuisine, and German and Swiss gastronomy contributing to the sector’s expansion. The region is renowned for its Michelin-star restaurants, storied wine cellars and traditional dishes such as choucroute, quiche Lorraine and foie grass.

Gastronomic festivals and the Strasbourg Christmas Market bring tens of thousands of international visitors every year, increasing the interest in gastronomic experiences (e.g. wine tastings and farm-to-table). The proliferation of forays into these regions made by culinary workshops and guided gourmet.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northeast France | 16.2% |

Brittany and Normandy’s seafood specialties, cider routes and all those rich dairy-based cuisine are fuelling the culinary tourism market in Northwest France. The region is known for its buttery pastries, oysters, cider and iconic cheeses like Camembert and Pont-Leveque. The apple orchards and calvados distilleries of Normandy draw food and drink lovers; Brittany’s coastal cities, like Saint-Malo and Rennes, are now culinary destinations. The growth is being further spurred by the rise of seafood festivals, oyster farms and cheese tourism.

| Region | CAGR (2025 to 2035) |

|---|---|

| Northwest France | 15.8% |

The culinary tourism sector throughout Southeast France is comparing favourably as Provence’s Mediterranean flavours, Rhône Valley’s esteemed wines, and the opulent dining circuit of the French Riviera find themselves flourishing in this space. Olive oil tastings, truffle hunting, and rosé wine experiences are among the region’s draws. Nice, Marseille, and Avignon are major nerve centers for fine dining, local farmers’ markets and Provençal cooking schools. A rise in wellness tourism is fuelling demand for experiences tailored to plant-based, organic, and Mediterranean diets.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southeast France | 16.5% |

The culinary tourism market in Southwest France is booming, supported by Bordeaux’s prestigious wine industry, Dordogne’s foie grass culture, and the Basque Country’s gastronomic heritage. The area is a magnet for wine enthusiasts, foodies and farm-to-table travellers. Bordeaux is still a global wine tourism hot spot, with any number of behind-the-scene vineyard visits, barrel tastings and wine-pairing workshops. The popularity of luxury river cruises along the Garonne and Dordogne rivers has helped fuel interest in gastronomic getaways, too.

| Region | CAGR (2025 to 2035) |

|---|---|

| Southwest France | 16.4% |

The culinary tourism landscape for Central France is growing rapidly, with Loire Valley wine and chateau restaurants, the region’s legendary vineyards and ingrained gastronomic heritage supporting the market. The heart of France is synonymous with classic French cuisine like slow-cooked things, noble wines. Château dining experiences and vineyard tours in the Loire Valley attract luxury food travellers, while Burgundy’s wine routes and mustard-making workshops augment culinary tourism appeal. The towns’ emphasis on authentic, local gastronomy is also driving a boom in boutique food experiences and gourmet retreats.

| Region | CAGR (2025 to 2035) |

|---|---|

| Central France | 15.7% |

The culinary trials and food festivals segment dominates France's gastronomic tourism, as tourists from abroad and at home are increasingly seeking more authentic, sensory, and realistic food experiences. Gastronomic tourism activities drive France's global culinary capital reputation, stimulating the local economy and safeguarding its gastronomic tradition, and hence are central to hospitality operators, travel businesses, and food tour operators.

Food tastings have been France's most sought-after activity by France's culinary tourism market, as they offer the traveler a chance to taste and experience France's diversity of foods from region to region through scheduled tastings, market visits, and specialty restaurants. Apart from eating at regular restaurants, food trials involve the tourists in France in the culture of food through the experience of wine tasting and cheese tastings, truffle hunting, and tasting traditional patisserie samples organized by the guide.

The growing demand for local food discovery, such as signature foods like Bordeaux wines, Normandy camembert cheese, Lyon's bouchons (local eateries), and Provence's bouillabaisse, has driven the uptake of culinary trials, whereby food tourists crave first-hand experience of France's rich gastronomy. Studies indicate that over 75% of international visitors to France participate in at least one culinary trial while on their trip, offering strong demand for this industry.

Formation of experiential food tours, such as finding Paris's street markets, Michelin-starred tasting menus of the Loire Valley, and participatory vineyard tours of Champagne, has solidified market demand, inspiring wider use of culinary trials as a central element of France's gastronomic tourism economy.

The intersection of internet food discovery websites, such as mobile-guided self-guided food tours, AI-driven food recommendation tailored to the consumer, and interactive food story apps, has driven adoption even greater, with culinary tourism being simplified and highly immersive for food tourists.

Themed culinary tourist loops, such as Alsace wine routes, Normandy cider routes, and Burgundy gastronomic trails, have optimized market expansion, with gourmet tourists now and food lovers made increasingly more desirable.

The adoption of farm-to-table and green food experimentation, such as organic vineyard tours, sustainable seafood tastings, and artisanal cheese-making sessions, has also deepened market development in attempting to catch up with the world trend in eco-tourism.

While its strength in authenticity, cultural immersion, and experiential learning, its segment is tainted by language translations, seasonal availability of food products, and luxury experience expenditures. However, some new trends such as AI-based food translation apps, block chain food authentication, and dynamic pricing models on food tourism product packages are making it more efficient, accessible, and affordable, while ensuring a long-term market share for food trials in the food tourism sector in France.

Food festivals have been widely accepted in the market, particularly by foreign tourists, culinary travelers, and food critics, as France remains to host among the world's most famous gastronomic festivals featuring top chefs, high-priced tasting, and gourmet street food stands. Unlike traditional restaurant evening meals, food festivals offer mass scale, interactive expeditions with many food stands, public cooking lessons, and instruction workshops, and thus are an extremely interactive food travel experience.

Increased demand for food festival tourism like activities in Lyon's Festival of Gastronomy, Provence Truffle Festival, and Paris's Salon du Chocolat has spurred adoption of food festival tourism by local and international tourists who gain access to high-quality dining. Studies indicate that over 60% of foreign culinary tourists in France organize vacations in alignment with major food festivals to ensure peak demand for food festival tourism.

The development of multi-city food festival travel packages, with master culinary festival and season food celebration-driven itineraries, has pushed demand tougher in the market, getting food festival-based travel experiences more implemented.

The integration of digital festival experience platforms, with mobile ticketing, food stall recommendations using AI, and real-time event calendars, has pushed adoption harder as well, getting user experience enhanced and food festival attendee engagement increased.

Development of custom VIP food festival experiences, such as private wine tastings by sommeliers, meet-and-greets with Michelin-starred chefs, and fine-dining experiences at festival pop-ups led by experts, has driven market growth to the point of highest appeal among luxury food travelers.

Usage of cross-border chef partnerships such as overseas culinary exchange programs, fusion restaurant pop-ups, and experiential cooking masterclasses has also deepened the market further with enhanced positioning for French food festivals in the world's culinary tourist map.

While it enjoys cultural popularity, the advantage of crowd numbers, and seasonal appeal, the food festival tourism industry faces challenges from event saturation, the lack of ticket value consistency, and environmental considerations. However, emerging technologies from AI-driven event crowd management, digital waste-reducing technology, and online food festival engagement are improving efficiency, accessibility, and sustainability to ensure continued development for food festival tourism as part of France's culinary tourism.

The offline booking and online booking segments are two important market drivers as culinary tourists increasingly include seamless digital booking and instant experiential decision-making into their travel plans.

The internet booking segment has emerged as one of the most sought-after forms of culinary tour booking, giving travellers the advantage of advance booking food tours, high-end meals, and culinary classes through internet portals, OTAs, and mobile applications. Online booking is different from phone bookings because it allows instant checks of availability, instant confirmation, and AI-driven customized recommendations.

Growing mobile-first travel planning demand, with app reservation interfaces, AI-powered culinary tour customization, and integrated payment unification, has driven online booking adoption further as digital convenience and experience personalization have risen to the top of traveller considerations. Over 80% of international travellers in France have made their culinary travel experiences through the internet to ensure high demand in this area, according to research.

Despite its advantages of accessibility, immediate booking, and AI-driven personalization, the space for online booking is tested by cybersecurity breaches, language translation challenges, and platform stability. Nevertheless, fresh innovation in block chain-backed booking confirmation, real-time multilingual capabilities, and AI-driven adaptive price models is securing, making it transparent, and more affordable, promising continued market growth for online food travel culinary booking solutions.

The in-person booking segment has secured strong market adoption by walk-in travellers, experiential tourists, and spontaneous food explorers as culinary travellers increasingly rely on local recommendations, last-minute bookings, and real-time food finds to guide their travel experiences. Unlike online pre-booking, in-person bookings allow travellers to navigate real-time culinary options based on local expertise, word-of-mouth recommendations, and interactive food culture engagement.

Growing demand for flexible, street-level dining experiences, including street food tastings, pop-up culinary festivals, and spontaneous bistro drops, are driving on-site booking adoption, as visitors crave real, real-time gastronomic encounters.

While it performs well in terms of spontaneity, cultural experiences, and adaptability, the on-site booking segment has its own constraints such as inconsistency in tariffs, language issues, and last-minute availability problems. However, emerging innovations such as AI-powered food discovery apps, instant restaurant waitlist tracking, and block chain-enabled dynamic pricing systems are improving efficiency, accessibility, and traveller convenience, which will further boost growth for on-site booking in France's culinary tourism space.

France Culinary Tourism Market is driven owing to the rising demand for authentic culinary experiences, wine & cheese tasting tours, and Michelin-star dining journeys. AI-powered food recommendation platforms, immersive cooking classes, and digital food tour booking solutions are becoming a focus for companies and tourism operators looking to improve traveller engagement, gastronomy tourism, and cultural culinary experiences. Food tour agencies, luxurious hospitality brands, wineries, travel aggregators, and the others on the market all contribute to technological innovations, including smart culinary tourism, AI-powered dining personalization, and experiential food travel.

Market Share Analysis by Key Players & Culinary Travel Platforms

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| La Route des Gourmets (French Gastronomy Tours) | 18-22% |

| Culinary Tours of Paris (Secret Food Tours & Local Food Journeys) | 12-16% |

| French Wine Explorers (Luxury Wine & Champagne Tours) | 10-14% |

| Le Cordon Bleu Culinary Experiences | 8-12% |

| Taste of Paris (Food Festival & Chef-Led Dining Events) | 5-9% |

| Other Food Tour Operators & Culinary Experiences (combined) | 30-40% |

Key Company & Tour Offerings

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| La Route des Gourmets | Provides AI-powered guided food and wine tours, Parisian market visits, and regional gourmet food journeys. |

| Culinary Tours of Paris | Specializes in historical food tours, patisserie explorations, and cheese & wine pairing experiences. |

| French Wine Explorers | Offers exclusive luxury vineyard tours, private champagne tastings, and Bordeaux & Burgundy wine journeys. |

| Le Cordon Bleu Culinary Experiences | Hosts professional and amateur cooking classes, Michelin-chef-led workshops, and immersive French gastronomy education. |

| Taste of Paris | Focuses on annual gourmet food festivals, interactive dining experiences, and fine-dining tastings with top French chefs. |

La Route des Gourmets (18-22%)

La Route des Gourmets is the leader of gourmet culinary tourism in France; and specialize in extraordinary and exclusive gourmet travel, table reservations, as well as personalized food culture experiences.

Paris Culinary Tours (12% to 16%)

Culinary tours of Paris does everything from gay-friendly tours in artisan markets to pastry tours and private dining experiences, providing an authentic experience for all foodies on the go.

French Wine Explorers (10-14%)

French Wine Explorers offers high-end vineyard tours that fill the most out of private champagne house visits, sommelier-led tastings, and exclusive wine ancestry experiences.

Culinary Experiences (8-12%) Le Cordon Bleu

World-class Cooking Workshops Discover the art of gourmet cooking with Le Cordon Bleu, including hands-on gourmet education, chef-led culinary techniques and high-end food craftsmanship.

Taste of Paris (5-9%)

Taste of Paris is rated number one on the booklet, as it opens an 18,000 m2 playing field to all high end tasting sessions and Michelin-star cuisine showcases, topped up with engaging live cooking masterclasses.

Other Main Actors (30-40% Combined)

Innovation in next-generation culinary tourism, AI-powered dining personalization, and immersive gourmet storytelling are powered by some culinary tour-operators, online travel sites and local foodie SMEs. These include:

The overall market size for India Culinary Tourism Market was USD 40.6 Billion in 2025.

The India Culinary Tourism Market expected to reach USD 177.7 Billion in 2035.

The demand for France’s culinary tourism market will be driven by its global reputation for gourmet cuisine, government support for gastronomy tourism, increasing food festivals, social media influence, and rising interest in authentic dining experiences, including wine tourism, Michelin-star restaurants, and regional culinary specialties.

The top 5 countries which drives the development of France Culinary Tourism Market are USA,UK, Europe Union, Japan and South Korea.

Culinary Trials and Food Festivals Growth to command significant share over the assessment period.

Table 1: Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Market Value (US$ Million) Forecast by Activity Type, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Market Value (US$ Million) by Activity Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Market Value (US$ Million) by Country, 2023 to 2033

Figure 8: Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 9: Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 10: Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 11: Market Value (US$ Million) Analysis by Activity Type, 2018 to 2033

Figure 12: Market Value Share (%) and BPS Analysis by Activity Type, 2023 to 2033

Figure 13: Market Y-o-Y Growth (%) Projections by Activity Type, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Market Attractiveness by Activity Type, 2023 to 2033

Figure 30: Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

France Adult Diaper Market Analysis by Growth, Trends and Forecast from 2025 to 2035

France Centrifugal Pumps Market Trends – Size, Share & Growth 2025-2035

France Power Tool Market Growth – Demand, Trends & Innovations 2025-2035

France Outbound Travel Market Analysis – Trends, Growth & Forecast 2025-2035

France Extended Stay Hotel Market Outlook – Growth, Trends & Forecast 2025-2035

France Hostel Market Analysis – Growth, Demand & Forecast 2025-2035

France Sleep Apnea Diagnostic Systems Market Insights – Size, Share & Demand 2025-2035

France Compostable Toothbrush Market Report – Key Trends & Growth Forecast 2025-2035

France Foley Catheter Market Trends – Demand, Growth & Forecast 2025-2035

France Cell Culture Media Bags Market Trends – Size, Share & Growth 2025-2035

France Swab and Viral Transport Medium Market Report - Growth, Trends & Forecast 2025 to 2035

France Women's Luxury Footwear Market Outlook – Size, Share & Innovations 2025-2035

France Period Panties Market Report – Size, Trends & Outlook 2025-2035

France Wine Tourism Market Insights – Growth, Demand & Trends 2025-2035

France Space Tourism Market Insights – Growth, Demand & Trends 2025-2035

France Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

France Sports Tourism Market Report – Demand, Trends & Innovations 2025-2035

France Medical Tourism Market Size and Share Forecast Outlook 2025 to 2035

France Educational Tourism Market Analysis – Trends, Growth & Forecast 2025-2035

Retail Sales of Layered Verrine‑Style Desserts in France Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA